MISO will waste no time in 2025 trying to blunt the threat of a shortage that could arrive in the summer months by encouraging new generation and enacting more resource adequacy measures.

MISO leadership spent 2024 reiterating that the grid operator is on a collision course with a supply deficit unless members get more projects built, it supercharges transmission planning and it can persuade members to stave off generation retirements.

During MISO’s Board Week Dec. 10-12, MISO executives said they would pursue large-scale load shedding drills among the membership, indicating the RTO anticipates blackouts.

However, MISO CEO John Bear said he feels that MISO has accomplished more in terms of resource adequacy in the past “three years versus the last 10.”

“I do feel like we’re at a little bit of inflection point though,” Bear said at a Dec. 12 MISO Board of Directors meeting. He said though MISO is cleared to roll out a sloped demand curve in its seasonal-based capacity auctions this spring, a new capacity accreditation by 2028 and has attained board permission for its newest long-range transmission plan, it still faces a resource gap as soon as summer.

“Now we need members to revise their plans and really roll up their sleeves. … We’ve got to get resources added to the system,” Bear said. He added that even before the surge in data center growth projection, MISO and the Organization of MISO States’ (OMS) resource adequacy survey indicated reserve margin deficits could occur within months.

In September, MISO Independent Market Monitor David Patton agreed MISO is implementing resource adequacy improvements at a “remarkable” clip — a good thing for the sake of future reliability.

“The seasonal capacity auctions and reliability-based demand curve are being implemented in a third of the time it takes other RTOs,” Patton said.

“Pressures on resource adequacy from fleet transition and projected large spot load additions continue and will increase unless MISO and members take mitigating action,” Durgesh Manjure added during MISO’s mid-September Board Week.

“We are losing megawatts faster than we can replace them,” he emphasized.

Manjure also said the generator interconnection queue isn’t the source of guaranteed resource additions that it used to be. He said approximately 57 GW of new resources have attained interconnection agreements but remain unfinished largely due to straggling supply chains. Manjure said projects could face anywhere from three to seven years of delay before megawatts materialize on the system after signing their interconnection agreements.

The true conversion rate of the interconnection queue “is becoming more and more nebulous,” Manjure said. “It’s becoming harder to predict what’s going to come online.”

However, he said there’s “no dearth” of projects in the queue. Staff often point out that MISO’s 312-GW interconnection queue alone is more than twice the RTO’s peak load.

MISO in late 2024 concluded its members need to add projects at an “unprecedented” 17 GW/year clip to achieve resource adequacy while decarbonizing the grid. That’s triple the rate members have added per year over the past few years. (See MISO Assessment Calls for 17 GW in New Resources Annually.)

The Need for Queue Speed

To get more new generators churning out energy sooner, MISO is fashioning an express lane in its interconnection queue for projects that bolster resource adequacy. The idea — which is set for more workshopping with stakeholders in the coming months — would have select generation developers entering a fast lane devoted to projects with authorization from their state authorities. MISO would perform individual, rather than batch, studies on the projects and funnel them to interconnection agreements quicker. (See MISO Tells Board RA Fast Lane in Interconnection Queue is a Must.)

MISO’s emphasis on needing more generation expeditiously appears incompatible with its call in late 2024 to officially skip acceptance of a 2024 cycle of queue projects for study. But the RTO insists it has good reason to take a step back — it’s working with a tech startup to create a more automated queue that turns out studies faster. (See MISO to Skip 2024 Queue Cycle While it Automates Study Process with Tech Startup.)

If MISO gets its way, it will process smaller queues this year and into the foreseeable future. The grid operator has filed with FERC to impose a 50% peak demand cap on the project submittals it will accept into its interconnection queue annually. The 2025 cycle of queue projects is tentatively scheduled to kick off in the third quarter, since MISO intends to have the cap in place before it formally accepts a new cycle. MISO has said smaller queue classes will make interconnection studies workable and realistic.

Sloped Curves to Net More Capacity

MISO’s springtime capacity auctions for the 2025/26 planning year will be the first to feature a sloped demand curve. The grid operator hopes to use the curves as a safety net to have more capacity on hand than strictly necessary to meet planning reserve margin requirements. FERC allowed MISO to use them in place of the vertical demand curve it had been using since 2011. (See FERC Approves Sloped Demand Curve in MISO Capacity Market.)

Amid talk of heightened operating risks, MISO filed to increase its current $3,500/MWh value of lost load to $10,000/MWh. The plan is pending before FERC.

MISO, OMS to Outline Possible New Resource Adequacy Standard

Further, MISO has promised to work with state regulators in 2025 to come up with a potential new direction on its resource adequacy standard.

MISO has said it might draw on a combination of measurements gaining attention across the industry, including:

-

- Its existing loss of load expectation to capture frequency of events.

- Expected unserved energy to capture the size of events.

- Loss of load hours to capture event duration.

- Value at Risk or Conditional Value at Risk to measure the magnitude of the aftermath of worst-case events.

MISO Director of Strategic Initiatives and Assessments Jordan Bakke told attendees at a November Resource Adequacy Subcommittee that “more investigation is needed” to figure out how risk will play out as its system evolves. MISO has suggested its current loss of load expectation criterion could in the future lead to “materially higher risk” by underestimating system vulnerability.

Bakke said MISO’s one-day-in-10-years loss of load resource adequacy standard “has a number of limitations.” But he also said MISO believes it has some time on its side because the new risks the industry is trying to steel itself against will arise from a “highly evolved” system that is a few years down the road. Bakke pointed out that MISO’s Regional Resource Assessment shows that within 20 years, risk will swing from summer to winter, with emergency events expected to grow in size and be longer lived.

OMS has advised MISO to tread carefully and be mindful of state jurisdiction when crafting a new resource adequacy standard. (See MISO Dips Toes into Potential New Resource Adequacy Standard; States Demand Key Role.)

OMS is standing up a devoted resource adequacy committee to work with MISO. Bakke said the RTO will collaborate with OMS throughout 2025 to develop a recommendation on preferred changes to resource adequacy criteria at the end of the year.

Bakke added “it’s too soon to know” when MISO might be able to employ new criteria. He said it’s MISO’s goal to “illuminate the topic” by providing risk assessments while OMS holds deciding power.

Executive Director of Market and Grid Strategy Zak Joundi has said “we were fortunate in the past” to operate the system reliably simply by preparing for summer peak load.

“That’s no longer the case,” he told attendees at the March MISO Board Week.

Futures to Become Bolder

The grid operator will take a break from long-range transmission planning over 2025 to refurbish its three 20-year futures scenarios, which form the foundation of MISO’s long-term transmission planning. (See MISO Pauses Long-range Tx Planning in 2025 to go Back to the Futures.) The RTO has promised to come back in 2026 with another portfolio of long-range transmission projects for its Midwest region.

Bear said the changing world means it’s time for MISO to revisit its 20-year transmission planning futures and contemplate more load growth, more electrification and a resource transition in overdrive.

Meanwhile, regulatory work will begin on MISO’s second, nearly $22 billion LRTP portfolio, approved in December. MISO staff have vowed to appear before state commissions to vouch for the transmission’s importance in its members’ resource planning. (See MISO Board Endorses $21.8B Long-range Transmission Plan.)

Director of Cost Allocation and Competitive Transmission Jeremiah Doner called the second LRTP portfolio a “step forward for the system in the 765-kV transmission,” pointing out that swaths of MISO Midwest lack a 765-kV backbone.

Load Growth Looms

Bear said while MISO has accomplished more resource adequacy initiatives than ever before through the stakeholder process in 2024, he joked that the “bad news” is MISO and stakeholders must consider several more in the coming months.

“My concern is that all the things we’re seeing, our neighbors our seeing. Our reserve margins are getting tighter, and we’re seeing load growth … not seen since the ‘60s and ‘70s,” Bear said during the September board meeting.

“When you start adding load additions the size of small cities, you really have to step back,” he said.

“MISO folks need to stay ahead of the curve,” Board Chair Todd Raba agreed at the time.

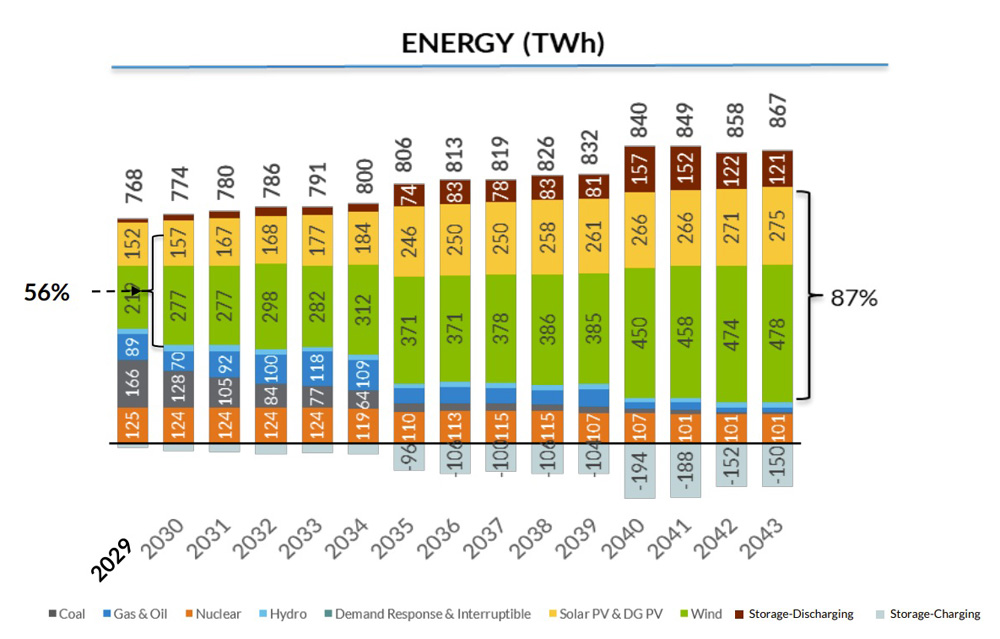

MISO executives expect load to grow by about 60% by 2040. That will be paired with an anticipated 87% renewable energy output from the RTO’s fleet. By 2030, the RTO expects more than 50% renewable energy output.

MISO expects a 10 to 14% increase in load over the next few years, fueled primarily by the rise of data centers.

“There’s not a state in our footprint that doesn’t want to see that economic development,” MISO’s Bob Kuzman said at Infocast’s inaugural Midcontinent Clean Energy conference in late August.

However, Kuzman warned that data centers need dispatchable, at-the-ready resources. He warned that the replacement generation coming online needs to have the same reliability attributes that departing thermal generators were able to furnish.

“These large AI and data centers need power 24/7/365. … They are not interruptible,” he said.