IESO is asking generation owners what it will take to extend the lives of their units beyond their current contracts as Ontario seeks to meet a projected 75% load increase by 2050.

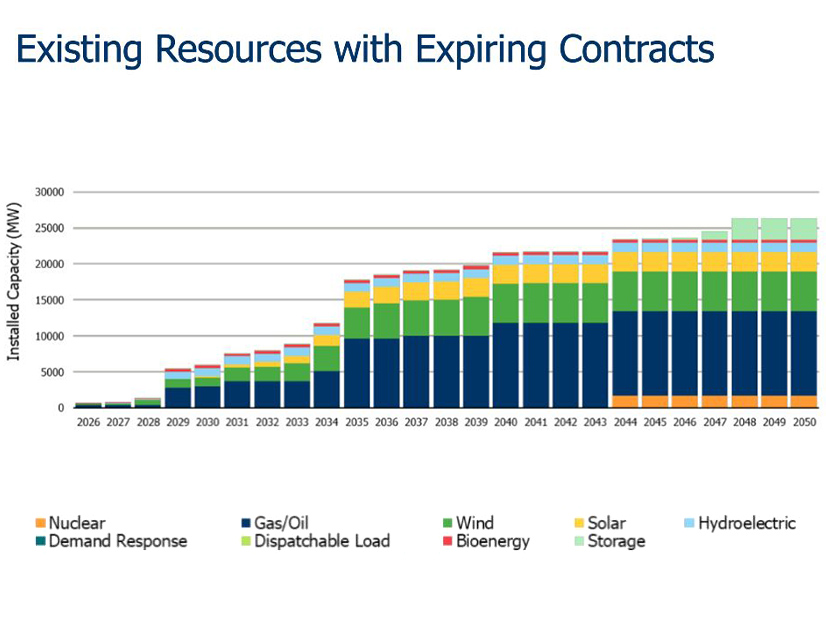

IESO’s expiring contracts will grow from 5,000 MW/year in 2029 to more than 20,000 MW/year in 2040.

The ISO said it plans to begin soliciting repowering facilities in the Long-Term 2 Window 2 procurement, scheduled for Q2 2026. It will be open to energy and capacity streams, with repowering projects seeking 20-year commitments likely competing against greenfield projects.

“We’re very cognizant as the ISO that we’re going to need a … majority of … these existing facilities to come back and to sign on for an additional term,” IESO’s Ben Weir said during an engagement session Oct. 20. “So we really want to work with everybody to make sure that the framework is tenable.”

Dave Barreca, IESO’s supervisor of resource acquisition, said the ISO’s goal is to “secure the most cost-effective resources available [and] maximize the value of Ontario’s existing generation fleet.”

“As we all know, we forecast continued electricity growth over that period. And so there is a need for that power to come from somewhere, and I think that facilities that already exist — steel in the ground — is certainly as good a place as any.”

Current Practice

IESO has extended some expiring contracts by five years in the Medium-Term procurements (MT1, MT2) but it recognizes that some facilities will need longer contracts and big investments — including large-scale equipment replacements — to continue running.

“These facilities and others like them will continue to age,” Barreca said. “And so the question then becomes … what to do — other than, of course, decommissioning. And as these facilities get older, the five-year term may become … less feasible to keep that facility running.”

Definitions

IESO laid out an initial set of definitions for the program:

-

- repowering: full or partial replacement that results in a “like new” facility and may increase output;

- refurbishment: smaller-scale improvements that will extend lifespan for a shorter period and may result in increased output;

- upgrades: replacing components such as turbines with more efficient equipment to increase plant output; and

- expansions: adding new generating units to an existing facility to increase output.

But IESO also asked generators to help it fine-tune its definitions. “There is likely a range of viable options for existing facilities nearing the end of their current commitments,” it said in a presentation. “IESO is seeking to better understand these options in order to appropriately design repowering rules.”

Contract Term Risk

Barreca said IESO wants to balance certainty for owners with ratepayers’ “contract term risk”— the risk of too many facilities winning repowering contracts — and taking outages — at the same time.

“We’re going to see the retirement — or at least temporary retirement — of the Pickering Generating Station [for its own repowering]. So we can’t really afford to let everyone go off and repower at the same time,” Barreca said.

Gas Repowerings a Provincial Policy Matter

Weir said the ISO’s repowering rules likely will include technology-specific conditions — including those that would apply to repowering of gas facilities. “At the end of the day, whether we are going to allow repowered gas facilities will be a government policy call,” he said.

The Ministry of Energy and Mines’ Integrated Energy Plan calls for “the rational expansion of the natural gas network,” warning that “a premature phaseout of natural gas-fired electricity generation is not feasible and would hurt electricity consumers and the economy.” (See Ontario Integrated Energy Plan Boosts Gas, Nukes.)

Next Steps

IESO requested that written feedback on the repowering concept be submitted to engagement@ieso.ca by Nov. 21. Among the issues on which it seeks input are required contract length, potential regulatory barriers, eligibility and contract design, and the likelihood of generation owners choosing to decommission rather than repower.

The ISO promised a follow-up engagement in early 2026.