PJM’s winter outlook found the RTO should have enough resources to meet the forecast peak load of 145,700 MW, although the reserve margin continues to decline as new resource development lags. If the forecast is reached, it would surpass the previous winter’s record-setting peak of 143,700 MW. (See PJM Sets Record Winter Peak Load.)

Load growth has continued to erode PJM’s reserve margin, which stands at 7.5 GW in the forecast, down from 8.7 GW in the previous year. About 4.8 GW of new nameplate generation was included in the modeling. Much of that is solar, however, and amounts to just 1 GW of capacity. (See PJM OC Briefs: Oct. 10, 2024.)

“The grid is set up to keep the power flowing reliably this winter under forecast conditions, but the tightening of our margins will begin to impact us in the next few years if it continues,” said Aftab Khan, PJM executive vice president of operations, planning and security, in an announcement of the winter outlook. “PJM is working on multiple levels with all of our stakeholders to reverse this trend of demand growing faster than we can add generation,”

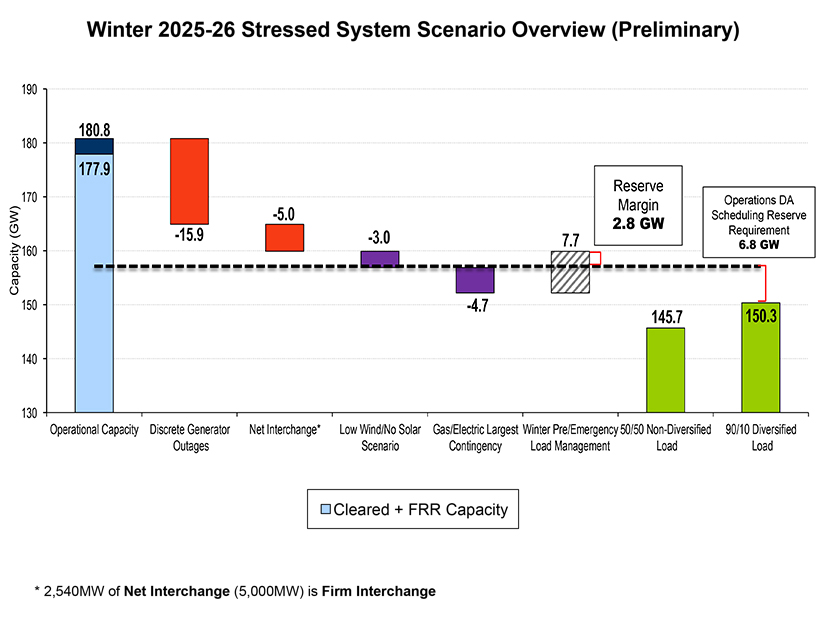

The analysis shows 180.8 GW of operational capacity, which includes 177.9 GW with commitments in the capacity market, as well as resources anticipated to be available. An additional 7.7 GW of load management will be available. Of those resources, 15.9 GW is expected to be on outage during periods of system strain, and 5 GW of exports were included.

The reserve margin measures the amount of operational capacity above the 90/10 diversified load forecast plus the 6.8-GW day-ahead scheduling reserve requirement.

The amount of operational capacity reflects improvements in resource performance observed since the December 2022 Winter Storm Elliott. After that storm, PJM made several changes to its emergency procedures, non-performance penalties and advance commitment practices. The announcement says the margin could become tighter if those improvements do not continue.

“Generator performance will be critical to maintaining reliability this winter,” said Mike Bryson, PJM senior vice president of operations. “We are encouraged by the work we have seen by generation owners to fortify their units for winter operations, and we will continue to focus on communication and coordination that help us understand how PJM can help to mitigate gas scheduling challenges or other generator limitations.”

Presenting the outlook during the Nov. 3 Operating Committee meeting, PJM’s Akash Patel outlined the preliminary results of scenarios exploring how low renewable generation or the largest gas contingency could affect the reserve margin. If wind and solar output were to be 3 GW lower than expected, there would be 200 MW of operational capacity available before load management would be required. The largest gas contingency would take 4.7 GW off the system, shrinking the reserve margin to 5.8 GW; pairing the two scenarios would leave a 2.8-GW margin.

Paul Sotkiewicz, president of E-Cubed Policy Associates, questioned why PJM included 5 GW of exports in the analysis, stating that PJM’s governing documents require that non-firm ties to other regions be curtailed if it falls into a reserve shortage.

PJM Director of Operations Planning Dave Souder said the 5 GW is the historical value PJM has exported over peaks. The study results indicate with that level of exports PJM would be deficient and would begin implementing procedures to curtail off-system sales.

The announcement of the outlook says PJM and ReliabilityFirst intend to double the number of site visits they will conduct at 30 generators to share best practices on winterization. PJM also will conduct unannounced tests of generators that have not run in the weeks ahead of the winter season.