MISO has indicated that new generation to serve data centers and other large loads will be mission critical over 2026 and said it will take pains to interconnect units.

The grid operator also will plan accordingly for fewer renewables in the footprint in the future and will embark on long-range transmission planning for its Southern load pockets.

‘Speed to Power’ + Fast Pass Gen Projects

MISO CEO John Bear said speed to power will be MISO’s theme in 2026, as it is nationally. He said MISO’s interconnection queue fast lane is working as intended to sate demand.

“The first cycle of GIAs is signing within days, not years,” Bear reported at MISO’s Dec. 11 board meeting.

MISO created a temporary queue express lane to get necessary generation online faster. Throughout 2026, MISO will welcome four more 15-project cycles into its interconnection queue express lane.

The first two cycles of projects are composed overwhelmingly of gas generation. MISO expects the 11 GW of new natural gas generation from the first two classes of its fast lane to begin coming online in 2028. (See MISO Accepts 6 GW of Mostly Gas Gen in 2nd Queue Fast Lane Class.)

Bear said MISO is working to condense timelines in the ordinary interconnection queue. He said regular queue phases are “shrinking dramatically” and can now be measured in days, not years.

“We have to be faster, and we have to be better,” Bear told stakeholders, members and board members.

MISO has vowed to ease the process to bring co-located generation and load online sooner, trying to move as fast as new large loads demand. The RTO said it may create interconnection agreements where generation is barred from injecting into the MISO system. The design work would take place over 2026. (See MISO Floats ‘Zero Injection’ Agreements to Bring Co-located Gen Online.)

MISO Senior Vice President Andre Porter said MISO today has 180 GW of installed capacity, 138 GW of that accredited. He said though MISO contains more gigawatts than it did a decade ago, its accredited capacity values have remained flat. However, he said members are making demonstrable progress on the RTO’s supply.

MISO reported that its three-year historical supply additions increased over 2025 from 4.7 GW to an estimated 6.7 GW annually. But Porter added that incremental load growth by 2030 also increased over 2025, up to 23 GW from an 18-GW estimate just months earlier.

“Members are making real progress in terms of additions they’re making. There’s significant momentum in the MISO region that’s going to allow us to rise above the noise,” Porter said, referring to the daily headlines on growing demand.

Porter said MISO has a goal to complete 25 generator interconnections per quarter over 2026 and 2027. He said MISO likely will need to sign on 8 GW of accredited capacity per year to continue to meet resource adequacy targets.

“You’re going to see much more speed within the generator interconnection queue,” Porter promised members a Dec. 10 Advisory Committee meeting. He said MISO understands that the queue “can no longer be an impediment” to generation development.

MISO’s regular generator interconnection queue contains 910 projects at 169 GW, much lower than the more than 300 GW MISO began 2025 with. Developers have withdrawn 129 GW worth of projects over 2025 since the Trump administration announced a phaseout of tax credits for renewable energy. MISO has yet to factor in the projects that queued up for the 2025 cycle. The RTO warned that the regular queue will fluctuate over the first half of 2026 as more developers remove projects and as it adds 2025 projects.

MISO, by its estimate, will field expedited transmission requests to support 13.1 GW in load growth throughout 2026. MISO approved expedited transmission projects to support 9.7 GW of large load additions in 2025.

“Since we’ve closed our [Transmission Expansion Plan] process in September, we’ve had more requests for expedited review than in all of 2025. And last year was multitudes of the year before,” MISO Executive Director of Transmission Planning Laura Rauch reported at the MISO Board of Directors’ System Planning Committee meeting Dec. 9.

Load Grows Where Data Centers Go

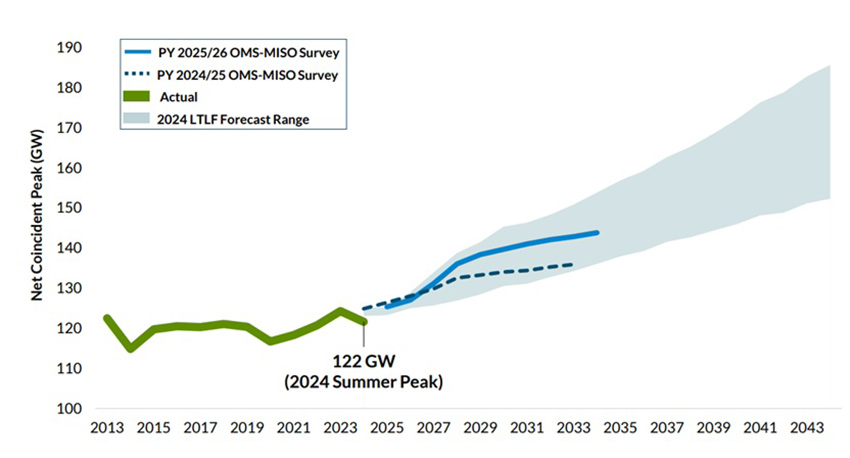

MISO Senior Vice President Todd Ramey said MISO members’ load forecasts show an uptick in load around 2027, when the net coincident peak could pass 130 GW.

“We’re pretty tight on surplus capacity here, so I think this shows a need to focus on getting accredited capacity online as load growth continues to pick up,” Ramey said during the RTO’s June Board Week.

MISO’s 2025/26 Planning Resource Auction showed capacity is at a premium in the footprint — at least during summer when prices soared to $666.50/MW-day. (See MISO Summer Capacity Prices Shoot to $666.50 in 2025/26 Auction.)

Fewer Future Renewables

The RTO reported that it noticed a drop in members’ plans for standalone renewable energy and increasing plans for dispatchable resources.

Rauch said MISO clocked a sizable difference between the future generation plans its members submit now versus what they submitted a few years ago. She said members foresee more thermal, dispatchable energy within 20 years. MISO has said more on-call energy will prove useful to combat load growth.

MISO has reported that since 2024, its members’ plans for new, dispatchable resources jumped from 32 GW to 50 GW by 2043. Plans for standalone renewable energy, on the other hand, dropped from 103 GW to 55 GW. MISO said it noticed the sea change from surveying its members about their plans for its 2024 Regional Resource Assessment and again in 2025 as part of the OMS-MISO Resource Adequacy Survey.

Despite the renewable slowdown, MISO expects to have about 40 GW of installed solar capacity at the end of 2028.

By 2045, MISO believes it could have anywhere from 383 GW to 454 GW of installed capacity, with a bigger natural gas generation buildout and fewer renewable energy resources. (See MISO Draft Tx Planning Futures Envision 400-GW Supply or More by 2045.)

“We’re expecting to see a significantly more balanced system” than before, Porter said.

But MISO’s four transmission planning scenarios, to be finalized in spring 2026, don’t allow for much energy storage, a detail MISO Director Barbara Krumsiek asked about during MISO’s quarterly Board Week in December.

Rauch said MISO’s reworked versions of the future simply don’t contain as much excess energy production from renewable energy, making storage a less compelling avenue.

At a Dec. 10 Advisory Committee meeting, Clean Grid Alliance’s Beth Soholt urged MISO not to underestimate storage expansion and consider giving it a broader use category in the markets.

“It’s like bacon. It makes everything better. Add it to a sandwich and it tastes better,” Soholt joked.

Soholt said MISO’s market rules for storage can either be a “barrier or a facilitator.”

More DOE Emergencies, More Thermal Resources

Porter said MISO expects to receive more emergency orders from the Department of Energy to keep thermal resources online. However, he said some members themselves might be considering delaying retirements on some of those units.

“The thought is that perhaps we won’t need as many of those orders moving forward,” Porter said.

Since May, there’s been no end in sight to DOE’s interventions to keep a Michigan coal plant online. The Department of Energy in fall ordered Consumers Energy’s J.H. Campbell coal plant to delay closure through the winter. But MISO and its Independent Market Monitor said J.H. Campbell did not clear the planning resource auction and was not needed for resource adequacy. (See MISO: Retirement-delayed Campbell Coal Plant not a Capacity Resource.)

According to Yes Energy data, the 1.45-GW plant had an average 70% capacity factor over June and July 2025.

Ramping Needs

With a solar fleet capable of a 14.5-GW peak and set to double over 2026, MISO will pay more attention than it ever has to its steeper ramping needs, which have risen dramatically with a growing renewable fleet.

Zak Joundi, executive director of markets and grid strategy, said MISO will design a process to dynamically set requirements for ramp capability and regulation reserves throughout 2026.

MISO must “clear the right products in the right areas,” Joundi told the MISO Board of Directors in early December. However, Joundi said while designs would be more computationally complex, MISO would stop short of clearing ancillary services on a nodal basis, like its real-time energy market.

MISO South Long-Range Tx Plan an Open Question

MISO will turn its attention to long-range transmission planning for the most constrained load pockets in its South region. The RTO has pledged to conduct a risk assessment as part of its first long-range transmission effort in MISO South in 2026, focusing on load pockets across Louisiana and southeast Texas.

But don’t expect multibillion-dollar transmission portfolios like those designed for MISO Midwest. The RTO’s planners will take a more measured approach with the South. (See MISO to Include Southeastern Texas in South Long-range Tx Planning.)

Rauch said MISO would “practice what a long-term transmission plan and risk assessment will look like” with its South stakeholders over 2026. She said MISO won’t propose solutions until it and stakeholders can review results of the risk analysis and better understand whether generation, transmission or something else might be needed.

“We don’t want to commit to anything until we see those,” Rauch said. She added that MISO could conduct more assessments after the initial risk assessment to further flesh out solution decisions.

MISO’s South planning announcement was prodded in part by a late May 2025 load shedding incident in New Orleans. Repercussions from widespread blackouts in the New Orleans area are to reverberate into 2026 as MISO has promised to launch a new transmission warning system. (See MISO to Debut Tx Warning System in 2026.)

Finally, MISO in 2026 will manage planned transmission outages related to construction of its first, $10.6 billion batch of long-range transmission projects in MISO Midwest that were approved in 2022. Executive Director of System Operations J.T. Smith said the construction is expected to alter MISO’s usual congestion patterns.

Smith said “good, solid outage coordination” will be key, alongside reflecting changes in MISO’s financial transmission.

“It is going to be impactful. There are going to be some right of ways that we lose access to for a while,” Smith told MISO directors at a Dec. 9 Markets Committee of the Board of Directors.

Bear agreed that outage coordination will be key as the first long-range transmission projects are built. MISO expects the largest disruptions from LRTP project construction in 2026, 2027 and 2028.