Tensions between New England states and New England Governors Call for RTO Reform.)

A few days later, the New England States Committee on Electricity (NESCOE) released “New England States’ Vision for a Clean, Affordable and Reliable 21st Century Regional Electric Grid.” The report urged ISO-NE to convene a “collaborative process” with states and other stakeholders in 2021 to consider changes to its mission statement and governance structure “to achieve greater transparency around decision-making, a needed focus on consumer cost concerns and support for states’ energy and environmental laws.” (See States Demand ‘Central Role’ in ISO-NE Market Design.)

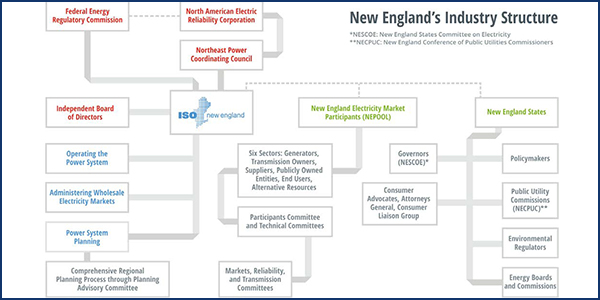

The statement made repeated references to the RTO’s “lack of transparency,” which “undermines public confidence” in the organization. Neither ISO-NE Board of Directors meetings nor NEPOOL stakeholder meetings are open to the public.

It also criticized the makeup of ISO-NE’s Joint Nominating Committee, which selects board members. The committee comprises seven incumbent board members, six market participants — one from each of NEPOOL’s sectors — and only one shared vote for the six New England states.

Katie Dykes, commissioner of Connecticut’s Department of Energy and Environmental Protection, said in September that improving ISO-NE’s transparency and accountability is “core to the design and implementation of our wholesale markets” and a “necessary and essential step” to achieve affordable decarbonization that relies on competition and minimizes risk to ratepayers. She added that states currently do not have adequate input and visibility into the RTO’s governance structure. (See Mass., Conn. Seek Federal Partner on Decarbonization.)

In November, ISO-NE CEO Gordon van Welie shared the RTO’s vision statement with NEPOOL: “to harness the power of competition and advanced technologies to reliably plan and operate the grid as the region transitions to clean energy.” (See “ISO-NE Shares ‘Vision for the Future,’” NEPOOL Participants Committee Briefs: Nov. 5, 2020.)

The events set up an interesting end to 2020 and foreshadowed what is ahead in 2021.

Starting Jan. 13, the states and NESCOE will hold a series of public online technical conferences focusing on wholesale market design, transmission planning and governance reform.

“Understanding there are resource constraints on people and organizations, we really cannot afford to just go along and hope that we will land with the right market design and the right transmission pieces that need to be built,” said Judy Chang, undersecretary of energy for the Massachusetts Executive Office of Energy and Environmental Affairs. “I think that’s the ultimate vision … to really work collaboratively so that we can achieve this future in the least amount of disruption and at the lowest cost.” (See NE Energy Leaders Discuss Paths to Decarbonization.)

Carbon Pricing

Carbon pricing was another hot topic in 2020. There was fervent opposition from state officials like Dykes, who said she opposed ISO-NE’s proposal to add a carbon price on top of the Regional Greenhouse Gas Initiative (RGGI), which sets the cap for carbon emissions across New England and other Eastern states. (See Dykes Calls out ISO-NE, FERC on Carbon Pricing.)

“Our states in New England, participating in RGGI as we do, have sent multiple letters to ISO New England and to NEPOOL regarding carbon pricing,” Dykes said in September. “And essentially, repeatedly, we’ve had to go on record stating that we are not in support of a carbon adder as a supplement or perhaps as a replacement for the RGGI program.”

However, Sen. Sheldon Whitehouse (D-R.I.) said in November that “carbon pricing is a pretty essential component of any rational analysis in the energy sector,” and there is an “imbalance” in the form of a massive subsidy for fossil fuels. (See Overheard at New England Energy Summit.)

Whitehouse said a carbon price is “far from dead” in Congress. It is the “leading strategy” on the Republican side, and there are four separate Democratic carbon pricing bills, “so this is not some fringe idea.”

FERC Commissioner Neil Chatterjee said in November, after he was demoted by President Trump in part for supporting carbon pricing in RTOs and ISOs, that state policies have negatively affected the competitiveness and function of the markets, which required “tough, but in my view, necessary decisions” at the commission. (See Officials Discuss Future of ISO-NE During Summit.)

“It all boils down to this: Carbon pricing is a fuel-neutral, transparent and market-based approach that can be harmonized with the markets we oversee,” Chatterjee said. “This stands in stark contrast to policy tools like subsidies, which can amount to hidden costs that can degrade market efficiency and skew price signals, ultimately hurting the consumer.” (See FERC: Send Us Your Carbon Pricing Plans.)

In December, Connecticut, Massachusetts, Rhode Island and D.C. signed a memorandum of understanding to launch the Transportation and Climate Initiative Program (TCI-P), which aims to cut greenhouse gas emissions from vehicles by 26% from 2022 to 2032.

A cap-and-invest program, TCI-P would require large gasoline and diesel fuel suppliers to purchase allowances for emissions and later auction them, which officials said will generate $300 million for yearly investments in less polluting transportation. Each year, the total number of emission allowances would decline. (See NE States, DC Sign MOU to Cut Transportation Pollution.)

FERC Updates

FERC in October rejected ISO-NE’s proposed Energy Security Improvements (ESI) market design because it said the proposal would add substantial costs to consumers “without meaningfully improving fuel security” (ER20-1567).

ESI would have allowed the RTO to procure energy call options for three new day-ahead ancillary service products to improve the region’s energy security, particularly in winter when natural gas shortages can leave generators without fuel. Option awards would have been co-optimized with all energy supply offers and demand bids in the day-ahead market. FERC also rejected an alternative proposed by NEPOOL that would have lowered costs to ratepayers, saying it contained the same deficiencies. (See FERC Rejects ESI Proposal from ISO-NE.)

The result of more than a year of stakeholder meetings, the ESI proposal was prompted by FERC’s July 2018 finding that ISO-NE’s tariff lacks a way to address fuel security concerns that the RTO said could result in reliability violations as soon as 2022. The tariff currently only allows cost-of-service agreements to respond to local transmission security issues.

Following the rejection, ISO-NE asked FERC whether it could seek its direction on how to improve fuel security following the ruling. ISO-NE said the region “is at a crossroads with … energy security and its reserve markets. The ISO does not believe that it is prudent to move forward without the opportunity to speak freely with the commission and its staff. Accordingly, we are stalled.” (See ISO-NE to FERC on Fuel Security: What Now?)

Also in November, FERC defended its Competitive Auctions with Sponsored Policy Resources (CASPR) order, which permitted ISO-NE to create a two-stage capacity auction to accommodate state renewable energy procurements (ER18-619). The commission said it continued “to find the economic principles underlying CASPR to be sound” and agreed with the RTO’s recommendation to prioritize the preservation of a competitive Forward Capacity Auction price to ensure investor confidence. (See FERC Defends CASPR Order.)

Democratic Commissioner Richard Glick dissented, saying he does not believe CASPR “is a just and reasonable means of accommodating state public policies” in the Forward Capacity Market. He said concerns about “consequences that resource entry and exit decisions have for climate change, among other things, are likely to play a more important role in resource entry and exit than the FCM clearing price,” especially in New England.

Speaking of FCM, FERC ordered ISO-NE to remove its new-entrant rules from its tariff in December, preventing resources from being allowed to lock in their prices for seven years (EL20-54). The rules had been in effect since ISO-NE began its capacity market in 2006.

The commission said the rules resulted in “unreasonable price distortion” and that locked-in prices are “no longer required to attract new entry, with the benefits provided by price certainty no longer outweighing their price-suppressive effects.” Price-lock agreements in effect before the order will not be impacted, with the new rules starting with FCA 16, scheduled for February 2022. (See FERC Orders End to ISO-NE Capacity Price Locks.)

Renewable Energy

Solar developers were the clear winners in the Maine Public Utilities Commission’s renewable energy procurement in September, accounting for 482 of the 546 MW in approved projects through a competitive bidding process. It was the PUC’s largest procurement of renewable energy since restructuring more than 20 years ago. (See Maine Makes Record Renewable Procurement.)

Winning bidders estimated the projects would reduce greenhouse gas emissions by approximately 500,000 tons per year. The projects were the first approved since Mills, a Democrat, signed a bill last year to increase the state’s renewable portfolio standard to 80% by 2030 and set a goal of 100% renewable energy by 2050.

Later in October, Rhode Island Gov. Gina Raimondo (D) announced a new competitive solicitation to procure up to 600 MW of offshore wind energy. (See R.I. Opens Solicitation for 600 MW of Offshore Wind.) Raimondo had signed an executive order in January committing her state to use renewables to meet 100% of its electricity demand by 2030.

The state’s target for OSW energy is 1,030 MW, with 430 MW currently selected. The potential addition of 600 MW would meet the target.

During a speech in December, U.S. Sen. Ed Markey (D-Mass.) said New England states have the chance to be “the true leaders of the Green New Deal” that he co-sponsored with Rep. Alexandria Ocasio-Cortez (D-N.Y.) — or some variation of it.

Markey said achieving the Green New Deal’s objectives of a 100% clean energy economy and carbon-free power sector by 2035 will require billions of dollars for battery storage and promoting electric vehicle adoption through the construction of at least 500,000 new charging stations. (See “Markey: Climate Issues Top Agenda,” Overheard at NE Electricity Restructuring Roundtable.)

“This is not pie in the sky, put a man-on-the-moon stuff; these are largely technologies that already exist,” Markey said. “It’s been a political problem but not a technological problem. … We know we can get this done. It is just a matter of political will. I will be working very hard to make sure that these hundreds of billions of dollars are spent in a way in which we have public-private partnerships jumpstarting clean energy innovation and deployment.”