FERC on Thursday approved ISO-NE’s Inventoried Energy Program (IEP) as a “reasonable” and “technology-neutral” short-term solution to compensating resources that provide fuel security during New England’s winters (ER19-1428).

The commission denied rehearing of its automatic acceptance of the IEP in August 2019. The four-member commission lacked a quorum on the matter at the time. Then-Commissioner Cheryl LaFleur had recused herself from all matters involving ISO-NE, later becoming a member of its Board of Directors after she left the commission. (See Lacking Quorum, FERC OKs ISO-NE Energy Security Plan.)

Thursday’s ruling affirms ISO-NE’s ability to implement the IEP for the capacity commitment periods covered by Forward Capacity Auctions 14 and 15, allowing it to compensate resources for maintaining inventoried energy during the winter months of 2023/24 and 2024/25.

The IEP is a voluntary program that consists of five components, including a two-settlement structure, a forward rate, a spot rate, trigger conditions and a maximum duration. Under the two-settlement structure, participants can choose to participate in either the forward and spot market components of the program or just the spot market.

“Participants that opt to participate in both components take on a financial obligation for inventoried energy during the program delivery period (December through February) at the forward rate in the first settlement period,” FERC explained. “Any deviations from inventoried energy maintained for each event trigger (an inventoried energy day) are settled in the second settlement period at the spot rate.”

ISO-NE proposed a fixed forward rate of $82.49/MWh for inventoried energy sold forward during the delivery period, an estimate of the minimum rate that a gas-only resource would require to sign a winter-peaking supply contract for LNG.

The RTO estimates the program will cost between $102 million and $148 million per year, depending on participation, resource performance and winter severity. It assumed that 1.2 million to 1.8 million MWh of inventoried energy, respectively, would be sold forward and maintained for each inventoried energy day per year.

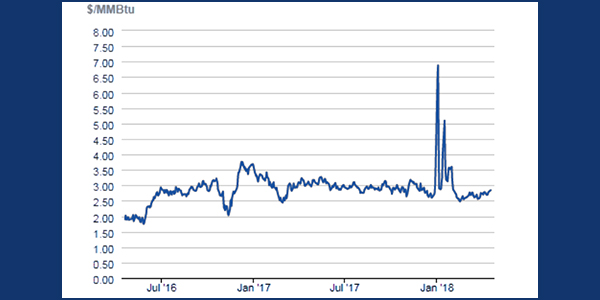

Natural gas spot prices spiked during New England’s extended cold snap of 2017-2018. | EIA

The commission agreed with ISO-NE that a “misaligned incentives” problem in the current market design may cause fuel-secure resources to be insufficiently incented to invest in energy supply contracts, which may have adverse efficiency and reliability consequences.

Although IEP does not constitute a fully market-based solution, “the proposal is a step in the right direction … while ISO-NE finishes developing a long-term market solution,” the commission said.

Commissioner Richard Glick dissented in a separate statement, calling the IEP “an ill-conceived giveaway that acts as if throwing money at a problem is always just and reasonable.”

ISO-NE kicked off a two-year effort to address regional fuel security after its January 2018 Operational Fuel-Security Analysis (OFSA) showed that the loss of 1,700 MW from Exelon’s Mystic 8 and 9 gas-fired units would deplete 87 hours of 10-minute operating reserves and result in 24 hours of load shedding during the winters of 2022/23 and 2023/24. (See Report: Fuel Security Key Risk for New England Grid.)

The Energy Security Improvements filing by the RTO in April 2020 comprised long-term proposals prompted by FERC’s July 2018 finding that ISO-NE’s Tariff was not just and reasonable because the RTO lacked a way to address fuel security concerns. (See ISO-NE Sending 2 Energy Security Plans to FERC.)

Comments and Protests

Several commenters supported the IEP, with FirstLight Power Resources urging the commission to resist requests to amend the proposal because they would be an unhelpful distraction from the long-term market design efforts.

Calpine and Vistra Energy stated that the IEP’s forward component is the key to winter fuel security because it incentivizes market participants to take the necessary steps to achieve fuel security, including procuring an adequate amount of fuel and fully optimizing their existing fuel infrastructure.

Algonquin Gas Transmission supported the IEP but said that the long-term solution can only address New England’s fuel security challenges if it addresses the lack of firm natural gas transportation and storage in the region.

On the other side, the New England Power Pool stated that neither the IEP nor any other proposal had sufficient stakeholder support to win its endorsement. It said the commission “should not direct specific changes that were not already addressed in the stakeholder process without full stakeholder consideration of such changes through the commission-approved participant processes.” The Environmental Defense Fund meanwhile said the interim nature of the IEP does not permit deviation from the just-and-reasonable standard and that no provision under Federal Power Act Section 205 permits the commission to accept filings on an interim basis.

Several commenters also said ISO-NE had failed to demonstrate that the IEP will benefit customers. NRG Energy urged the commission to reject the program and provide guidance for a substitute interim fuel security proposal. The Massachusetts attorney general stated that the program lacks evidentiary support and will result in arbitrary and discriminatory rates. The Maine Public Utilities Commission argued that, without a determination of need, there is no ability to measure the program’s success.

The commission countered the complaints, saying that the IEP “will likely provide reliability benefits, such as incenting up to 1.8 million MWh of inventoried energy to be available during stressed winter conditions,” while also asserting authority under Section 205 to accept interim solutions proposed by applicants.

Rebutting the demonstrated need argument, the commission found “that a detailed cost-benefit analysis is not required for the commission to find proposed Tariff provisions just and reasonable.”

The commission disagreed with a joint protest by New England Consumer-Owned Systems and Energy New England that the IEP cannot be deemed just and reasonable because it is neither market- nor cost-based.

“By setting a fixed forward rate based on a winter-peaking supply contract for LNG, ISO-NE estimated the minimum value that would incent program participation from a natural gas-only resource, thereby approximating the price that would occur if inventoried energy was competitively procured through a market-based mechanism where a natural gas-only resource was the marginal resource that established the price paid to all resources providing the service,” the commission said.

FirstLight and NRG contended that the program does not correct for the suppression of FCA clearing prices that occurs when resources seeking retirement are held in the market for fuel security reasons and included in the FCA as price-takers, arguments the commission found were “outside the scope of this proceeding.”

The commission also disagreed with arguments that the existing fuel security cost-of-service Tariff provisions or Pay-for-Performance (PfP) negates the need for the IEP, or that its costs are duplicative to those of PfP, again citing the “misaligned incentives issue.”

“It is premature to judge whether the costs of the Inventoried Energy Program are duplicative to those of the long-term market solution because the long-term solution is pending before the commission and is not before us in this proceeding,” the commission said.

FERC said that establishing rates in advance increases the IEP’s effectiveness in deterring retirements by enabling participants to better forecast expected program revenues even if the forward rate is not fully precise. “Accordingly, we disagree with parties suggesting that the forward rate be updated closer to the time of delivery to capture prevailing market conditions,” the commission said. “We also decline to adopt the alternative proposals proposed.”

Rehearing and Program Revenues

On rehearing, several parties reiterated the same arguments made in their underlying protests, the commission said.

The New England States Committee on Electricity argued that the commission erred by failing to articulate a satisfactory explanation and otherwise engage in reasoned decision-making in accepting the IEP because it failed to respond meaningfully to the arguments before it, address substantial evidence in the record, or explain its departure from precedent.

“The commission acted consistent with the directives of FPA Section 205 given the lack of quorum in this proceeding at that time,” FERC said. “Now that the commission has a quorum, we have determined that, based on a review of the evidence in the record, the proposed Tariff revisions are just and reasonable.”

The commission agreed with ISO-NE and its Internal Market Monitor that net revenues from the program should be treated as revenue from an ancillary service in the calculation of an existing resource’s net going-forward costs. The revenues will also be reflected in the Forward Capacity Market’s delist bid mitigation.

“We acknowledge that there are many factors that influence a resource’s retirement decision and that IEP revenues will vary from resource to resource. And, as ISO-NE asserts, the program is not intended to deter the retirement of a specific resource,” the commission said. “However, we find that these revenues appropriately compensate resources that contribute to winter energy security. Moreover, we agree with ISO-NE that it is important that the program be in place in time for participants considering retirement decisions for FCA 14 and FCA 15.”

Dissent on ‘Fatal Flaws’

Commissioner Glick said that the willingness to spend customers’ money without evidence of a commensurate benefit will make stakeholders, including both states and customers, suspicious of actions by the commission and ISO-NE that purport to address fuel security, potentially undermining more serious efforts to actually address the issue.

“I am particularly troubled by the evidence in the record that the program will hand out tens of millions of dollars to nuclear, coal and hydropower generators without any indication that those payments will cause the slightest change in those generators’ behavior,” Glick said. “Handing out money for nothing is a windfall, not a just and reasonable rate. …

“Although the simplicity of ISO-NE’s proposal may, at first, seem appealing, the program contains a number of what should be fatal flaws,” he said.

FERC Commissioner Richard Glick tweeted about his dissent June 18.

Most importantly, Glick said, the RTO does not point to any evidence that there is a near-term operational problem that cannot be adequately addressed by its existing rules, or any evidence that the IEP would address such a problem by making the region more fuel secure.

“Creating a program to funnel money to uneconomic resources in order to prevent their retirement would seem to undermine a key element of the balancing act that the commission relied upon when it found the Capacity Auctions with Sponsored Policy Resources (CASPR) program just and reasonable,” Glick said.

The RTO’s willingness to propose a program that will “work at cross-purposes with the CASPR’s substitution auction raises serious questions about the durability of the CASPR construct,” he said. The proposal “does not possess even the basic principles of an effective market-based solution [and] evaluated against those principles, the [IEP] gets a failing grade.”