By Amanda Durish Cook

MISO is offering stakeholders a compromise on one of two resource adequacy proposals it will file with FERC next month, removing a provision that would eliminate capacity credits for slow-response load-modifying resources (LMRs).

Zakaria Joundi, MISO’s recently appointed director of resource adequacy coordination, acknowledged he’s entering his new role as the RTO completes a contentious proposal. Nevertheless, he called the LMR measure “a step in the right direction” for MISO.

But several stakeholders on a Resource Adequacy Subcommittee teleconference Wednesday blasted the filings as poorly supported and questioned their need. The proposals include measures to reduce capacity accreditation for LMRs based on their actual ability to mitigate reliability issues and require resources to procure transmission deliverability to their full installed capacity levels before receiving full capacity credits. (See MISO Prepares Deliverability, LMR Accreditation Filings.)

The proposals are set to take effect in time for the 2021/22 Planning Resource Auction.

LMR Accreditation Alterations

MISO said employing an LMR accreditation “based on lead times and call capacity” will lead to more reliable operations.

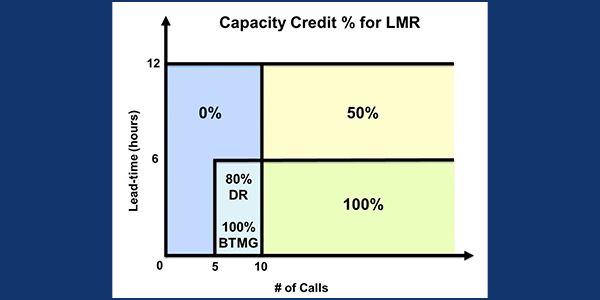

The RTO plans to base an LMR’s capacity accreditation on the smaller of either an average of its actual availability over a three-year period or its tested availability. LMRs that can respond more often and with shorter lead times will receive a larger capacity credit, while those that can respond to 10 or more calls in a year will receive full capacity credit. (See MISO Pursues Leaner LMR Accreditation.)

But MISO said it will put a two-year hold on its plan to eliminate capacity credits for LMRs that cannot be ready to reduce load within six hours.

Instead, the RTO now proposes that LMRs with lead times greater than six hours but less than or equal to 12 hours receive a 50% capacity credit if they can respond to at least 10 calls in a year. MISO said the compromise should only be effective until 2023, when the RTO will again seek a 0% capacity credit for the long-lead resources.

MISO has previously said that LMRs needing more than six hours’ notice don’t help mitigate emergency conditions, when time is of the essence.

The proposal still calls for demand response resources to receive a 100% credit if they can be available within six hours or less to 10 calls or more in a year, while resources that can respond to five to nine calls would receive an 80% accreditation. Behind-the-meter generation (BTMG) that can deploy with notice of six hours or less and respond to five or more calls in a year would also receive a 100% capacity credit. MISO staff explained that BTMG accreditation requirements are more lenient because their credits are already reduced by a forced outage rate.

Stiffer Capacity Deliverability

MISO is holding firm on a provision that would eliminate capacity resources’ ability to demonstrate full deliverability by way of unforced capacity (UCAP) levels, plucking full capacity credits from resources that use a UCAP-based determination. Instead, the gold standard in capacity deliverability would be resources that can procure firm transmission up to their installed capacity (ICAP) levels.

The RTO’s Tariff requires capacity resources to demonstrate capacity deliverability by having network resource interconnection service (NRIS), which stipulates that the entire ICAP of the resources must be deliverable. However, the Tariff also allows resources to demonstrate deliverability by securing energy resource interconnection service (ERIS) and procuring firm transmission service up to their UCAP levels, which tend to be about 5 to 10% below full ICAP levels. MISO’s Independent Market Monitor has contended that the RTO doesn’t properly account for capacity deliverability because its loss-of-load expectation study assumes that all capacity resources are fully deliverable on an ICAP basis.

MISO has said that while it would not require planning resources to procure full transmission service up to their ICAP levels, resources that are only partially deliverable would not receive full capacity credits. The RTO said it would be fine for conventional generators to opt not to purchase additional transmission service and settle for fewer zonal resource credits.

“There will be impacted entities,” Joundi said of the stricter deliverability requirement. He conceded that it may be expensive for some resources to secure firm transmission service up to their ICAP levels.

Customized Energy Solutions’ Ted Kuhn asked if MISO has determined a course of action if FERC rejects either the LMR capacity accreditation or ICAP deliverability proposals.

“Although it’s a policy to never answer a hypothetical, this depends on the reaction from FERC,” MISO Executive Director of Market Operations Shawn McFarlane said. He said the RTO would only rework the proposal if FERC indicates there’s a “tremendously fatal flaw” in the LMR filing. It would, however, have enough time to pursue a “two-step” process with FERC, he said, meaning a refiling to correct small concerns, if the commission has them.

However, McFarlane said the proposals at this point aren’t open to further stakeholder suggestions.

Opposition

Some stakeholders remain opposed to both measures, with most pushback against the LMR measure. Critics say MISO hasn’t made a convincing argument that the LMR accreditation process needs more rules.

Customized Energy Solutions’ David Sapper, representing MISO load-serving entities, said the RTO hasn’t demonstrated that its proposals will make capacity more abundant or available.

“MISO has neither clearly defined a problem with LMR contribution to resource adequacy nor demonstrated benefits from its proposed solutions that outweigh expected high costs of the solutions,” Sapper said.

He pointed out that it was only a little more than a year ago that MISO got permission to require its LMRs to offer capacity in less than 12 hours and in accordance with a seasonal availability report. (See MISO LMR Capacity Rules Get FERC Approval.)

“It’s not clear why MISO is not letting the new processes work,” Sapper said, adding that the RTO’s six-hour lead time benchmark “will drive at least some” LMRs from the PRA.

Sapper advanced a motion that the subcommittee formally oppose the LMR filing — which it will put to an email vote.

McFarlane said the number of LMRs registering as capacity resources within the footprint only continues to increase, as do the number of emergency events. He said the uptick in both means MISO doesn’t have the luxury of waiting longer to propose new rules.

Staff also said the first FERC filing regarding LMRs was always intended to be a stopgap as MISO worked on a fuller solution.

“We think the 50% accreditation, especially in the next PRA, is a drastic change,” Michigan Public Service Commission staff member Bonnie Janssen said.

WPPI Energy’s Steve Leovy said he remains dissatisfied with the solution and what he perceives as rigidness on MISO’s part to change the proposal on stakeholder advice.

“We were careening towards a solution that I felt was pretty clear at the outset,” Leovy said, adding that he remains concerned about “shocks to MISO’s resource adequacy” as a result of the reductions in LMR capacity credits.

“What I’ve seen is a sharpshooter approach where [MISO] singles out a certain resource and just picks on it when there are other things it could do,” Kuhn said.