By Rich Heidorn Jr.

PJM officials plan to hold the next Base Residual Auction about six months after they receive FERC approval of its compliance filing implementing the expanded minimum offer price rule (MOPR).

The proposed timeline will be included in the RTO’s compliance filing to expand the MOPR to new state-subsidized resources, due Wednesday.

“We have worked very hard at PJM to achieve a balance between the disparate stakeholder positions on this subject,” Stu Bresler, senior vice president of market services, told a special meeting of the Market Implementation Committee. “We need to get back on that three-year forward mechanism.”

FERC ordered PJM on Dec. 19 to expand the MOPR to new state-subsidized resources, including self-supply assets of cooperatives and vertically integrated utilities (EL16-49, EL18-178). (See FERC Extends PJM MOPR to State Subsidies.)

The Organization of PJM States Inc. (OPSI) voted last month to ask for at least 12 months between the FERC compliance order and the BRA, with a cap limiting the delay to no later than May 31, 2021. Regulators from Ohio and Pennsylvania abstained. Other market participants have urged PJM to conduct the next auction before the end of 2020.

Starting the Clock

Bresler said the RTO will need six months to plan the auction after the ruling, calling the expanded MOPR the biggest change to the capacity market since the beginning of Capacity Performance rules, which took effect with the 2015 BRA. “We can’t start that clock the day the compliance order comes out,” he said, adding the RTO will need about two weeks to review the ruling before beginning pre-auction activity.

Bresler said PJM officials will propose compressing the pre-auction activity timeline to six months from the normal nine months for the 2022/23 auction, which has been delayed since last year because of uncertainty over the rules.

PJM will ask FERC for flexibility to delay the 2022/23 auction until as late as mid-March 2021 if a member state passes legislation responding to the expanded MOPR before June 1 and the state requests the additional time.

Bresler said PJM didn’t want a blanket delay if no state legislation is passed but also didn’t want to lack the flexibility to respond to the states, which could seek to leave the capacity market by having their utilities adopt the fixed resource requirement. (See PJM’s MOPR Quandary: Should States Stay or Should they Go?)

Pre-auction activities would be compressed further to 4.5 months after the 2022/23 BRA. PJM said it would conduct BRAs for 2023/24 through 2025/26 at six-month intervals, with a six-week span between the posting of auction results and the beginning of pre-auction activities.

Incremental Auctions

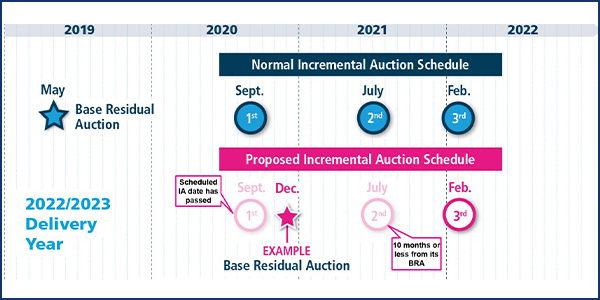

PJM typically holds three Incremental Auctions for each delivery year, with the first 16 months after the BRA, the second 10 months later and the third in the February before the delivery year begins.

But officials said they may cancel the first or second IAs if required by the schedule. An IA will be canceled if: its normally scheduled date has already passed; if it would fall within the same calendar year as the BRA for that delivery year; or if it falls within 10 months from the BRA for that delivery year.

Asset Life Ban

PJM officials also outlined their proposals for implementing the asset-life ban provisions of the Dec. 19 order along with their definition of “asset life” and the treatment of generation-backed demand response.

FERC said a resource would be barred from the capacity market if it clears the market under the competitive exemption by initially forswearing state subsidies but “subsequently” accepts a subsidy.

PJM’s Pat Bruno said there is disagreement about what FERC meant by “subsequently,” with some stakeholders saying the ban is triggered if the resource ever accepts a subsidy after winning a capacity obligation.

But Bruno said PJM will propose that the ban apply only if a subsidy is accepted for the delivery year in which the resource was treated as new entry and won a capacity obligation.

Asset Life

FERC’s order said default cost of new entry (CONE) calculations should assume a 20-year asset life for all generation resources. But PJM said it will propose to allow asset lives of up to 35 years for resources seeking a unit-specific MOPR floor price.

“We want it to be reasonably close to commercial reality,” explained Adam Keech, vice president of market services.

Keech said PJM settled on the 35-year maximum based on Footnote 301 of the order, in which the commission responded to a proposal by the American Wind Energy Association, the Solar RTO Coalition and the Solar Energy Industries Association, which filed comments as “Clean Energy Industries.”

“Rapid changes in market conditions and generation technology could make resources uneconomic in less than Clean Energy Industries’ proposed 35 years,” FERC said.

PJM said it and the Independent Market Monitor will review claims of longer asset lives based on evidence including audited financial statements; project financing documents; independent project engineer opinions; manufacturer’s performance guarantees; and federal filings such as FERC Form No. 1 or SEC Form 10-K.

Generator-backed Demand Response

PJM also plans to propose generator-backed DR providers be allowed to provide evidence showing that the cost of a backup generator is not reflective of their cost to implement planned DR or their avoidable costs. DR providers have said that many backup generators are installed for resilience, not for provision of DR.

The RTO also will propose that DR providers be permitted to provide evidence showing reduced demand charges to offset the costs of a backup generator if the generator’s cost is included in the CONE or avoided-cost rate (ACR) for the DR.

PJM acknowledged that the demand charge savings could be difficult to quantify and will require subjectivity in resource-specific reviews. But the RTO said ignoring the savings would artificially inflate the net cost of providing DR.

Filing due Wednesday

MIC Chair Lisa Morelli ended Thursday’s meeting by saying it was unlikely PJM staff will have time to share a draft of the compliance filing prior to Wednesday’s deadline. “I don’t have huge expectations that we will have time to do so,” she said.