Staff, Stakeholders See Resource Adequacy as Key Issue

SPP staff and stakeholders spent much of last week’s virtual Markets and Operations Policy Committee meeting discussing resource adequacy and the various initiatives the grid operator has rolled out to address the issue.

“Resource adequacy is a critical area for us,” SPP’s Casey Cathey said. “The regional fuel mix is consistently changing. The state of the future grid is extremely important. Loads are changing; pretty much everything’s changing that we know of in our industry, even HR.”

As director of grid asset utilization, Cathey runs a department responsible for planning a reliable and efficient bulk electric transmission system, with an eye on economically preparing SPP for the future grid. His staff facilitates generation interconnection and transmission service functions and operates resource adequacy across both the Western and Eastern interconnections.

Cathey’s department is not alone.

“Everything we’re doing related to resource adequacy is critical, which is why we have a number of different groups that are focusing on various aspects of resource adequacy,” COO Lanny Nickell said.

SPP’s Supply Adequacy Working Group (SAWG) handles immediate resource adequacy issues and the technical aspects of various studies. The Improved Resource Availability Task Force was formed after the February 2021 winter storm and is working on fuel assurance and resource planning and availability recommendations identified in the RTO’s review of the storm. (See SPP Board of Directors/Members Committee Briefs: July 26-27.)

The grid operator has also created the Resource and Energy Adequacy Leadership (REAL) Team under state regulators’ Regional State Committee. Chaired by Texas Public Utility Commissioner Will McAdams, the REAL Team has been tasked with the more strategic aspects of resource adequacy by assessing SPP’s current construct and anticipated challenges from resource mix changes, extreme weather effects, increased demand and evolving consumer behaviors.

Staff and stakeholders will be busy in the near term. SPP’s annual tasks include winter and summer season deliverability studies and, this year, a loss-of-load expectation study to help determine the planning reserve margin for summer. The study will address weather-forecast uncertainty by using 40 historical weather years dating back to 1980. It will also determine a winter resource requirement and PRM and an unforced capacity PRM.

Staff and the REAL Team are both looking at whether an expected unserved energy (EUE) standard needs to be developed. Then there’s the SAWG and Operating Reliability Working Group’s joint review of the planned and maintenance outage policy and a slew of other work.

Cathey noted SPP and the industry have traditionally followed the one-day-in-10-years LOLE standard, a legacy from a time when generation fleets primarily comprised thermal resources. He said the industry may be leaning toward a combined standard that combines LOLE with EUE and loss-of-load-hours.

“One thing that is missing in our LOLE study is forecasting climate change. There’s not a forecast or prediction or aspect to our LOLE study today, so that’s another area that we’d like to continue to explore,” Cathey said. “We have an urgency for resource adequacy, not the least of which is that resource adequacy is now one of our top corporate risks and also industry-wide. Everyone’s trying to figure out the potential policy changes.”

Nickell assured stakeholders that they will continue to have a voice in the resource adequacy work.

“I just want to deal with the impression that this is all happening behind the scenes and behind closed doors, and it’s just staff collaborating on this stuff,” he said. “That’s absolutely not true. We have been working with stakeholders along the way. … They will all have an opportunity to provide input.”

Responding to FERC’s Rejection

One of the REAL Team’s first actions has been to direct the SAWG to modify and “harmonize” two revision requests so they focus on equitable and appropriate treatment of resources in response to FERC’s recent rejection of SPP’s capacity accreditation methodology for wind and solar resources on procedural grounds.

The commission agreed in March with renewable energy developers’ arguments that it had erred with last year’s order accepting the RTO’s proposed tariff revisions to accredit wind and solar resources based on historical performance using an effective load-carrying capacity (ELCC) methodology (ER22-379). (See FERC Grants Rehearing of SPP Capacity Accreditation Proposal.)

“This was a surprise to SPP and SPP staff and members,” Cathey said, noting the ELCC was expected to be in place this summer.

The SAWG is working to separate the ELCC and performance-based accreditation into two separate RRs, with the ELCC request expected to reflect FERC guidance. The RRs have been targeted for final presentation to the board and RSC in October.

Cathey said the accreditation methodology changes for all resources should be filed together as a policy change and their implementation’s timing be consistent across all resource types. He said seasonal net peak demand should be defined in the tariff and modifications considered for ELCC allocation methodology.

FERC said in its filing that it expects staff to provide “sufficient detail in its tariff, consistent with the directives of this order, to allow the commission to act in a subsequent order without the need for additional record development.”

“We all know, especially since we passed the performance-based accreditation policy last summer, that we were working to become more equitable in our accreditation process across all fuel types,” Cathey said. “However, from a legal perspective, that was not in front of [FERC] in that docket, and so it’s certainly a lessons-learned for us.”

2024 ITP Scope Revisions OK’d

The MOPC approved a pair of Economic Studies Working Group recommendations to the 2024 Integrated Transmission Planning 10-Year Assessment’s scope that are more reflective of current grid conditions.

The first revision would include a winter weather analysis because of more frequent extreme conditions, such as the February 2021 and December 2022 storms. The MOPC and the Strategic Planning Committee both directed the ESWG to study extreme winter weather conditions.

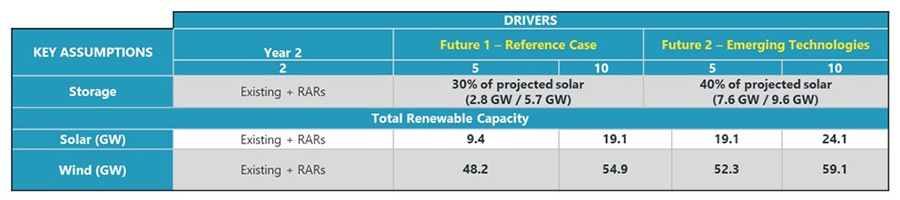

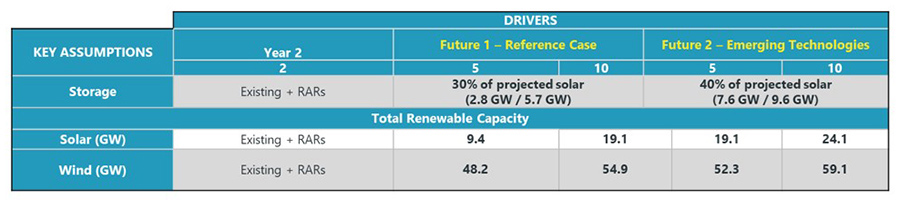

The second increases the amount of assumed amounts of renewable capacity in the scope’s two futures, based on the amount of renewable interconnection requests in the queue. Both measures passed overwhelmingly, 80% and 93%, respectively.

Increased renewable energy assumptions in the 2024 ITP’s scope | SPP

Increased renewable energy assumptions in the 2024 ITP’s scope | SPP

The ESWG suggests building two distinct winter weather power-flow scenarios: one focused on operational conditions to better understand reliability issues that took place in December, and a generic model based on a set of historical winter regional stressors such as fuel availability, wind output, and transmission and generation outages.

“At the very least for December 2022 … we are going to have some outages baked in to be able to study what exactly happened in Winter Storm Elliot,” said ESWG Chair Derek Brown, of Evergy.

Brown said it could take as much as $600,000 for additional staff time to keep the 2024 ITP on schedule.

The ESWG also proposes to increase its assumptions for renewables added to the grid in the futures’ year 5 and year 10 scenarios. The studies will assume year 10 highs of 19.1 GW for solar in the reference case and 24.1 GW in the emerging technologies case; 54.9 GW and 59.1 GW for wind; and 5.7 GW and 9.6 GW for battery storage.

GI Backlog Tracking for 2025 Completion

SPP remains on track to clear its generator interconnection queue’s backlog by 2025 despite 599 active requests, Cathey said. The queue’s six cluster studies are all green thanks to the grid operator’s two-year-old, three-phase approach to processing generator interconnection requests in place since 2022 and its backlog mitigation plan.

The mitigation efforts began in 2022 with 898 GI requests for 171.5 GW of generation in the queue. As of Sunday, the requests are down to 593 for 118.1 GW of capacity.

“It’s mostly around restudies and ensuring that we’re not causing too much churn to the GI customers and making sure that we get through the backlog as each cluster of DISIS [definitive interconnection system impact studies] is captured,” Cathey said. “So far, it still appears to be effective.”

Even with the backlog, SPP has added almost 28 GW of capacity to the system since 2016 and executed 144 interconnection agreements. Complicating matters going forward is that a little over 41% of the queue’s requests (48.3 GW) are for solar. Wind (29.9 GW) and energy storage (21.8 GW) — all of it four-hour, lithium-ion batteries, Cathey said — account for much of the rest. Developers have 21 requests for 3.5 GW of thermal capacity in the queue.

“We’re trying to thread that needle in terms of where our fuel mix is going five, 10, 15 years in the future, coupled with our load profiles,” Cathey said. “We definitely need to work on those particular policies because even if they’re all approved, as massive as 119 GW are, it’s more than twice our peak load.”

Tx Service RR Remanded

The MOPC remanded a revision request back to the Transmission Working Group after Dogwood Energy’s Rob Janssen pulled it off the consent agenda for further discussion and vetting in the stakeholder process.

Dogwood abstained from the Regional Tariff Working Group’s vote on RR534, which is intended to clarify and correct tariff language that limits transmission service to the amount of interconnection service.

Janssen said 95% of RR534 is “perfectly fine,” but the inclusion of point-to-point service along with network service runs counter to FERC Order 888’s language that doesn’t allow limitations on parties purchasing transmission service in the absence of anticompetitive practices.

“While you do try to include both point-to-point transmission service and network service in this set of restrictions, my concern is that you actually increase the probability of gaming, because now you’re allowing a third party to buy point-to-point transmission service and effectively block a load-serving entity that might have a deal with a generator for being able to get transmission service for any deal that they put in place,” Janssen said. “That could result in a very significant problem for some parties as SPP’s grid gets more resource-constrained and parties are fighting for access to generating resources.”

The consent agenda, approved unanimously, included seven other RRs that are effective immediately and one, RR530, that requires the Board of Directors’ approval:

- RR530: identifies consistent criteria for when it is acceptable to implement a transmission reconfiguration and outlines responsibilities for the reliability coordinator and transmission operator.

- RR532: removes section 4.5.9.21 (Real-Time Joint Operating Agreement Amount) and adds the variable RtJoaHrlyAmt in the definitions section of 4.5.12 (Revenue Neutrality Uplift Distribution Amount) among other cleanup to revenue neutrality uplift language.

- RR533: adds language to clarify how resources will be settled with operational tools downstream from the real-time balancing market and that cleared quantities are updated when a price correction is needed for the day-ahead market.

- RR535: corrects the protocols for uncertainty products by clarifying summation for reserve zone additions, settlement variables and if/else replacements.

- RR538: ensures the protocols and tariff clearly describe when emergency limits will be used and how market participants can know if the emergency limits are used.

- RR540: ensures RR382 (Multi-day Minimum Run Time) is accurately implemented by revising governing language for day-ahead and reliability unit commitment make-whole payments.

- RR541: clarifies that the credit customer, not the market participant, is the highest level for exposure tracking.

- RR544: modifies the Transmission Owner Selection Process Task Force’s changes to the competitive transmission selection process to include cost caps and guarantees in competitive upgrades.