As ISO-NE continues to hack away at the complicated process of updating its capacity accreditation method, the grid operator is turning its attention to gas.

In a presentation to the NEPOOL Markets Committee on Tuesday, ISO-NE officials outlined principles for how they plan to upgrade accreditation of gas resources, which has been an emphasis for many stakeholders frustrated that the current process fails to take into account fuel storage limitations.

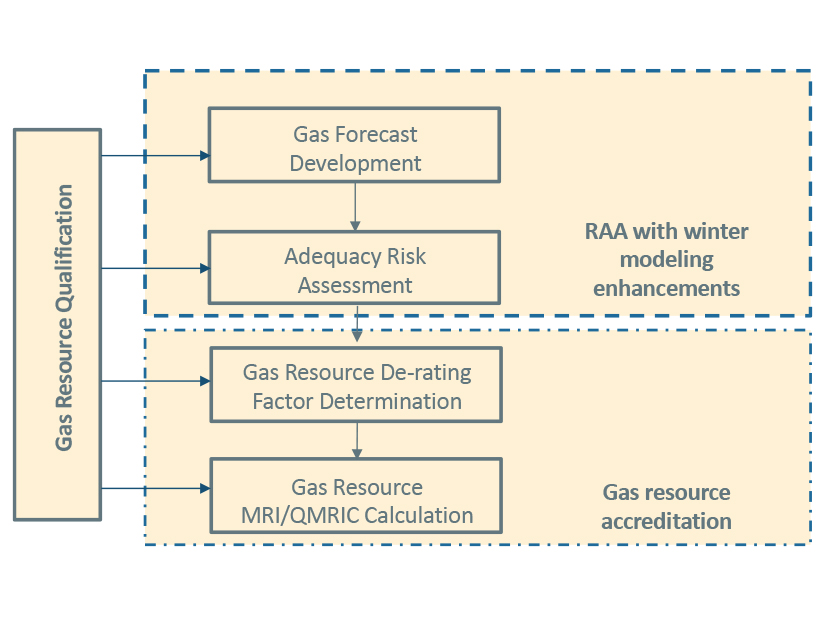

ISO-NE is planning to introduce a qualification rule that would reflect gas generators’ fuel storage capabilities and fuel contracting arrangements for the winter, said Tongxin Zheng, the RTO’s director of advanced technology solutions.

Gas resources’ qualified capacity for the winter season would be divided into firm and non-firm capacity. Non-firm capacity — that which is not backed up by on-site fuel storage or firm fuel contracts — would lead to a lower capacity rating for resources.

“Gas resources will be required to demonstrate firm fuel arrangements (e.g., LNG contracts, firm pipeline transport, proposed dual-fuel capability and on-site storage capability) in the qualification process,” Zheng said.

ISO-NE is also planning major changes to how it models resource adequacy during the winter. The grid operator is planning to use forecasts of available pipeline capacity and LNG under different scenarios to enhance its modeling.

Early Concerns from LS Power

Ben Griffiths of LS Power offered a rebuttal to ISO-NE, presenting on the company’s initial criticisms.

In particular, Griffiths said LS is “concerned that the ISO is deviating from its unit-specific approach when addressing pipeline gas availability.”

Unlike other pieces of ISO-NE’s marginal reliability impact (MRI) approach to accreditation, he said, the proposed fuel framework “relies on class-level accreditation mechanisms.”

ISO-NE’s resource capacity accreditation project “will be a failure unless it can reasonably distinguish between high-quality, gas-only resources and low-quality ones,” Griffiths said.

Among the various discrepancies between resources, he said, are that gas availability is spottier at downstream delivery points; different pipelines go to different points; and different units have gas arrangements with varying levels of “firmness.”

He noted an incident from March of this year, when multiple gas-fired generators warned the grid operator that they might be short on gas imminently. To fill the gap, several additional fast-start resources came online — including another gas plant, LS Power’s Wallingford facility.

“If some gas resources are coming offline for fuel unavailability while others can come online with no notice to replace them, then gas resources cannot be treated as one-for-one,” Griffiths said.