WASHINGTON — 2023 began with a mild winter, setting the pace for a relatively quiet year in which natural gas and wholesale electricity prices dropped and the U.S. added 26 GW in generation capacity, according to FERC’s annual State of the Markets report, released March 21.

And while the expected growth in demand from data centers and cryptocurrency miners continues to concern grid operators, total electric consumption dropped slightly in 2023.

The single biggest factor was natural gas, FERC staff told commissioners at their monthly open meeting. Record-high production exceeded consumption, which was lower than expected because of reduced heating demand from the residential and commercial sectors in January and February, the peak of heating season. This led to lower gas prices, which in turn led to lower electricity prices.

Still, “domestic consumption of natural gas grew for the second straight year,” according to the report. “Power burn — the largest component of U.S. natural gas demand — reached a new annual average high of 35.4 [billion cubic feet per day], representing a 7% year-over-year increase as lower natural gas prices and coal power plant retirements drove higher levels of electricity generation from natural gas resources.”

LNG exports to Canada, Mexico and Europe also increased, though the U.S. remains a net importer of gas from Canada.

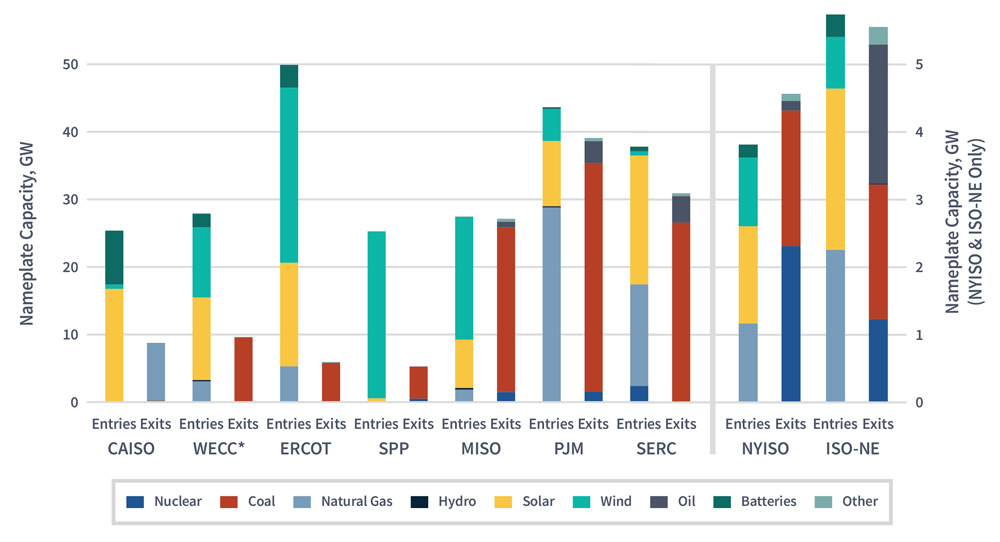

Four members of the public interrupted the meeting and were escorted out of FERC headquarters in protest of fossil fuel infrastructure. They missed hearing that solar was the dominant resource type added to the grid in 2023, at 18 GW. This was more than double the amount of wind, natural gas or battery resources, which each ranged between 6 and 9 GW in added capacity.

Battery storage had a landmark year, as additions rose by about 50% to 6.1 GW. 2023 also saw the first addition of nuclear capacity in seven years, the Vogtle plant in Georgia, and the completion of the first utility-scale offshore wind project, South Fork Wind off New York. And coal resources continued to decline, with 6.8 GW in retirements, a nearly 19% drop.

“Nevertheless, in terms of installed capacity, natural gas remained the primary resource type at the end of the year at 45% of the capacity mix, followed by coal at 15%, wind at 12%, nuclear at 8%, hydro at 8%, solar at 7%, oil at 2%, other at 2% and batteries at 1%,” according to the report.

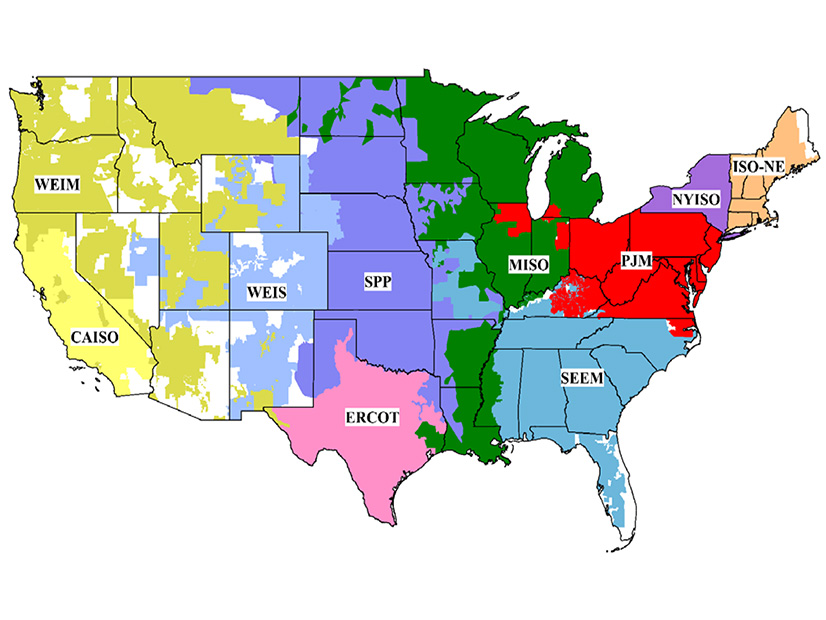

The 49-page report has a section on “Transforming Markets,” which recounts the many changes and new products by RTOs and ISOs being implemented. These include SPP’s Uncertainty Reserve ancillary service; PJM’s increase in synchronized reserve procurement; CAISO’s Day-Ahead Market Enhancements; ISO-NE’s new day-ahead ancillary services market; and MISO’s seasonal capacity market construct.

“All of these changes that are being reported in the State of the Markets report are encouraging,” Commissioner Allison Clements said. “I think it’s really important to have this context when we’re thinking about the pace of change and potential thermal retirements. These retirements will not be happening in a static environment, as market, grid and operations transitions are well underway. …

“And there is no shortage of replacement generation and storage lining up ready to serve, and their integration will be aided by FERC’s reforms and by the ongoing work in the regions.”

Clements’ upbeat assessment was countered by Commissioner Mark Christie, who quoted the PJM Independent Market Monitor’s State of the Market Report, which said up to 58 GW of thermal resources could retire by 2030. (See related story, PJM Monitor Finds Markets Overall Competitive.)

“Given current technology and the short time period, the retiring capacity can only be replaced by gas-fired or dual-fuel generation,” the Monitor wrote. “Renewables can replace a significant amount of the energy output but cannot replace the capacity. Capacity means that the resource is expected to be available when needed, regardless of the time of day or ambient conditions. … The current PJM interconnection queue does not include adequate thermal capacity to replace the potentially retiring thermal capacity.”

While Christie supports Order 2023 as “a good step forward” to unclogging RTOs’ generator interconnection queues, “it’s not a silver bullet” for maintaining resource adequacy, he said. Clearing “the queue is not going to fix it, because the queue is largely nondispatchable, intermittent resources that are simply not one-for-one replacements.” And the gas-fired resources in the queue won’t all necessarily get built because of the difficulty of siting pipelines, he said.

Asked to respond to Christie’s remarks, Chair Willie Phillips pointed to the commission’s pending final rule on transmission, which he said is coming soon.

“There is no one silver bullet that is going to fix interconnection, and there is no one silver bullet that is going to fix transmission. But … there is no greater action that the commission can take that can address reliability, affordability and sustainability than addressing transmission reform in general,” Phillips said. “Now we have more work to do, and we are laser-focused, as I’ve said many times, on our long-term and regional planning rule. And we are in the last leg of the final lap. … I’m like Michael Johnson at this point. We are running as fast as we can to get this done.”