CARMEL, Ind. — MISO this week said its future holds exponential renewable growth, free-falling carbon emissions and a stubbornly persistent capacity risk, requiring a slew of new capacity.

The pronouncements come from the initial findings of MISO’s annual Regional Resource Assessment (RRA). The grid operator said that by using publicly available utility plans and its own assumptions, it expects the system will draw 30% of its annual energy from renewables by 2027 and approach 60% by 2041.

Also by 2041, the footprint will collectively decarbonize 80% from peak 2005 levels, MISO predicted. Renewables currently make up about 13% of the RTO’s resource portfolio.

“That is significant because this study is basically bringing together our members’ plans … and showing what the footprint will look like,” MISO engineer Aditya Jayam Prabhakar said during a Resource Adequacy Subcommittee meeting Wednesday.

Jayam Prabhakar said the risk of a capacity shortfall will persist throughout the fleet transition, “highlighting the immediate importance of coordinated resource planning.”

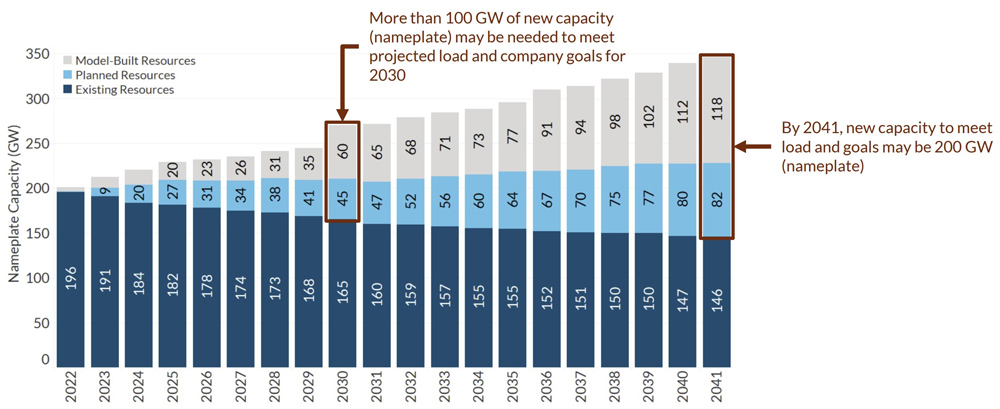

The grid operator said it found a need for members to expand nameplate capacity by 100 GW by 2030 to meet their combined carbon-reduction plans and stay within safe reserve margins. By 2041, MISO may need a 200-GW expansion in nameplate capacity.

The RTO also said it expects average capacity factors for operational natural gas and coal units to decline between 10 and 30% over the next 20 years. It said that even if current company resource planning is implemented on time, a systemwide shortfall is possible beginning in 2027.

Jayam Prabhakar added that the assessment relies on “highly evolving” information and characterized MISO’s analysis as a “guided tour,” as opposed to a deep exploration of future possibilities.

MISO did not include generation retirements beyond what is already publicly announced. Michelle Bloodworth, of coal lobby group America’s Power, said she thought the RTO was underestimating thermal generation retirements.

“Like all studies, the results of the RRA are sensitive to inputs and assumptions. This is but one possible scenario in a quickly evolving landscape,” Policy Studies Engineer Hilary Brown said.

MISO future capacity need projections | MISO

MISO future capacity need projections | MISO

She said MISO is notably missing some intermediate resource planning information from members around their 2030 greenhouse gas emissions goals. “Many companies have defined carbon-reduction milestones around 2030, leading to a possible large, single-year buildout.”

Responding to stakeholders’ questions, Brown said MISO has not yet included the torrent of renewable energy development that will possibly take place under the recently signed Inflation Reduction Act. She said the impacts under the law will be contemplated in next year’s assessment.

“We’re going to see some pretty crazy changes next year in how companies react to the Inflation Reduction Act,” Southern Renewable Energy Association Executive Director Simon Mahan said.

Brown said a “one-for-one capacity replacement” is not sufficient when replacing thermal generation with intermittents. She said that while MISO foresees a deepening capacity shortfall, members’ plans could change in reaction to MISO’s Planning Resource Auctions (PRAs).

“This isn’t new. We’ve seen it in last year’s PRA,” Brown said of declining and inadequate margins. (See OMS RA Summit Confronts Midwestern Supply Squeeze.)

Months after MISO’s capacity auction shortfall, several utilities unveiled deferrals on coal retirements.

WEC Energy Group and Alliant Energy have announced they are postponing retirement plans for multiple coal plants because of concerns over grid reliability. Likewise, Ameren Missouri is expected to defer the planned Sept. 1 retirement of its 1.2-GW Rush Island power plant until 2025. Two Montana Public Service Commissioners recently called on state lawmakers to do everything in their power to keep the Colstrip generating facility operating to prevent freezing deaths this winter. Colstrip is owned by Talen Montana, Puget Sound Energy, Portland General Electric, Avista, PacifiCorp and NorthWestern Energy.

On the other end of the spectrum, Clean Grid Alliance in mid-August saluted Illinois, Iowa and Indiana in particular as jurisdictions in the MISO footprint where renewable energy development is blossoming.

The alliance said Indiana’s 6.3 GW of solar projects in development currently ranks third in the nation; Illinois’ nearly 8 GW of operating wind, solar and storage capacity currently ranks sixth; and Iowa leads with 207 MW of land-based wind power coming online in the second quarter of 2022.

CGA said the nine states in MISO’s Midwestern region combined have 12 GW of clean power capacity in advanced stages of development.

Multiple stakeholders said MISO did not reveal enough about its modeling methods and data sources for others to fact-check its resource analysis.

The RTO plans to publish the full 2022 RRA in November.

Stakeholders Ask MISO for Midyear Capacity Accreditation

Disappearing reserves in its capacity auction has sparked a new stakeholder proposal at MISO.

MidAmerican Energy’s Dennis Kimm asked that MISO accredit new planning resources that enter the picture after the planning year is underway.

MISO doesn’t currently permit new generation to convert its output into accredited capacity in the middle of a planning year. New generators currently must wait until preparation for next year’s capacity auction begins before they become eligible to receive zonal resource credits.

Several stakeholders said they supported the proposal and requested MISO create new tariff language immediately.

Alliant’s James Niccolls said that, “frankly, it’s hard to explain” MISO’s current practice to his company’s leadership and customers.

“There’s obviously widespread stakeholder support on this,” RASC Chair Kari Hassler said.

Meanwhile, stakeholders again requested that MISO publish more data ahead of its PRAs on generator suspensions and granted participation exclusions. Some have said MISO should publish a line item on generation that’s likely to be unavailable in the auction and give members a better idea of the footprint’s expected margins before the auction window opens.