The SPP Markets and Operations Policy Committee has approved tariff revisions that would implement dispatchable transactions in the real-time energy market.

Real-time Dispatchable Transactions

The SPP Markets and Operations Policy Committee on Jan. 15 approved tariff revisions that would implement dispatchable transactions in the real-time energy market.

Dispatchable transactions, already instituted in the RTO’s day-ahead market, allow market participants to submit dynamic schedules, which SPP evaluates and dispatches economically. RR653, passed with 95.56% stakeholder approval, essentially would extend the existing dynamic interchange transaction framework to the Real-Time Balancing Market.

The goal, said Yasser Bahbaz, SPP senior director of market development, is to increase market participation, especially at the seams. Market participants could change their bids and offers up to 30 minutes prior to the operating hour. “The advantage here is that now we would have a transaction product in real time that we could economically assess and dispatch in real time, and we’d determine whether it’s economically favorable to serve our market,” Bahbaz said.

“Because it is a dispatchable transaction, the market will have every opportunity to assess that transaction,” Bahbaz said in addressing some stakeholder concerns. “So we think this is better than having fixed schedules, in some ways, because we would be able to assess ramp, and to the extent that we can take in imports or have exports, it would be co-optimized with what we have. … The nice thing about this product is that it is fully flexible.”

Steve Sanders, strategic adviser for the Western Area Power Administration, said that while the organization was supportive of the product’s concept, “this proposal is not there yet. It lacks the effectiveness of market-to-market seams coordination and zonal resource optimization, with several risks to both product manipulation, effects to internal market optimization, and reliability during abnormal or emergency operating conditions.”

“I think we are committed to solving these issues together with staff” and the Market Monitoring Unit before the proposal is filed with FERC, Sanders continued. “Our goal would be that, to the extent that we have a product that would pass the FERC hurdle and provide benefits to the market and not create issues, that would be a desirable outcome.”

American Electric Power’s Richard Ross — chair of the Market Working Group, which recommended approval of the revisions — asked Bahbaz whether any of WAPA’s concerns gave SPP pause in moving forward with them. “Do you think we need to do additional work as a group before this is approved, or can we overcome these concerns during the FERC filing?”

“From SPP’s standpoint here, I think it’s important for us to move this forward,” Bahbaz answered.

Jodi Woods, SPP director of market monitoring, said the RTO addressed many of the MMU’s concerns with the proposal, “but we do still have some outstanding ones that we’re continuing to monitor. … We’re going to follow it through implementation … including potentially recommending additional tariff language.”

Extension for FERC Order 881 Implementation

The MOPC approved asking FERC for an extension to comply with certain requirements of Order 881, from July 12 this year to Sept. 1, 2026.

Issued in 2022, Order 881 directs transmission owners and providers to end the use of static line ratings, and to use ambient-adjusted ratings (AARs) and seasonal ratings instead. FERC allowed three years to implement the requirements.

In December 2023, FERC found that SPP’s plan was mostly in compliance but that it had not properly explained whether and, if so, how the use of AARs would affect existing market processes (ER22-2339).

Since then, the RTO’s Ambient Adjusted Ratings Implementation Task Force has worked to develop the timelines and other requirements for the calculation and implementation of AARs. But members of the task force recommended to the Operations Reliability Working Group (ORWG) that based on TO readiness, staff should request an extension to comply with the AAR requirements.

Based on a survey conducted Dec. 20, 2024, only 24% of members said they would be ready on SPP’s targeted go-live date of July 1. According to the ORWG, a minimum of 67% of impacted members, and a minimum of 90% of impacted lines and flowgates (“critical mass”), are needed for implementation.

It also wants more time for testing, preferably not while SPP works to integrate RTO West, and avoiding a peak season for implementation.

Responding to COO Lanny Nickell on how the Sept. 1 date was chosen, SPP’s Charles Cates said staff were confident that implementation could not be achieved any earlier than April 1, 2026. “But they also don’t want us to take too much time.”

Advanced Power Alliance’s Steve Gaw asked if SPP had any idea how much delaying implementation of AARs, which he noted can reduce transmission congestion, would cost.

Cates answered that it would be “minimal to none. The budget that we have accounted for the project, we are not anticipating to change at this time. There may be some additional staff costs as we implement this, but those will be embedded.”

“That was a great answer to a question I didn’t ask,” Gaw replied. “My question was, how much are we potentially costing the market by not implementing 881 in a timely manner?”

“We’re not sure. We have not done in a while an ambient-adjusted market study,” Cates said.

Gaw then noted the survey showed that 71% of members said they would be ready by Dec. 1, 2025, surpassing staff’s 67% threshold. “Why did you all feel like that that wasn’t a better date, at least to get us up and running sooner with this?” he asked. “I think FERC might scrutinize this fairly significantly because of the extent of the delay.”

Cates responded by saying staff expected SPP’s request to be among the shorter extensions among the RTOs, with some asking for up to 2028, “and I certainly understand why.” Specific to SPP, “we have a lot of deliveries coming for the West integration. So we need to be very careful with how we stage this and not interact with that project.”

The Natural Resources Defense Council’s Christy Walsh also noted the survey results and wondered how much of that 71% actually would be ready in October. “I understand you don’t want to implement something new in the middle of winter — that makes complete sense — but we’re constantly hearing we have a resource adequacy problem. … If we have 71% of people ready to free up some transmission constraints on the transmission system where we have more resources adequacy, that just seems like an easy win,” she said.

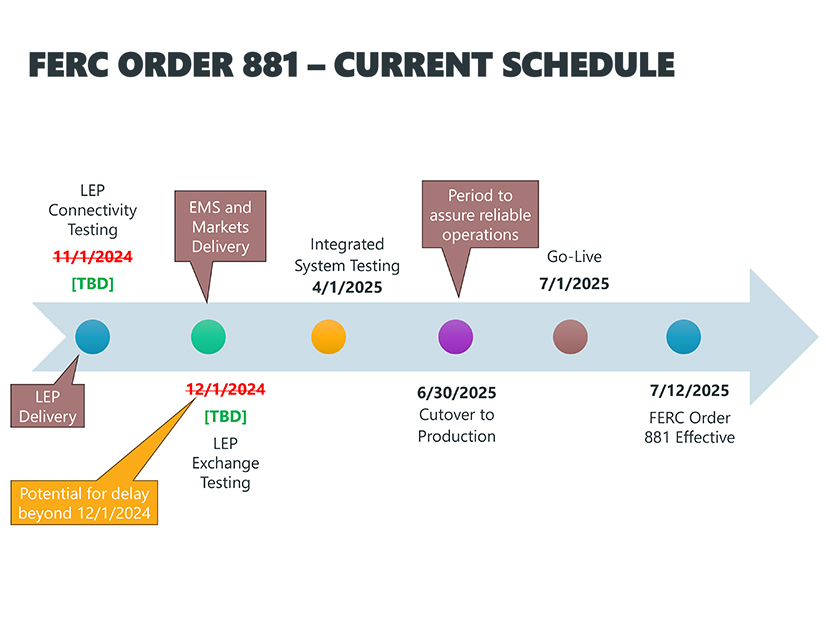

Evergy’s Jeremy Harris, chair of ORWG, noted that under SPP’s current timeline for implementation, its ratings database, the Limit Exchange Portal (LEP), was supposed to have begun testing Nov. 1. It still has not been delivered. “So from a TO/TOP perspective, we have little faith in SPP’s timeline, and we need this extension because we will need to connect to it, and SPP doesn’t even have the tool.”

“That still doesn’t explain to me why we have a survey that says 71% think they’ll be ready by the end of this year,” Walsh countered. “I’m hearing separately, ‘but not really.’”

Harris responded that he expected that if the survey were conducted today, there would be fewer members saying they would be ready based on the fact that the LEP tool still was not ready.

The extension request was approved with 94.44% support.

Expedited Resource Adequacy Process

In a relatively close vote, the committee endorsed developing a proposal to create a one-time process to quickly add generation to meet load-responsible entities’ resource adequacy needs outside of SPP’s generator interconnection procedures.

“Given the concerns by some stakeholders to come up with a process to meet those [RA] needs,” SPP’s Steve Purdy said.

The proposal largely is based on MISO’s Expedited Resource Adequacy Study, which it hopes to file by February. (See MISO Tells Board RA Fast Lane in Interconnection Queue is a Must.) Both essentially would create a “fast lane” for projects that are deemed necessary to maintain reliability.

In SPP’s case, the projects would be determined by the LREs themselves. And the RTO is relying on its Regional State Committee’s endorsement “to undergird and provide justification for the deviation from established FERC policy,” Purdy said. “It’s not truly a GI study; it’s a resource adequacy study that involves interconnection of new resources,” though it would follow certain procedures for studying projects.

The process would be open to any generator type, though there would be a capacity ceiling determined by SPP based on LREs’ load projections. Projects would be required to have a proposed commercial operation date within five years of its submission; if SPP’s preferred timeline is approved, that would be by 2030.

The goal is for the MOPC to approve the formal revision request in April, with RSC and Board of Directors approval in May.

“I think SPP staff has done a remarkable job in a very short time,” Golden Spread Electric Cooperative’s Mike Wise said. “I think this is a good example of SPP staff responding to stakeholders’ concerns and developing a product that really can meet their needs.”

Other stakeholders representing LREs voiced their support. But several stakeholders voiced opposition based on the ongoing work on SPP’s Consolidated Planning Process (CPP).

APA’s Gaw said, “We really don’t know what this exact proposal is going to look like when it gets into [revision request] form. We’ve got serious concerns with this proposal for a number of reasons,” among them being that stakeholders already have spent “countless hours” on the CPP, but this new proposal seemed to be taking precedence.

He also argued that MISO is letting states determine their RA needs, while “this is entirely left up to the load-responsible entities, and I don’t know how the states are going to be able to manage ensuring consumer protections.”

“CPP is something that would address a lot of the concerns that we have right now, and MISO is not in the same position as SPP is,” AES’ Shilpi Sunil Kumar said. “I would request staff to keep that in mind, that we don’t need to do exactly as MISO is doing because their concerns and problems are different.”

Invenergy’s Arash Ghodsian said that, as he told MISO with its proposal, “we need some transparency on some of the details” about the affected-system aspect. “There’s probably room for some improvement, but the details at this point are very important if we’re going to provide support.”

Purdy responded that SPP likely would need to propose revisions to its Joint Operating Agreement with MISO.

Lucas to Succeed Nickell as COO

Nickell opened what he said likely would be his last MOPC meeting as the committee’s secretary with a brief speech as he prepares to take over for SPP CEO Barbara Sugg on April 1.

“I’m super excited — really excited — to be SPP’s next CEO; to have the opportunity to lead this organization,” Nickell said. “My goal for SPP is really simple: … I want SPP to be the best. The best RTO in the country. That really shouldn’t be that hard to do because we already have the best employees, and we already have the best stakeholders.”

After his remarks, Nickell announced that Antoine Lucas, vice president of markets, will take over as COO.

“I’m really excited about this new opportunity, particularly the increased role in the stakeholder process that comes along with it,” Lucas said.

Nickell also reminded attendees of SPP’s inaugural Energy Synergy Summit, announced the previous day, to be held March 3-4 in Dallas.

In its announcement, the RTO billed the event as “a deep dive into resource adequacy, load and generation interconnection, grid modernization, and the policies and partnerships needed to support them.”

“This is going to be a tremendous opportunity for our stakeholders and anyone who’s interested in … figuring out how to add resources quicker while doing it reliably, and adding load, not only quicker but also reliably,” Nickell said. “Trying to meet both the expectations that I know a lot of our members have: ‘I need more resources, and I want to serve this load that I know is coming.’ That is what the purpose of this summit is: to talk about both those issues.”

Nickell was asked whether this would be the first in an annual series. “I suspect that we’ll need to do that,” he replied, though he seemed to imply this new event really is a continuation of the RTO’s Resource Adequacy Summit, held in 2023. “This time we thought, ‘Man, we need to combine the topics of resource adequacy and load growth, and specifically the kind of load growth that we’re seeing … with big data centers.”

The deadline for registration is Feb. 24, while the special room rate for the Dallas/Fort Worth Airport Marriott, where the conference will be held, ends Feb. 10.