FERC voted unanimously at its open meeting Feb. 20 to launch a review of data center co-location issues in PJM that will look into whether the RTO’s tariff needs to be revised to ensure grid reliability and fair costs to customers (EL25-49, AD24-11).

The commission’s order focuses on PJM because it has seen a larger number of proceedings on the issue, as it is home to the largest data center market in the world and a large number of nuclear power plants interested in such contracts.

“Co-location arrangements are a fairly new phenomenon that entail huge ramifications for grid reliability and consumer costs,” FERC Chair Mark Christie said in a statement. “Given these ramifications, the commission truly needs to ‘get it right’ when it comes to evaluating co-location issues.”

The order comes after FERC in November rejected a proposed expansion of a co-location deal between an Amazon Web Services data center and Talen Energy’s Susquehanna nuclear plant in Pennsylvania. (See FERC Rejects Expansion of Co-located Data Center at Susquehanna Nuclear Plant.)

It had received several, dueling sets of filings from both sides of the argument, and it held a technical conference on the subject earlier that month with witnesses from other markets. (See FERC Dives into Data Center Co-location Debate at Technical Conference.)

FERC gave PJM and its transmission owners just 30 days to determine whether the RTO’s tariff needs updates to accommodate co-location arrangements. The commission found the tariff may be unjust or unreasonable because it does not have such rules.

The commission is taking comments on the broader issues, and it will incorporate the record from the technical conference and related complaints. Parties have 30 days to file comments and another 30 to file replies.

Without a common understanding of entities’ responsibilities, FERC is concerned that the arrangements could be developed in a way that is not fair for other customers.

“We are especially concerned that the absence of tariff provisions creates the potential that participants in a co-location arrangement may not be required to pay for wholesale services that they receive,” FERC said.

The issues with co-location fall under both FERC and state jurisdiction, with the commission having to ensure that rates for the wholesale sale of transmission of electricity, as well as practices directly affecting such sales, are just and reasonable and not unduly discriminatory or preferential. States have the oversight of retail sales not in interstate commerce, as well as facilities used for the generation and distribution of electricity.

“The boundaries between federal and state jurisdiction are not hermetically sealed,” FERC said. “The application of these principles to the issue of co-location will often depend heavily on the specific facts and circumstances presented in particular situations.”

With co-location, some basic principles on that split will apply across all the contracts. States will keep exclusive jurisdiction over retail sales, which means they decide which entities are legally permitted to provide electricity to retail customers and how the costs of providing wholesale power are recovered from retail customers.

FERC has exclusive authority over the rates, terms and conditions for the sales from generating resources used to serve co-located loads, as well as practices directly affecting such sales. FERC also has jurisdiction over any transmission service used to serve co-location arrangements.

The commission seeks comments on jurisdictional issues, including when large loads are interconnected to the transmission system in interstate commerce and what evidence FERC should use to determine that.

Another issue FERC wants commenters to address is how such co-location arrangements have raised concerns around reliability and resource adequacy. NERC testified that 1,550 MW of voltage-sensitive load (data centers) disconnected from the system in a recent fault.

If the co-location arrangements proliferate, it could have major impacts on PJM’s grid, which was often designed around nuclear plants, as the RTO’s Independent Market Monitor testified. Taking the capacity out of the markets could also cause prices to spike for other customers, as the IMM and the Illinois Attorney General’s Office testified.

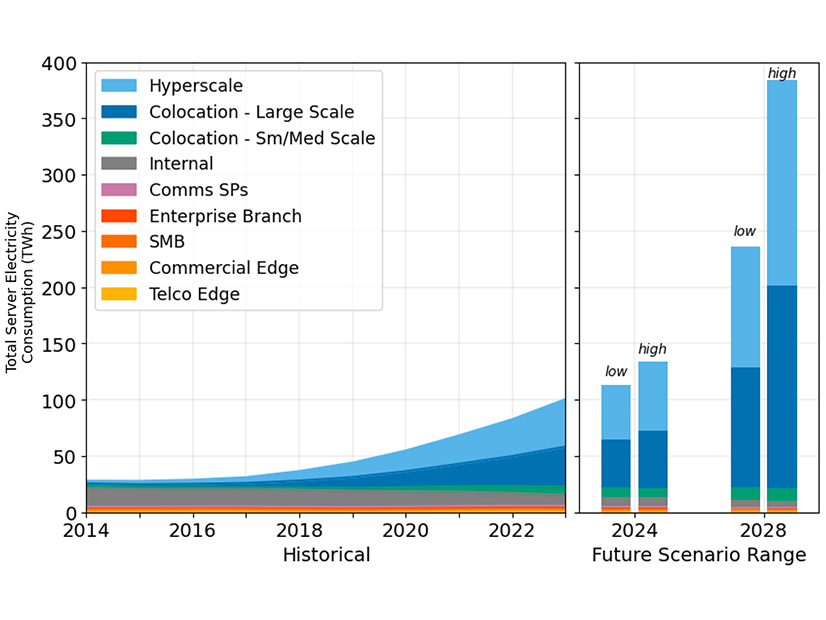

“That being said, we recognize, as does PJM, that these concerns are not necessarily unique to co-location arrangements and that significant load growth more generally may raise many of the same concerns,” FERC said.

Exelon Co-location Tariff Rejected

In a related order, FERC rejected a series of filings made by Exelon’s utilities, all PJM members, that tried to set up rules for any co-locations in its territory (ER24-2888, et al.). Exelon in 2022 spun off Constellation Energy, which now owns the largest nuclear fleet in the country, but most of that is connected to transmission lines the original company owns.

FERC found that the tariff revisions fall outside any individual utility’s tariff because they impermissibly alter the definition of load in PJM’s tariff.

The order drew a concurrence from Commissioner Willie Phillips, who as chair voted to approve the Susquehanna proposal. The majority in that order had not wanted to set policy by precedent, but Phillips felt that approval would not have limited FERC’s flexibility going forward.

This time, while he sided with the majority to reject Exelon’s filings, he noted that they raise real issues, including ensuring that co-located loads pay their fair share of costs, but they will be examined in the rulemaking proceeding, he noted.

A bipartisan consensus has emerged that data centers and the artificial intelligence applications they enable are national interest resources with profound implications for both national security and economic growth, Phillips said.

“I believe that this commission, in cooperation with our federal, state and local partners, should take all reasonable steps within our authority to support their development,” he added. “I view today’s orders as a down payment on this important national investment.”