FERC on March 20 released its State of the Markets report, which showed higher demand and lower wholesale prices across the organized markets in 2024.

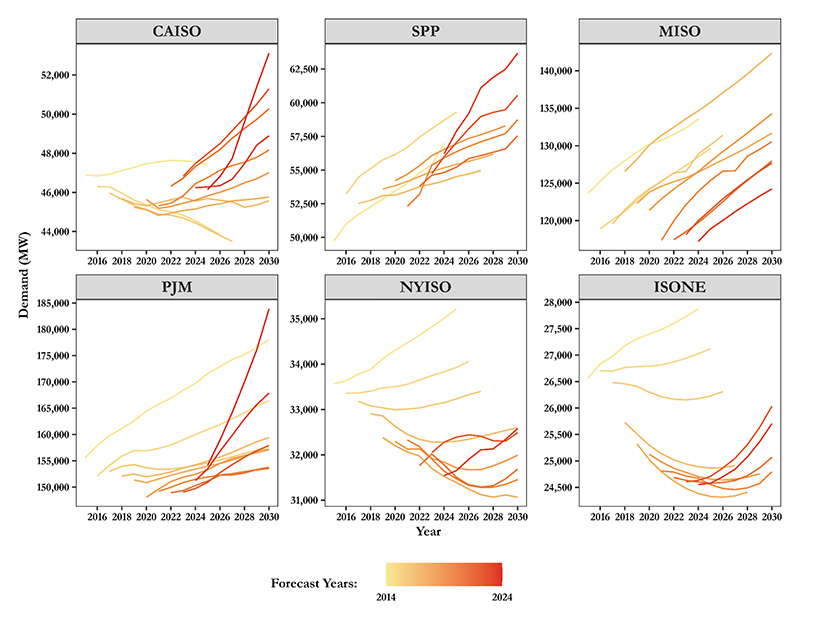

The higher demand was driven by a warmer summer, leading to higher demand peaks in CAISO, ERCOT and PJM, but the report also noted demand is expected to increase even more in coming years.

“Going forward, NERC forecasts that U.S. electric loads will grow more quickly and increase by 132 GW by the summer of 2029 and by 149 GW by the winter of 2029,” the report said.

Generation of electricity was higher from 2023 to meet the demand, totaling 4,151 TWh nationally, though the resource mix continued to change. Coal generation was down 3.3% from 2023, utility-scale solar was up 32% and wind generation grew by 7.7%.

The lower national prices masked regional disparities, with ERCOT North Hub and trading hubs in the West seeing the steepest drops, while wholesale prices in the Northeast were up from 2023.

“Compared to the five-year average prior to 2023, electricity prices were down significantly in nearly all representative trading hubs, with the greatest decreases in ERCOT, CAISO, SPP and the Southeast,” the report said. “In RTOs/ISOs, mean load-weighted electricity prices were down 25% compared to the five-year average prior to 2023.”

FERC Chair Mark Christie highlighted the regional differences in prices, saying that the State of the Market report from PJM Monitor Joe Bowring showed an uptick in prices there. (See PJM Market Monitor Publishes Mixed Views in Annual Report.)

“LMPs went up by almost 8%, and the overall total cost of wholesale power went up by almost 5%, so I’m not saying that it’s a discrepancy, but PJM is the largest operator by load, and Dr. Bowring reports that their wholesale power costs went up almost 5%,” Christie said.

The report shows wholesale prices going up by 4% at the node FERC tracks in PJM, but it does not examine all-in costs like Bowring’s does, staffer Taylor Webster said at the commission’s open meeting.

Beyond prices, Christie also highlighted that reserve margins are shrinking around the country.

“This report is consistent with reports we have been regularly receiving from NERC as well as RTO sources, such as from PJM and MISO,” Christie said in a statement. “The combination of rapidly increasing electricity demand, driven by hyperscale customers such as data centers, paired with the alarming rate of baseload generation retirements and lack of new dispatchable generation, is not sustainable and must be addressed.”

Data centers are expected to add 13 to 55 GW across the country over the next five years, with uncertainty about supply chains, questions about how efficient computation in artificial intelligence will be, and the availability of electric generation in some regions. The changing demand, resource mix and weather patterns all have had an impact on capacity markets, with ISO-NE, MISO, NYISO and PJM all seeing prices rise in those markets, the report said.

“Although the mechanisms differ, each of the nation’s RTOs and ISOs are working to preserve resource adequacy by enacting changes consistent with their specific market structures,” the report said. “Some of these changes have been enacted, while others are underway or on the horizon. The full effects of these resource adequacy reforms are not yet fully clear.”

Commissioner Judy Chang noted the markets also feel the effects of cheap natural gas. Prices for the commodity were down from 2023, with the Henry Hub benchmark dropping 11% to average $2.25/MMBtu.

“I just want to make a note that our electricity prices are very sensitive to gas prices, I would say probably across the entire U.S.,” she said. “But also, while energy prices are low, it also puts upward pressure on capacity prices.”

That pressure is felt in regions like PJM, where prices shot up in a very visible way, but also in regions where capacity costs are included in bilateral contracts that power plants sign for offtake, Chang added.