More than half the U.S. coal fleet could be retired by 2025 to reduce emissions and generating costs, with no harm to reliability, according to a new report by the Rocky Mountain Institute.

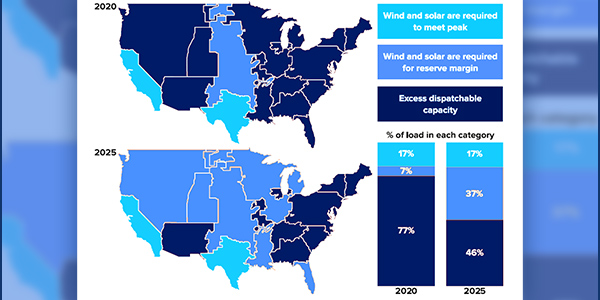

Based on an analysis of NERC data, RMI says 27% of the coal fleet — mostly in the Northeast and Southeast where reserve margins are high — could be retired without replacement. Another 29% could be cost-effectively replaced with wind and solar.

Renewables, storage and demand-side management would be required to maintain reserve margin targets and replace the remaining coal plants in the U.S., it said.

“In considering economic retirement opportunities, utilities and regulators often raise concerns about reliability if coal capacity retires,” says the report, Cutting Carbon While Keeping the Lights On. “We find that these concerns are generally misplaced, and that the United States is on track to have 60 GW of excess generation capacity in 2025, above and beyond reserve margin targets.”

The report notes that most of the country has more dispatchable generation than necessary to meet reserve margin targets. PJM has more than 30 GW of excess generating capacity above its 15% reserve margin and its dispatchable thermal capacity exceeds the reserve margin without including wind or solar.

“No region in this category has experienced a major outage related to inadequate generation capacity in recent years,” it said. The report does not mention the 2014 polar vortex, when as much as 22% of PJM’s generating capacity was idled and the RTO came close to having to shed load.

It notes that ERCOT and CAMX (covering California) already rely on effective load carrying capacity-weighted wind and solar capacity to meet peak demand. SPP depends on wind to meet reserve margin targets.

RMI’s analysts based their economic comparison of coal and renewables on “direct, going-forward costs” of coal plants and did not consider the impact of any price or cap on carbon emissions or other environmental externalities. It noted, however, that a 2020 study by Energy and Environmental Economics found that a $10/ton price on carbon emissions — well below what most economists say is necessary — would cause the economic retirement of all PJM coal capacity by 2030.

RMI said its analysis targeted 2020-2025 “under an assumption that present-day reserve margin targets will continue to govern system planning and operations in the next few years.”

“We recognize the importance of reassessing reserve margin targets given the increasing severity of extreme weather that has contributed to the recent outages in California and Texas, but we do not undertake that analysis here,” it added.

NERC did not respond to a request for comment on the report.

In its 2020 Long-Term Reliability Assessment in December, however, NERC said that the growth of renewables and retirement of conventional generation over the next decade means “resource planners must consider greater uncertainty across the resource fleet as well as uncertainty in electricity demand that is increasingly being affected by demand-side resources. As a result, reserve margins and capacity-based estimates can give a false sense of comfort.” (See NERC: Grid Operations ‘Fundamentally Changing’)

Michelle Bloodworth, CEO of coal advocacy group America’s Power, said last month’s extreme cold showed the importance of maintaining “fuel-secure coal units necessary for supporting grid resilience in much of the country.”

“While Texas was experiencing rolling blackouts, we saw that coal was able to increase its output and provide close to half the electricity in all or parts of the 21 states that comprise the MISO and SPP regions,” she said. “This recent experience underscores the importance of maintaining fuel diversity and the need to maintain coal-fired generation, even while the nation’s electricity mix is changing.”

Bloodworth also cited the group’s recent article outlining challenges to decarbonizing by 2035.

Ben Fowke, CEO of Xcel Energy, also has expressed skepticism about an all-renewable generating fleet. In testimony before the Senate Committee on Environment and Public Works Wednesday, Fowke noted that his company expects renewables to make up two-thirds of its energy mix by 2030. “However, renewable energy can only take us so far,” he said. “At higher levels of intermittent renewables, the cost of the energy system begins to skyrocket, and its reliability degrades. That means that the whole industry — even Xcel Energy with our remarkable renewable resources — will need some form of new, carbon-free, 24/7 dispatchable generation to remove the last increment of emissions on our system and get to zero.”

‘All-source’ Procurement

RMI also issued a second report recommending states adopt “all-source” resource procurements and projecting a need for 700 GW of new generation investment over the next decade, including 420 GW in the territory of vertically integrated utilities.

All-source portfolios would include utility-scale and distributed energy resources. RMI said procurements should be aligned with states’ objectives, including resilience, decarbonization and economic development. It also urged a “least regrets” approach to capture the benefits of competition and declining costs of new technologies.

The report cited numerous case studies, including Xcel’s all-source solicitation in Colorado in 2017, saying it was proof “that a solution-agnostic needs description can elicit many bids and record low bid prices for renewable energy and hybrid resources.”

Vertically integrated utilities are expected to spend up to $750 billion through 2030 on new resources, RMI said. “With an improved approach to resource procurement, the industry has a once-in-a-generation opportunity to ensure that this money is spent in ways that leverage the market, support diverse stakeholder priorities and minimize risks going forward. The alternative — continuation of legacy processes and approaches to resource investment — risks squandering capital and locking in customer costs and carbon for decades to come.”