Oregon should recognize the capacity contributions of all resources including variable renewables, according to a new report commissioned by the state Public Utilities Commission.

The report from consulting firm Energy and Environmental Economics (E3) counsels the PUC to adopt a plan based on methods already familiar to market participants in Eastern RTOs. These include use of demand curves to adjust capacity prices and measuring the marginal capacity contributions from renewable resources based on effective load-carrying capability (ELCC).

The E3 report seeks to answer a key question the PUC posed in April 2019 when it initiated an investigation (UM 2011) into a “comprehensive approach” to recognizing the capacity contributions of the various resources in utility integrated resource plans (IRPs): How should capacity be valued?

“The capacity provided by a resource to the electric system plays a central role in determining that resource’s overall value and therefore informs fair compensation to that resource,” the PUC wrote then. The growing penetration of variable energy resources “requires an examination at how capacity from various resources should be valued.”

The PUC said its existing programs have dealt with capacity valuation on a “piecemeal” basis, using different methodologies to account for capacity from utility-scale generation, distributed resources, energy efficiency, storage and demand response. At the same time, variable resources were short-changed by receiving “little to no credit” for their contributions to peak needs.

“A holistic investigation into these issues related to capacity could lead to a harmonization of some of these disparate approaches,” the PUC said.

The regulator pointed out that capacity valuation can play a role in the implementation of time-of-use rates or in evaluating programs such as demand response that can avoid or postpone investments in new resources.

“Other program benefit evaluations where capacity value needs to be considered include transportation, electrification and energy storage,” the PUC said.

Marching Down the Decarbonization Curve

“I think we’ve all seen across the West what can happen when capacity planning doesn’t quite go to plan,” E3 Director Zachary Ming said during a PUC-hosted video call Thursday to explain the capacity valuation report. “I’m really happy to be part of this proceeding that’s happening in Oregon to try to make sure the state gets ahead — and stays ahead — of the curve on this capacity issue that’s becoming more and more important with every year as we march down the decarbonization curve.”

Ming offered a primer on concepts that might be unfamiliar to Westerners not steeped in the organized capacity markets prevailing in the East.

The study’s authors asked two questions in their effort to identify a capacity compensation scheme: How much capacity in megawatts can any one resource provide? And for any megawatt of capacity, what is the value of that capacity to the system?

“Once you answer those questions, then you can set a dollar value,” Ming said. Any compensation framework should “appropriately measure” the quantity and value of the capacity a resource is providing, he said.

Ming said ELCC is the “gold standard” for measuring a resource’s contribution to maintaining the one-day-in-10-years loss of load probability (LOLP) principle typically recognized as the basis for gauging system reliability. ELCC allows for a comparison between different types of resources and measures the “perfect capacity” from each that would provide equivalent system reliability. For example, based on operating characteristics, a 100 MW solar plant and 50 MW gas-fired plant would each be capable of providing 50 MW of capacity.

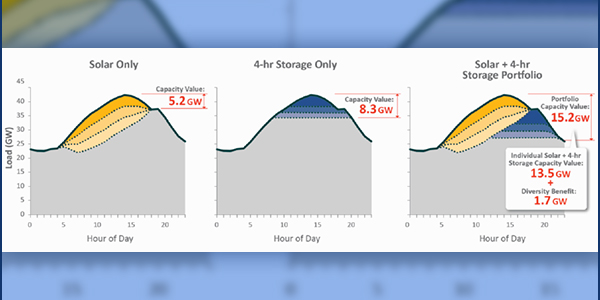

Measuring the ELCC of a resource such as solar can become particularly tricky, Ming said. Under the concept of “antagonistic pairings,” resources with similar limitations reduce each other’s ability to provide capacity, something that occurs when more solar plants are added to an already solar-heavy system. In contrast, the “synergistic” pairing of resources with different characteristics, such as solar and storage, improve each other’s ability to provide capacity.

Regulators might have reasons for applying ELCC in different ways, Ming said. To assess overall system reliability, a “portfolio ELCC” approach can be used to capture the combined capabilities of all resources on the system. A “last-in ELCC” approach can capture the marginal ELCC of the next unit of a variable or energy-limited resource, an important tool when trying to understand how a newly procured resource will contribute to system capacity needs.

The industry widely uses simplified “approximation metrics” to reduce the complexity of estimating ELCC, Ming said. Among the most common is use of hourly LOLP to gauge ELCC. Historically, LOLP hours have been almost “exactly correlated” with peak load hours, he said.

“Resource availability wasn’t really an issue [in the past]. All resources — you could turn them on and off; you could run them for as long as you wanted. The only issue of not being able to meet load is if load got too high, which happened in peak hours or during extreme weather years,” Ming said.

Increased adoption of renewables, especially solar, means that LOLP has shifted into the evening hours when load is actually falling but the volume of energy produced is also declining with the setting sun.

“In today’s system, you see this most notably in California, although Oregon is headed in this direction, the loss of load probability hours have shifted [to] both later in the day and later in the summer,” Ming said.

He said the monetary value of capacity should be rooted in the principle of avoided cost. “A resource should be provided no more compensation than the least-cost resource that can be procured by the utility that provides equivalent reliability.”

To keep costs in check, the report proposes that Oregon policymakers adjust capacity prices based on a sloped demand curve “similar” to those used in organized capacity markets. That would enable the regulator to increase the value of capacity as the system moves from periods of resource sufficiency to deficiency. During times of sufficiency, the capacity value might reflect only operations and maintenance costs. In periods of deficiency, the value might rise to the net resource cost (similar to net cost of new entry), which reflects the total cost of building, integrating and operating a resource minus the revenue it earns from energy and ancillary services.

Different Strokes

Acknowledging the difficulty of creating a single capacity compensation framework for all resource types, E3 instead recommended two broad approaches.

Dispatchable resources such as gas-fired plants would earn payments based on a fixed annual value determined by its MW capacity credit multiplied by the $/MW-year value of the capacity. Resources paid under this “fixed payment” scheme would be subject to penalties for lack of performance during critical periods.

A “pay-as-you-go” scheme would compensate variable renewables based on performance during peak demand or capacity scarcity hours. The plan could be structured to either pay resources dynamically during only periods of system stress, or it could “send a consistent pre-determined price signal for all hours that have a higher” LOLP, E3 said. The plan would avoid subjecting variable resources to an “undue performance requirement,” Ming noted.

Because of their dispatchability, storage resources would fall under the fixed payment scheme, with compensation based on the product of the “last-in” ELCC and the monetary value of capacity.

“Performance would be measured by having the utility send a signal to the storage resource based on its capabilities. If it responds, it won’t be assessed penalties,” Ming said. Using pay-as-you-go to compensate storage could be “potentially discriminatory” because it could require the resource to cycle every day to receive payment. It also avoids compensating a storage resource when it’s not actually needed for capacity.

Like storage, demand response resources would receive fixed annual payments. Because DR has more limitations than storage, performance requirements would be based on a resource’s “inherent capabilities, identical to what is used in its ELCC calculation.”

For hybrid resources, E3 proposed a “bifurcated” scheme in which the renewable portion of the resource would be compensated under pay-as-you-go while the storage portion receives a fixed payment. “We do not think that a fixed payment only is appropriate for hybrids for the same reason it’s not for renewables,” Ming said.

‘Deliberately Provocative’

Fred Heutte, senior policy associate with the Northwest Energy Coalition, asked what E3 meant by “dispatchable” resources. Heutte noted that E3 had performed a study for Tampa Electric showing that solar can be dispatchable in providing incremental and decremental energy, providing load-following capability.

“It’s not something commonly done right now, but it’s certainly possible. Is that what you mean by dispatchable or is there something else?” Heutte asked.

“I think for the purposes of providing non-capacity services to the system, dispatching solar can be useful, like providing ancillary services,” Ming responded. “From a capacity perspective, I don’t know that I’d consider solar dispatchable, but it’s a term of art; there’s a gray line, of course.”

Dispatchability is really a function of how a capacity resource responds within its compensation framework, Ming continued. Solar will provide as much energy as it can when it’s producing to meet capacity needs.

“Storage is going to provide energy when [the grid operator] sends a signal to dispatch, and to that extent the compensation framework impacts how storage is dispatched. The compensation framework does not impact how solar is dispatched,” Ming said.

Representing the Oregon Solar Energy Industries Association, Patrick McGuire asked how E3 saw the “last-in” ELCC being updated over time. “If it’s put into a contract, does it have to be leveled?”

“We would expect both the last-in ELCC and the table of loss of load probability hours is going to be different in each future year, and they’re going to be changing as the resource mix and the loads on the system change,” Ming said. “In particular, we would expect the last-in ELCC of solar to decline over time.”

Commissioner Letha Tawney asked whether the PUC should be concerned about whether LOLP data is sufficiently accounting for climate change.

“The West-wide heat storm this August was relatively unusual in the historical data, but over the multi-decadal timeframe of these contracts, [it] may not be such an outlier,” Tawney said.

“The answer to that question is quite simply an emphatic ‘yes,’” Ming said. “You do need to account for a changing climate. That is easier said than done. There are firms and researchers that are looking at how to do that. I would say the standard practice in the industry probably doesn’t do as good of a job accounting for climate as it should.”

Heutte posed a “deliberately provocative” question about the risks of introducing concepts from organized markets into Oregon’s IRP process, such as net cost of new entry (CONE) and sloped demand curves. He said for the past two decades he’s read prominent economists who claim capacity markets are the way forward for the electricity sector, but that recent talk from states such as Illinois, Maryland and New Jersey about pulling out of PJM’s capacity construct calls into question the concepts underpinning those markets.

“I’m wondering what can we learn from that. … How can we be assured going forward that those kinds of design elements will actually produce the kind of results we’re looking for?

Ming said E3 explicitly avoided using the term net CONE and instead used net resource cost, which is fundamental to ratemaking.

“Trying to isolate the portion of the resource that’s attributable to capacity and attributable to energy is something that’s done in ratemaking in every regulated jurisdiction across the country,” Ming said.

He said the reason states are looking to pull out of PJM is unrelated to the way the market sets net CONE or the demand curve.

“It’s related to the inability of renewables to bid into the capacity market. They’re forced to bid in prices that are higher than the clearing price and, ultimately, they don’t clear the market and they don’t get paid anything for capacity. So that minimum offer price rule implemented by FERC this year, that is what is driving the states to exit the capacity market,” he said.