By Rich Heidorn Jr.

FERC on Friday approved ISO-NE’s plan to correct a key calculation in evaluating delist bids, a change that could reduce capacity prices.

The 2-1 ruling, supported by Commissioners Cheryl LaFleur and Richard Glick, prompted a dissent by Chairman Neil Chatterjee, who said that making the change effective for Forward Capacity Auction 13 violated the commission’s rule against retroactive ratemaking (ER18-1770). Commissioner Kevin McIntyre, who is battling a brain tumor, did not participate.

At issue was how ISO-NE’s Internal Market Monitor calculates the “economic life” of resources that want to retire or permanently leave the capacity market. Such a resource must provide at least five years of cash flow estimates to justify their delist bids, which specify the price at or below which it would retire.

To determine whether the bid price is competitive, the Monitor calculates the expected remaining economic life of the resource — the number of capacity commitment periods in which the resource could continue operating profitably. The Monitor calculates the competitive delist price as the lowest capacity payment at which the resource would be no worse off by retaining its capacity obligation rather than retiring immediately.

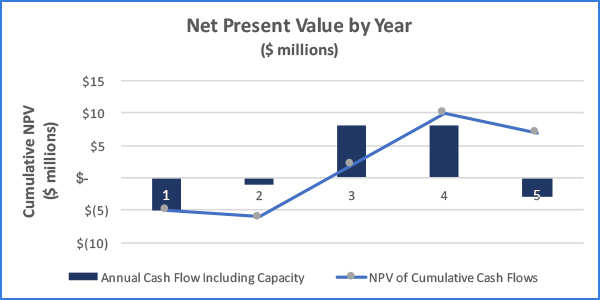

ISO-NE said the Monitor recently determined that its calculations — which defined the economic life as the period for which the resource’s cumulative net present value (NPV) is positive — were overstating the true economics of some resources and could result in improperly high delist bids.

The calculation assumed that a resource that earned positive cash flows in the earlier years would continue to operate while suffering losses as long as the cumulative cash flows remained positive — an assumption that ignored that a resource would choose to retire as soon as its cash flows turned negative.

Under the new rules, the economic life of a resource will be the period that maximizes the NPV. The rules are effective Aug. 10, 2018, and will apply for FCA 13 in February 2019.

In ISO-NE’s filing, Hemant Patil, an economist with the Monitor, gave an example of a resource that expects positive cash flows of $5 million in year one and negative cash flows of $3 million in year two and each subsequent year. “The current Tariff calculation would yield an economic life of two years because the resource could operate for two years with resulting cumulative cash flows of $2 million — positive $5 million in year one plus negative $3 million in year two. This assumption is inconsistent with how a competitive supplier would operate a resource. In this example, the supplier would not choose to operate its resource beyond year one and incur the negative cash flows of $3 million in year two. Instead, it would choose to exit the [Forward Capacity Market] after year one in order to maximize its cumulative cash flows at $5 million.”

ISO-NE and the New England Power Pool’s Participants Committee said they sought the change after an unidentified supplier submitted delist bids for four resources totaling 2,000 MW for FCA 13, which they said could harm the competitiveness of the auction.

The RTO gave another example in which its prior rules estimated a resource would need $11 million in revenue to break even, inflating the delist price by $2.5/kW-month over the $8 million revenue requirement under the revised rules. If the supplier has market power, it could also inflate the prices for the remainder of its portfolio. If that unit was the marginal bid affecting 30,000 MW of cleared capacity, the incorrect calculation would raise consumer costs by about $900 million ($2.5/kW-month x 12 months x 30,000 MW), the RTO said.

LaFleur and Glick rejected a protest by the New England Power Generators Association, which complained that the Aug. 10 effective date requested by ISO-NE and NEPOOL disrupted market expectations and violated the commission’s rule against retroactive ratemaking. NEPGA asked the commission to reject the proposal and order the RTO to bring it before stakeholders, with no changes effective before FCA 14 in 2020.

The proposal was approved by NEPOOL’s Markets and Participants committees, both with about 69% in support. The commission said that although the stakeholder review was “expedited, the record reflects that ISO-NE met its burden for stakeholder review … under its Participants Agreement.”

“A rational resource, in exercising competitive bidding behavior, would seek to exit the market, or retire, before it starts incurring consecutive losses,” the commission said in approving the change. “The benefits of the proposed economic life revisions outweigh potential disruptions to market participants’ settled expectations and harm caused by reliance on the existing [capacity market] rules.”

Chatterjee disagreed, saying that making the rules effective for FCA 13 harmed “market participants who relied on the existing Tariff in calculating prices and entering into contracts” in preparation for the auction.

Chatterjee said it was “troubling” that the RTO submitted the proposal after calculating the economic impact of the existing rules. “This change would achieve a specific price-oriented outcome based on information ISO-NE possesses due to its unique role as both system operator and auction administrator,” he said. “This case raises very serious questions about when and how the rule against retroactive ratemaking applies.”