Planning Committee

Interconnection Process Proposals

Members praised work done by PJM in the stakeholder process in the development of new rules for the interconnection process, as four proposals were brought to last week’s Planning Committee meeting.

Jack Thomas, of PJM’s Knowledge Management Center, provided a first read of the new interconnection process proposals from the work done at the Interconnection Process Reform Task Force.

An issue charge for work to be completed was approved at the April PC meeting, with task force meetings starting later that month. (See “Interconnection Process Reform Endorsed,” PJM PC/TEAC Briefs: April 6, 2021.)

Key work activities include studies related to the interconnection process and costs related to network upgrades; improving and clarifying the use of interim agreements; the process for rules and requirements for new service requests; and ways to reduce the interconnection queue backlog.

Stakeholders also discussed how PJM will transition to a new interconnection process. Thomas said a separate slate of transition proposals is still being developed and will be presented for a first read at the January PC meeting.

PJM conducted a poll in November on the proposals, with a total of 625 companies responding, including 280 member companies. The PJM proposal received the highest level of support, with 83% of all responding stakeholders supporting the measure and 86% support from PJM members. The next most popular proposal was a joint effort from Open Road Renewables and Cypress Creek Renewables, which received 60% support from all stakeholders and 33% support from PJM members.

A proposal from RWE Renewables received 35% support from all stakeholders and 22% support from PJM members. Finally, Clearway Energy’s proposal received 29% from stakeholders and 16% from members.

More than 90 design components were included in the matrix developed at the task force.

Thomas said details common to all four proposals included moving away from the concept of “first come, first served” projects in the queue to a “first ready, first served” concept. Thomas said the change will ensure projects that are ready to be built are prioritized instead of allowing speculative projects to fill the interconnection queue.

The proposals would add language that if a facility study isn’t needed and no network upgrades are necessary for a project, then it could move to the final agreement stage early, speeding up the process. The study window for projects is also proposed to be scheduled for 710 days, or just under two years.

Three separate phases are being created to go through the interconnection process with different milestones attached to each phase. Thomas said at the end of each phase, there will be a decision point for customers to either continue with a project or abandon it and remove it from the queue.

Prior to proceeding to the final agreement, Thomas said, a customer will need to have all security deposit amounts submitted, 100% control of the building site, the attainment of all necessary state, county and local permits and the completion of all state jurisdictional interconnection requirements.

Jason Connell, director of infrastructure planning for PJM, said the RTO has spent most of the year putting together a proposal that is “workable” and “achieves a level of consensus” from the task force. Connell said PJM used an “enormous amount of feedback” from stakeholders to formulate the proposal.

“This moves the PJM interconnection process into a new stage where we can provide customers more cost certainty [and] timing certainty and make sure the projects that are ready to move ahead into construction and interconnection do so,” Connell said.

Matthew Crosby of Cypress Creek thanked PJM for their leadership in the task force. Crosby said its proposal wit Open Road largely mirrored PJM’s except for state jurisdictional issues. It would give interconnection customers “more flexibility,” Crosby said, allowing project customers to post a security deposit and grant extension rights in the event of delays outside of the control of customers.

Iker Chocarro of RWE said there were five different issues his company wanted to “improve upon” in their proposal compared to PJM’s. Those issues included:

- site control language alignment;

- affected-systems studies coordination;

- interconnection service agreement execution timeline;

- study methodology and coordination; and

- public policy and state agreement approach alignment.

Chocarro said RWE recognized that the last two items were likely out of scope from the issue charge, but he encouraged PJM to address and coordinate with stakeholders on those issues in the future.

Paul Sotkiewicz of E-Cubed Policy Associates said PJM did an “absolutely fabulous job” in running the stakeholder process in the task force and that their actions should serve as a “model going forward” as other issues are debated. He said its proposal “strikes the right balance” of where it needs to go in the future in the interconnection process.

“This has been a really good experience, and I hope the rest of PJM can replicate the process that’s been done here,” Sotkiewicz said.

Brian Kauffman of Enel North America said PJM has “put a lot of work” into the stakeholder process on the interconnection process issue and “appreciated the time and energy” spent in the task force.

John Brodbeck, senior manager of transmission at EDP Renewables North America, said he witnessed a “very level-headed and consistent effort” by PJM to improve the interconnection process and would like to see new rules implemented as soon as possible.

Alex Stern, director of RTO strategy for PSEG Services, said he was “impressed” by the level of discussion that took place between stakeholders with diverse perspectives, as well as PJM, both in task force meetings and offline to develop proposals and reach consensus.

“I think we landed in a good spot, and I think you’ll see a number of the transmission owners supportive of the PJM approach,” Stern said.

Thomas said the process in the task force was difficult but ultimately fruitful.

“At the beginning we did start off polar opposites, and I think we’ve managed to get really close to the equator and get packages forward that everybody will be able to live with,” Thomas said.

The committee will be asked to vote on the proposals at next month’s PC meeting.

Generator Deliverability Proposal

Jonathan Kern of PJM’s transmission planning department provided an update on a timeline for the development of a proposal to change the generator deliverability test.

Kern said PJM has agreed to conduct two sets of studies. The first is on the baseline in the 2026 Regional Transmission Expansion Plan summer, winter and light load assumptions, and the second is on an interconnection queue case using commercial probabilities to get an idea of the long-term implications of new rules.

All the work PJM is doing to provide transmission results and complete the studies is “customized,” Kern said, with staff developing power flow models and completing an “extensive” revision to the in-house generator deliverability code. He said the in-house work has resulted in delays in the completion of the generator deliverability testing.

PJM is planning on providing a first read of the proposed generator deliverability changes at the Feb. 8 PC meeting.

“We have to make sure all the new rules are reasonable, both on an individual unit basis and collectively,” Kern said.

Apex Clean Energy’s Richard Seide asked if there will be any FERC filing involved in the process by PJM because of the potential for “significant changes” and impacts to customers.

Kern said that will come down to whether the changes will be considered planning assumption changes. He said typically in the past, PJM handled planning assumption changes through manual adjustments that didn’t require any revisions to governing documents of FERC filings.

Kern said work currently being done in PC special sessions on capacity interconnection rights for effective load-carrying capability resources will also help to determine whether a FERC filing is needed or not.

“Depending on how that process works out, we may or may not have to make a filing,” Kern said.

Sotkiewicz said the generator deliverability issue “dovetails with a lot of market and resource adequacy reliability issues.” He said he can imagine scenarios in which capacity is being purchased that is not deliverable or could be backed down at PJM’s direction because there’s not enough transmission to deliver the energy on the system.

Sotkiewicz said there should be a more holistic discussion beyond the PC, possibly involving a joint meeting with the Market Implementation Committee.

“As we’re having these discussions, it becomes more apparent that this is beyond a Planning Committee technical issue that we’re dealing with,” Sotkiewicz said.

Preliminary 2022 Load Forecast

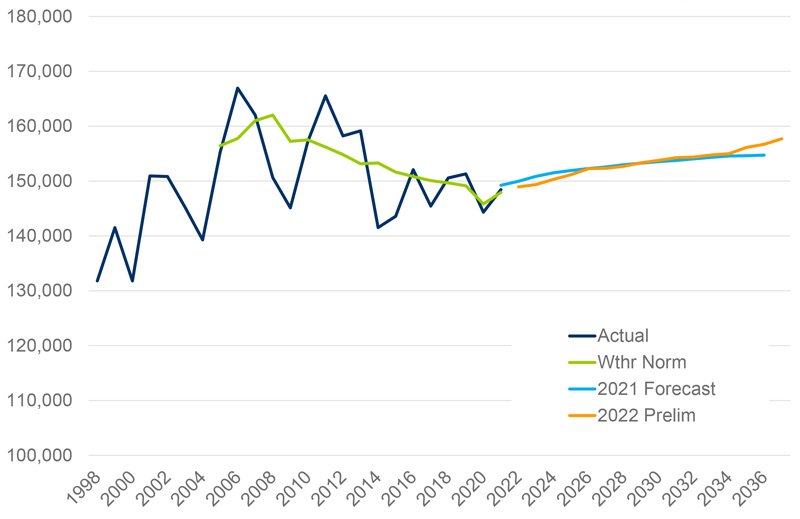

PJM is anticipating “accelerated load growth” compared to last year’s forecast as the 2022 load forecast is finalized this month, largely driven by the development of data centers in Virginia.

Tom Falin, director of resource adequacy planning for PJM, reviewed the preliminary 2022 load forecast results; the final results are expected by the end of the year. The long-term load forecast includes peak demand and energy forecasts for all zones, load deliverability areas and PJM over a 15-year forecast period.

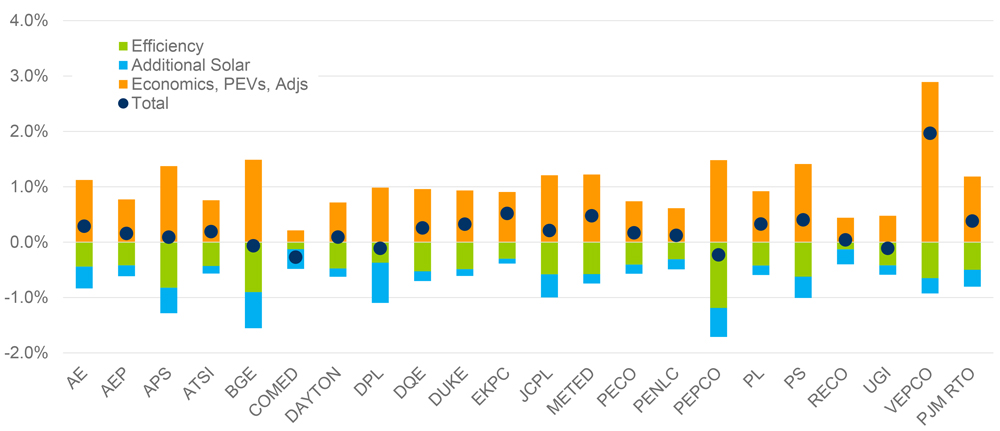

The preliminary 15-year annualized load growth rate in the summer months for 2022 is estimated at 0.4%, Falin said, compared to 0.2% in the 2021 load forecast. However, 2025’s rate is estimated to be 0.5% lower than in last year’s model, driven by improvements in modeling.

Preliminary 15-year annualized load growth rates in the winter months for 2022 are estimated at 0.6%, compared to 0.2% in the 2021 load forecast. Falin said behind-the-meter solar growth in PJM reduces the load impact modeling for the summer months by about 0.3% per year.

Falin said the 2022 methodology changes in the forecast included enhancement to the sector models like residential, commercial and industrial customers to “better capture granularity.” PJM specifically looked at industrial intensity, a measure of the electricity demand per unit output, and the industrial makeup of individual zones to have a better idea of the types of industry.

PJM summer and winter forecast comparisons between 2021 and 2022. | PJM

PJM summer and winter forecast comparisons between 2021 and 2022. | PJM“A steel plant is going to be much more energy intensive than electronics manufacturing,” Falin said.

PJM also made improvements to better capture weather response in the summer and winter. Falin said the impact of the two modeling changes was “not great,” and there were changes to the model in the last few years that had a larger impact.

Falin said the model parameters included a behind-the-meter solar and battery forecast for the first time. He said the amount forecasted was “extremely small,” at 30 MW across the RTO, but PJM is “trying to get ahead of the game” as more storage comes online.

“That is something that could expand significantly in the future,” Falin said.

In the forecast adjustment parameter for different transmission zones, PJM received information from Dominion about the addition of data centers in Northern Virginia. Falin said the planned data center projects could amount to as much as 2,800 MW of additional load by 2025.

“Past Dominion forecasts have underestimated the growth in data centers to some extent, so PJM has to be sure to capture that,” Falin said.

Risk Management Committee

Bankruptcy Protections Issue Charge Endorsed

Stakeholders unanimously endorsed an issue charge at last week’s Risk Management Committee meeting to examine changes to PJM’s bankruptcy process with members.

Jess Troiano, senior counsel for PJM, reviewed the revised problem statement and issue charge addressing potential bankruptcy protection opportunities to be made in the tariff.

Troiano said PJM currently has several steps it can take regarding bankruptcies, including retaining all payments due as cash security for all obligations; suspending and/or terminating transmission service; and limiting, suspending and/or terminating market participation.

PJM has handled 15 bankruptcy proceedings in the last three years, Troiano said, with the RTO having to secure outside representation with its bankruptcy counsel to protect its interests. PJM hasn’t suffered any “catastrophic loss” resulting from the bankruptcies, but its outside counsel and in-house staff identified areas in the tariff that the RTO can “fortify” to create stronger protections against future bankruptcies.

Some of the possible enhancements identified include:

- distinguishing between liquidation and reorganization in bankruptcies;

- requiring designation of PJM as a critical vendor upon bankruptcy filing;

- establishing an obligation to replenish collateral for post-petition activity;

- adding language with respect to priority interest in collateral; and

- strengthening recoupment language.

“We are not limited to these five, and we’re not beholden to these five,” Troiano said.

Work on the issue charge will begin at the January RMC meeting and is expected to take four months.