A solar project was installed on a warehouse rooftop in Perth Amboy as part of New Jersey's Community Solar Energy Pilot Program

| Solar LandscapeWhile 2020 was marked by the emergence of COVID-19 and its disruptions on everyday life, 2021 featured an attempt to return to some normalcy while still dealing with the impacts of the pandemic.

PJM’s year was punctuated by changes in the capacity market through votes by stakeholders and the Board of Managers and a lack of action by FERC that led to the implementation of the RTO’s narrowed minimum offer price rule (MOPR). The year also included the first capacity auction conducted since 2019, as well as moves to seek solutions for the incorporation of more renewable resources into the grid.

Here’s a review of some of the biggest PJM stories of 2021 and a peek at issues stakeholders will be tackling in 2022.

MOPR Changes

In March, FERC’s technical conference on capacity markets targeted PJM’s MOPR, with both commission Chair Richard Glick and PJM CEO Manu Asthana saying the MOPR was not “sustainable” because it was hindering state decarbonization efforts and that it was forcing consumers to “spend billions of dollars extra in the name of trying to address price suppression” by state-subsidized resources.

Glick said he wanted FERC to move quickly on the MOPR despite other capacity market changes that could take longer to accomplish, seeking its replacement or elimination in time for the 2023/24 Base Residual Auction originally scheduled for December.

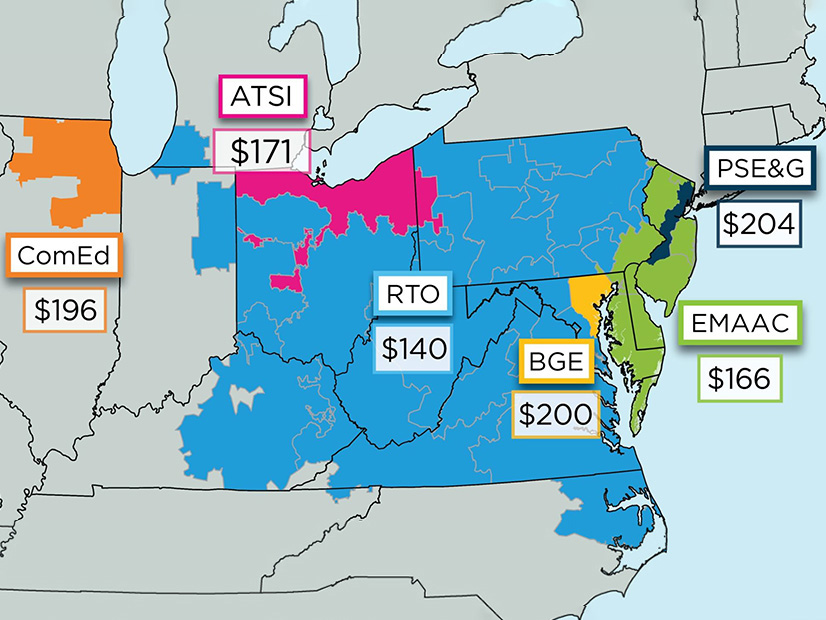

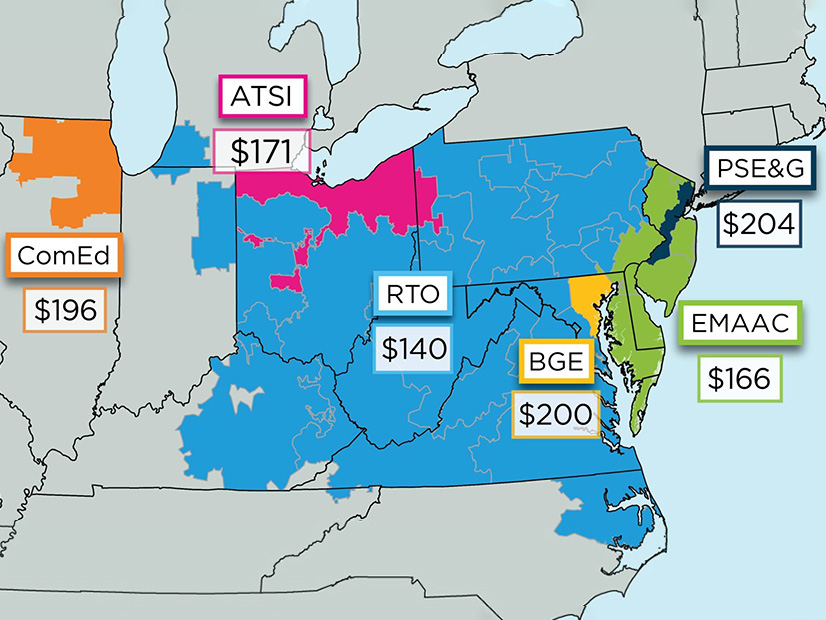

Capacity price results from the 2021/22 Base Residual Auction in May | PJM

Capacity price results from the 2021/22 Base Residual Auction in May | PJM

By the end of June, stakeholders overwhelmingly supported PJM’s replacement for the extended MOPR, handing the final recommendation to the board. The proposal topped eight other plans in a special Members Committee meeting, receiving an 87-18 vote for a sector-weighted score of 4.18/5 (83.6%).

The new MOPR applies only to resources connected to the exercise of buyer-side market power or those receiving state subsidies conditioned on clearing the capacity auction. The vote was conducted under the RTO’s critical issue fast path (CIFP) accelerated stakeholder process mechanism, initiated for the first time in PJM’s history by the board in April.

Market participants are also asked to sign attestations declaring that they are not exercising market power or receiving state funds tied to clearing in the auction. PJM said it and the Monitor will conduct “fact-specific, case-by-case reviews” if they suspect market power. If they have concerns that a market seller “provided a misrepresentation or otherwise acted fraudulently,” a referral to FERC can be made for further investigation.

With the new rules in place, PJM would eliminate both the expanded MOPR and the prior MOPR, which was limited to new natural gas resources.

The PJM Board of Managers approved the RTO’s MOPR proposal, sending it to FERC on July 30. By the end of August, dozens of comments flowed into FERC in both support and opposition to the filing (ER21-2582).

Ultimately the rule took effect at the end of September after FERC deadlocked 2-2 on PJM’s proposal, becoming effective “by operation of law.” (See FERC Deadlock Allows Revised PJM MOPR.)

FERC Chairman Richard Glick | © RTO Insider LLC

FERC Chairman Richard Glick | © RTO Insider LLC

Glick and Commissioner Allison Clements, both Democrats, supported the PJM filing, with Republicans James Danly and Mark Christie standing in opposition.

At FERC’s October open meeting, Glick said “good riddance” to the old MOPR, calling it a “thinly veiled attempt to frustrate state efforts to promote cleaner energy.”

Christie said in his statement that he agreed that the expanded MOPR needed “to be replaced or significantly modified” because it was “simply unsustainable” because of the disparate energy policies among PJM’s 13 states and D.C. But he called the RTO’s proposal the “flawed and rushed result of an ‘expedited’ stakeholder process.” Danly said PJM’s proposal should have been rejected because it eliminated “all mitigation of the price-suppressive effects of state subsidies.”

By October, Vistra, Old Dominion Electric Cooperative, the Electric Power Supply Association and regulators from Ohio and Pennsylvania filed rehearing requests. FERC ultimately declined rehearing requests on Nov. 29, setting up further action in appellate court. (See FERC Declines Rehearing of PJM MOPR: Ball now in 3rd Circuit Court.)

The PJM Power Providers Group, the Pennsylvania Public Utility Commission and the Public Utilities Commission of Ohio all filed challenges with the 3rd U.S. Circuit Court of Appeals.

Return of Capacity Auctions

PJM was finally able hold the 2022/23 BRA in May and post results in June after a delay of more than a year, stemming from FERC’s 2019 approval of the extended MOPR.

The RTO announced that capacity prices dropped significantly for the 2022/23 delivery year, with rest-of-RTO prices falling by nearly two-thirds to $50/MW-day and prices in the Eastern and Southwest Mid-Atlantic Area Council (MAAC) regions falling to their lowest on record. (See Capacity Prices Drop Sharply in PJM Auction.)

The BRA cleared 144,477 MW of resources for the June 1, 2022, through May 31, 2023, delivery year at a cost of $3.9 billion, or $4.4 billion less than the 2018 auction for 2021/22 delivery year, after adjustments for an increase in entities choosing to skip the auction by using the fixed resource requirement (FRR).

The auction gave PJM a 19.9% reserve margin, above the 14.5% requirement, including load and resource commitments under FRR.

Before the auction, Dominion Energy Virginia chose the FRR option beginning with the 2022/23 BRA over concerns an expanded MOPR would undermine its ability to meet Virginia’s renewable energy targets. The utility’s FRR election covered more than 60 generating units totaling more than 18.1 GW, including its 1.7-GW Surry nuclear power plant. All told, 175 generating units chose the FRR for the 2022/23 BRA, the second highest on record and more than double the 85 units that chose the FRR option for 2021/22. (See Dominion Opts out of PJM Capacity Auction.)

To get back to a three-year forward schedule for PJM’s capacity auctions, FERC in October approved a compressed schedule for auctions through 2024.

PJM received approval from the commission to push the 2023/24 BRA to Jan. 25, after initially scheduling it for December, because of FERC-required changes related to the market seller offer cap. The RTO said the auction delay was necessary to give capacity market sellers and the Monitor a “realistic opportunity” to appeal PJM’s final decisions on unit-specific offer cap requests resulting from the MSOC changes.

But the BRA has been delayed once again, after the commission last month partially reversed its May 2020 decision on PJM’s proposed energy price formation revisions. PJM must submit a compliance filing with the commission within 30 days proposing a new schedule for the BRA and subsequent capacity auctions impacted by the delay. (See related story, FERC Reverses Itself on PJM Reserve Market Changes.)

Fast-start Pricing

In May, FERC accepted PJM’s compliance filing on its rules for fast-start resources, allowing tariff changes to take effect on an issue that had been before the commission since 2017 (ER19-2722). (See FERC Accepts PJM Fast-start Tariff Changes.)

PJM’s proposal added a new section to its Operating Agreement defining a fast-start resource as “capable of operating with a notification time plus start-up time of one hour or less, and a minimum run time or minimum down time of one hour or less, based on operating characteristics.”

Resource Adequacy

The Resource Adequacy Senior Task Force (RASTF), a new senior task force aimed at addressing resource adequacy topics and recommending possible changes to the capacity market, won stakeholder approval in October.

David Anders, director of stakeholder affairs for PJM, called the task force the “central clearinghouse” for work related to resource adequacy following stakeholder discussions on the MOPR.

The task force was partially the result of a letter issued by the board in April urging stakeholders to address a series of topics related to the capacity market, including the evaluation of characteristics of the appropriate level of capacity procurement and the examination of the need to strengthen the qualification and performance requirements on capacity resources.

Stakeholders suggested including a discussion on opportunities to address the social cost of carbon; procurement of clean resource attributes in the RTO’s capacity, energy and ancillary services markets; FRR rules; and generation performance assessments.

The RTO is looking to implement an issue charge for the RASTF this month, with work in the task force expected to be completed by late 2023 in time for implementation in the 2027/28 BRA in May 2024.

Energy Transition

PJM announced in October that it received 79 proposals addressing both the onshore and offshore demands of New Jersey’s ambitious offshore wind program as part of the RTO’s “state agreement approach” under FERC Order 1000.

The RTO is currently evaluating issues around reinforcing networks and preparing reviews of the offshore elements of the proposals by collaborating with consultants with offshore wind expertise.

PJM gave an example of how proposals to New Jersey’s solicitation for offshore wind transmission projects may look. | PJM

PJM gave an example of how proposals to New Jersey’s solicitation for offshore wind transmission projects may look. | PJM

The New Jersey Board of Public Utilities has already awarded three offshore wind projects in two solicitations: the 1,100-MW Ocean Wind 1 and 1,148-MW Ocean Wind 2 projects, both developed by Ørsted, and the 1,510-MW Atlantic Shores project, a joint venture between EDF Renewables North America and Shell New Energies US. The BPU is planning to hold three more solicitations over the next five years to help the state reach its goal of supplying 7,500 MW of offshore wind by 2035. (See NJ Awards Two Offshore Wind Projects.)

The BPU has issued a guidance document indicating certain processes to be employed going forward during the project evaluations. New Jersey retains the right to elect to move ahead with any of the projects and is targeting the end of the year to make final decisions.

Besides the offshore wind initiative, PJM in December kicked off what it said will be a multiyear initiative on the study of integrating the increasing number of renewable resources in the region. (See PJM Energy Transition Study Released.)

The paper, “Energy Transition in PJM: Frameworks for Analysis,” included the RTO’s preliminary five-year strategy built on three pillars: facilitating state and federal decarbonization policies; planning for the grid of the future; and fostering innovation for the transition.

PJM said the study is designed to help identify gaps and opportunities in the current market construct and provide insights into the future of market design, transmission planning and system operations.

Windmills stand on a hill in Fayelle County, Pa. | © RTO Insider LLC

Windmills stand on a hill in Fayelle County, Pa. | © RTO Insider LLC

The study considers three scenarios in which an increasing amount of energy is served by renewable generation. The “base” scenario included 10% of the annual energy in the PJM footprint coming from renewable generation, while the “policy” and “accelerated” scenarios had renewables representing 22% and 50% of the annual energy, respectively.

In the accelerated scenario, up to 70% of the dispatch was considered carbon-free when combined with nuclear generation. The accelerated scenario includes 29 GW of offshore wind, 36 GW of onshore wind and 55 GW of solar. As of 2020, renewables represented 6% of PJM’s annual energy.

Work on the study is expected to continue through 2022 with an updated report coming around the end of the first quarter of the year.