VALLEY FORGE, Pa. — PJM expects to issue at least $1 billion in penalties over generation outages during Christmas weekend, when plummeting temperatures stretched the region to its limits, RTO officials told stakeholders this week.

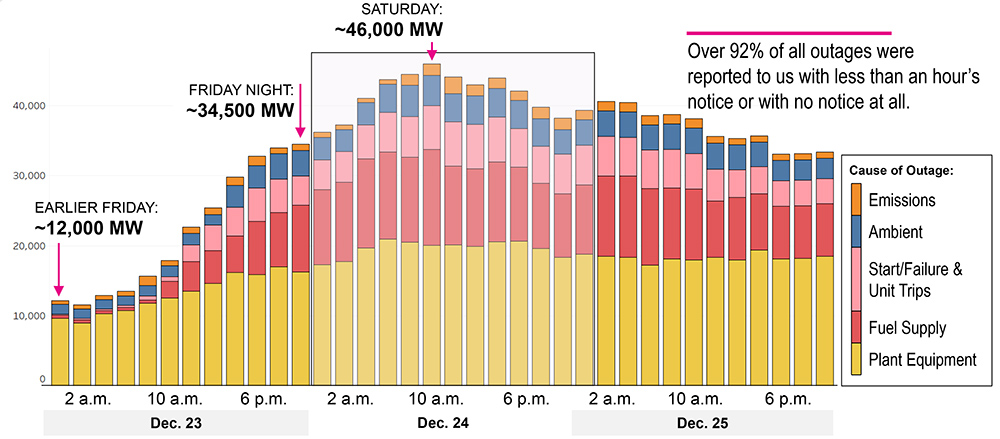

PJM reported 46,000 MW of forced outages during Winter Storm Elliott on Dec. 24, representing more than 23% of its capacity and including almost 38% of its natural gas capacity. More than 92% of forced outages were reported to PJM with less than an hour’s notice — or with no notice at all.

PJM lost about one-quarter of its generating fleet — including 38% of natural gas units — after temperatures plunged over Christmas weekend. | PJM

PJM lost about one-quarter of its generating fleet — including 38% of natural gas units — after temperatures plunged over Christmas weekend. | PJM

“A large portion of our generation fleet failed to do what was required of them,” Donnie Bielak, PJM’s senior dispatch manager, told the Market Implementation Committee during a presentation Wednesday on the storm’s impact.

Although demand response and consumers’ conservation actions helped PJM avoid shedding load, the RTO was forced to cut exports to the Carolinas and the Tennessee Valley Authority, where there were load sheds.

Winter Storm Elliott was the fifth event in 10 years in which reliability was jeopardized by unplanned generating unit outages in cold weather. It came less than two years after Winter Storm Uri in February 2021 resulted in the largest firm load shed event in U.S. history.

FERC and NERC announced Dec. 28 they would investigate the response to Elliott. (See FERC, NERC Set Probe on Xmas Storm Blackouts.)

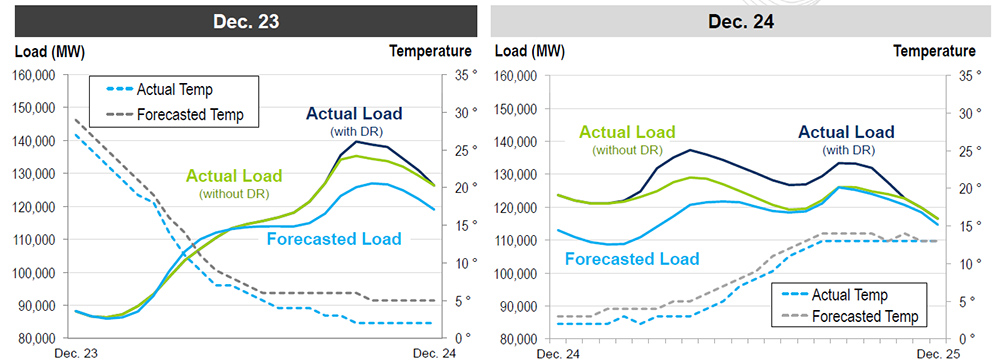

Temperatures dropped 29 degrees F from about 36 degrees to 7 degrees within 12 hours on Dec. 23, the “most drastic” drop in more than a decade and lower than weather forecasts had predicted, PJM said. That contributed to a load forecast that fell 10% below actual load.

Temperatures dropped from about 36 degrees to 7 degrees within 12 hours on Dec. 23, the “most drastic” drop in more than a decade and lower than weather forecasts had predicted. That contributed to a load forecast that fell 10% below actual load that day. | PJM

Temperatures dropped from about 36 degrees to 7 degrees within 12 hours on Dec. 23, the “most drastic” drop in more than a decade and lower than weather forecasts had predicted. That contributed to a load forecast that fell 10% below actual load that day. | PJM

Trying ‘to Stress Us Out’

Bielak told the Operating Committee in a second discussion Thursday that control room operators were “heavily, heavily strained” trying to maintain reliability through the valley period overnight Dec. 23 before the Christmas Eve morning peak.

“We just kept losing units. … It didn’t stop,” Bielak said.

He quoted a control room colleague, who remarked that it was like the dispatchers’ training in the PJM simulator, where instructors throw repeated outages at them “to stress us out.”

The Christmas Eve valley was the highest in the last decade and 40,000 MW higher than the second highest.

The extreme outages limited PJM’s ability to replenish pond levels at pumped storage sites before the Christmas Eve morning peak. “We were mortgaging the future,” Bielak said. “If we didn’t get through the valley there would be no peak anyway.”

30% Gas Supply Drop in Utica, Marcellus Shale

While some gas units tripped or were unable to start because of the cold, other units lacked fuel as a result of a 30% drop in gas production from the Marcellus and Utica shale regions. That repeated a pattern seen in Winter Storm Uri, when there were major production cuts in Texas and the Southwest.

Brian Fitzpatrick, PJM’s principal fuel supply strategist, said the RTO holds weekly meetings with pipeline operators between November and March to discuss electric and gas load forecasts and pipeline restrictions. “Those conversations ramped up” leading to the storm, he said, and the RTO monitored the interstate gas pipelines. But he acknowledged that “there is no bulletin board” providing the RTO real-time information on gas production. “We don’t see supply numbers until the next day,” he said.

Fitzpatrick said PJM’s challenge was the speed at which the load changed and how quickly the pipeline line pack diminished between late morning and late afternoon on Dec. 23.

Paul Sotkiewicz, of E-Cubed Policy Associates, said he was shocked by the reduced Marcellus production but noted some of his clients’ gas units faced pipeline reductions even where production cuts were not an issue.

Fitzpatrick said PJM does not know why production was cut but that it will likely be a focus of the FERC-NERC investigation. “My assumption is that it’s predominantly related to well freeze-offs. But were those well freeze-offs caused by something else? Was it a lack of manpower because of the holiday?” he said. “It wasn’t an absolute temperature issue necessarily. … The issue was how rapidly it got cold; right before the event it was very warm.”

Why Didn’t CP Fix This?

Christi Tezak, of ClearView Energy Partners, questioned why PJM’s Capacity Performance structure appeared to have led to higher outage rates compared to similar colds snaps in the past.

CP, which increased penalties for failing to deliver and bonuses for overperforming, was enacted in response to the 22% forced outage rate during the 2014 polar vortex.

“The whole point of CP was to provide those incentives on the front end” to prepare for winter weather, said PJM Senior Vice President of Market Services Stu Bresler. He said the RTO was seeking additional information from generators on their poor performance. “We have the same questions as you do,” he said.

Penalties

PJM estimates that the non-performance charges for generators will be between $1 billion to $2 billion. However, it cautioned that the figure is preliminary and includes facilities that may have permissible reasons to be excused. Given the scale of the penalties, PJM will be providing individual resource performance data to operators before it levies the charges, with the aim to have that sent out by the first full week of February.

“Right now this data only includes preliminary excuses for being scheduled down for economic dispatch,” PJM’s Susan Kenney said Wednesday.

Stakeholders in the generation sector complained they were both being held responsible for natural gas pipeline failures and being held to the capacity needs of other regions.

Throughout most of the weekend, PJM continued to be a net exporter of energy to surrounding regions, though efforts were taken to curtail the outward flow. Bielak said PJM are not “isolationists” and were not going to cut exports that would push other regions into load shedding.

One stakeholder who asked not to be identified questioned whether the penalties could cause disruptions to the markets should a significant number of generation owners go into default.

He asked “are we potentially moving towards a situation where markets are stressed due to” large numbers of participants going into default?

PJM CFO Lisa Drauschak said that while failure to pay does constitute a default, stakeholders are not responsible for any undercollection as it is subtracted from the bonuses paid out. In timing the payments, she said staff is taking into account non-payment risk and the RTO’s liquidity to ensure that there is no risk to stakeholders.

Erik Heinle of Vistra questioned whether the data gathering over the penalties could prompt a delay in 2025/26 Base Residual Auction slated for June.

“We agree it’s a question; it’s something we’re thinking about,” Bresler said. But the RTO hasn’t committed to changing any dates, he said.

Verifying Outage Causes

PJM said more than 92% of all outages were reported to the RTO with less than an hour’s notice, or with no notice at all.

Yet, when outages peaked at about 46,000 MW on the morning of Dec. 24, less than 15% of the lost capacity was attributed to start failures and unit trips, which occur without prior notice.

Bielak said dispatchers were calling operators who had not reported any problems and were informed “we can’t run.”

“Well, you should have had that note in … eDART [the dispatcher application and reporting tool] so we wouldn’t have bothered trying to call you,” Bielak said.

Dave Mabry, of the PJM Industrial Customer Coalition, said it appeared PJM suffered a “loss of situational awareness” during the storm.

“We really, really rely on members to tell us what the status of their units and parameters are … going into any kind of significant weather, but also on a daily basis because that’s how we make decisions,” said Senior Vice President of Operations Mike Bryson.

In response to a question from Tyson Slocum, energy program director for Public Citizen, Bryson acknowledged that PJM does not do any validation of the outage causes cited by generators. “If the unit was out, it’s going to be subject to a” penalty regardless of the cause, he said.

Slocum said companies with multiple units have an incentive to prolong scarcity events by providing misleading outage data because the CP penalties may be exceeded by CP bonus payments and revenue from high prices.

Sotkiewicz took offense at Slocum’s “implication that games are being played” by generators. “Trust me. We would want to be running,” he said, citing PJM’s estimate that penalties could total $2 billion.

PJM’s Chris Pilong said generators record the outage cause in eDART in real-time but provide more detail later in NERC’s Generating Availability Data System.

Monitoring Analytics President Joe Bowring said the Independent Market Monitor will be reviewing “every single outage,” adding, “we don’t think the reporting was entirely accurate.”

NERC Winter Standards Not Strict Enough

PJM officials said the Christmas storm experience underscored the RTO’s concerns that NERC’s proposed reliability standards on freeze protection for generation and natural gas facilities impacting the bulk power system are not strict enough.

Bryson said PJM’s concerns were included in the ISO-RTO Council’s (IRC) Dec. 8 comments in response to NERC’s Oct. 28 petition for approval of proposed Reliability Standards EOP-011-3 and EOP-012-1.3 (RD23-1). (See FERC, NERC See Progress on Winter Weatherization.)

The IRC said NERC’s proposal to use weather data since only 2000 “is not indicative of the actual extreme weather conditions that units may experience in the PJM region.”

Bryson said the RTO also is concerned with the “somewhat casual ability for generators to opt out of the standard.”

The IRC cited language allowing generators to reject the requirements based on a “commercial” constraint.

“Given that it is not at all clear how costly a measure must be before it presents a ‘commercial’ constraint, or how any such standard could be fairly applied both to independent power producers and to vertically integrated utilities subject to rate regulation, the IRC is concerned that these requirements as drafted will encourage generators to avoid making improvements, particularly if a competitor elects to utilize this ‘opt-out’ to gain a competitive advantage by avoiding the capital expenditures necessary for compliance,” it said.

Is Gas Unreliable?

Greg Poulos, executive director of the Consumer Advocates of PJM States, asked whether the events had raised questions about the reliability of gas. Bielak said it was too soon to draw any conclusions but said the RTO was taking additional steps to maintain reliability for the rest of the winter.

PJM officials said there will be additional discussions of the Christmas event at the Electric-Gas Coordination Senior Task Force meeting Jan. 19.