Michael Giberson, R Street Institute | R Street Institute

Michael Giberson, R Street Institute | R Street InstituteBy Michael Giberson

FERC must look beyond reliability standards to boost electric industry winter readiness.

Winter Storm Elliott smashed into the Southeastern U.S. last year at just the wrong time, right before Christmas, disrupting both long-planned travel and last-minute holiday shopping. It was a bad time for the affected region’s electric utilities too, as power generators struggled under freezing temperatures while customer demand rose to winter records.

Duke Energy in North Carolina and the Tennessee Valley Authority (TVA) had to cut power to some consumers to help keep the grid from failing. For both power companies, it was the first time they had to employ these extreme reliability measures.

A few days later, FERC, NERC and NERC regional entities announced they would investigate operations of the bulk-power system during the storm. A report will emerge in a few months with useful details on which components failed and which reliability standards were not well enforced. But one may wonder what we can learn from the fifth such joint investigation that was not obvious from the previous four winter storm investigations.

The fourth FERC-NERC winter storm report, examining February 2021’s Winter Storm Uri, summarized the main finding of the earlier three. What have we learned? Small equipment failures — the freezing up of a gauge or a sensing line — can sideline a generating unit; gas supply interruptions were an issue; generation owners sometimes failed to prepare adequately; operators lacked training for extreme winter weather conditions; and utilities need to improve emergency communication practices. All four reports observe these kinds of failures and make similar recommendations.

Coincidentally, in February FERC approved winter reliability standards that address about half of the recommendations from the fourth FERC-NERC winter storm report. The standards are a step forward, said FERC Commissioner Mark Christie, “but the much bigger issue to me is market design.” Does it still support reliability?

The interaction of reliability and markets has always been a concern within restructured regions. Revenue from energy, ancillary service and capacity markets is intended to incentivize enough investment that supply can reliably meet customer demand under a wide range of conditions. Emergency operations help maintain service in extreme cases. At least those are market design goals.

But as has been discovered over and over, emergency operations can undermine market incentives supporting resource adequacy. For example, an RTO might call on demand response resources to help maintain a safe level of operating reserves. If the RTO market interpreted reduction in load as falling consumer demand, then prices fall at a time when resources are exceptionally scarce. The price suppressing potential of demand response programs was uncovered in RTOs a decade ago, but similar problems continue to emerge.

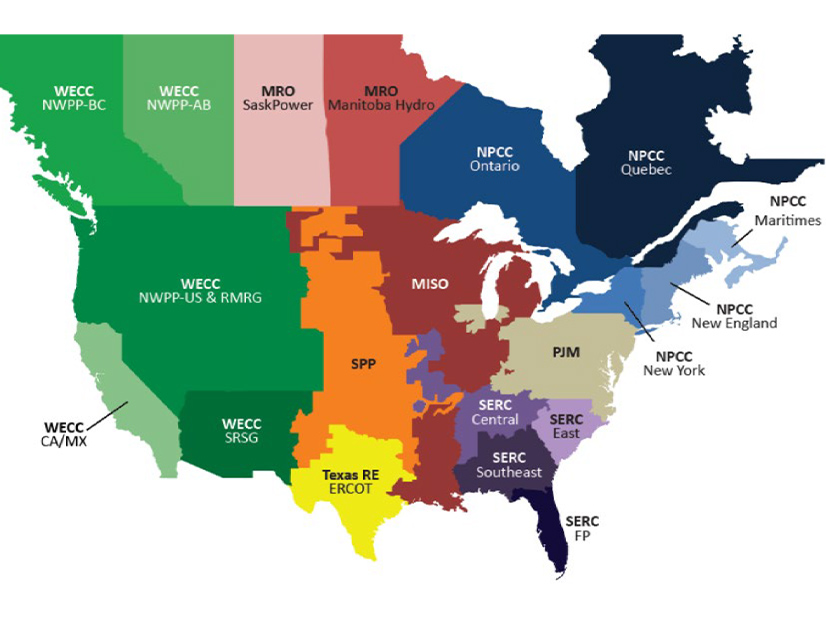

This sort of fine-grained market design work is essential to refining RTO systems. However, the sheer scale of some winter storms suggests attention to the bigger picture is needed too. Texas, the biggest state of the lower 48, was smaller than the winter storms that struck it in February 2011 and February 2021. Even PJM and MISO, the two largest of the RTOs in terms of generating capacity, are too small to handle the biggest winter storms alone. Winter storm readiness requires more extensive and effective interregional ties between RTOs and their neighbors.

Interregional Interties

This feature of the winter challenge leads to the first of two recommendations for winter readiness that go beyond the scope of FERC-NERC investigations: FERC should make interregional transmission projects a high priority. In the just released draft National Transmission Needs Study, the U.S. Department of Energy (DOE) identified over 50 recent transmission needs studies conducted by a wide range of organizations. The draft report concludes that significant system resilience, reliability and economic benefits can be expected from expanded interregional transfer capacity.

Particularly significant, as indicated by the DOE’s report, are expanded interties between the Western and Eastern interconnection in the Plains states and interties between ERCOT to both the west and east. A study by Grid Strategies and the American Council on Renewable Energy concluded “modest investments in interregional transmission capacity would have yielded nearly $100 million in benefits during the five-day event, while most areas could have saved tens of millions of dollars.” A transmission line connecting ERCOT to utilities in the Southeast could have saved lives in Texas during Winter Storm Uri and saved consumers at least $1 billion in energy bills.

Winter Storm Elliott makes clear the need for better interregional coordination beyond RTOs, both for interregional transmission planning and for everyday operations. Utilities in the Southeast region launched a trading platform in 2022 — the Southeast Energy Exchange Market (SEEM) — to help them share excess supplies. When the storm came, however, buying opportunities on SEEM disappeared. PJM and MISO both sent power into the southeast during the storm that helped limit the use of rolling outages in the area.

The Western Energy Imbalance Market (WEIM), operated by CAISO, has not yet been hit by winter storms comparable to Elliott. However, during the August 2020 heat wave, resources participating in WEIM were able to sell into CAISO and helped limit involuntary load shedding in California. The contrasting performance of markets in non-RTO regions may be reason for FERC to take another look at SEEM’s market design. In all regions, RTO or non-RTO, reliability advantages of interregional transmission will remain untapped without a functional regulatory framework that lets private capital flow.

Load Responsiveness

A second general recommendation calls for a renewed emphasis on demand-side engagement in power markets. The new reliability rules approved by FERC in February will require utilities to separate out protected circuits — hospitals, police and fire stations, and circuits providing other reliability protections — from other customers. The move will help ensure the high cost of involuntary load shedding is spread more evenly. However, technology now allows widespread participation in voluntary economic and emergency demand response programs.

PJM deployed cuts of up to 7,000 MW through voluntary load management programs during Elliott. These programs were one reason PJM could avoid involuntary load shedding when demand came in above forecast and generating units were failing at unexpectedly high rates. In addition to RTO programs, companies like Tesla, Sunnova, OhmConnect and Octopus Energy are implementing voluntary consumer response programs that can aid RTOs during periods of grid stress. It is much better for a few thousand customers to reduce use by 1 or 2% than have a few customers unwillingly cut off 100%.

FERC policy endorses active load-side participation in RTO markets, but the limited reach of existing programs, the high cost of involuntary load shedding and promise suggested by new programs mean now is a good time for more focus on customer engagement. Load shedding for bulk system reliability can be reduced by innovative, voluntary retail customer programs. As such efforts span wholesale and retail sectors, state and FERC commissioners should establish a joint effort to reduce involuntary load shedding by better enabling voluntary customer response programs.

Conclusion

Commissioner Christie was on to something when he raised questions about institutional design in the context of winter weather failures, which is outside the scope of FERC-NERC reliability investigations. Reliability assessments are missing some of the biggest aspects of prudent reliability policy. Notably, robust interregional transmission, active demand-side participation and healthy regional market design play key roles in meeting customer needs during extreme winter weather.

Some of the necessary work is simply ensuring emergency operations do not inadvertently undermine incentives to invest in winter readiness. Better mobilizing voluntary consumer responses can substantially reduce the need for involuntary cutoffs. Another part is ensuring effective mobilization of resources on a scale large enough to match winter threats. For example, FERC or Congress could establish interregional planning requirements and remove regulatory barriers to merchant developers to kickstart a woefully underdeveloped system. Competitive, interconnected markets are a reliability imperative.

Michael Giberson is a senior fellow with R Street Institute’s Energy & Environmental Policy Team.