The U.S. Department of Energy on Wednesday released a draft of its “Transmission System Interconnection Roadmap,” which offers ways to improve the backlogged process of connecting new generation to the grid.

The draft comes after meetings with more than 2,000 individuals from 350 different organizations, the department said. DOE is hopeful that even more comment on the draft so it can come out with a final report, Becca Jones-Albertus, director of the department’s Solar Energy Technologies Office, said in an interview Thursday. DOE is working on another report on interconnection issues at the distribution level.

“We’re focused at DOE at how we can enable achievement of the president’s goal to decarbonize the electric grid by 2035,” Jones-Albertus said. “There are a number of big challenges we need to tackle to get there, and interconnection is one of them.”

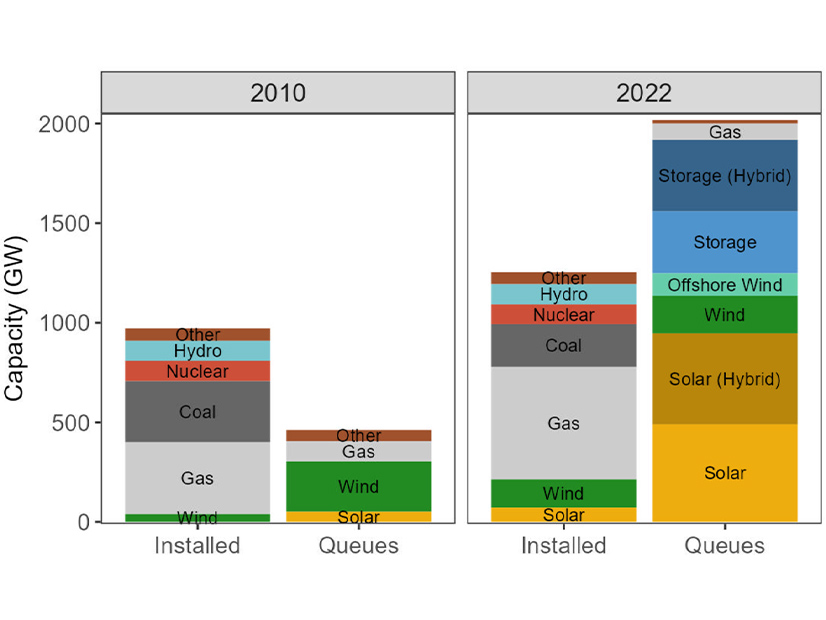

Interconnection queues have about 2,000 GW of wind, solar and batteries in them; if they were all somehow built, it would be nearly enough to reach that decarbonization goal, Jones-Albertus said. Only about 20% or so of projects get built, but the fact that developers sit in them for an average of five years shows they are clogged and need reforms, she said.

DOE was working on the roadmap at the same time FERC worked on Order 2023, which covers about a quarter of its recommendations, according to the draft. The commission’s still-pending Notice of Proposed Rulemaking on transmission planning includes other proposals in the roadmap.

“Though this roadmap contains some solutions that relate to Order 2023, it also introduces additional ideas that support longer-term interconnection process evolution,” the draft says. “Such an approach is important not only to facilitate industry-wide discourse that builds upon Order 2023 but also to maintain usefulness for transmission providers that are not FERC jurisdictional.”

A major reason queues are so overstuffed is the transition to clean energy, which has led to a spike in requests. The report says that “queue volumes are likely to be large and potentially volatile for the foreseeable future.”

When FERC issued Order 2003 20 years ago, it did not contemplate the extent to which resource developers would use interconnection processes to obtain cost and siting information, the report says.

“Because the interconnection process provides accurate, binding information on interconnection costs and operational requirements, resource developers often use the interconnection process to determine ultimate project viability,” the report says. “Additionally, due to long queue wait times, resource developers may also submit interconnection requests to maintain a place in line, to be able to turn around projects more rapidly if they can find a buyer.”

Those “speculative projects” have contributed to the larger queues now; some of DOE’s recommended improvements are aimed at limiting them going forward.

“We really believe it’s possible to get to better processes and doing that by improving the data … [and] having more information available to developers about where to site projects,” Jones-Albertus said.

Order 2023’s requirement for transmission planners to offer heat maps should cut back on the use of speculative projects to find cheap spots to plug into the grid, she added. DOE is also focused on bringing new information technology solutions on the queue, upskilling the workforce and tackling the ever-thorny issue of cost allocation.

“By addressing all of these, I believe we can get to much better interconnection processes, where we can get timelines that are down from averages of five years to less than 18 months,” Jones-Albertus said. “We can have higher completion rates, lower cost uncertainty and better system reliability.”

CAISO and MISO have both proposed strategies that would “ration” interconnection capacity to reduce their queue volumes. CAISO does it by prioritizing interconnection in zones that have available capacity, or resource-rich areas, while MISO would limit interconnection requests to its annual peak demand.

“Administrative rationing may be a short-term strategy for temporarily clearing backlogs, but it would likely be inconsistent with open access and competition policies and may thus be more of a short-term, emergency solution rather than a longer-term one,” the report says.

Another reason to speed up the queues is that demand has started to grow for the first time in a decade in many regions. That is expected to increase with electrification efforts, while many traditional generators are retiring.

“Certainly having shorter queue timelines, higher completion rates [and] lower costs will help that additional capacity be built … in a predictable manner so that grid operators can count on when that generation capacity is going to be there for resource adequacy,” Jones-Albertus said. “I think it is a challenge now that it is hard to predict when some of these plants will come online, in part because of the lengthy interconnection process timelines.”