Markets and Reliability Committee

Vote to Close Clean Attribute Group Fails

VALLEY FORGE, Pa. — The Markets and Reliability Committee voted against sunsetting the Clean Attribute Procurement Senior Task Force (CAPSTF), instead putting the group on track to be on hiatus as a state-led working group continues discussions outside the PJM stakeholder process. (See “Stakeholders Mixed on Sunsetting Clean Attribute Procurement STF,” PJM MRC Briefs: Oct. 25, 2023.)

Task force facilitator Scott Baker said PJM dropped its recommendation to sunset the CAPSTF given ongoing discussions the states are having with FERC staff to explore whether a forward clean energy market (FCEM) would fall under state or federal jurisdiction.

If the issue is determined to fall under the commission’s purview, it would return to the PJM stakeholder process to determine what form it would take and how it would operate. After Baker said PJM would not pursue sunsetting the task force, Paul Sotkiewicz, president of E-cubed Policy Associates representing JPower USA, motioned to sunset, receiving 34% support.

The FCEM design would allow clean energy attributes to be purchased and traded by states and entities with sustainability targets and provide a centralized platform for existing renewable energy credit (REC) sales. PJM currently administers a registry of RECs through the subsidiary PJM EIS (Environmental Information Services), but it does not facilitate the trading of credits.

Constellation’s Juliet Anderson said that if a Forward Energy Attribute Market design was determined to be FERC-jurisdictional, it could be returned to PJM stakeholders for consideration most efficiently through the existing charter of the senior task force.

Calpine’s David “Scarp” Scarpignato said PJM task forces are meant to address specific topics over a specific period of time and the work envisioned for the CAPSTF has been complete. He argued that a new stakeholder group with a scope or charter more specific to any future needs would be better than leaving the task force open in case it can be restarted.

Endorsement of Multi-schedule Modeling Solution Deferred

Stakeholders opted to defer voting on two proposals to narrow the number of market seller offers entered into the market clearing engine (MCE) in order to allow multi-schedule modeling capability to be added to the engine without causing processing times to increase beyond the day-ahead market’s 2.5-hour clearing window. The introduction of multi-schedule modeling is part of a larger overhaul of the engine under PJM’s Next Generation Markets initiative. (See “Multiple Proposals Considered for Incorporation of Multi-schedule Modeling,” PJM MRC Briefs: Oct. 25, 2023)

PJM Associate General Counsel Chen Lu recommended delaying the vote to the December meeting in the hope that an anticipated FERC order on parameter-limited offers and real-time values would provide more clarity on how the proposals would be viewed by the commission. However, the docket was pulled off the agenda for the Nov. 16 open meeting (EL21-78).

Both proposals would allow the day-ahead market to adopt the formula currently used in the real-time market to select one schedule from a resource to be modeled by the MCE. The main motion, sponsored by PJM in the Market Implementation Committee, would consider all offers with the aim of producing a schedule with the lowest total dispatch cost.

The alternate motion, jointly sponsored by GT Power and PJM, would use the same formula, but would mitigate resources that fail the three-pivotal-supplier test to their cost-based offers, disregarding any price-based offers. During emergency conditions, the proposal also would limit capacity resources to their price-based parameter-limited offers.

GT Power’s Tom Hyzinski said the joint proposal would alleviate the potential “crossing curves” issue in PJM’s design, in which the RTO would consider offers only at their economic minimum (EcoMin) value even if that offer would be more expensive at higher outputs. Highlighting the topic during the Oct. 25 MRC meeting, Deputy Market Monitor Catherine Tyler gave an example of a resource where the price-based offer is cheapest at its 100-MW EcoMin but jumps to the $1,000/MWh offer cap when the resource is dispatched above 120 MW. In such a case, she said the cost-based offer should be selected even if it’s more expensive at EcoMin.

Tyler said both PJM proposals could run into an issue in which dual-fuel generators may be selected to run on a schedule using a fuel that is not economical for a portion of the day. The Market Monitor/GT Power Group joint proposal is identical to the PJM/GT Power Group proposal except that the Monitor proposal allows generators to select the fuel they want to use while the PJM proposal has PJM choose the fuel.

Scarpignato said the proposals would go beyond fixing an issue identified by the Energy Management System vendor and would sacrifice some of the current flexibility in the day-ahead market. PJM’s Keyur Patel responded that the status quo has the most optimal schedule selection process and there would be trade-offs to meet the technical requirements of adding multi-schedule modeling capability to the MCE.

Sotkiewicz urged PJM to explore whether hardware and software changes could resolve the computational limitations to allow the status quo schedule selection to be retained.

“We’re sacrificing optimality on solutions because we’re unwilling to make a lot of the investments in hardware, software, parallel processing,” he said. “We’re drifting away from optimality, and we could pour more money into resources on this to get to the right answer.”

Patel said PJM looks at upgrading its hardware every two to three years, but the benefits of replacing servers are limited as the software is integrated. He said solution times are expected to improve as the software is fine-tuned after being launched.

New Winterization Requirements Endorsed

The committee endorsed revisions to Manual 14D, which details operational requirements for generators, to require that resources prepare for winter conditions by either developing their own winterization checklist or following the list produced by PJM, which itself was expanded under the proposal. (See “Generation Winterization Requirements Endorsed,” PJM OC Briefs: Nov. 2, 2023.)

The revised checklist added guidance for combustion turbine intake preparation, drawing from NERC’s Lessons Learned. It prompts generation owners to assess safety hazards posed by snow and ice accumulation on wind and solar facilities, inspect commodities and resources that may be used in severe winter weather, and consider adding a “freeze protection operator” staff member to inspect critical equipment.

The revisions also included clarifying changes such as replacing definitions with references to corresponding sections of the governing documents, specifying that the critical information and reporting requirements include a need to notify PJM dispatch by phone and several administrative changes.

PJM Presents Regulation Market Rework

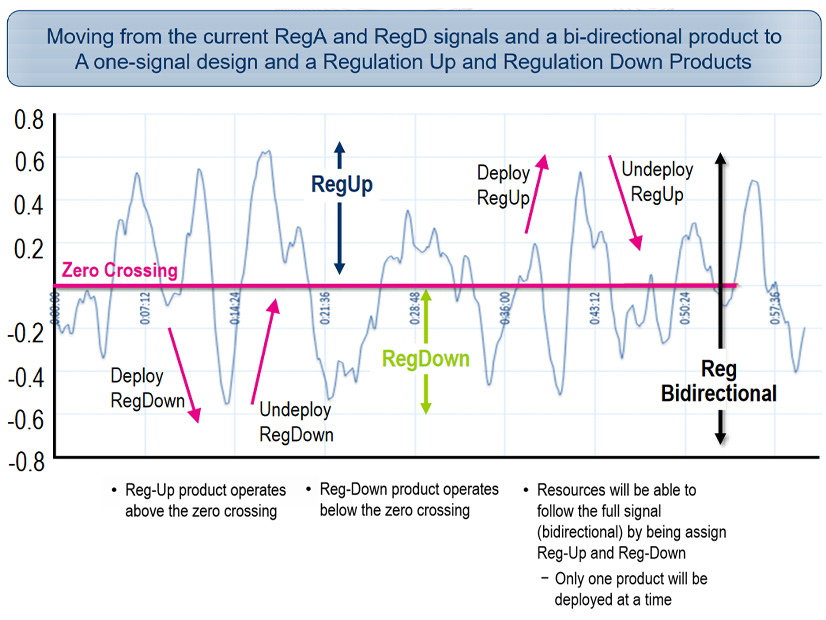

PJM’s Danielle Croop presented the proposal recommended by the Regulation Market Design Senior Task Force (RMDSTF) to redesign the regulation market to have one price signal and two products representing a resource’s ability to adjust its output up or down. The proposal carried 86% support at the RMDSTF during an August vote, with two competing proposals receiving 26% and 6%.

The new price signal would be easier for market participants to follow and would result in all resources having the same settlement process, Croop said. Resources would be able to participate as being only regulation up (RegUp), regulation down (RegDn) or capable of doing both. The current market design has two price signals: Regulation D for resources that can modulate their output almost instantly and Regulation A for longer deployments.

The proposal also would shift to a 30-minute clearing and commitment period, down from the hourly intervals used now; less testing required for new and returning regulation resources; a ramp-limited lost opportunity cost (LOC) calculation meant to avoid overestimating LOC; and a performance score based only on the precision of the response, rather than the average of the scoring of its response accuracy, delay and precision. The proposal would add an annual review of the market to consider if the changes the grid is experiencing during the clean energy transition necessitate any adjustment of the regulation requirement.

Croop said the new scoring method would tend to be stricter, but still accurately capture resources’ performance when called upon.

The market overhaul implementation would be split into two phases, with the first year introducing all the changes except the RegUp and RegDn products, which would be added in the second year.

American Electric Power’s Brock Ondayko said the proposal may impact the ability for energy storage to provide regulation service, as those resources typically would be able to provide both RegUp and RegDn but would be able to move in one direction only if they are fully charged or depleted.

Croop told RTO Insider that there wouldn’t be a change to how batteries participate in the market, and they would be able to remain in the market when fully charged or depleted. However, they may experience a reduction in their performance score if they are not able to follow the price signal.

Carl Johnson, representing the PJM Public Power Coalition, said he was concerned the task force would work around the edges of an RTO proposal FERC rejected in 2018 and was glad to see an entirely new market design proposal came out of the group’s deliberations. (See FERC Rejects PJM Regulation Plan, Calls Tech Conference.)

Independent Market Monitor Joe Bowring presented several concerns with the proposal, arguing the bidirectional price signal is not fully developed. He also argued against calculating LOC based on how a resource is dispatched over multiple regulation intervals, preferring it be reset for each half-hour period, and said PJM’s approach would result in significant overpayment of opportunity costs.

“There is no good reason to approve a market design that has not been developed or tested. In addition, the joint optimization with the energy market would make the energy market less efficient,” Bowring said.

PJM, Monitor Urge Participants to Complete Account Manager Migration

PJM’s Chidi Ofoegbu said the Dec. 13 deadline for eDART accounts to be migrated to the new Account Manager (AM) software is fast approaching with less than a fifth of users completing the transfer process. Of the 7,933 accounts in eDART across 758 companies, 1,433 have a corresponding account in AM, representing a completion rate of about 18%. (See “Migration of eDART Accounts to New Platform Underway,” PJM PC/TEAC Briefs: Aug. 8, 2023.)

Once the deadline arrives, active eDART accounts will have their access revoked and users will not be able to access their accounts, rendering them unable to create generation or transmission tickers, respond to data requests or view reports in eDART.

Bowring said it would be difficult to participate in PJM’s markets and complete required tasks without access to the online tools.

“Key market functions depend on eDART. If you do not have access to eDART it’s hard to see how you could function in the markets. … The numbers now are frighteningly low given how close the deadline is,” he said.

Members Committee

3 Revisions to Stakeholder Process Endorsed

The Members Committee endorsed revisions to Manual 34, which outlines the stakeholder process, to change the voting structure at the MRC and MC, clarify the relationship between the higher and lower committees, and set deadlines for adding items to committee agendas. (See “3 Changes to Stakeholder Process Proposed,” PJM MRC Briefs: Oct. 25, 2023.)

Under language brought by Dayton Light and Power (DLP), the senior standing committees continue to vote on any main motions before considering alternates. Those alternates now would be voted on simultaneously, similar to the lower committees.

One of the two proposals by Exelon clarifies that the MRC and MC hold final authority on topics considered by task forces and the lower committees, which have the role of setting the order of proposal votes at senior committees. The other revision requires that requests to add items to committee agendas must be made at least seven days in advance and include a summary of any action sought by the committee in order to be considered timely. Committee chairs would retain discretion to consider untimely items should they be time-sensitive or the result of unforeseen disruptions, or non-voting items such as informational reports.

Several states objected to the two Exelon revisions and abstained from voting on the DLP proposal. Four industrial consumers also abstained on the DLP language.