ISO-NE on March 13 presented the NEPOOL Markets Committee with additional results of the impact analysis for the RTO’s resource capacity accreditation (RCA) project, which looked at how changes to the resource mix would affect the seasonal distribution of shortfall risks.

The RCA project is being developing in conjunction with structural changes to the timescale of the Forward Capacity Auction (FCA). The RTO has proposed a three-year delay of FCA 19 to develop and implement the changes. (See related story, NEPOOL MC Backs Further Forward Capacity Auction Delay.)

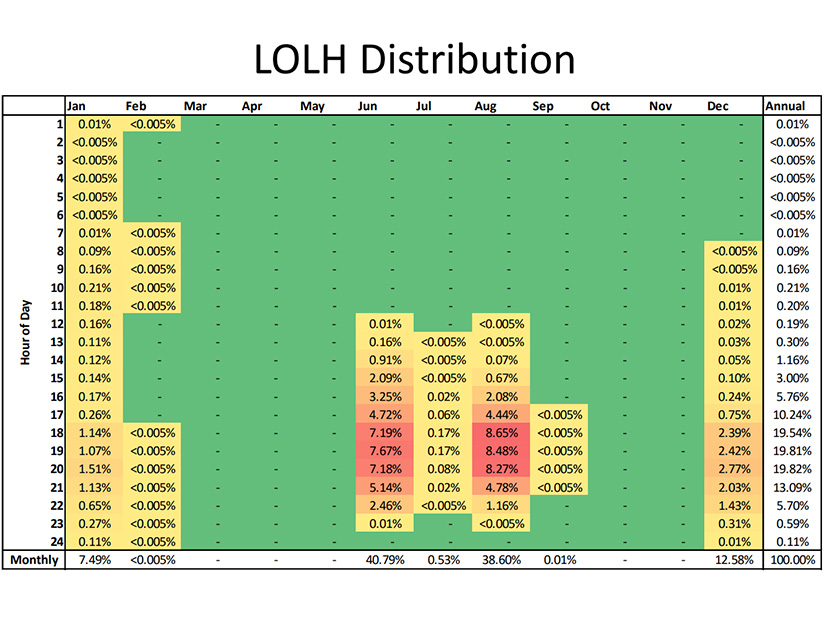

In the initial impact analysis “base case,” ISO-NE estimated that loss-of-load risk is distributed 80% in the winter and 20% in the summer. (See NEPOOL Markets Committee Briefs: Feb. 6, 2024.)

The sensitivity analyses presented to the MC included three scenarios:

-

-

- the addition of wind, solar and battery resources without corresponding resource retirements;

- the addition of the renewable resources accompanied by the retirement of oil-only capacity; and

- the addition of renewables accompanied by the retirement of coal capacity.

-

The addition of renewables without retirements would be more likely to reduce the number of days with loss-of-load events in the winter than in the summer but would provide greater reductions in the duration of the events in the summer than in the winter, ISO-NE found.

When coal capacity was retired, ISO-NE found increased risk of multiday loss-of-load events in the winter, shifting the region’s risk profile towards the winter, said Dane Schiro, the RTO’s principal analyst.

Compared to the retirement of coal, retiring oil capacity “can be thought of as retiring proportionally more summer capacity than winter capacity” because of the model’s winter fuel constraints for oil resources, Schiro said. Therefore, the retirement of oil capacity shifted the overall risk profile toward the summer relative to the coal-retirement scenario.

“The seasonal output characteristics of retiring and new resources are important to the seasonal risk split,” Schiro said, adding that the findings were in line with expectations.

ISO-NE will present additional sensitivity results to the MC in April.

Regional Differences in Gas Accreditation

Ben Griffiths, vice president of wholesale market policy at LS Power, made the case for the RCA updates to incorporate regional differences in pipeline gas availability in the winter.

ISO-NE is planning to treat access to nonfirm gas as the same across the region, despite LS Power data showing that gas access varies significantly based on where generators are located on the pipeline system, Griffiths said.

“Observational data, economic modeling and physical analysis all indicate that gas availability is location and fact specific,” Griffiths said. “A failure to reflect locational attributes will lead to inaccurate pricing for gas generators, worse reliability [and] potential premature retirement.”

Gas units in Connecticut run “at a higher level than we would expect across a range of temperatures, and there is no appreciable temperature-dependent output deviation,” Griffiths said. “This suggests that the gas system is not constrained in Connecticut at any observed temperature.”

In contrast, generation for some units in Maine and Massachusetts historically has been highly temperature dependent, although this temperature correlation can vary significantly unit to unit, Griffiths added.

The accreditation of gas resources has been a major topic of the RCA project. ISO-NE has advocated for a “market constraint approach,” in which the RTO would limit the amount of nonfirm gas capacity it procures based on the region’s gas constraints while having gas-fired resources compete for capacity obligations.

ISO-NE initially indicated it would not be able to design and implement this approach for FCA 19, but it said March 13 that if the proposal for an additional two-year delay of the auction is approved by FERC, it will prioritize implementing a market constraint approach in time for it. (See NEPOOL Markets Committee Briefs: Jan. 11, 2024.)

Regardless of the approach ISO-NE takes, it must account for local differences, Griffiths said.

Under the market-constraint approach, ISO-NE could create “a nested zone for Connecticut which has higher levels of fuel availability and is, in effect, unconstrained,” Griffiths said. LS Power’s proposal would not affect the total amount of accredited gas capacity and simply would change how the overall capacity of the fleet is distributed, he added.