Stakeholders Defer Vote on Long-term Planning Proposal

VALLEY FORGE, Pa. — The PJM Markets and Reliability Committee delayed voting on a proposal establishing a multiscenario long-term transmission planning process to allow stakeholders to first see what action FERC may take on regional planning. The motion to defer received 78% sector-weighted support.

The proposal would create two reliability-focused scenarios identifying transmission violations eight and 15 years in advance; two policy scenarios looking at new generation development backed by state legislation eight to 15 years out; and an additional policy scenario including higher generation entry not backed by signed legislation. It also would expand PJM’s two-year planning cycle to three years to accommodate the increased number of scenarios. (See “Stakeholders Long-term Regional Transmission Planning Proposal,” PJM PC/TEAC Briefs: March 5, 2024.)

FERC announced it intends to vote on an order related to cost allocation for regional transmission expansion during a May 13 special meeting. (See FERC Observers, Stakeholders Lay out What is at Stake with Tx Rule Looming.)

Paul Sotkiewicz, president of E-cubed Policy Associates, said the proposal is deficient from both policy and process standpoints, arguing it would replace the ideal of having markets driving planning decisions with PJM picking “winners and losers.” By constructing the proposal through workshops, rather than committees, he said the stakeholder process was bypassed, preventing the language from being fully vetted by members.

“There are some real deep concerns from a process standpoint and from a concept standpoint,” he said.

Sotkiewicz introduced the motion to defer to a month after FERC is expected to issue the order on the basis that members should have time to understand how it may interact with PJM’s proposal.

“This is a major change. You’ve got a FERC rulemaking sitting out there that’s going to come out in three weeks. There’s no reason to vote on this now,” he said.

Gregory Poulos, executive director of the Consumer Advocates of the PJM States (CAPS), said advocates are frustrated that alternatives to the standard stakeholder process increasingly are being used to seek endorsement of changes with reduced stakeholder input.

Denise Foster Cronin, of the East Kentucky Power Cooperative (EKPC), said the proposal could lead to significant costs for market participants and should be implemented by revising the governing documents rather than by edits to Manual 14B and Manual 14F alone.

PJM argued a delay was unnecessary as its proposal is in line with the notice of proposed rulemaking (NOPR) the commission issued in April 2022 (RM21-17). PJM’s Jason Connell clarified that expectation is entirely based on the NOPR, and RTO staff has not discussed the contents of the order with FERC.

The RTO’s Michael Herman told the committee that if it endorsed the proposal without a deferral, a competitive window could be opened in 2025, whereas a delay could compromise its ability to implement the new process on its envisioned timeline.

PJM CEO Manu Asthana admitted there could be unintended consequences, such as PJM projecting too much load growth and overbuilding transmission, but the reliability needs outweigh the risks.

“There’s many risks, but not doing this is a bigger risk,” he said.

Ryann Reagan, of the New Jersey Board of Public Utilities (BPU), said the scenario-based planning paradigm is a major improvement that could relieve the interconnection backlog and contribute to proactive planning connect generation to the grid at the most cost-effective locations.

PJM Re-evaluating CONE Inputs

Rising interest rates and construction costs have prompted PJM to initiate a re-evaluation of the inputs used to calculate the cost of new entry (CONE) for the reference resource in the quadrennial review. That parameter is a factor used to determine demand curve scaling. (See FERC Approves PJM Quadrennial Review.)

The new analysis will be for the values used in the quadrennial review accepted by FERC on Feb. 14, 2023, effective for the 2026/27 Base Residual Auction (BRA) scheduled to be run in December 2024. The Brattle Group has been hired as an independent consultant for the review; the firm also was brought in for the initial quadrennial review.

PJM’s Pat Bruno said initial analysis of the change suggests updated figures could lead net CONE to increase between $50 and $100/MW-day. He said the review will be limited to the inputs used to calculate the reference resource CONE and will not affect other values produced by the quadrennial review.

Several stakeholders questioned why the energy and ancillary service (EAS) offset is not also being reconsidered given the potential for forward energy prices to change significantly between the quadrennial review’s completion and the BRA. Two significant changes made in the most recent quadrennial review were shifting the reference resource from a combustion turbine to a combined-cycle generator and using a forward EAS offset, which uses forward energy forecasts to estimate revenues a market seller will receive outside the capacity market.

Stakeholders also suggested that developing a trigger for PJM to review quadrennial review figures or periodic reviews could increase transparency.

Additional Guidance on Co-located Load

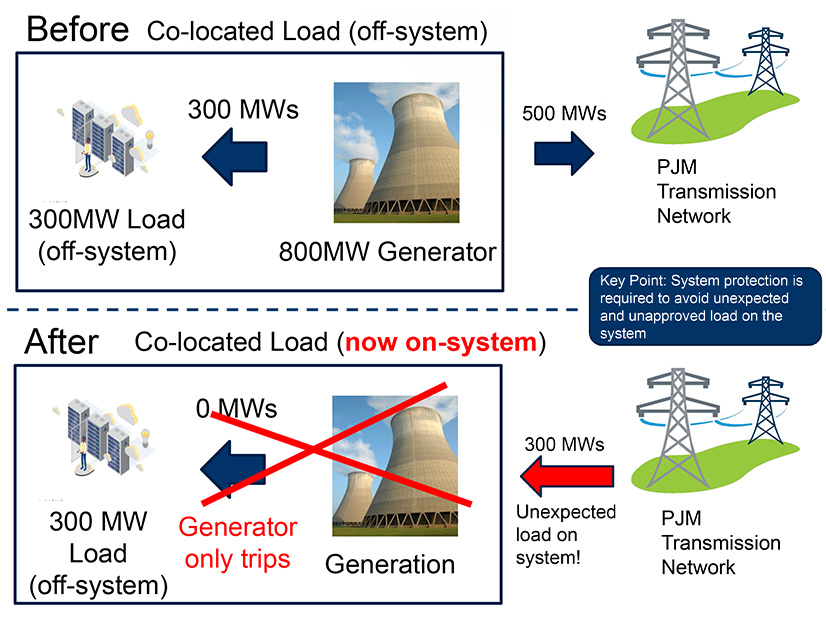

PJM has revised its guidance for generators with co-located load clarifying how it conducts grid impact studies, the difference between co-located load configurations where the load is connected to the PJM grid or only the generator, and the circumstances under which generators with a capacity obligation can serve non-network load.

The guidance initially was posted in March and presented to the Market Implementation Committee on April 3. PJM updated the language with feedback received from stakeholders and reposted the document April 17. (See “PJM Provides Guidance on Co-located Load Configurations,” PJM MIC Briefs: April 3, 2024.)

PJM’s Tim Horger presented the revised guidance, saying the RTO’s preference is that co-located load be interconnected with PJM, which provides firm service and subjects consumers to all service charges. However, the guidance acknowledges that jurisdictional constraints prevent it from requiring that configuration.

The alternative configuration is for the co-located load to be behind the generator’s meter and not directly connected to the PJM grid, thereby not receiving firm service and allowing it to avoid service charges. The generator’s capacity interconnection rights (CIRs) would be reduced by the amount of non-network load being served.

If the generator trips offline or otherwise cannot serve non-network load, the configuration must prevent the load from being able to draw from the PJM grid instead. A portion of the generator’s committed capacity can serve non-network load; however, it must be approved to go on forced outage by PJM, which could expose the unit to capacity performance penalties if it is dispatched by PJM and does not switch its output to the grid.

The revised guidance clarifies how backup generators submit forced outage requests and adds that energy-only resources always will be approved for an outage to serve non-network load but still must request an outage to provide visibility to operators.

The co-located load is required to reduce its consumption to zero before the generator can coordinate with PJM to switch from the primary resource to the backup generator.

Adrien Ford, Constellation Energy’s director of wholesale market development, said the requirement that load power down before being served by the backup generator ignores technologies for which the load could remain online while the power source is switched over without risking the load inadvertently drawing off the PJM grid, such as battery storage.

Under both configurations, PJM requires a network impact study be completed before co-located load comes online so PJM can analyze any potential reliability issues that arise, such as a need for more reactive power capability. If grid upgrades are required, the costs would be assigned to the generator.

“We need to know about these configurations. If there’s co-located load coming onto the system, we need to know it’s out there, so it needs to go through the proper interconnection system,” Horger said.

Connell said it typically takes fewer than nine months to complete network impact studies on co-located load requests, depending on the configuration, with simpler arrangements often being completed much quicker.

Horger said PJM plans to draft manual revisions addressing co-located load over the next sixth months with the aim of arriving at governing document revisions. As the amount of co-located load has increased, he said it started to affect PJM planning and operations, necessitating clear rules.

Stakeholders voted on rule change packages for co-located load in October 2023, but none received adequate support. One of the core sticking points between the proposals was whether capacity resources should be permitted to retain their CIRs while serving non-network co-located load if that load could be quickly curtailed to allow the generator to meet its capacity obligation.

Quick Fix for Dual-fuel Classification Endorsed

Stakeholders endorsed a quick-fix proposal from Calpine Energy to adjust the qualifications for a generator to offer capacity as a dual-fuel resource to include gas units that can operate on an alternate fuel after starting on gas.

Calpine’s David “Scarp” Scarpignato said the change would be implemented in the 2026/27 BRA due to how far into pre-auction activities the 2025/26 BRA is. The quick-fix process allows a proposal to be voted on concurrently with an issue charge and problem statement. (See “Calpine Proposes Changes to Dual Fuel Classification,” PJM MRC/MC Briefs: March 20, 2024.)

Scarp said many combustion turbines and combined-cycle units capable of operating on an alternate fuel still consume gas to start, but the amount is so miniscule they could start multiple times on residual fuel in the pipeline even if supply was so compromised that they couldn’t use gas as their primary fuel.

Erik Heinle, Vistra director of PJM market policy, said the change addresses an oversight in the governing document language establishing dual-fuel classification, leading to no dual-fuel combined-cycle generators being offered for the 2025/26 auction.

Stakeholders Endorse Additional ELCC Data Posting

The committee endorsed a PJM proposal adding a paragraph to Manual 33, which pertains to administrative services, allowing PJM to post aggregated forced outage data broken down by effective load carrying capability (ELCC) class.

PJM’s Pat Bruno said manual language requires that any aggregated data must include four or more generation owners to be posted, which could prevent PJM from publishing outage data for ELCC classes in some hours. The revisions would allow PJM to post data for those hours while excising data for ELCC classes for hours in which the four-generation owner threshold was not met.

Heinle said the data could help market sellers better understand their ELCC accreditation and performance as PJM shifts to using marginal ELCC to determine the amount of capacity they can offer into the market.

Independent Market Monitor Joe Bowring said posting aggregated data would be a major departure from PJM’s practice of posting such data only after major events, such as storms resulting in high outage rates. He said the difference in forced outage rates could allow identification of which resource went online and the revealing of market-sensitive data.

Changes to Capacity Assignments for Large Load Additions Contemplated

PJM’s Pete Langbein presented a first read of a proposal revising how capacity obligations are assigned for serving large load additions (LLAs) — forecast load interconnection requests not captured in PJM’s economic forecasting. (See “Stakeholders Endorse Proposal on Large Load Capacity Obligations,” PJM MIC Briefs: April 3, 2024.)

The Tariff and Reliability Assurance Agreement (RAA) revisions would rework how PJM calculates capacity obligation assignments to exclude LLAs included in Table B-9 of the load forecast from base zonal scaling factors and add those LLAs back when determining the obligation peak load input.

Bowring argued that PJM’s processes for reviewing LLA submissions and assigning capacity need a deeper look as they can result in consumers buying excess capacity if forecast load does not manifest in the expected delivery year.

Michael Cocco, of Old Dominion Electric Cooperative, agreed with Bowring but said LLAs receive some high-level review by the Load Analysis Subcommittee and PJM staff, which ultimately accept or reject the LLAs.

PJM’s Andrew Gledhill said the RTO has rejected LLA submissions and would retain the power to review and ultimately determine whether they are incorporated into the load forecast and translated into capacity obligations.

Alex Stern, Exelon director of RTO relations and strategy, said the proposal aims to ensure capacity assignments accurately reflect the load that’s expected to materialize in a region.

“This seems to be an enhancement to the load forecasting process and that’s a primary goal and objective of what we do here, which is making sure we’re investing in what we need to invest in, but also making sure that costs on the transmission and generation side are properly allocated to all customers,” he said.

Other MRC Business

Stakeholders endorsed with 67% sector-weighted support a set of revisions to PJM’s governing documents drafted through the Governing Document Enhancement and Clarification Subcommittee (GDECS), with the most notable being lowercasing the term “end-use customer” in the language detailing load management participation in the capacity market. Bowring and some stakeholders argued the change could significantly alter which entities can participate in demand response and said the change should have been made through the stakeholder process. (See “Governing Documents Revisions Endorsed Through GDECS Process,” PJM MRC/MC Briefs: March 20, 2024.)

The committee endorsed by acclamation governing document and manual revisions adding definitions of three synchronous condenser parameters — condense startup costs, condense-to-generate costs and condense energy use. PJM’s David Hauske said the parameters are in use and the new language codifies ongoing practice. (See “Other Committee Business,” PJM MRC/MC Briefs: March 20, 2024.)

PJM reviewed revisions to Manual 3, which details transmission operations, and Manual 36, pertaining to system restoration, following the documents’ periodic review. Both proposals are slated to be voted on by the MRC at its May 22 meeting.

The changes to Manual 3 would include a requirement that transmission owners notify the Operating Committee prior to implementing dynamic line ratings (DLRs) and rules for rescheduling canceled transmission outage tickets.

Manual 36 revisions update the list of TOs within PJM and the list of TO deadlines for submitting annual restoration plan reviews.