PPL reported GAAP earnings of $190 million for the second quarter and executives focused on changing market dynamics in PJM during a teleconference with analysts Aug. 2.

The call came just days after PJM released the results of its latest Base Residual Auction, which showed significant spikes in capacity prices. (See related story, PJM Capacity Prices Spike 10-fold in 2025/26 Auction.) CEO Vince Sorgi said PPL is supporting legislative changes in Pennsylvania that would allow the utility to invest in generation.

“With increasing demand and tight supply, we need to do everything we can to protect our customers from such price volatility, including investing further in transmission upgrades to alleviate constrained zones, incorporating additional grid-enhancing technologies to get as much as we can from existing lines, and advocating for legislative changes in Pennsylvania that would drive needed generation development, including authority that would support regulated utility investments in new generation,” he added.

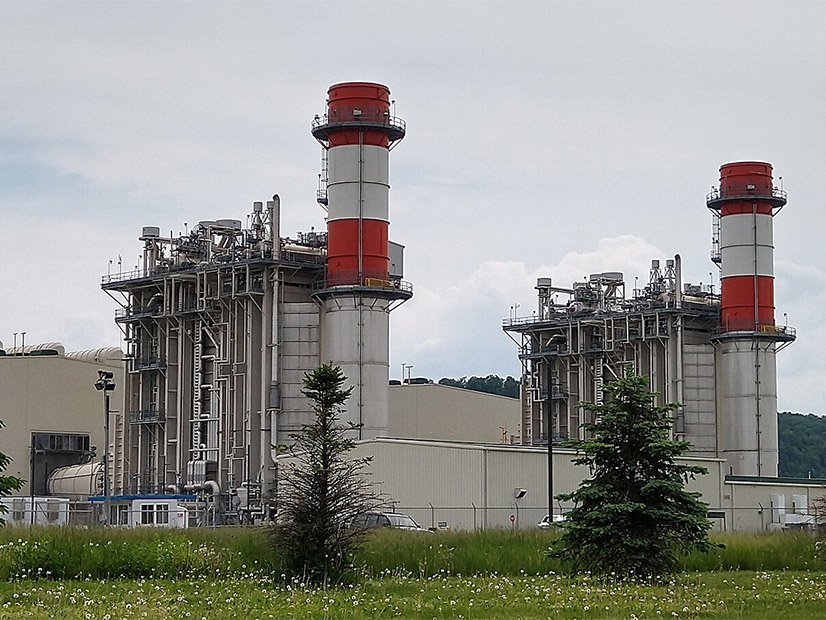

PPL is a wires-only firm, having split off its generation when it created Talen Energy in 2015, but given the shift in the generation fleet as demand is on the rise from data centers, PPL would support a major shift in Pennsylvania’s regulatory framework.

The capacity auction results show that PJM has a clear need for investment in the transmission system and for new generation, Sorgi said.

“I think those auction results also would reinforce our strategy in working with the state of Pennsylvania and the other [electric distribution companies] in the state to help resolve the resource adequacy concerns that many of us have been talking about for a while now, in particular in PJM,” Sorgi said. “And so we’re not going to just sit back and wait for this issue to resolve itself.”

PPL has an obligation to serve its customers, and it will do that by expanding the grid and by pursuing legislative changes, he added.

One of the analysts asked Sorgi about the last time restructured states in PJM backed generation, which led to the Supreme Court rejecting a Maryland subsidy that was based on the RTO’s capacity auction prices in Hughes v. Talen Energy Marketing in 2016. (See Supreme Court Rejects MD Subsidy for CPV Plant.) At the time, PPL still owned 65% of Talen, making it the lead complainant in the case.

The biggest difference between now and then is what is in the generation queue, Sorgi argued.

“What we’re seeing right now is significant amounts of dispatchable generation being retired with very little dispatchable generation coming on,” Sorgi said. “And, so … the big issue is not so much the energy play as the capacity play and making sure that we have enough capacity to serve 24 hours a day, seven days a week, 365” days a year.

PPL will be watching to see if the results from the most recent auction entice new, dispatchable resources to bid into the market in next year’s BRA for the 2027/28 delivery year.

“We suspect that the [independent power producers] will want to see more than just this one data point before they’re committing to building new dispatchable gen like natural gas,” Sorgi said. “So, we’ll be keeping an eye on that.”

Pennsylvania is taking the issue seriously, Sorgi said, and PPL looks forward to continuing to work with other parties on legislation.

The capacity auction results could lead to PPL’s average customers paying $10 to $15 more per month, but Sorgi noted other factors could offset that. The utility has significant interest from new data centers in its territory, with 5 GW worth of interconnection requests at a high level and 17 GW overall, though Sorgi said some of that larger number represents developers submitting speculative projects to find open, economic space on the grid.

Just building out the transmission grid to serve those 5 GW of more secure data centers would lead to them paying more of the transmission side of the bill, offsetting the capacity market’s impact to residential consumers, Sorgi said.