Generation owners point to the nearly 10-fold increase in capacity prices seen in the 2025/26 Base Residual Auction (BRA) results announced July 30 as the price signal they need to invest in new development. Meanwhile, consumer advocates say they worry a compressed auction schedule and backlogged interconnection queue will limit the ability for market participants to react.

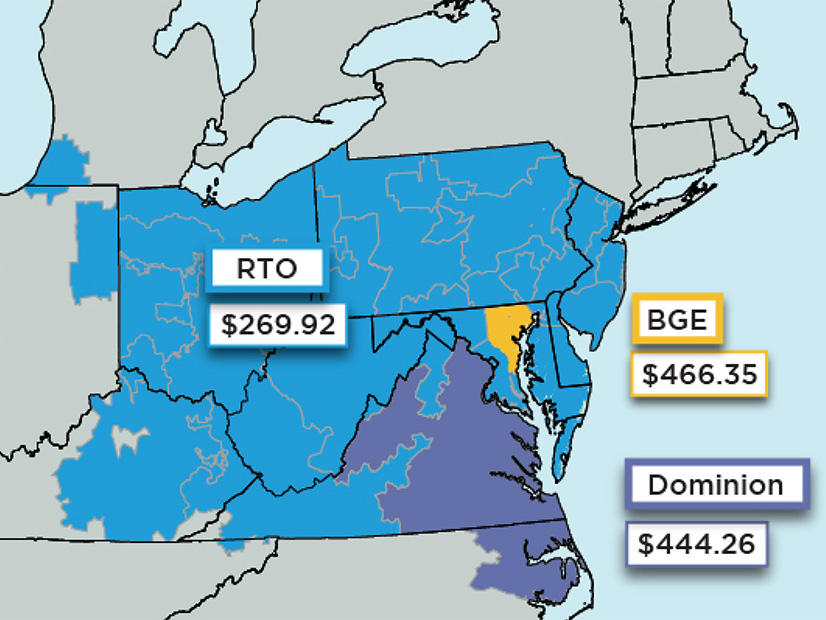

The clearing price for most of the RTO jumped to $269.92/MW-day and two regions surged to their price caps, reaching $466.35/MW-day in the Baltimore Gas and Electric (BGE) zone and $444.26/MW-day in the Dominion zone. The “rest-of-RTO” price in the previous auction was $28.92/MW-day. (See related story, PJM Capacity Prices Spike 10-fold in 2025/26 Auction.)

PJM said the increase was driven by tightening supply as generation resources retire, increased demand as data center load is expected to come online and a shift in how PJM forecasts reliability risks and determines the capacity contribution for resources.

Nearly half of the capacity that cleared the auction was supplied by gas generation, at 48%, followed by 21% nuclear and 18% coal. Demand response made up 5% of cleared capacity. Hydro fell to 4% and wind and solar were at 1%.

“The significantly higher prices in this auction confirm our concerns that the supply/demand balance is tightening across the RTO. The market is sending a price signal that should incent investment in resources,” PJM CEO Manu Asthana said in a July 30 announcement of the BRA results.

Consumer Advocates, Enviros: Sluggish Planning and Market Design

Illinois Citizens Utility Board Executive Director Sarah Moskowitz said PJM has been slow to adapt and failed to design a capacity market that sparks new generation investments without creating a windfall for developers.

“The power grid operator’s compressed auction schedules mean generators can’t build and come online quickly enough to respond to prices and bring down costs. Just as concerning, PJM has dragged its feet on interconnection and long-term transmission policy reforms that could speed up its approval process and bring needed clean, affordable energy online more quickly. Similarly, we have concerns about the accuracy of PJM’s load forecasting, as detailed in a recent letter from consumer advocates to PJM,” she said.

Susan Bruce, representing the PJM Industrial Customers Coalition (ICC), said the auction results differ significantly from simulated results PJM presented in the stakeholder process and it remains unclear what led to that gap.

“Regardless, the auction results will have a serious impact on customers. Given the timing of the auction relative to the 2025/2026 delivery year, customers have little to no opportunity to take action to minimize the cost consequences. And with delays in the interconnection queue, there is real concern about what may happen in the next auction,” she said. “Focused and dedicated efforts must be undertaken — post haste — to ensure that PJM market design can both facilitate new entry and retention of resources, without market power being exercised, better accommodate single point load integration, and properly reflect the value of non-weather sensitive customers’ demand response capability.”

Tom Rutigliano, of the Natural Resources Defense Council, said the price jump is the result of a reliance on fossil fuel generation at the expense of designing a market and grid set up to facilitate the development of clean energy. Gas-fired resources in particular, he said, have failed to live up to the promise of delivering reliability at low cost.

“Make no mistake: This was foreseeable and preventable. This is what happens when regulators sideline a wealth of historically affordable clean energy resources waiting at their doorstep and the transmission needed to bring them online. For years, the largest grid operator in the eastern U.S. has all but refused to diversify its resource mix and bring new energy online, and instead opted to depend excessively on an aging fossil fuel fleet while ignoring its reliability failures. This sticker shock is a direct result of recent regulatory changes made to address those reliability failures.”

He argued the cure to high capacity costs lies in the renewable energy projects pending in PJM’s interconnection queue.

“Diverse power grids are critical for reliability, and now we see just how critical they are for affordability. With wind and solar only making up an abysmal 2% of resources in this auction, but the overwhelming majority of PJM’s project queue, it is clearer than ever that PJM needs to rapidly scale up new energy resources to protect customers and resilience,” he said. “The cost of PJM’s interconnection delays has now reached billions of dollars. Leaders in PJM states must demand accountability and solutions from their grid operator before they have to pay billions more in the next auction just five months from now.”

PJM spokesperson Dan Lockwood said the RTO is in the process of implementing a FERC-approved reworking in how it conducts generation interconnection studies, which uses a cluster-based approach to determining any necessary network upgrades and allocating costs. He said that approach is expected to process 72 GW of resources in 2024 and 2025.

“Today, about 38,000 MW of resources that have already cleared PJM’s interconnection process have not been built due to external challenges that have nothing to do with PJM, including financing, supply chain and siting/permitting issues. PJM remains concerned with this slow pace of new generation construction and is considering ways to accelerate those who can successfully overcome those challenges and build,” Lockwood said.

Transmission Owners See Regulated Generation as Solution

During the utility’s July 31 earnings call, FirstEnergy CEO Brian Tierney said the high capacity prices and sluggish resource development suggest state administered capacity procurements may have a part to play in augmenting PJM’s marketplace, pointing to those run by the New York State Energy Research and Development Authority (NYSERDA) and New York Power Authority (NYPA).

The utility has limited ability to own capacity assets in many states. However, conversations about permitting it to develop dispatchable generation with a regulated return could allow it to respond to price signals when other market participants are not. In states where FirstEnergy does own generation, like West Virginia, he said that could take the shape of new combined cycle gas resources, while in Pennsylvania, that would take legislative changes.

“There are people that get upset and say, ‘You’re going back to regulation.’ I don’t think you have to go back to regulation. I think you can still have energy markets. I think you can still have retail choice where you have it today. But I also think you could have constructs like NYSERDA or NYPA where they could buy on behalf of the state’s residents. And that doesn’t have to be an end to competition,” Tierney said. “And they can even have auctions where all people could participate in that: utilities, independent power producers and others. So, for the people that say it has to be one or the other, I just don’t think that’s a valid premise.”

Part of the difficulty Tierney outlined is the disparity between the amount of time it takes to plan and develop new generation resources, compared to how quickly new loads can come onto the grid. He said new resources built in response to the higher prices could take as long as six years to come online, falling toward the end of the period PJM said it’s concerned about resource adequacy in a February 2023 white paper. (See “PJM White Paper Expounds Reliability Concerns,” PJM Board Initiates Fast-track Process to Address Reliability.)

While he said new resources with a regulated return could be part of the solution, Tierney said developing new competitive generation is off the table.

“The thing we wouldn’t be willing to do would be start competitive generation of our own. That’s something that we’ve recently come out of. We paid a heavy price for that. We’ve rebuilt our balance sheet in the wake of that, and that’s not a place that we’re going to be going back to. But other things, other opportunities that could benefit our customers have the capacity that they need be responsive from a price standpoint are all things that are on the table and are all things we’re talking to our states about,” he said.

In a statement, Exelon said the results show a need for new generation and transmission assets, particularly within the constrained BGE zone. In its announcement of the auction results, PJM said the higher zonal prices for BGE and Dominion were the result of insufficient generation within the zones and limited transmission to import from other regions.

“The recent PJM auction results underscore a critical need for strategic investments within the Exelon footprint, particularly in our BGE service territory in Maryland. The elevated price levels in this area, as well as others, reflect both a scarcity of resources and transmission constraints. Even with Exelon’s ongoing investments, including $34.5 billion over the next few years to upgrade the energy grid, additional transmission projects are still needed to ensure the strength and reliability of the energy grid now and in the foreseeable future,” the utility said.

During Exelon’s Aug. 1 earnings call, CEO Calvin Butler said all options are being pursued in response to a question asking whether the utility is looking at authorization for including peaker generation in rates.

“We’re working with our commissions on all types of scenarios. We shouldn’t take anything off the table because we need to address this issue and ensure affordability and equity [are] at the forefront of all discussions,” he said.

Generators Say Auction Delivers Needed Investment Signal

Enel North America Head of Energy and Commodity Management Roberto Rosner said the auction tells generation developers that now is the time to build new capacity resources.

“The signal from the auction is unmistakable: PJM needs more clean generation and more flexible demand-side resources. Power producers like Enel are eager for PJM to implement its interconnection reform so we can add more clean, affordable megawatts to the grid. As load forecasts rise from electrification and data center buildout, the value of demand response for maintaining reliability has never been clearer. It’s also clear that the substantial derate of capacity through ELCC ratings had a meaningful impact on the outcome.”

Voltus President Matthew Plante said the results were predictable given the number of generation retirements and PJM’s load forecasts. However, shifts in resource accreditation also had a large impact on the amount of supply able to offer into the auction. PJM’s shift to marginal effective load carrying capability (ELCC) and reworked risk modeling led to the focus on when resources can perform shifting from summer to winter.

“As the grid changes, we’re no longer in a situation where peaks are always during the summer months. In fact, the last time PJM dispatched the emergency load reduction program was December 2022 … so now it’s equally likely that PJM will need these resources in the winter than in the summer,” he said.

For demand response, that led to a 25% derate in the capacity resources could offer, reducing DR supply by about 3,000 MW. Nonetheless, Plante said the high price point is likely to turn around a yearslong decline in DR participation in PJM’s capacity market. Asset-backed DR resources — such as smart thermostats, batteries or anything requiring a capital investment — are especially likely to be buoyed by the high prices.

“It’s hard to find a customer that doesn’t want to take advantage of the value proposition that now exists,” he said.

Technological barriers have limited DR participation in the past, but most of those have been alleviated in recent years, Plante said. PJM and DR providers are working on addressing remaining regulatory barriers. He called the ELCC derate a “sledgehammer solution” and said the whiplash of frequent rule changes could affect market participation.

“I think regulators need to understand that there’s sometimes we change the rules too frequently and are reactive to things, and yes, a whiplash on rules in particular leads to volatility in the number of megawatts enrolled,” he said.