Several state consumer advocates filed a complaint at FERC on Nov. 18 alleging that PJM’s capacity market is failing to mitigate market power, overestimating future load and producing high clearing prices that generation owners cannot act on.

The complaint asks the commission to find that the 2025/26 Base Residual Auction (BRA) failed to produce appropriate rates, require a host of changes to the auction design and establish a refund with replacement rates. The complaint was jointly submitted by the Illinois Attorney General’s Office, Illinois Citizens Utility Board, Maryland Office of People’s Counsel, New Jersey Division of Rate Counsel, Office of the Ohio Consumers’ Counsel and D.C. Office of the People’s Counsel.

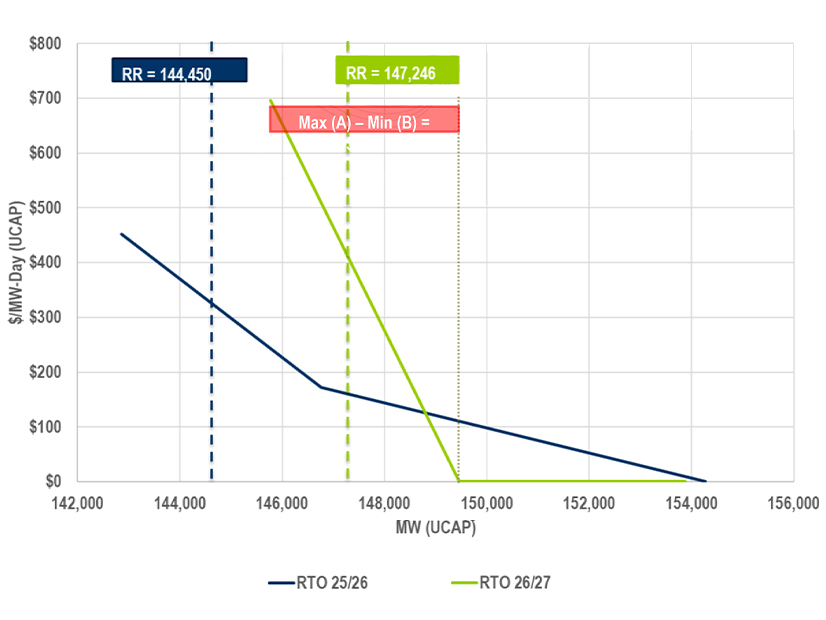

“From one auction to the next, the total capacity cost to consumers jumped from $2.2 billion to $14.7 billion. Worse, continuing to run BRAs using the current design promises the possibility of future auction clearing prices that are even higher. Absent changes to fix the PJM capacity market’s flawed auction rules, some have predicted that the 2026/2027 BRA could clear at the new, higher offer cap ($696/MW-day) regionwide, ballooning charges to PJM ratepayers to $37 billion,” the advocates said.

One of the market changes they advocated for is already the topic of a separate complaint filed by a group of public interest organizations: PJM’s practice of not modeling the expected output of generators operating on reliability must-run (RMR) agreements (EL24-148). The retirement of Talen Energy’s 1,273-MW Brandon Shores and 702-MW H.A. Wagner generators outside of Baltimore have been credited as one of the drivers of the BGE zone reaching the $466.35/MW-day price cap in the 2025/26 auction.

While the RTO plans to submit a proposal under Federal Power Act Section 205 that would add the output of two generators running on RMR agreements to the supply stack beginning with the 2026/27 auction, the advocates want that change to be made for the prior auction as well. (See “Insight into Upcoming Filing,” FERC Approves PJM Capacity Auction Delay.)

In addition to requiring that RMR units offer into the capacity market, they requested that the commission extend the advance notice that generation owners must provide PJM ahead of deactivating resources, empower the RTO to delay deactivations for reliability, base RMR compensation on a cost-of-service rate and require that RMR resources participate in all relevant PJM markets.

The advocates wrote that market power protections are incomplete so long as intermittent generation and storage are exempt from the requirement that all resources must offer into the capacity market and demand response resources are not subject to the three-pivotal-supplier (TPS) market power test. Citing analysis from the Independent Market Monitor on the auction, they said the tight balance between supply and demand led to all capacity resources having market power, underscoring the need to ensure that no resource classes are able to exercise market power. In that analysis, the Monitor has argued that DR and intermittent resources did exercise market power in the auction, a claim PJM has said is unsubstantiated. (See PJM Market Monitor Releases Second Section of 2025/26 Capacity Auction Report.)

“The primary cause of the BRA price spike is not the interplay of supply and demand. It is the byproduct of a market power problem endemic to the PJM design that the existing mitigation protocols are unable to address,” the advocates wrote.

They requested that DR resources that fail the TPS test be limited to offer caps akin to generation resources; be required to offer their maximum dispatchable demand reduction into the markets; and have their performance measured as a function of the actual metered reduction in load before and after the resource is dispatched.

They also asked that the commission implement the Monitor’s recommendation that the capacity ratings for gas generation be applied seasonally to align with PJM’s risk modeling. Accreditation for gas resources is capped at their summer ratings, a practice the advocates said is inconsistent with PJM’s risk modeling skewing toward the winter. Aligning the two would more accurately reflect their potential contribution to high-risk winter periods.

New supply is unlikely to offer a remedy, the advocates wrote, because of the confluence of a compressed auction schedule and backlogged interconnection queue that make it unlikely that developers can construct resources in response to high prices. In testimony supporting the complaint, Daymark Energy Advisors CEO Marc Montalvo said the high prices serve no benefit for consumers and allow generators to collect windfall revenues. Prioritizing interconnection studies for resources that would be built in constrained locational deliverability areas would allow the resources with the highest impact to be accelerated through the queue, Montalvo recommended.

“Under current market conditions, capacity prices are being driven by the barriers to entry of new supply — including constraints on the time it takes to study interconnection requests and build new transmission to interconnect new resources in the queue — which add to the market power of incumbent suppliers,” Montalvo wrote. “High prices cannot bring new generation into the market more quickly than it can be interconnected, and while such prices might retain existing generation, they are substantially above any just and reasonable measure of the net going forward costs that existing resources must cover to deliver capacity.”

He went on to argue that the sudden jump in BRA clearing prices — from $28.92/MW-day in the 2024/25 BRA to $269.92/MW-day in the following auction — calls into question whether the underlying fundamentals reflect an abrupt shift from surplus to shortage or a flawed market design.

The advocates also called for FERC to direct PJM to open a stakeholder process to make several changes to the capacity market in the longer term. It singles out the calculation of the net cost of new entry parameter and shifting the capacity market to a prompt or staggered auction to alleviate inflated load forecasts. They argued that PJM has a track record of over-forecasting load, a trend that could be exacerbated by rapidly accelerating estimates of data center load.

“These clearing price outcomes do not match the market facts on the ground. Yes, load is increasing — but PJM has historically overestimated load and appears poised to do so again by exaggerating the likely additions of massive data center loads without firm power supplies,” they said.