RSC, Directors Approve One-time Study to Meet PRM Requirements

SPP’s Board of Directors has approved a one-time process to quickly add generation so load-responsible entities (LRE) can meet their resource adequacy needs under the grid operator’s planning reserve margin (PRM) requirements.

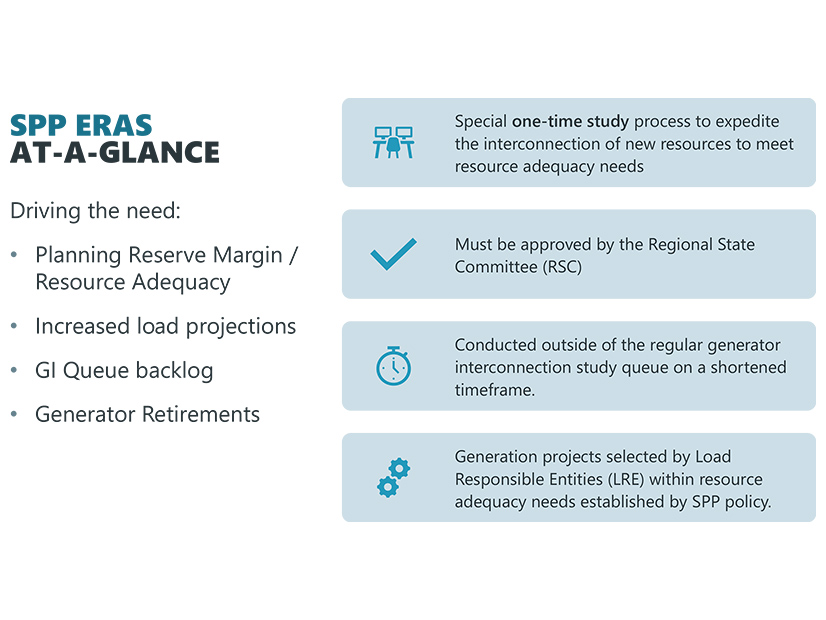

During its virtual Feb. 4 quarterly meeting, the board endorsed the Resource and Energy Adequacy Leadership Team’s proposal for an expedited resource adequacy study (ERAS) to ease the interconnection of new resources. The process, separate from the RTO’s existing generator interconnection (GI) process and its definitive interconnection system impact study of proposed generation, is designed to address resource adequacy concerns created by increased load projections, generation retirements and the current GI queue backlog.

While cautioning that stakeholders fall on both sides of the recommendation, CEO Barbara Sugg said, “I believe we have to do everything we can to get generation online as quickly as we can and meet our reliability needs, and I think this is a big step toward that.”

“This provides an additional optionality for those trying to meet the additional PRM requirements, so I think this is a positive step forward,” director Stuart Solomon, a former utility CEO, said.

Under the proposal, LREs will be able to select any generation and fuel type, based on their needs, for a special one-time study conducted outside the regular GI study queue. Requests accepted into the study will have priority over all GI requests without signed agreements. The requests must have a commercial operation date within two years.

The Regional State Committee (RSC), which unanimously approved the proposal during its Feb. 3 meeting, also will be required to approve the one-time ERAS.

While LREs generally supported the recommendation, developers said that existing GI requests might suffer financial harm from ERAS projects “jumping the line.” They also expressed concerns about FERC’s acceptance of an eventual tariff change, saying that it appears contrary to longstanding policy.

However, that policy could change. U.S. lawmakers have introduced legislation requiring the commission to craft rules so transmission providers can set up special queues for reliability needs and dispatchable generation. (See Bills Introduced in Congress to Speed up Queues for Dispatchable Power Plants.)

“We also understand the desire to add more generation, but we really still echo some concerns about the potential harm that this could have on projects in the existing queue and getting to our goals of getting through the backlog,” NextEra Energy Resources’ Jennifer Solomon said. “One of the problems that we see with moving this to FERC is that currently, the proposal is only open to projects that are selected by an LRE. There a number of issues that we will look at as the [tariff revision] develops, but I echo that it’s important that we stay kind of focused on how, if this moves forward, [it does so] in a way that ensures that it’s targeted, that it’s looking at how the [commercial operation dates] are going to be met.”

“We’re in a very unusual time. We have unprecedented load growth. We have these increases in PRMs, but it’s really challenging load-responsible entities,” Oklahoma Municipal Power Authority’s Dave Osburn said. “We’re the entities that are responsible for serving load. What SPP put forward is a bold plan, but this is the time for bold plans.”

The Members Committee approved the measure with its advisory vote, 16-4, with two abstentions. The Advanced Power Alliance, EDP Renewables, the Natural Resources Defense Council and Pine Gate Renewables opposed the proposal.

RA, Congestion-hedging Recs Pass

The board also approved several other recommendations related to resource adequacy and congestion hedging that previously were endorsed by the RSC:

-

- A long-term PRM policy paper outlining the framework for establishing planning horizon PRM requirements and providing LREs with adequate advance notice leading up to the applicable operating seasons. Stakeholders approved a Year 4, Year 7 and Year 10 cadence for the loss-of-load expectation studies and switching the LOLE study from a biennial analysis to annually.

- Implementing a 2029 PRM for the summer and winter seasons of 17% and 38%, respectively, based on submitted forecasts for the resource and load mix using the 2023 LOLE study.

- Two policies stemming from the Holistic Integrated Tariff Team’s work on congestion hedging. One increases opportunities for all market participants to receive long-term congestion rights (LTCRs) awards and the other coordinates with planning to review firm transmission assumptions used in planning processes. The LTCR proposal allows the netting of flows in their allocation. Eligible participants can nominate up to 50% of each path, with all current awarded LTCR paths over 50% grandfathered. The awarded LTCRs can be held for five years.

SPP staff said the increase in LTCRs would improve their allocation while also maintaining participants’ ability to retain current allocations by grandfathering those rights. That would result in more awards with no entity losing their current positions there, they said.

However, stakeholders pushed back, as they have since firm transmission service customers first asked in 2016 for improvements in determining the amount of auction revenue rights awarded in the annual and monthly ARR allocations. The Market Working Group and Cost Allocation Working Group both voted against the proposals, expressing a desire to wait until the 2025/26 LTCR period to evaluate other changes. Concerns also arose that allowing more LTCRs to be allocated could lead to underfunding issues.

“I think we have a responsibility to think about the public interest, and expanding the size of the pie is a way to create value for customers across the SPP region,” director Steve Wright said. “A 50% increase in LTCRs seems like a very big deal to me. There’s a lot of value that’s created and therefore, a lot of benefit that can flow through to members in the SPP region. I think we have a responsibility to go try and make that happen and continue to work with those who are concerned that their existing rights may be impacted in some way.”

EDP Renewables’ David Mindham was among those protesting the congestion-hedging recommendation over what he said was a lack of equity in allocating LTCRs.

“What we’re saying in SPP right now is the only way you can get value from paying for transmission is if you’re already getting that value, so that discourages new entry into willingly paying for transmission on the SPP system,” he said. “EDP has paid for a lot of transmission service throughout the years. We’re not going to do that anymore. We’re not going to willingly pay for transmission because we weren’t here long enough to derive value from the existing long-term congestion process. We’ve been run out of the market.”

The Members Committee voted against the motion with their advisory ballot, 6-10, with six abstentions.

Nickell, Sugg Share CEO Report

Lanny Nickell, who doesn’t officially take the CEO’s reins at the RTO until April 1, shared his initial thoughts with stakeholders while sharing the president’s report to the board with Sugg.

“I made a commitment to the board to help SPP succeed by placing an emphasis on operational excellence, ambitious strategy and high visibility,” he said. “Those are the three pillars that I believe will allow us to be successful, if built upon a foundation of SPP’s world-class culture and stakeholder experience.” (See Nickell: SPP’s Culture Paves Way for its 2025 Success.)

Nickell listed SPP’s three corporate goals for 2025, down from five the year before:

-

- Continuing to mitigate resource adequacy risks (he sits on the Resource Energy and Adequacy Leadership Team).

- Accelerating generator and load interconnection while planning for the load of the future.

- Continuing SPP’s Western expansion.

“Just because there’s three and not five doesn’t mean there’s less work,” he said. “These do not represent all the work and initiatives that will be undertaken throughout the year. They just simply represent the objectives that need to be most visible within our member community and within the organization and need a higher degree of focus and attention to ensure successful completion.”

Sugg, who announced her retirement last year, said, “I’ve worked with Lanny for a long time, and I have every confidence that he’s the best choice.

“As I look forward, I’m excited about where SPP is headed,” she added. “There’s no shortage of challenges, but we’ve proven time and time again that we always rise to the challenge. Lanny has got a lot on his plate and very high expectations that he set for himself, never mind the expectations that you all set for him. Certainly, I’m going to be watching SPP from the front row with my pompoms and whatever else I need to cheer on the organization as a whole.”

Ellis Retires, Evergy Exec Hired

Sugg also said Sam Ellis had retired Feb. 3 as vice president of IT after 22 years with SPP. He joined the organization in 2003 from member company Empire District Electric Co.

“It’s particularly noteworthy that I tried to hire Sam, and he rejected my offers prior to 2003, not that I’m holding a grudge against Sam or anything,” Sugg said. “He finally did come to SPP, and he did finally come and work directly for me. Anyway, we’re going to miss Sam, his sense of humor, his love for this company, and for our people.”

Ellis received a round of virtual applause from the board and stakeholders.

Nickell tag-teamed Sugg by announcing Kevin Bryant’s hire as the RTO’s first executive vice president of stakeholder affairs and chief strategy officer. Bryant will oversee the development and execution of SPP’s corporate strategy; lead the administration of its stakeholder process; and direct the management of the organization’s relationships and communications with internal and external stakeholders, including member companies and market participants in the Eastern and Western Interconnections.

Bryant comes to SPP after 22 years at Evergy, where he most recently was the company’s COO and its CFO before that. He will join the staff April 1.

RTO Western Expansion Progressing

COO Antoine Lucas said during the quarterly update to stakeholders that while SPP has received tariff approval for Markets+, it also is waiting on FERC’s go-ahead for its Western RTO expansion. The RTO filed a response to the commission’s deficiency filing in November.

“I hope that we will get that approval toward the middle of this month,” he said.

Lucas said in the meantime, staff is working with its vendor to build out the market systems. He said there have been a “few challenges” with software delays, but that staff is working to ensure the RTO expansion meets its April 2026 go-live target.

Casey Cathey, vice president of engineering, said SPP signed 108 generator interconnection agreements for more than 18 GW of capacity in 2024, three times more than the 10-year average for GIAs. He said the RTO expects to execute another 150 GIAs for 6.7 GW this year, when four study clusters are expected to enter negotiations for GI agreements.

The GI backlog effort continues, Cathey said, with clusters through 2022 resolved this year. The 2025 study cluster closes March 1, leaving the 2026 cluster as potentially the first study group under SPP’s consolidated planning process. Staff plans to bring a revision request for stakeholder approval in the second quarter this year and file a tariff change at FERC in the third quarter.

RSC OKs Order 1920 Extension

The RSC unanimously approved staff’s recommendation to request an extension of a six-month engagement period under FERC Order 1920 until Nov. 3.

The order requires transmission operators to produce a 20-year regional transmission plan to identify long-term needs at least every five years. SPP has produced 20-year plans for at least a decade. However, it still is subject to a six-month engagement period to allow state entities to negotiate a cost allocation method and/or a state agreement process.

“It really appears FERC wants to model other regions after what SPP does, and that is to have states involved in cost-allocation decisions provided to transmission upgrades,” SPP General Counsel Paul Suskie told the regulators.

SPP’s engagement period was to end May 5, but several RSC members expressed a desire for an extension. The committee is responsible for determining cost allocation issues, financial transmission rights allocations and the regional resource adequacy approach.

STEP Report Approved

The board’s unanimously approved consent agenda included:

-

- Approval of the 2025 SPP Transmission Expansion Plan report, which indicates 43 transmission upgrades, valued at $161.8 million, have been completed since the 2024 report. Another 290 upgrades were issued notices to construct, valued at $3.2 billion, and 20 upgrades worth $195.4 million were withdrawn.

- A revision request (RR650) to develop HVDC planning criteria for SPP’s governing documents.

- Endorsement of the Oversight Committee’s recommendation that the 17 members of the 2024 industry expert pool be renewed for 2025 and that five new members be added: former SPP exec Michael Desselle and Carolyn Barbash, Adrienne Bradley, Susan Thomas and Stanley Krause.

- Adding an independent director to the 24-person Strategic Planning Committee, giving the board between three and five seats.