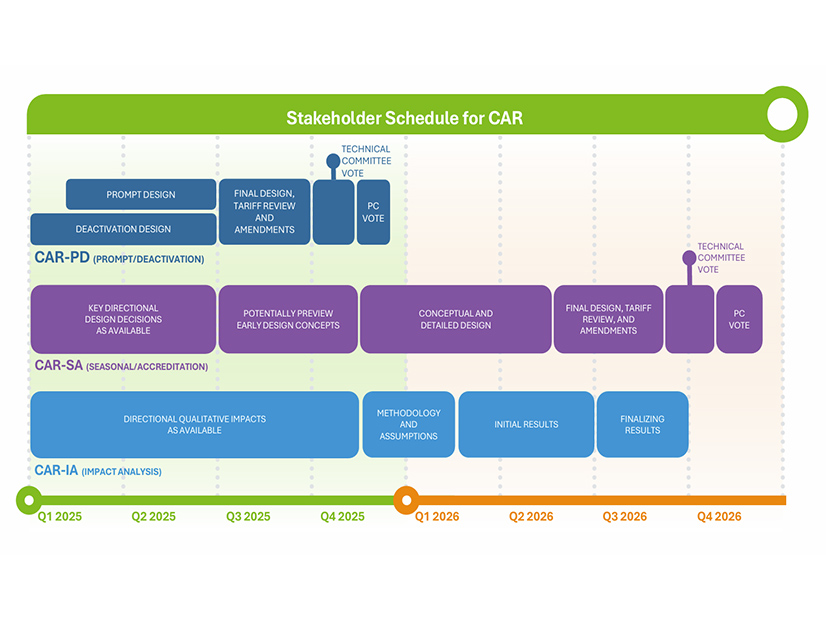

ISO-NE provided stakeholders with a high-level overview of its proposed prompt capacity market design and discussed several other aspects of its capacity auction reform (CAR) project at a two-day meeting of the NEPOOL Markets Committee on March 11 and 12.

The CAR project aims to transform the region’s Forward Capacity Market, with auctions held over three years prior to each yearlong capacity commitment period (CCP), into a prompt and seasonal capacity market, held a month or two prior to each CCP, which would be split into summer and winter periods with separately procured capacity. (See ISO-NE Refines Scope, Schedule for Capacity Auction Reforms.)

Chris Geissler, director of economic analysis at ISO-NE, said the RTO would run the first prompt auction in April or May 2028 for the CCP beginning on June 1, 2028. It would finalize resources’ qualified capacity values in early 2028.

New resources would need to be in service prior to the auction to sell capacity, Geissler said. One of the motivations behind the prompt auction format is to eliminate “phantom entry,” in which an in-development resource secures a capacity supply obligation (CSO) but does not come online in time for the CCP.

Geissler said ISO-NE would provide “as much opportunity for new resources to demonstrate being in service as possible.” The RTO would allow non-commercial resources to participate in auction qualification and intends to set the latest possible deadline for resources to demonstrate they have achieved commercial operation.

He emphasized that the fundamentals of the demand curve and bid formulation will stay the same in a prompt market.

“Under either a forward or a prompt auction, a resource’s competitive capacity offer price should consider the incremental costs associated with taking on a CSO,” Geissler said.

He noted that some costs that would be included in offers in a forward auction — such as investment costs for a new resource — could not be included in offers in a prompt market. While this could lower some offer prices, Geissler said he does not expect this to lower overall market prices.

“Resources that are considering investment costs will only incur those costs if they expect to recover them via the markets, whether those markets are forward or prompt,” Geissler said. “We would therefore expect similar quantities of capacity to be sold in a forward or prompt market, producing comparable capacity prices.”

Seasonal Market Update

Jennifer Engelson, supervisor of resource qualification at ISO-NE, provided additional information on the RTO’s plans for the seasonal divide of the CCP.

ISO-NE would split the annual CCP into six-month summer and winter seasons beginning and ending at the ends of April and October, respectively. These periods would be aligned with the seasons used in NYISO’s capacity market. ISO-NE would run separate seasonal auctions for the next CCP each spring.

Dividing the CCP into two seasons is intended to help ISO-NE mitigate growing winter reliability risks, driven by heating electrification and gas supply issues. While ISO-NE considered using more than two seasons, it determined that “two longer seasons with clear peaks would be more economically efficient for the region” because of the concentration of risks in the winter and summer, Engelson said.

Resource Deactivations

Under ISO-NE’s existing tariff, the resource retirement process is tied to the FCM, and resources planning to retire signal their intent about four years prior to their exit from the market.

Because a prompt auction would provide little time to address potential system issues caused by the retirement, ISO-NE plans to decouple the retirement process from the capacity market. (See NEPOOL Markets Committee Briefs: Feb. 11, 2025 and ISO-NE Introduces Proposed Resource Retirement Changes.)

Under the new process, deactivation notices would be due two years prior to each CCP. Notices would be binding and set off a review process to evaluate potential reliability and market power issues created by the resource’s retirement.

The reliability review — triggered for all resources with more than 20 MW of capacity — would include an evaluation of local transmission security. If issues are identified, ISO-NE could retain the resource through an out-of-market agreement. The RTO has said repeatedly it plans to consider resource retentions only to address local transmission security issues and will not retain resources for energy security.

To evaluate and mitigate market power, the ISO-NE Internal Market Monitor would review deactivation submissions “to determine whether the retirement is justified by economics or potentially motivated by benefits to a portfolio.”

Retiring resources would be subject to a conduct test to evaluate the economics of the retirement and a net portfolio benefits (NPB) test to assess whether retiring a profitable resource would increase revenue for the resource owner’s remaining portfolio.

“When a participant fails both the conduct and the NPB test, this suggests that the deactivation represents an exercise of market power,” said Zeky Murra-Anton, an economist at ISO-NE.

When market power is identified, ISO-NE plans to impose a 1.5-times multiplier on the projected increase in portfolio-wide revenue caused by the retirement. Murra-Anton said this multiplier is intended “to effectively deter deactivations for market power purposes without being excessively punitive.”

Treatment of Repowering Resources

ISO-NE also discussed how the CAR changes would affect resource repowering efforts.

The RTO’s interconnection procedures and FCM have mechanisms for evaluating changes to existing resources. Both the interconnection process and the FCM are undergoing major reform efforts, which will necessitate changes to the treatment of resource repowering.

Alex Rost, director of transmission services at ISO-NE, assured stakeholders that the RTO is committed to retaining “a path for repowering projects as the CAR design is set.”

“At a fundamental level, [interconnection customers] with repowering projects that seek to change/replace an original generating facility with a new generating facility, where the new generating facility assumes its needed interconnection service from the original generating facility, will maintain the ability to do so,” Rost wrote in a memo issued prior to the meeting.

NEPGA Tie Benefits Concerns

Bruce Anderson, general counsel for the New England Power Generators Association, presented some concerns about how ISO-NE’s capacity market accounts for tie benefits, which the RTO has defined as “the assumed amount of emergency assistance from neighboring control areas that New England could rely on … in the event of a capacity shortage.”

“The current market design ‘assumes away’ approximately 2,000 MW of capacity demand based on the belief that system energy from neighboring control areas is equivalent to ‘firm capacity,’” Anderson said, adding that these assumed tie benefits reduce the region’s installed capacity requirement.

Because tie benefits are not subject to the same obligations, audits and nonperformance charges as resources with CSOs, Anderson said treating tie benefits as “equal to actual capacity” creates risks of price suppression and capacity under-procurement.

Anderson added that price suppression increases the likelihood of “uneconomic retirements of resources important to system reliability.”

He said NEPGA will propose alternatives intended to improve ISO-NE’s tie benefits accounting methodology in the coming months.

Flexible Response Services

Also at the meeting, Matthew White, vice president of market development and settlements at ISO-NE, discussed the RTO’s long-term plan to improve its flexible response capabilities “to address greater operational uncertainties with an increasingly weather-dependent resource mix.”

In a memo issued prior to the meeting, White wrote that ISO-NE is “assessing a combination of new probabilistic forecasts and enhancements to the co-optimized energy and reserve markets.”

On March 1, ISO-NE launched a new day-ahead ancillary services market, which procures reserves to help grid operators cope with load variability and fill any energy gaps that arise between the day-ahead energy market and the load forecast. (See FERC Approves ISO-NE’s Day-Ahead Ancillary Services Initiative.)

Looking forward, ISO-NE is considering how to improve its real-time forecasting of ramping needs and may look to procure “dynamically determined incremental quantities” of 10- and 30-minute reserves and new longer-response reserve products, potentially in the 60- or 90-minute range, White said.

“New England’s power system is becoming increasingly dynamic, and extending conceptually familiar market designs with new probabilistic modeling capabilities appears to be a promising next step to reliably address increasing operational uncertainties,” White wrote.

“By carrying less incremental reserves when net load uncertainty or ramping needs are forecast to be low, unnecessary costs can be avoided; and by increasing incremental reserves when net load uncertainty or ramping needs are forecast to be higher, reliability can be maintained,” he added.

Fall Markets Report

Finally, the IMM’s Kathryn Lynch presented the Monitor’s fall quarterly markets report, which found that wholesale market costs during the quarter increased by 8% relative to fall 2023, up to nearly $1.5 billion in total costs.

Market costs increased despite a 13% decrease in natural gas prices and the lowest recorded fall season power demand.

The increase was driven by increased emissions costs for the Regional Greenhouse Gas Initiative and decreased imports and domestic nuclear generation, Lynch said. Average hourly nuclear generation decreased by about 423 MW compared to the prior fall “due to planned and forced outages,” while net imports dropped by an hourly average of 892 MW because of “dry weather in Québec and a nuclear generator outage in New Brunswick.”

Overall, market pricing outcomes were competitive, and “there was no evidence of impactful capacity withholding,” Lynch said.