FERC will hold a two-day technical conference June 4-5, where it will look at resource adequacy issues in the ISO/RTO markets, with most of the focus on those with capacity markets.

FERC will hold a two-day technical conference June 4-5, where it will look at resource adequacy issues in the ISO/RTO markets, with most of the focus on those with capacity markets.

Capacity auctions in PJM and MISO have generated headlines recently as both markets face narrowing supply-and-demand balances that have led to spiking prices and yet another round of changes, which have been nearly constant since the capacity markets were created.

“The problem with the capacity market and the reason there’s all this tinkering is there’s literally hundreds of parameters that make a big impact on the prices and the quantities,” Forward Market Design founder Peter Cramton said in an interview. “And people care enormously about those prices and quantities, and so they argue about them endlessly. So, in essence, capacity market has been troubled by this constant stakeholder debate about this effectively moving money from one side of the market to the other.”

Cramton previously was an independent director on ERCOT’s Board of Directors. Forward Market Design filed comments in the tech conference’s docket (AD25-7) outlining a major overhaul to organized markets that would scrap the capacity auctions and replace them with “forward energy markets.”

The concept could be readily implemented by ISO/RTOs because it does not require changing their core systems for the day-ahead and real-time markets, the company said.

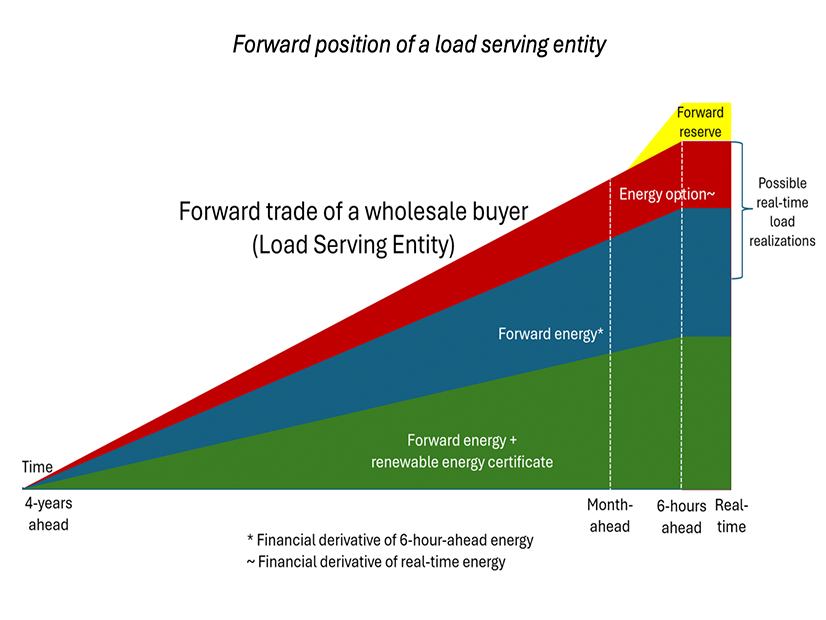

“Unique prices and quantities that maximize total welfare are calculated hourly for all forward products,” it added. “This lets market participants trade gradually over tens of thousands of auctions to establish desired positions in forward energy and energy options before day-ahead is reached. Their positions can be adjusted based on the latest information and the consensus views of market participants with intuitive trade-to-target strategies.”

When the capacity markets first were developed, the trading technology was not as effective as it is today, Cramton said.

“This new approach is really focusing on the fundamental problem that the natural sellers and natural buyers have to deal with, and that is to establish positions to best manage needs and risks,” he added. “And the way this happens in the forward energy market is the system operator conducts an hourly auction for highly granular energy and energy option products. This is done with this new trading technology, flow trading, which is effectively what we already do today in the day-ahead and the real-time market.”

Instead of trading once or twice a year in capacity auctions, market participants can trade much more frequently and make constant adjustments to their positions over time, Cramton said. Forward hedges can be locked in gradually over time, helping participants manage risk and limit trading costs.

Capacity prices are high because of tightening supply and demand balances, which makes sense, but the overall cost is very high because there is a huge quantity of megawatt-days trading at that high price, Cramton said.

“That’s what the forward energy market avoids by trading every hour rather than trading once a year,” Cramton said. “So, when you’re trading every hour, you may have this disequilibrium, and the prices are very high momentarily, but very small quantities are transacting many orders of magnitude smaller.”

That still produces the all-important price signals to guide investment, but because of the smaller amounts being traded, the actual money involved will not lead to price spikes for consumers once the capacity year starts.

“Prices are changing gradually, and to the extent that the actions are taken to address the shortfall that’s leading to the high prices, then the prices will fall over time as supply responds,” Cramton said.

Replacing capacity markets with forward energy markets would represent a major change in organized markets, and Cramton’s endorsement makes it an option worth considering, Copper Monarch’s Vincent Duane, a longtime former PJM executive, said in an interview. But that is only one of the long-term options on the table.

“The commission is trying to explore what types of alternatives might sort of break the logjam of increased costs of supply versus the sort of affordability crisis,” Duane said. The market design can continue to be tinkered around the edges; it could be knocked down and rebuilt; or it could be replaced with something entirely different.

The recent return to demand growth has come at a time when the cost of building power plants has gone up, with combined cycle rising from $1,000/kW about five years to $2,500/kW today, Duane said.

“The capacity market printed a price of about $280.60/MW-day the last time around,” Duane said. “But that doesn’t translate into what it’s going to cost to incent new investment, which, of course, is desperately needed.”

FERC Chair Mark Christie is not tied to the organized markets in the way many of his predecessors were, having published an article suggesting it was time to move on from the single clearing price model that is fundamental in ISO/RTOs. (See FERC’s Christie Calls for Reassessment of Single Clearing Price.)

“Does it make sense in this day and age with the very different technologies that we now have, not to mention the ages of these technologies, to treat them all, from a capacity market perspective, as just another megawatt, as another megawatt, as another megawatt,” Duane said. “And I think he’s got a serious question in mind as to whether that makes sense.”

Paying some supply more than others might be a way to get around the fact that the current systems’ prices are politically unviable, but still not high enough to attract the needed wave of investment in new power plants, Duane said.

A key input to capacity prices is the load forecast. The markets need to clear enough capacity to meet future demand, plus a reserve margin, and forecasters face new uncertainty from the growth in large loads. The Electricity Customer Alliance and other customer groups wrote a letter May 30 to all four FERC commissioners ahead of the technical conference, saying FERC should ensure that best practices in load forecasting are being used.

The alliance includes some of those new large loads along with everyday mass market customers, and the letter’s co-signers included the Electricity Consumers Resource Council and the National Association of State Utility Consumer Advocates.

“We cannot meet these national security imperatives … without more confidence in load growth forecasts, greater transparency and standardization in how forecasts are constructed, and clearer lines of communication among state and federal regulators, transmission operators, generators, load-serving entities and customers as forecasts are adjusted,” the letter says. “Customers face significant reliability and cost risks when load growth forecasts and projections are uncertain and not transparent.”

Looking into where current practices are incomplete or inaccurate and identifying best practices are important steps to protecting customers from reliability risks if forecasts are too low, or paying for stranded costs if they are too high, the letter says. “The commission is uniquely positioned to convene the states, industry and customers to examine load forecasting practices, given the impact of these practices on matters in the jurisdiction of both the commission and the states.”