FERC spent June 4-5 looking into resource adequacy across the markets it regulates.

For most organized markets across most of their history, resource adequacy was relatively easy to handle, with supply long and demand growing slowly.

That has changed rapidly in just the past few years, with a spike in demand growth led by new data centers. FERC spent June 4-5 looking into the issue across the markets it regulates.

FERC Chair Mark Christie has been talking about a reliability crisis for years, as dispatchable generation has retired with replacements that at best do not offer the same characteristics.

“So now the crisis is really right on our doorstep,” Christie said. “But let’s not forget, while this conference is about the impending crisis of reliability from resource shortfalls, it really has another crisis connected to it, and that is the crisis of rising consumer power bills, because consumers have to pay for capacity, as we all know. And I know that in at least two states in PJM — Maryland and New Jersey — this very week consumers are seeing big jumps in their power bills because of rising capacity costs.”

The technical conference, along with pre-filed comments and another round after the conference, will build a record that FERC could use in future proceedings on the issues, he said.

The industry is facing a lot of uncertainty, including extreme weather, supply chain constraints, rising costs for equipment and how much it can really count on demand forecasts, Commissioner Judy Chang said.

“The compounded complexities around the regulatory and commercial structures deployed in various regions across the country make all of our jobs difficult, and that’s why we’re having this conversation today, to add to the record, but also to add an opportunity to discuss these questions,” she added.

NERC has been monitoring resource adequacy for decades, and, outside a few regions, it mostly was boring until 2018, CEO Jim Robb said.

“For the first time, in 2018, our long-term resource adequacy assessment showed a material expectation of long-term unserved energy, and 18 months later, that expectation, unfortunately, was realized with a significant load-shed event in California in August of 2020,” Robb said. “And since then, our analyses have shown growing risk of unserved energy across the continent.”

The theory around resource adequacy in wholesale markets was simple, with trading in spot markets producing price signals that would lead to bilateral deals that can support new entry of generation, ISO-NE CEO Gordon van Welie said.

“The construct assumed that society would be tolerant of occasional shortages and high prices to allow market incentives to work,” van Welie said. “In practice, we have learned that the theoretical construct made assumptions that were inaccurate. Specifically, it assumed the proper price formation in the energy market, which has been stymied by price caps and externalities that have not been priced. This has led to the need to replace the missing money.”

It also ignored the need for a reserve margin, and in that gap came the capacity markets. Both ISO-NE and PJM have used three-year forward markets, but van Welie said his RTO is working on a prompt, seasonal design that is better equipped to deal with the realities the system is facing.

“The seasonal pricing will reflect the dynamic changes and constraints in the regional power system, provide the economic stimulus to drive bilateral trading and discipline wholesale buyers who have not covered their share of the resource adequacy objective,” van Welie said.

The new construct would require support from the states, reduced barriers to entry and substantial bilateral trading to manage volatility and support investment, he added.

PJM’s markets generally have worked well in the past, with its capacity market helping to bring online 50 GW of new resources that includes significant renewables and 8 GW of demand response since it launched in 2007, CEO Manu Asthana said.

“So, it’s not something very lightly that we would want to move away from,” Asthana said. “I think they have worked, but — and there’s a ‘but’ — as you know, we’ve been expressing resource adequacy concerns for some years now, and they’re driven by generator retirements, slow new entry and accelerating demand growth.”

Artificial intelligence is effectively just a “toddler” at this point, with ChatGPT launching less than three years ago, Asthana said. The technology is only to grow, and Asthana said he believes it will change the world — and in the process lead to much higher demand for power.

Other regions have seen their once large reserve margins shrink down to their minimum targets, and that is likely to remain the case.

“We hit minimum planning reserve margins in 2022; we’ve been treading water to maintain that level ever since,” MISO Senior Vice President Todd Ramey said. “I think that’s the new normal for our region. All of the incentives do not point to excessive planning reserve margins.”

A key way MISO keeps track of resource adequacy is surveys it conducts with the Organization of MISO States, which represents states that largely are vertically integrated. The latest survey June 6 will show the industry in the region has work to do to maintain its reserve margin target next year and for the rest of the decade, Ramey said.

A longer-term 20-year assessment from a couple years ago showed only renewables coming online, which would have left the grid short of key reliability services. But Ramey said that has changed for the next long-term assessments as states have added more dispatchable resources to their plans.

For states that have ceded more control to FERC, the options to ensure reliability are more limited, with van Welie suggesting some kind of financial hit is needed, such as a penalty baked into the market, or just letting scarcity pricing occur in the spot market.

While restructured states have given FERC more control over resource adequacy, none of them under its regulation has gone as far as Texas, where the standard utility has been eliminated, leaving large parts of their customers still on utility service. Asthana suggested states could change the rules set for utilities to procure supplies for those customers to boost bilateral trading and supplement the wholesale market.

“Because a lot of the load clears through state-run auctions, I think our states have the ability to try to hedge their consumers through those auctions for capacity,” Asthana said. “And I think those hedges and those bilaterals will also incentivize new generation, and those are conversations we’re having with our states.”

State of PJM’s Markets

After an initial panel of ISO/RTO CEOs, the technical conference started focusing on regions, and PJM got the most attention, with three panels taking up more than half a day.

Commissioner Chang noted PJM has seen some of the largest concerns, but paradoxically, it has seen some of the lightest renewable power development, with 93% of its generation still conventional.

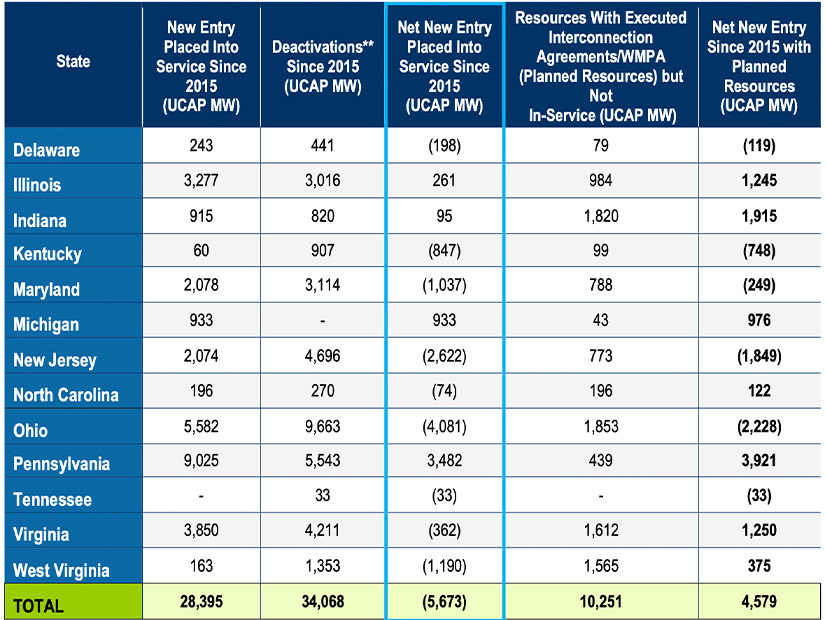

Given that PJM is going through more retirements of conventional generation, and most of the new developments are renewables, the mismatch in retirements and replacements is a concern for the near future, and the RTO already has to start planning for it, said Vice President of Market Design and Economics Adam Keech. On top of that, PJM has several hot markets for data centers, with the resulting demand growth acting as an accelerant to every other issue it faces.

Data centers are looking for highly reliable, 24/7 power, but a recent study from Duke University showed they can be flexible if they use on-site resources such as batteries to participate as demand response, said LS Power Senior Vice President of Wholesale Market Policy Marji Philips. (See US Grid has Flexible Headroom for Data Center Demand Growth.)

“It’s really only the times the system is stressed that you need the thermal generation,” Philips said. “The problem is when it’s stressed, you need it all. And PJM, as Adam said, is seeing a retirement of those resources.”

Renewables are dominating the queue, and the most economical of those are going to be built and will benefit the grid and consumers, PJM Independent Market Monitor Joe Bowring said.

“All I’m saying is that there’s a baseline level of dispatchable resources you need for reliability to meet the demand during the high expected unserved energy hours,” Bowring said. “So, I mean … low-marginal-cost energy is great for customers, but it doesn’t meet that same reliability.”

The resource adequacy issue and consumer costs in PJM have caused some to question longstanding policies on the market. (See Utilities Pushing for a Return to Owning Generation in Pennsylvania.)

But PJM Power Providers President Glen Thomas doubted Pennsylvania will change course and said Ohio just reaffirmed its market-centric policy with a recent change in law. Illinois, Maryland and New Jersey all restructured, and they have moved to a middle path, relying on the markets while being more active in picking resources, which he argued led to the retirements of others.

“They’ve largely been able to do that because of the tremendous surplus that Pennsylvania has built up,” Thomas said. “And I would also add that Pennsylvania would never have been able to build that surplus under a vertically integrated [integrated resource plan] regime. There’s no way state regulators would allow the system to be that overbuilt.”

Now that excess capacity is bailing out even Virginia, which is a vertically integrated state that is dealing with massive demand growth from its world-leading data center market, he said.

Chair Christie, who was a regulator on Virginia’s State Corporation Commission for years before joining FERC and is a strong proponent of its regulatory setup, said traditional regulation worked for years there and only ran into the same issue around unexpected demand growth that is causing issues around the country.

“That was a decision driven by policies adopted by our legislature to give tax subsidies to data centers and other attractions, which the utility commission had nothing to do with,” Christie said. “So, the IRP system is not the reason, as Glen said, Virginia is now a big importer.”

The prices are getting too high even for Pennsylvania, PPL Chief Legal Officer Wendy Stark said. The capacity market cleared at $270/MW-day last time, which was enough for Gov. Josh Shapiro (D) to file a complaint. That led to a settlement capping the next two auctions at $325.

“That also is not enough to incent new generation, so customers will be paying even more than they are now,” Stark said, adding that prices need to be at $500 to $600/MW-day. “That’s a problem, and as a utility with that obligation to serve, we at this point are really dependent upon the PJM capacity market. I will tell you at this point that feels like a single point of failure for us.”

Pennsylvania and other states restructured because cost-of-service regulation proved inefficient, which meant high costs as well, Bowring said.

“The idea that a regulated generator, because it’s subject to a regulatory process, is going to do things more efficiently is questionable,” Bowring said. “The markets have demonstrated the reverse for quite some time. So, I didn’t think I’d be here jumping up to defend the PJM capacity market.”

Bowring also doubted that the mandatory market ever will be meaningfully substituted with bilateral deals because it effectively forces much of that activity into the capacity auctions.

“Cost-of-service regulation worked to provide reliability for 100 years,” Bowring said. “It could certainly do that. I think it did it at a higher cost than markets.”

Capacity is a political construct, and states should be given more say in how it is managed, said Jacob Finkel, deputy secretary of policy in Shapiro’s office. The 14 states that are in PJM are swamped by the sheer number of stakeholders in a process that does not give them major formal input, he said.

“Most of our ability right now revolves around whatever goodwill we can build with PJM around working with the board and working with management, and it should be more than that,” Finkel said.

With the disconnect between price signals and new supply as the balance is getting tighter, Finkel suggested PJM needs to embrace resources such as virtual power plants (VPPs) and grid-enhancing technologies (GETs) that can be added to the grid quickly.

“All the acronyms should be deployed,” Finkel said.

Getting such resources will help, but after the quip, Finkel said ultimately if the issues around the market cannot be resolved in a way that is fair for ratepayers, Pennsylvania could move back to its own planning.