WESTBOROUGH, Mass. — NEPOOL technical committees voted in favor of ISO-NE’s proposal to adopt a prompt capacity auction and update the RTO’s resource retirement process, indicating broad stakeholder support for the first phase of ISO-NE’s capacity market overhaul.

In a joint meeting Nov. 12, the NEPOOL Markets Committee voted 97.9% in favor of the proposal and approved one of three amendments proposed by stakeholders. The NEPOOL Transmission Committee voted to support the associated transmission-related changes.

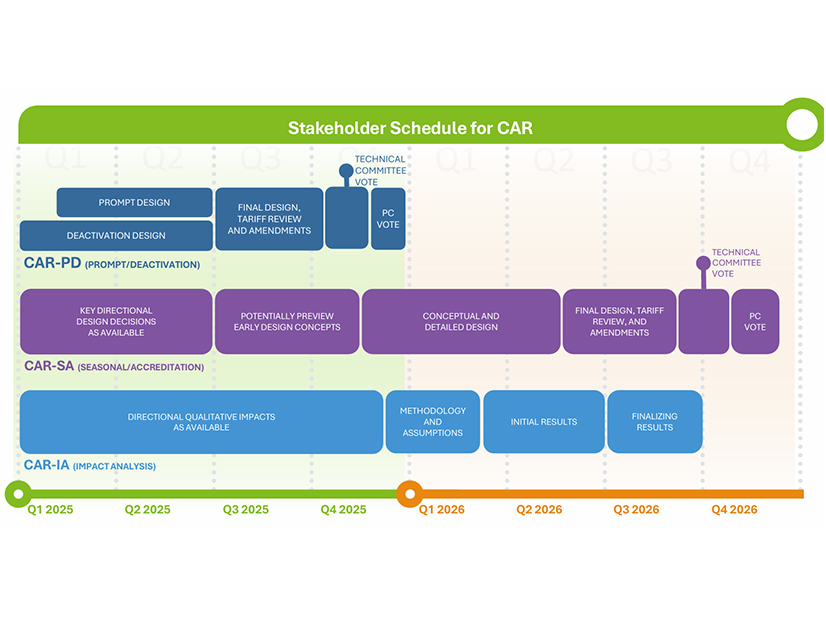

The proposal encompasses the first phase of work in ISO-NE’s Capacity Auction Reform (CAR) project. The RTO began stakeholder discussions in September on the second phase of the project, which centers around accreditation changes and shifting to a seasonal capacity market. (See ISO-NE Kicks off Talks on Accreditation, Seasonal Capacity Changes.)

While ISO-NE plans to file the two phases separately, both are intended to take effect for the 2028/29 capacity commitment period (CCP).

Under the proposed changes, ISO-NE would hold capacity auctions about a month prior to the start of each CCP, compared to the more than three years that historically have separated Forward Capacity Auctions and CCPs.

The proposal also would decouple resource deactivation from the auction process. ISO-NE has said processing resource deactivations in the immediate leadup to prompt auctions would not give it enough time to address any issues triggered by retirements. In the Forward Capacity Market, resources submit delist bids more than four years before the relevant CCP.

ISO-NE proposes to require resources to submit deactivation notifications one year before the start of the relevant CCP. It has said the one-year deadline balances the tradeoffs between a longer timeline, which would give ISO-NE and market participants enough time to respond to retirements, and a shorter timeline, which would enable resources considering retirement to make a better informed decision.

While the changes received widespread support from NEPOOL members, several stakeholders outlined lingering concerns about the risk that ISO-NE will not be able to obtain FERC approval of the second phase of CAR changes in time for the 2028/29 CCP, leaving the Phase 1 changes to stand alone for the first prompt auction.

Stakeholders also expressed concern that the shorter retirement notification period will increase the risk of out-of-market resource retentions. They emphasized the need to encourage bilateral transactions to protect against price volatility.

The MC also voted 83.3% to adopt an amendment by the New England Power Generators Association (NEPGA) to maintain ISO-NE’s current rules allowing capacity supply offers to reflect resources’ physical limitations in high ambient temperatures.

ISO-NE had proposed to eliminate its option for resources to submit ambient air delist bids associated with capacity it would not be able to provide when ambient temperatures exceed 90 degrees Fahrenheit. These delist bids are not subject to cost review by the Internal Market Monitor.

NEPGA made the case that, without the amendment, market participants would “unnecessarily be required to submit a cost workbook for megawatts it is physically unable to produce at those high ambient temperatures.” It proposed “technical conforming language” extending the existing exemption to the new design. ISO-NE indicated it would adopt the changes into its proposal.

The MC rejected a pair of proposals related to the competitive offer price threshold (COPT), which sets the price above which offers are subject to Monitor review.

Under ISO-NE’s proposal, the RTO would continue to calculate the threshold based on the previous capacity auction clearing price and forecasting for the upcoming auction.

Several stakeholders have expressed concern that relying on four-year-old prices to set the threshold in the transition to a prompt auction could create issues related to stale data, pointing to higher prices in recent annual reconfiguration auctions and a recent increase in Pay-for-Performance penalties.

Calpine and LS Power each offered amendments to the threshold methodology. Calpine proposed basing the threshold on a calculation of the opportunity cost associated with scarcity revenues, while LS Power proposed a one-year fixed price for the 2028/29 CCP based on the outcomes of recent reconfiguration auctions.

Both proposals fell short of the 60% voting threshold for MC support. Calpine’s proposal received 53.8% support, and LS Power’s received 56.7%.

ISO-NE acknowledged the concerns about stale data and said it plans to take a more in-depth look at the threshold in the second phase of the CAR project.

If the second phase of CAR is not approved prior to the 2028/29 CCP, “the ISO anticipates that it would make further updates to the [Phase 1] design, which would include an assessment of the COPT given the latest information available,” the RTO noted in a memo published prior to the meeting.