Parties filing comments with FERC on expanding interregional transfer capability on the grid mostly supported the concept, though opinions were split on how to get there.

Due Monday, the comments came in response to a FERC technical conference on the subject late last year, and they could inform another Notice of Proposed Rulemaking in its broader efforts to revise transmission policy (AD23-3). (See FERC Considers Interregional Transfer Requirements.)

Many parties, including clean energy trade groups and environmentalists, want FERC to set minimum transfer requirements, based on either a flat megawatt amount or a percentage of peak load, between each neighboring region in the Lower 48 (except ERCOT, which was left out of the proposal as it is outside commission jurisdiction). Many of them pointed to a study by Grid Strategies that Americans for a Clean Energy Grid (ACEG) filed with its comments.

“Adopting a strong minimum requirement for Interregional Transfer Capability is the single most important step the commission can take to make the power system more reliable and resilient in the face of increasing threats from severe weather and other unexpected events,” ACEG said. “Interregional transmission is the most effective solution because the largest impacts from all of these threats tend to be localized in relatively small areas, so expanding interregional transmission provides a lifeline when a region’s electricity supply and demand is being affected by an unexpected event.”

Grid Strategies’ report, which looked into transfer capability among the Eastern Interconnection’s regions and ERCOT, found that all regions would benefit from a minimum transfer requirement of 20 to 25%. That would cut the need for peaking resources across the two interconnections by 137 GW.

“This 137-GW geographic diversity benefit translates to $113 billion in economic savings based on the avoided capital cost of an equivalent amount of gas combustion turbine capacity,” ACEG said.

Grid Strategies did not factor in likely changes such as the growth of renewables and increased electrification of home heating and other new sources of demand, or a growing reliance on natural gas plants — all of which would tend to increase the value of interregional transfers.

“Interregional transmission functions like an insurance policy against unexpected events, in that it is impossible to precisely predict when, where, or for what that insurance policy will be needed,” ACEG said. “Over the long term, all regions will be affected by such an event and will benefit from that interregional transfer capacity.”

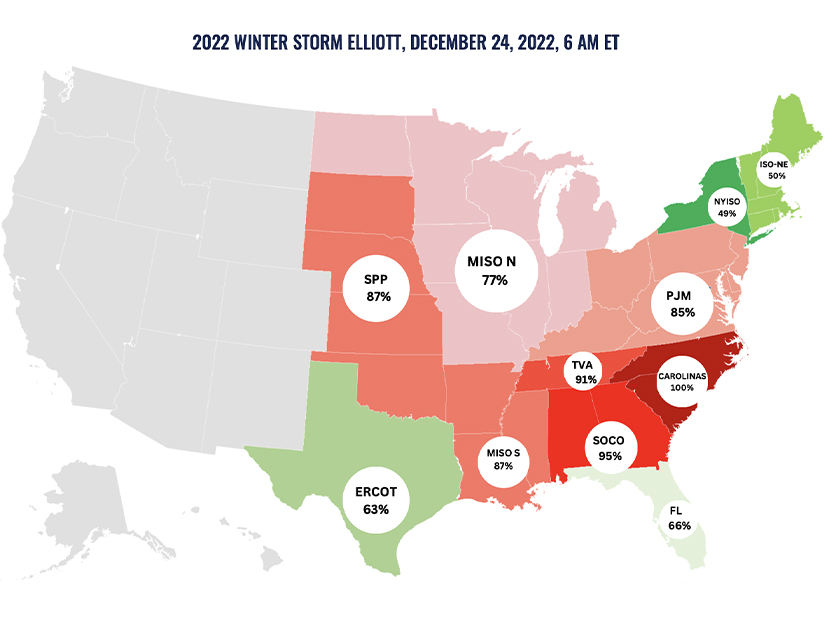

Natural Resources Defense Council, Sustainable FERC Project, Rocky Mountain Institute, Environmental Defense Fund, Sierra Club and others said the need for more interregional transfer capacity has only grown since FERC’s December conference because of the outages in the Southeast around Christmas last year.

“Transmission can deliver electricity in both directions, so both connected regions benefit,” the environmentalists said. “For example, transmission flows flipped from westward to eastward as Winter Storm Elliott moved eastward across the country, as has happened during past severe weather events.”

Such minimum transfer capacity can be viewed as insurance against outages caused by extreme weather and thus should have its costs spread widely, they said. The industry likewise spreads the costs of resource adequacy widely because meeting the one-day-in-10-year resource adequacy standard is viewed as good for all, the environmentalists said.

The Department of Energy also filed comments urging FERC to move forward on increasing interregional transfers, highlighting that its own recent draft study on transmission needs found increasing needs for such transfer in some regions by 2030 and in nearly all regions by 2040. DOE is also working on a National Transmission Planning Study focused on interregional transmission, which is expected to come out by the end of 2023.

“Recent work shows that large amounts of interregional transmission coming online between now and 2030 will enable the economic and consumer energy cost reduction benefits of the significant investments in clean energy manufacturing and generation, and the electrification of homes, businesses, and vehicles made by the Infrastructure Investment and Jobs Act and the Inflation Reduction Act,” DOE said. “Recent modeling by the Department of Energy and NREL finds that between 17 and 36 TW-miles … of new transmission capacity will be needed between 2023 and 2030 to connect the vast amount of new generation and storage resources enabled by both laws.”

It would be possible to tailor transfer requirements between specific pairs of regions, but that entails factoring in weather and climate patterns, generation mix and location, load patterns, the gas pipeline network, and hard-to-predict extreme weather, ACEG said. That could lead to “analysis paralysis” and also does not factor in that different parts of an interconnection are impacted by power flows all across it, the group added.

DOE said FERC should base any standards on well-defined processes that take into account clearly defined planning assumptions such as demand, weather events, contingencies, geographic and temporal scope to ensure consistent results around the industry.

While some argued for the simplicity of setting a minimum transfer percentage that applies everywhere, others said FERC can take the time to have regional and interregional planners study the issue and come up with more tailored solutions.

Support for Improved Interregional Planning

The Eastern Interconnection Planning Collaborative, which is made up of planning authorities from the interconnection and dates back to the last big push for interregional transmission 10 years ago, filed comments suggesting such a planning process. That process should involve DOE and the national labs, as well as the National Oceanic and Atmospheric Administration to quantify the needs addressed and benefits produced by interregional transfers.

“Although the metrics and analysis should be common across the interconnections for the reasons stated below, the application of those metrics and analysis to any particular interregional seam would reflect the specific locational and regional characteristics of the two adjoining regions,” EIPC said.

Common analytics would reflect the fact that the Eastern Interconnection is “one large, interconnected machine,” and would avoid having different regions rely on others too much to the detriment of joint reliability.

“EIPC does not support requiring transmission planning regions to use a simplistic ‘easily quantifiable’ minimum Interregional Transfer Capability requirement that cannot demonstrate a true need, and which may not stand up to a prudency review during state CPCN proceedings,” its filing said. “The development of a range of appropriate transfer capabilities that respects regional differences would be more defensible.”

PJM agreed with EIPC (of which it is a member), saying that it is unlikely that a common minimum requirement would be practical given the differences in planning and balancing authority size, topology and extreme weather exposure.

“A ‘range’ would be more appropriate since it could reflect these regional differences,” the RTO said. “As discussed above, PJM supports the EIPC’s proposed analysis to develop a range of transfer capabilities needed to offset the impacts of extreme events.”

PJM also pointed out that one cannot just build lines between different regions without ensuring that their regional grids are capable of supplying them. While it was able to help bail out some of its southern neighbors during winter storms around Christmas last year, the RTO’s aid was limited because of regional transmission constraints.

“PJM’s ability to transfer power between regions was often limited by facilities internal to the region receiving the electricity, and not necessarily by facilities along the seam,” the RTO said. “That is, PJM had additional energy available to be transferred, but could not due to internal congestion in neighboring systems.”

MISO made a similar point, noting that its large footprint at the center of the Eastern Interconnection has required it to work with PJM and other neighbors on formal joint operating agreements (JOAs) that have already improved interregional coordination.

“The commission should be mindful that setting a target number for Interregional Transfer Capability may not necessarily achieve the desired result because adding transmission capacity nominally between two regions would not necessarily account for underlying operational constraints, including those across third party seams and across the interconnection,” MISO said. “In fact, enhancing transfer capacity between two regions may be best served by an upgrade or operating procedures in a third region.”

The JOAs MISO has with PJM and SPP have helped make the most efficient use of existing infrastructure and maximized interregional transfers. The most effective way to increase interregional transfer capability would be to enhance interregional operations and improve interregional planning, MISO said.

American Electric Power (NASDAQ:AEP) was somewhat in between the two sides, saying it would make sense to use a minimum requirement at first to deal with the immediate needs of the system and then switch to improved regional planning.

“With the electric system becoming more weather dependent, increased transfer capacity between regions offers less expensive electricity, the sharing of resource adequacy over wider areas, and improved resilience during extreme events,” AEP said.

Getting the planning process right will take time, so it may be necessary to set some minimum requirements at first, the utility said. The planning process will need to be changed because Order 1000 only required that regions discuss interregional lines, and the different regions use different assumptions, making it hard to agree on specific projects.

CAISO Weighs in from the West

CAISO told FERC that it was worried the commission was adopting a solution before it has clearly articulated a problem.

“Resource sufficiency and extreme event considerations can vary by region, as can reliability, economic, and public policy driven transmission needs,” CAISO said. “The more efficient and cost-effective solutions to address these needs may vary by region and may not necessarily involve increasing interregional transfer capability. Requiring the CAISO region to establish a minimum level of interregional transfer capability is unnecessary and may not provide material benefits to the CAISO system, particularly in times of extreme weather events.”

While it might make sense to increase transfer capabilities in the West given the growth of renewable energy, CAISO does not want FERC to set minimum requirements. The ISO argued its existing planning processes were good enough to handle the issue already, such as its 20-year planning process that calls for another 10 GW of transfer capability by the 2040s.

What About Cost?

One issue that came up in several comments, including from the National Rural Electric Cooperative Association, the Transmission Access Policy Study Group, and joint comments from NRG Energy (NYSE:NRG) and Vistra (NYSE:VST) was the potential costs of adding new lines.

“NRECA member cooperatives have seen significant transmission cost increases in recent years and share a concern that their member-consumers should not be burdened with unjust, unreasonable, or unduly discriminatory transmission cost increases in the years ahead,” it said.

NRG and Vistra said that a line connecting two regions could become one of their largest single contingencies, requiring it to carry extra reserves and thus pushing up prices for consumers. They argued that it would make the most sense to treat interregional lines like pipelines and build them when anchor customers sign up for them (a method that has been used by merchant transmission developers).

“Interregional projects can produce benefits through energy arbitrage,” the two utilities said. “Further, an external or interregional tie has transfer value allocable to the cost of capacity rights in the facility. For this reason, the commission should first try to satisfy any need for Interregional Transfer Capability through a framework that presents options-to-buy to those interested in voluntary purchases of capacity rights on these systems.”