Reserve Requirement Study Assumptions

The PJM Planning Committee on June 2 unanimously endorsed the 2020 Reserve Requirement Study assumptions, which reset the installed reserve margin (IRM) and forecast pool requirement (FPR) for 2021/22 through 2023/24 and establish the initial levels for 2024/25.

Jason Quevada of PJM presented the assumptions, which were developed in the Resource Adequacy Analysis Subcommittee (RAAS). The 2020 assumptions are similar to those in 2019 except for the modeling of wind and solar, Quevada said during the PC’s meeting.

Previously, capacity values for wind and solar generators with three or more years of operating data were set based on their actual performance, with values for newer wind units set based on a combination of actual performance and class average capacity factors. The new Capacity Capability Senior Task Force will be meeting this year to develop a method for calculating wind and solar capacity values using effective load-carrying capability (ELCC), a measure of the additional load that a group of generators can supply without a reduction in reliability. (See AWEA Balks at PJM Plan on Wind, Solar Capacity.)

The ELCC approach, which is intended to address the underestimation of wind and solar output variability, is expected to have a minimal impact on the FPR.

The reserve requirement values will be based on a capacity benefit margin — the amount of transmission import capability reserved for emergency import sales — of 3,500 MW, the same as 2019. PJM will also continue using a load forecast error factor of 1%.

Staff will use the PRISM model to develop a cumulative capacity outage probability table for each week of the year except the winter peak. For the winter peak week, staff will create a table based on RTO-aggregate outage data collected between 2007/08 and 2019/20 to account for the risk caused by the large volume of concurrent outages observed during that time frame.

The final report is planned to be presented to the RAAS and the PC in September, with final approval in October.

Load Impact and Forecast Update

Andrew Gledhill of PJM’s resource adequacy planning unit presented the estimated COVID-19 impacts on load. Gledhill said that since March 24, weekday peaks have averaged 10.4% less (9,300 MW) than projected before the coronavirus pandemic. The weekday peak impacts have ranged from 0.6 to 15%, and the biggest impact to load forecasting came in the first week of May.

While impacts in May were generally larger than April, Gledhill said PJM believes some of the impact is because of increased “weather sensitivity” — increased cooling loads with summer’s arrival.

On May 26, for example, when the RTO’s weighted average daily temperature was above 70 degrees Fahrenheit, peak load was only 0.6% below expected.

“Essentially, PJM saw the impact of COVID-19 weaken a bit during the last half of May,” PJM spokeswoman Susan Buehler explained after the meeting. “It is likely some combination of increased economic activity and hotter weather driving up residential air conditioning usage as people continue telecommuting from home. We don’t yet have a full picture of which influence is greater.”

Overall energy consumption has been less affected by the pandemic, Gledhill said, with the average reduction since March 24 being 8%. Recent data suggest the reduced trend could be starting to change, he said, as a result of weather sensitivity and the lifting of stay-at-home orders across the country.

PJM last month asked FERC to approve a waiver allowing the RTO to post a revised peak load forecast for the second Incremental Auction for delivery year 2021/22.

The RTO posted its initial forecast for the auction before Feb. 1. The revised forecast reduces peak loads by 1.7% for 2020 and 1.6% for 2021, based on Moody’s Analytics’ April 2020 Economic Forecast, which predicts that third-quarter 2021 real GDP will be 7.1% lower than assumed in PJM’s posted load forecast.

PJM asked FERC to respond no later than June 15, three weeks before the start of the IA on July 6. PJM is publishing two sets of planning parameters for the auction, Gledhill said, with the first set based off the 2020 forecast and the second set based off the updated April forecast. If FERC approves the waiver, PJM will use the second set.

Competitive Planner Update

Ilyana Dropkin of PJM presented an update on the Competitive Planner, a web-based application for transmission owners and developers to participate in the RTO’s competitive planning process under Order 1000.

The current PJM process for proposal submission relies on an Excel template. Dropkin said that having a web-based application increases the speed and accuracy of the process and provides near-real-time tracking of submissions.

Beta testing was implemented May 6-20, Dropkin said, and volunteers suggested improvements and provided feedback about how the application compares to previous methods for submitting proposals.

Dropkin said registration for the new application is scheduled to begin June 22, and it will be opened for use about July 1.

Those looking to participate in the competitive planning process can get access to Competitive Planner by prequalifying through the critical energy/electric infrastructure information (CEII) process, Dropkin said.

Transmission Expansion Advisory Committee

Generation Deactivation Notification

Phil Yum of PJM provided the Transmission Expansion Advisory Committee an update on recent generation deactivation notifications, including a request received in May for Dickerson Units 1, 2 and 3. The coal-fired plant in Dickerson, Md., totals 545 MW.

According to a press release from plant owner GenOn Holdings, Units 1, 2 and 3 came online in 1959, 1960 and 1962, respectively. GenOn said the decision to deactivate the coal units was “driven by unfavorable economic conditions and increased costs associated with environmental compliance.”

GenOn requested a deactivation date of Aug. 13. The company will continue operating approximately 312 MW of natural gas- and oil-fired generating capacity at the site. Yum said a full result of the reliability analysis of the deactivation will be presented at the July TEAC meeting.

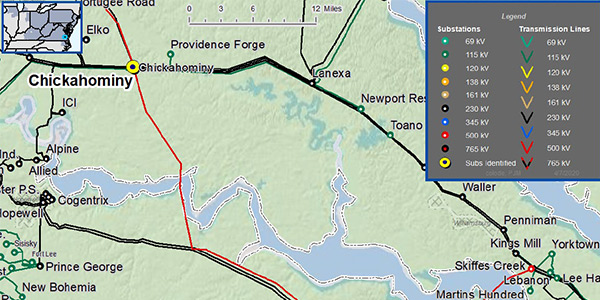

Yum also presented a second read of the deactivation of Chesterfield Units 5 and 6 (1,015 MW) in the Dominion zone, which are scheduled to retire on May 31, 2023. Yum said a generation deliverability problem was discovered at the Chickahominy 500/230-kV transformer, which would be overloaded with the loss of the Chickahominy-Surry 500-kV line.

PJM is recommending installing a second Chickahominy 500/230-kV transformer at an estimated cost of $22 million.

A second read was also presented on several transmission upgrade projects related to the reinstatement of the Shippingport, Pa.-based Beaver Valley nuclear plant in March. (See Beaver Valley Nuclear Plant to Stay Open.)