CARMEL, Ind. — MISO’s capacity auction shortfall has nearly doubled its probability of load shed in its Midwest region over last year, prompting stakeholder calls for an expansion of must-offer requirements and sounder supply predictions ahead of the auction.

The capacity shortage will lead to a one-day-in-5.6 years loss-of-load risk (or 0.179 days/year) in the Midwest beginning June 1, instead of the targeted one-day-in-10-years (0.1 days/year) MISO reported Wednesday.

Auction results indicate a 7.7% reserve margin in the Midwest, one percentage point below the planning reserve margin MISO prescribed heading into the auction.

MISO Independent Market Monitor David Patton said he doesn’t expect an increase in load shed during the 2022-23 planning year, but said next summer seems fraught. (See MISO Exec, IMM Debate Next Steps After Capacity Auction Shortfall.)

The April capacity auction cleared MISO Midwest at a $236.66/MW-day cost of new entry for generation, reflecting a 1.2-GW shortfall across the subregion. Staff have told stakeholders to prepare for the possibility of temporary, controlled load shedding over the summer months. (See MISO’s 2022/23 Capacity Auction Lays Bare Shortfalls in Midwest.)

MISO said its Zones 4, 5 and 6 “relied significantly on the auction” to meet resource adequacy requirements. Southern Illinois’ Zone 4 needed outside resources to cover 20% of its requirements before the auction, while Zones 5 and 6 in portions of Missouri, Indiana and Kentucky needed about 15% each.

MISO Director of Resource Adequacy Coordination Zakaria Joundi | © RTO Insider LLC

MISO Director of Resource Adequacy Coordination Zakaria Joundi | © RTO Insider LLC

During Wednesday’s Resource Adequacy Subcommittee meeting, MISO Director of Resource Adequacy Coordination Zakaria Joundi pledged future discussions with stakeholders on how the RTO can improve its public-facing and preliminary supply data before auctions.

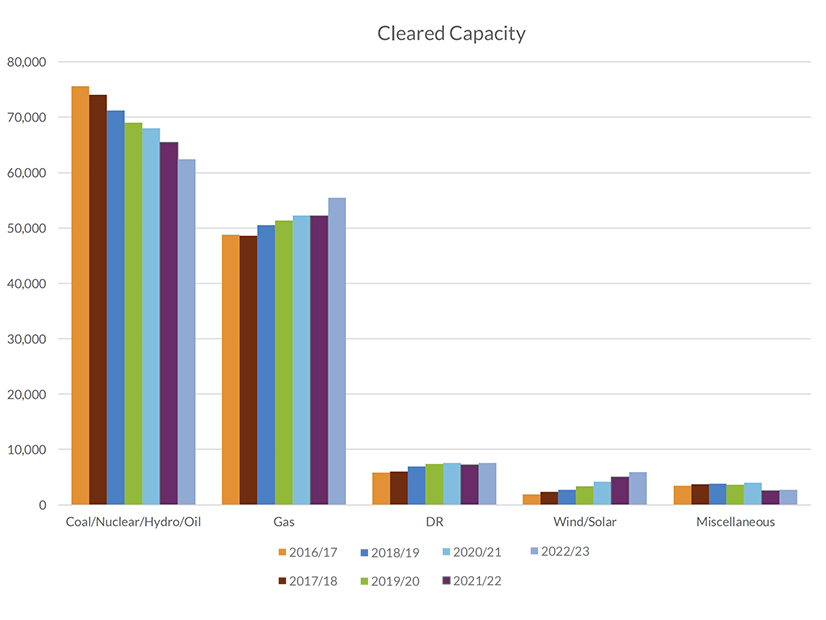

MISO said this year’s planning resource mix “shows the continuation of a multiyear trend toward less solid fuel and increased gas and nonconventional resources.” It said the capacity supplied by load-modifying resources increased 4.4% planning-year-over-planning-year.

The grid operator said 21 generation resources representing 3.4 GW in the Midwest footprint choose not to participate in the voluntary auction.

The RTO’s and the Organization of MISO States’ annual resource adequacy survey last year indicated 10 of the resources were deemed “high certainty” to be available for the 2022-23 planning year.

The other 11 resources were rated “low certainty.” The Monitor granted all 11 auction participation exclusions.

Minnesota Public Utilities Commission staffer Hwikwon Ham asked whether MISO tried to reach out to members to ask why they chose not to offer.

Eric Thoms, senior manager of resource adequacy operations, said MISO is still parsing through auction results data and has not communicated with those resource owners.

“I think now we’re trying to internalize some of the data,” he said.

Ham said those energy resources that didn’t offer should be considered “speculative.” MISO resources that are not classified as capacity planning resources do not have a must-offer requirement.

Monitor staffer Michael Chiasson recommended that the RTO extend a must-offer requirement to energy resources. He said the Monitor’s hands are tied by the MISO tariff to mitigate withholding resources that are not deemed planning resources and that it can’t recommend withholding sanctions on any resources other than capacity resources.

The IMM’s Taylor Martin also pointed out that MISO excludes resources with planned summers outages from auction participation.

WEC Energy Group’s Chris Plante asked whether staff has considered that some unit owners are using up to three-year suspension status to maintain MISO interconnection rights so they can retire and replace generation. Plante said such unit owners might be keeping a grip on their rights and never had the intention to participate in the auction.

Stakeholders have also asked MISO to evaluate how it calculates its capacity import and export limits between the 10 local resource zones in the auction given the changing generation fleet.

The grid operator has said new intermittent resources and baseload generation retirements impact base transmission system line loadings and the ability to import and export power, in some cases reducing necessary counterflow or increasing constraints. The RTO said the “location and availability of generators to ramp up during transfer and to redispatch around identified constraints is shrinking.”

MISO and stakeholders will continue dissecting the auction’s results and tee up possible process changes stemming over the summer.

The RTO’s plan to alter its annual capacity market into four seasonal capacity auctions with an availability-based capacity accreditation is still pending before FERC. Joundi said MISO hopes to have a decision from the commission within the next few months.

Meanwhile, staff plans to register their first energy storage resources for participation in its wholesale markets, including the capacity auction, by Sept. 1. FERC in 2020 accepted MISO’s Order 841 compliance plan to fully incorporate electric storage resources (ER19-465).

The grid operator hopes to finalize its business practice manuals accompanying the compliance plan by July 29. Stakeholders have asked for a refresher on the RTO’s market storage participation plan.