HOUSTON — The Gulf Coast Power Association’s 37th annual Spring Conference tackled the vexing assignment of how to reliably serve Texas’ unprecedented surge in demand with a cleaner energy supply.

The April 16-17 event featured experts from organizations trying to rise to the challenge and the companies behind the soaring demand.

“I just got to say it loud and clear: Since Uri, we’re too much talk and not enough cattle,” Hunt Energy Network CEO and former FERC Chair Pat Wood said during a keynote speech. “The fundamental fact is: We have told the world that Texas is ‘open for business.’ Everyone in this room believes it, and the world is responding. Companies are moving here in droves. People are flooding the state from both coasts.

“We’ve said we’re open for business, but we haven’t stocked the shelves. … We’ve invited gigawatts of new business and residential demand to come to our store, but we are woefully short on serving them.”

Wood said ERCOT needs to build a system that won’t “fail catastrophically from the center” but one that’s “redundantly resilient” to protect from overlapping risks. And Texas needs to unveil an “ERCOT 3.0” that adopts a “wartime-level sense of urgency,” upgrade the grid, streamline the interconnection queue and design pricing that inspires investors to build dispatchable generation without taxpayer subsidies. “Trucks and cranes from the Red River to the Rio Grande,” he said.

Wood also said Texas risks its “envy of the world” status in industry if it cannot employ creative solutions, including energy efficiency, load participation, and multidirectional flows on the transmission and distribution systems to unlock behind-the-meter generation.

“To paraphrase my old boss, we want no electron left behind. Let’s get back to work,” he said.

Wood said ERCOT’s future supply will be “digitalized, decentralized, diversified, democratized, dependable and decarbonized.” He said it’s ironic that Texas is at the vanguard of clean energy in a state that’s “almost embarrassed to talk about” climate change.

Outgoing Calpine CEO Thad Hill said it’s obvious Texas’ load is growing from data centers, manufacturing, natural gas and “maybe hydrogen.”

“This is more big-load-driven than it’s ever been. We’re talking about 300 to 400 MW hooking up to the grid at a time,” he said.

Hill said, however, he isn’t anxious over the future.

“What you’re going to hear from me is more hopeful,” he said. There’s cause for optimism because additions of price-responsive load are outstripping traditional load additions, and solar-and-storage combinations are blossoming, helping to solve ERCOT’s summer reliability issues.

Hill said ERCOT’s “major to do” should be creating a formal program for price-response load, more comprehensive than its existing Emergency Response Service. The hot summer and high prices in Texas in 2023 prodded new investment in dispatchable resources. He said gas plant plans in the ERCOT queue have doubled, with battery storage rising fivefold.

“Capital is flowing to dispatchable resources. … Gas is up; batteries are up. But man, we’ve got to find a way to institutionalize price-responsive load as a resource,” he said.

Hill also acknowledged that additions of short-duration battery storage have a ceiling on their usefulness.

“What happens when reserve events outlast the resources?” he asked, noting that ERCOT experienced two events upward of seven hours in which it needed consistent reserves, once in early September and once in early November. He said ERCOT should evaluate the duration it needs its ancillary services to last.

“Storage is doing great things for this market,” Hill said, but he urged market designers to be realistic about how long it can deliver. He said storage in ERCOT already has been found short of state of charge when called upon.

Hill advised Texas lawmakers to “take a legislative breather and let the experts work.” The legislature, which has been active the past two sessions, now needs to allow the Public Utility Commission’s and ERCOT’s plans to “take root.”

“We’ve got a good thing, though there’s been trauma along the way,” Hill said, referencing Winter Storm Uri. “I think we’re going to be just fine.”

On a panel concerning the “insatiable” demand for power, Entergy Texas CEO Eliecer Viamontes said his territory is seeing “once-in-a-generation load growth” that must be met with aggressive capacity buildout to elude load shed.

“This is game changing. We cannot propose incremental generation,” he said.

“I’ve been astounded at load growth. It’s something [that] 10 years ago, I wouldn’t have predicted,” said Jack Farley, HIF USA’s executive vice president.

Farley predicted about “one in five” of the approximately 60 GW of flexible load projects lined up in ERCOT’s queue will reach commercial operation.

“Nonflexible loads will have to become somewhat flexible going forward,” said Jeff Hanson, Digital Realty’s senior director of energy supply chain. It’s the “only way to address” infrastructure expansion failing to keep up with climbing load, he said.

Hanson said industry will remain drawn to Texas because of the welcoming regulatory climate that allows renewables to be built quickly, the “deep, deep pools” of sunshine and wind, the vastness of the state and the “lack of NIMBY-ism.”

Farley said behind-the-meter generation can help moderate runaway demand. Hanson added that large loads might consider adding their own onsite generation.

CenterPoint Energy Vice President of Regulatory Affairs Jason Ryan said Texas needs to employ an “all-of-the-above” strategy “to the max” to meet demand. With Houston’s energy needs set to double by 2050, he said the state already is behind in mounting major infrastructure buildouts. He asked the audience to consider the “100-plus years” it took for Houston to assemble its current grid.

Hanson predicted ERCOT will “be dancing on the edge” for a few tough years until infrastructure expansion can catch up.

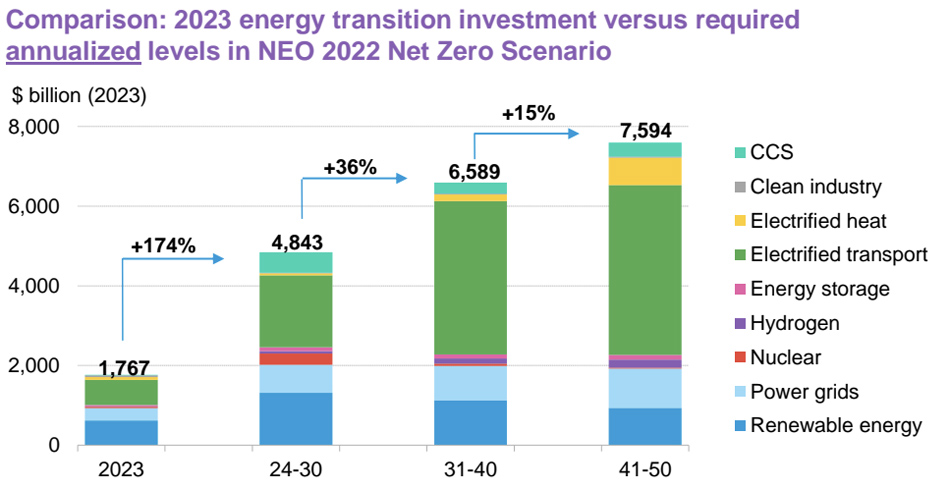

Bryan Fisher, managing director of climate aligned industries at RMI, said industrial decarbonization alone could double the nation’s demand for power.

“Texas and the Gulf Coast are ground zero for industrial decarbonization,” Fisher told attendees. He said the Houston area alone has the potential to serve not only national demand for hydrogen, but the world’s market as well. He said RMI’s preliminary analysis shows Houston could be confronting 2.5 times its peak demand today by 2050 because of the added demands of industrial electrification, hydrogen production, and carbon capture and sequestration.

Calls for ERCOT Transmission Planning

Priority Power Director of Development Brian Hudson said a decade ago, forecasters talked about 300 to 500 MW of load growth. He said those figures exploded in recent years to gigawatts.

“It’s got to be stuff that we haven’t tried before to keep up with the pace,” he said.

He said in addition to dynamic line ratings, Texas should consider making it easier for behind-the-meter generation projects of 10 MW and above to interconnect to the distribution system and lighten load.

Kip Fox, president of Electric Transmission Texas (ETT), an American Electric Power and Berkshire Hathaway Energy partnership, said he’s trying to energize a new line but can’t get approval from ERCOT for the necessary outage of nearby equipment because of current levels of demand. He said if ERCOT doesn’t give the go-ahead for an outage soon, ETT likely will have to wait through the summer moratorium to energize the line.

“We’re not fast enough to build. … It’s not like we haven’t submitted ideas to build transmission. But at the end of the day, someone in the regulatory space is going to have to realize we need it,” Fox said.

Kris Zadlo, chief commercial and technology officer at Grid United, said it’s no longer the pandemic causing supply chain woes, but skyrocketing load growth.

“We have unprecedented demand for equipment, and that’s not dawning on some,” Zadlo said. He said data centers are even procuring transformers, making it more difficult for a small Texas electric cooperative to secure equipment.

Multiple panelists said ERCOT should move away from planning for spot solutions and examine what transmission will be needed longer term.

“Long-term transmission plans have been shelved, and we need to act on them today,” Zadlo said. He also said someone needs to “challenge the utility mindset” and say, “‘Look, what you built yesterday will not work.’”

“Data centers go up faster than transmission does,” noted Ali Amirali, senior vice president of Lotus Infrastructure Partners.

Amirali said developers should prepare lines today to be high-voltage-ready, with insulation and right-of-way procurement, and find “patient” investors who see the value in having the option to easily size up transmission capacity.

Zadlo said the mindset that HVDC lines are novel and untested should be scrapped.

“It’s not that complicated,” Amirali agreed. He joked that he became a power systems engineer when he was young because he was “lazy,” and he figured the last great technological advancement in the field was transformers. Now he lamented that he was proven right and there haven’t been more advancements.

“We cannot solve today’s problems using yesterday’s technology, and to be honest, we’re still in the ’60s,” he said. He later laughed and added a disclaimer that his views are “mine and mine alone.”

The Lure of Gas

In an earlier panel, CPS Energy Chief Supply Officer Benjamin Ethridge said there are opportunities in the future for zero-emission dispatchable generation. For now, he said gas plants will be the dominant on-demand power source for growing load, and gas infrastructure needs major expansion.

“It’s great to have 2035 or 2040 goals, but we need to be able to weather the next winter storm, the next Uri,” said Michael Enger, Austin Energy’s vice president of energy market operations and resource planning.

Rockland Capital co-Managing Partner Scott Harlan said his company is interested solely in gas-fired facilities to bolster dispatchable resources. However, he said gas supply can be uncertain with intrastate pipeline companies that function as unregulated monopolies without transparency.

All agreed that the Texas Energy Fund, which provides as much as $10 billion in subsidies to fund dispatchable resources, is a welcome development.

Kathleen Smith, president of Aegle Power, said she was “very pleased” to see the subsidized loans approved by Texas voters and is excited to see what projects are submitted next month.

Smith also predicted the Texas Legislature will be relatively quiet on the energy front this session barring any new emergency events.

“I really hope the legislature stands down, maybe does a few tweaks but not anything massive,” Harlan said. He added he’s also concerned about EPA’s power plant emissions rule, expected to be released at the end of the month. He said if gas facilities are required to install carbon capture, it would add years to commercial operation dates.

“I’m hoping they take a more tempered approach. If they’re aggressive and require carbon capture on gas plants, there are going to be lawsuits,” he predicted.

Enger said he hopes for a trouble-free, windy summer. Ethridge said that though Austin is gearing up for another hot summer, his utility has more wind, solar and storage, and he’s “bullish” on ERCOT market dynamics.

Martin Pasqualini, managing director and partner of boutique investment firm CCA Group, said Texas law shouldn’t be hostile to wind and solar project financing.

“I think the renewable market can deal with neutrality but not outright antipathy,” he said.

Pasqualini pointed out Texas no longer is the only market experiencing load growth. It might be more difficult to build in other regions, he said, but it’s possible for renewable developers to withdraw from ERCOT.

Dean Tuel, vice president of Goldman Sachs-backed compressed air storage company Hydrostor, said his company takes advantage of low-cost excess and furnishes grid reliability — effectively capacity, though ERCOT doesn’t have a capacity market.

Tuel said he would like utilities to look further on the horizon for procurement plans. Utilities shouldn’t simply plan on erecting solar panels and short-term energy storage for the next few years but also should procure dispatchable resources for beyond 2030. He said for his company, whose assets have a 50-year lifespan, long-term offtake agreements are key.

OnPeak Power Managing Partner Ingmar Sterzing also said ERCOT no longer has the market cornered on fastest queue processing time.

“The load is coming in so quickly that it could definitely be a challenge,” he said.

Pranay Reminisetty, a lead interconnection engineer with DNV, said constraints on the ERCOT grid are piling up and the state needs new transmission so it doesn’t hamstring new generation.

“You have significant load growth in hours that you’re not really building generation for,” said Luis Lugo, head of ERCOT trading at Mercuria. He said April’s prices already have been high on unseasonably warm weather.

“Fundamentally, we’ve done nothing to build generation for hot weather,” Lugo said.

During a panel concerning corporate sustainability goals, Chris Dorow, regional manager of power and utilities for BASF, said that although some companies recently pushed out sustainability goals, those timelines always were “aspirational” because they were made when technology feasibility wasn’t fleshed out.

Tina Moss, senior director of net zero strategy for LyondellBasell Industries, said her company’s climate goals still boil down to matching the targets laid out in the Paris Agreement on climate change.

Alex Beck, co-founder of renewable financial firm GoodLynx, said companies’ sustainability offices often are “kneecapped” and not bestowed the budgets or power to enact their goals. “Corporate America needs to reframe” how it incorporates zero-emission energy and buy tax credits to finance clean energy projects, he said.