A lithium processing plant that could help put 800,000 electric vehicles on the road per year has received a conditional commitment for a $2.26 billion loan guarantee from the U.S. Department of Energy’s Loan Programs Office (LPO).

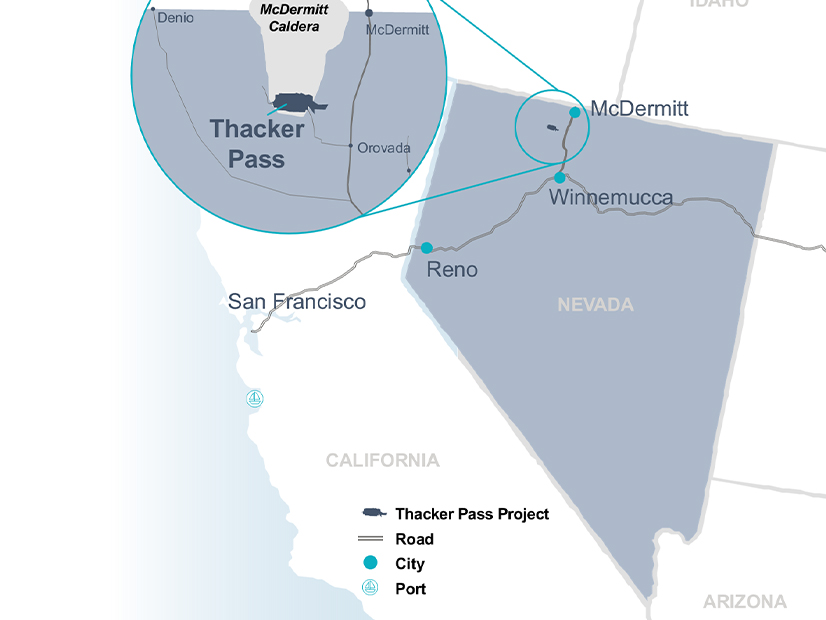

The plant would be in Humboldt County, on the Nevada-Oregon border, at Thacker Pass, where Lithium Americas Corp. and its Lithium Nevada Corp. subsidiary are developing a mine containing the largest proven lithium reserves in North America, according to the LPO announcement, released March 14.

The mine itself would be a shallow, open pit mine, located in a caldera, which is a collapsed volcanic crater, in this case formed millions of years ago. The processing plant would be located next to the mine.

Lithium Americas is developing the site in two phases, with production from the first phase expected to total 40,000 metric tons (MT) of battery-quality lithium carbonate per year, according to the company website. A metric ton is 2,204 pounds. The output from Thacker Pass “could support the production of batteries for up to 800,000 electric vehicles,” LPO said.

General Motors also is investing $650 million in Thacker Pass and would receive all the lithium carbonate from the mine’s processing plant for its first 10 years, with an option to extend its contract for five more years. Another plus for GM: The output from the plant would qualify for the Inflation Reduction Act’s EV domestic content requirements and tax credits.

GM also would have a right of first bid for the lithium carbonate produced in the second phase, which Lithium Americas estimates would double output to 80,000 MT per year.

In a project update, also issued March 14, Lithium Americas reported that site preparation is complete, including “all site clearing, commissioning a water supply system, site access improvements and site infrastructure.” Bechtel is the main contractor for Thacker Pass and has entered into a labor agreement with North America’s Building Trades Unions for construction of the project.

Lithium Americas estimates Thacker Pass would create about 1,800 construction jobs and 360 permanent jobs.

The company estimates a three-year construction period, with work to begin pending the finalization of the LPO loan, which the company is anticipating for this year. According to the LPO, finalization would depend on the company achieving specific technical, legal, environmental and financial conditions.

Lithium Americas expects the mine and processing plant to reach full production in 2028. Plans for the second phase of development have yet to be announced.

Lithium Americas CEO Jonathan Evans called the LPO loan a “significant milestone” for Thacker Pass.

The mine will provide the U.S. “an incredible opportunity to lead the next chapter of global electrification in a way that both strengthens our battery supply chains and ensures that the economic benefits are directed toward American workers, companies and communities,” Evans said in the company’s announcement of the conditional commitment.

“The loan plus GM’s strategic investment will provide the vast majority of the capital necessary to fund Phase 1” at Thacker Pass, he said.

The GM Connection

President Joe Biden wants half of all light-duty vehicles sold in the U.S. to be electric by 2030, a goal that has made a swift buildout of a domestic supply chain for lithium and EV batteries a priority for government and industry, as both seek to counter China’s dominance in global markets.

The conditional commitment is the 10th the LPO has made since 2022 under its Advanced Technology Vehicles Manufacturing program, and two additional loans have been finalized during that time, according to the loan announcement.

One of the program’s earliest loans was its $465 million commitment to Tesla in 2010, which was repaid fully in May 2013.

This is the second LPO loan that would benefit GM. In 2022, the office finalized a $2.5 billion loan to Ultium Cells, the joint venture of GM and LG Energy Solution, to help build three plants ― one each in Michigan, Ohio and Tennessee ― to produce lithium-ion battery cells.

The Thacker Pass loan comes as GM has been rethinking its plans for EV production. In 2021, the company committed to sell only light-duty EVs by 2035, but in recent months, it has announced delays in planned production of certain EV models as sales continue to increase, though not at the pace the automaker originally projected.

During a January earnings call, GM CEO Mary Barra said the company’s plans for 2024 include the production and sale of 200,000 to 300,000 Chevrolet, GMC, Cadillac and BrightDrop EVs, all using Ultium batteries. BrightDrop is the company’s electric delivery van. Barra said GM also will bring back plug-in hybrid models for “select vehicles in North America.”

GM’s last plug-in hybrid was the Chevy Volt, which was discontinued in 2019. Barra hedged the company’s plans, saying GM’s ramp-up of EV production will follow customer demand.

The Thacker Pass mine has been controversial for some environmental and tribal groups, which have repeatedly but unsuccessfully gone to court to try to stop construction. The Bureau of Land Management approved the project in 2021 and reconfirmed that decision in 2023, following a court ruling that ordered the agency to perform a further evaluation.

The most recent legal challenge ended in November 2023, when a federal district court in Nevada dismissed a claim by tribal groups that the mine was near a sacred site, as reported by the Associated Press.

Environmental groups also have raised concerns about the mine’s potential use of ground water, a frequent challenge for lithium mines. However, Lithium America’s website notes the Thacker Pass open pit mine would be less than 400 feet deep, relatively shallow for an open pit mine, which could make it less likely to affect groundwater.

The project also has been designed ― and permitted by the Nevada Division of Environmental Protection ― to minimize any use of groundwater; plus, any water used on the site would be recycled at least seven times.

In addition, the company has a community benefits agreement with the Fort McDermitt Paiute and Shoshone Tribe, the closest tribe to the project, according to Lithium Americas. The company has offered job training for tribal members to prepare them for jobs at the project.