By Tom Kleckner

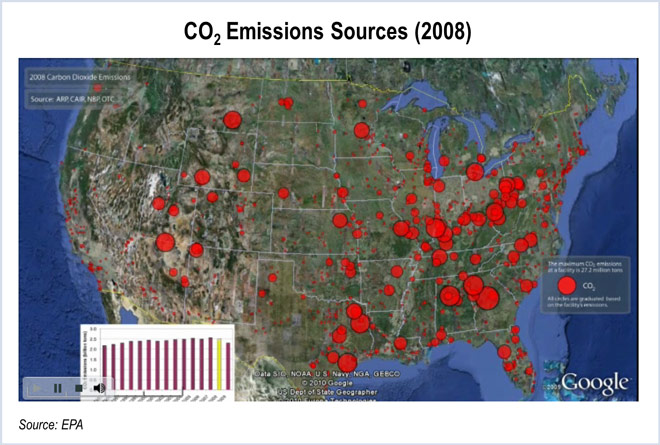

LITTLE ROCK, Ark. — While SPP says it is continuing to analyze the 1,500 pages in the Environmental Protection Agency’s Clean Power Plan, some stakeholders in the RTO’s 14-state footprint wasted no time taking action.

In the first of several expected legal challenges, state attorneys general from half of SPP’s states and six of MISO’s were among 15 who last week asked a federal court in D.C. to block the rules. Arkansas, Kansas, Louisiana, Nebraska, Oklahoma, South Dakota and Wyoming joined West Virginia in filing a petition seeking a stay of the plan pending the outcome of expected legal challenges.

Also joining the petition were Wisconsin (MISO), Ohio (PJM) and Indiana and Kentucky (MISO and PJM). Alabama and Florida, outside of any organized markets, also joined.

But even as elected officials’ rhetoric remains hot, there were signs that the behind-the-scenes work toward compliance has already begun.

Opposition from Okla., Ark.

Oklahoma Attorney General Scott Pruitt, who had filed an unsuccessful legal challenge even before the final rule was issued, continues to argue that the EPA rule is unlawful. EPA’s rules “[force] Oklahoma into fundamentally restructuring the generation, transmission, and regulation of electricity in such a manner that would threaten the reliability and affordability of power in the state,” he said.

Arkansas Gov. Asa Hutchinson also came out guns blazing. “It is clear that the Obama administration’s Clean Power Plan could still result in significant electric rate increases for middle class ratepayers while having a minimal impact on global temperatures,” he said. “My administration will do everything it can to protect ratepayers.”

Hutchinson has directed the leadership of the state’s Department of Environmental Quality (ADEQ) and Public Service Commission “to discuss the details of the rule and the stakeholder process.”

In a press conference Monday, ADEQ Director Becky Keogh and Ted Thomas, chairman of the Public Service Commission, said they have been told to seek the lowest-cost option and will explore strategies that meet the Clean Power Plan while planning for the state’s future and allowing for growth.

Arkansas would need to reduce its emissions by 36.5% from its 2012 levels to meet the rule. Keogh said the state would begin gathering stakeholder input in early October as it decides whether to submit a plan to EPA by the September 2016 deadline or ask for a two-year extension.

“We have a lot more time,” Thomas said, “which is important when you’re making decisions that affect the citizens of the state.”

But Keogh said that while Arkansas has joined litigation against the Clean Power Plan, ADEQ and the PSC will still need to work quickly.

“We feel it’s prudent for the state to begin a deliberative process to evaluate our options and the potential impacts of those options,” she said. “Should the rule become final — and the deadline will be upon us very soon — it’s too important to wait for a final rule and then determine a path forward.”

SPP Analyses

SPP has taken a broader approach when analyzing the Clean Power Plan and its impact on the footprint’s reliability and economics. In an emailed statement, Lanny Nickell, the RTO’s vice president of engineering, noted SPP’s highest priority is maintaining the Bulk Electric System’s reliability in the central U.S.

“Compliance with the Clean Power Plan is best facilitated through SPP’s regional transmission planning process and energy market administration,” Nickell said. “Transmission planning requires analysis of many variables and takes considerable time.”

SPP’s planning process currently operates on near-term and 10- and 20-year cycles. Several stakeholder-driven initiatives are evaluating how to improve the planning process and best take into account Clean Power Plan impacts.

“I imagine there will be modeling based on the new rule,” Thomas said. “We don’t know yet what that’s going to be, but SPP, MISO and other groups we work with have extensive access to modeling, where you can put in price impacts and see the result.”

SPP has issued three reports on the Clean Power Plan since last October.

The first, a transmission-system impact evaluation, warned of rolling blackouts or cascading outages “unless the proposed CPP is modified significantly.” SPP said the original 2020 date for interim goals was unworkable and did not allow enough time to build the needed generation and transmission to accommodate coal plant retirements and deliver wind energy to population centers. (See MISO, SPP: EPA Clean Power Plan Threatens Reliability, Needs Longer Compliance Schedule.)

In April, SPP released a second analysis that indicated a regional-compliance approach with the 2030 deadline would cost an estimated $2.9 billion per year in capital investment and energy production costs. (See SPP: $45/ton Adder, Wind, Gas Meets EPA Carbon Rule.)

SPP issued a third study last month that concluded a state-by-state compliance approach would be a 40% increase over the regional plan. The latest assessment analyzed the EPA rule’s impact on existing generation and resource-expansion plans, without including the cost of new transmission needed to maintain reliability, gas-infrastructure expansion, market-design changes or transmission congestion. (See SPP: State-by-State Compliance Would Hike Carbon Reduction Costs by 40%.)