By Michael Brooks and Suzanne Herel

The Delaware Public Service Commission on Tuesday unanimously approved Exelon’s $6.8 billion acquisition of Pepco Holdings Inc.

“There is a whole list of very positive things in this agreement,” Chairman Dallas Winslow told The News Journal.

The commission had delayed making its decision earlier this month when it learned that the Maryland Public Service Commission was going to make its decision soon (see below). Commission staff had argued that Maryland’s decision would be helpful, as their settlement with Exelon and Pepco contains a “most favored nation” clause, assuring that Delaware receives the same benefits as other states in the deal.

The commission has yet to make a formal order that reflects the balancing of benefits and did not say when it would do so. The approval leaves D.C. as the only holdout on a decision. The deal has been approved by the Federal Energy Regulatory Commission as well as regulators in New Jersey and in Virginia.

Maryland Approves with 3-2 Vote

The Maryland Public Service Commission voted 3-2 to approve the deal on May 15, saying Exelon’s reputation for service excellence was a deciding factor.

It conditioned the deal on higher reliability standards, $100 rate credits for residential customers and $43.2 million in energy efficiency programs in Montgomery and Prince George’s counties.

“Simply put, the evidence demonstrates that Delmarva and Pepco will be better utilities because of the merger,” they said in the order released Friday, which included 46 conditions. “Exelon has demonstrated that it knows how to run electric and gas distribution companies; indeed it is nationally recognized for its standards of excellence.”

Voting against the deal were Commissioners Harold Williams and Anne Hoskins. “The merger will impose substantial competitive harm to Maryland’s electricity market by eliminating across-the fence competition, silencing PHI’s unique non-generation voice, and chilling innovation in new energy-related technologies and products,” they said in a 51-page dissent. Exelon still needs to win the approval of Delaware and D.C. to close the deal.

The approval revises certain provisions of a settlement Exelon had reached in March with Montgomery and Prince George’s, in which the corporation agreed to pay a one-time $50 rate credit to each residential customer of Pepco’s two utilities in the state, Delmarva Power & Light and Potomac Electric Power Co. (PEPCO). Exelon had also agreed to invest $57.6 million in energy efficiency. (See Exelon, Pepco Ink Deal with Md. Counties, but Critics Stand Firm.)

The commission also required Exelon to:

- Develop 15 MW of solar generation by the end of 2018 — 5 MW in Montgomery County, 5 MW in Prince George’s County and 5 MW in the Delmarva service territory.

- Establish a $14.4 million Green Sustainability Fund — $8.4 million for Montgomery and $6 million for Prince George’s — for the counties to fund solar, energy storage and other distributed generation projects.

- Exceed Pepco’s level of charitable giving of $656,000 annually for at least 10 years.

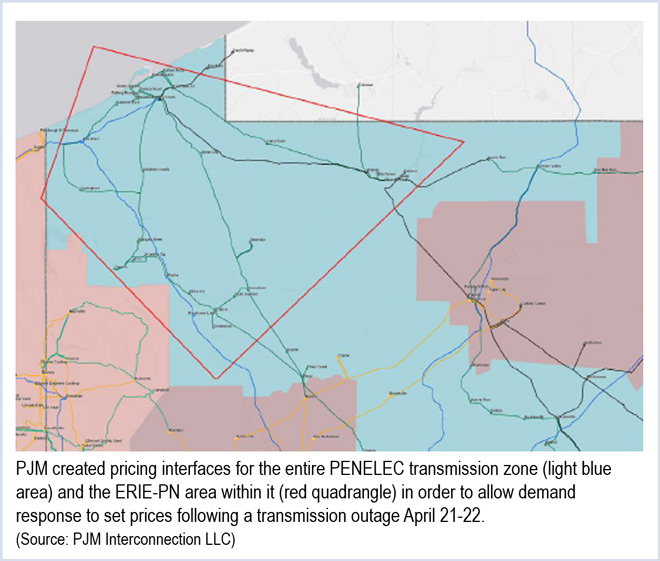

- Remain a part of PJM at least until the end of 2024.

- Develop a pilot program for recreational and transportation use by residents of Pepco’s transmission right-of-ways.

Exelon and Pepco have until May 26 to accept the commission’s conditions. In a statement, Exelon CEO Chris Crane said the company was pleased with the decision and that the commission had recognized its reliability marks, but that the conditions in the order would be “challenging.”

“It poses some stringent conditions that will be difficult to fulfill, but all of us at Exelon accept the challenge and commit to proving ourselves in an expanded role in Maryland,” Crane said.

Critics Disappointed

Commissioners Williams and Hoskins dissented, echoing criticism that has been levied at Exelon throughout the proceeding.

“Maryland w

They also noted that the Green Sustainable Fund would not benefit Delmarva Power’s territory on the state’s Eastern Shore.

While Montgomery County Executive Ike Leggett had reached the county’s settlement with Exelon, the County Council unanimously passed a resolution saying the settlement didn’t go far enough to protect ratepayers and encourage renewable energy. Councilmember Roger Berliner, an energy attorney who spearheaded the resolution, said he was “deeply disappointed with the decision.”

“Exelon has a proven track record of favoring its own nuclear generation holdings over renewable technologies like solar and wind,” Berliner said. “This merger poses an unacceptable threat to both ratepayers and our environment.”

Berliner did acknowledge the beneficial conditions of the approval. He said that he has been “knocking on Pepco’s doors” to open up their rights-of-way, but the utility “stiff-armed us for years.”

The order includes a concession Berliner had sought — a Montgomery County “green bank” through which the county will use Exelon contributions to “leverage” investment in clean energy and energy-efficiency technologies.

But Berliner lamented the fact that these breakthroughs were achieved through the acquisition process, and by the level of Exelon’s commitment to renewable energy, which he said, “just didn’t go far enough.”

Environmentalists agreed.

“We are disappointed by today’s decision, which comes as a blow to the future of clean energy in Maryland,” said David Smedick of the Sierra Club. “The meager conditions added by the commission do not come close to mitigating the harms that the merger will cause to Marylanders.”

Maryland Attorney General Brian E. Frosh also blasted the order.

“Today is a bad day for consumers, and a great day for monopolies,” he said in a statement. “This merger — which the PSC approved by the slimmest of margins — would create a company controlling service to 80% of Maryland’s electric consumers, with the incentive and ability to stifle competition and suppress innovation. The harm to customers under this arrangement are obvious and substantial.”

PJM Independent Market Monitor Joe Bowring was disappointed by the ruling.

“They didn’t accept our conditions, so we didn’t think they did enough,” Bowring said. “What we would have liked was for Maryland to accept the conditions we proposed,” which the Monitor has proposed to all of the involved entities.

One to Go

Opposition to the Exelon-Pepco marriage continued to grow last week in D.C., where regulators may make a decision as soon as May 27, when the record closes.

Four D.C. Council members and more than half of the District’s 42 local advisory neighborhood commissioners — some of whom rallied on the steps of the Wilson Building Tuesday — are lobbying Mayor Muriel Bowser to take a stand against the transaction, though she doesn’t have an official role in the decision.

Councilman David Grosso submitted a May 12 letter to the D.C. PSC urging the board to reject the deal. The following day, People’s Counsel Sandra Mattavous-Frye filed a brief advising the PSC against the takeover.

“While this merger provides a wealth of benefits for Exelon and PHI’s shareholders, it exposes District of Columbia ratepayers to a number of unnecessary risks,” she said. “I am primarily concerned that Exelon has failed to commit to meeting established reliability standards, that any financial benefit to consumers will be erased with the first rate case and that the major decisions impacting the city’s electrical infrastructure will be made by executives in Chicago.

“As it regards the city, I am concerned that the success the District has achieved in the area of deploying renewables will be compromised by Exelon’s corporate philosophy that favors generation companies. Moreover, I have no confidence in Exelon’s ability to deliver on the promise of more jobs.”

A Year in the Making

The deal, announced last April as an all-cash transaction, has been more than a year in the making. If the deal is approved, it will create the Mid-Atlantic’s largest electric and gas utility.

Exelon is familiar with mergers. The company is the product of the 2000 pairing of Philadelphia’s PECO Energy and Chicago’s Commonwealth Edison. In 2012, it acquired Baltimore’s Constellation Energy.

It hasn’t always been successful in its deal making, however.

Exelon dropped a proposed merger with Public Service Enterprise Group in 2006, and had its overtures spurned by PPL in 1995 and NRG in 2009.

Exelon has said the deal will boost its customer count to almost 9.8 million from 7.8 million and increase its rate base to almost $26 billion from $19 billion.

Exelon hopes to close the deal by the end of the year.