New Orleans, Louisiana

By David Cruthirds

Skrmetta throws out gauntlet to FERC and MISO – Outspoken Louisiana Commissioner Eric Skrmetta came out swinging with his opening keynote speech at the Gulf Coast Power Association’s Feb. 5, 2015 “special briefing” in New Orleans, La. Skrmetta, who defeated challenger Forest Wright in a hotly contested and closer-than-expected run-off last December, quickly attacked the “federal government” – FERC and the EPA – by saying Louisiana’s challenges stem directly from the federal government’s efforts to supplant the state’s sovereign authority. He acknowledged the federal government’s and the states’ interests diverge, noting the federal government seeks a cohesive national electric system while the states focus on keeping the system running to meet local needs.

Skrmetta contended Louisiana’s low electric rates are being threatened by the federal government’s push for more renewable energy and cleaner power generation because those objectives are being pursued without regard to the cost to consumers. Skrmetta contended the federal government’s various initiatives would cost consumers an estimated $1 trillion, and the section 111 (d) Clean Power Plan wouldn’t be the end of it. He slammed the federal government’s “predatory regulation” and “unfunded mandates,” asserting the feds are “long on viewpoint, but short on cash.” Skrmetta contended the federal government’s initiatives threaten Louisiana’s industrial renaissance, which is due in part to high electric rates in Europe from renewable energy mandates that are driving industrial companies toward the United States in general and Louisiana I particular.

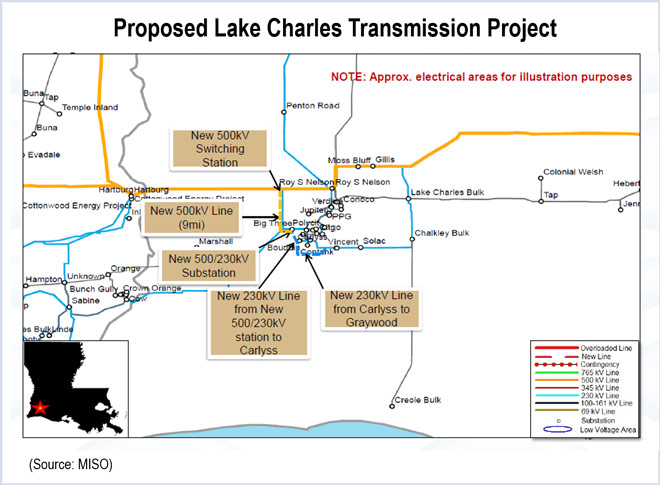

New generation needed by Entergy – Skrmetta said the estimated $119 billion of industrial investment coming to Louisiana would require Entergy to build 1,500 MW to 2,000 MW of new generation during the next three years, with another 1,000 MW needed after that. He credited Entergy for its proactive plan to buy the Union Power merchant plant, as well as the company’s plan to build new generation in Southwest Louisiana and on the Mississippi River corridor.

Entergy Louisiana President & CEO Phillip May participated in an afternoon panel, agreeing the industrial growth in Louisiana would drive the need for and location of new generation resources. Entergy expects to see 1,700 MW of new load by 2017, so the company will need to build or acquire new generation to serve that load. He noted Entergy is reviewing bids for long-term resources in one RFP, and expects to issue one or more RFPs in the future. May said declining reserve margins in MISO North/Central are expected to absorb the excess generation capacity in MISO South, so Entergy would need new steel in the ground whether in the form of self-build projects or long-term PPA.

Comment – Commissioner Skrmetta and May provided interesting perspectives on plans to build new generation to serve growing loads in Louisiana. Skrmetta’s view was that Entergy would be building the new generation itself, while May was careful to say the company would be issuing RFPs to measure bids against self-build projects. The Louisiana PSC requires jurisdictional utilities to test self-build proposals against the market under the oversight of an independent monitor, but the “Market-Based Mechanism” rules were adopted years ago and none of the current commissioners are very strong supporters of wholesale competition.

Entergy’s comments on recent earnings calls clearly indicate the company plans to meet its ambitious earnings growth targets by building the new generation itself, so the company likely will structure its RFPs in a way to favor its self-build projects. Entergy single-handedly decimated the once-thriving merchant sector in its footprint through its “market foreclosure” strategy, prompting the United States Department of Justice to conduct an as-yet unresolved investigation of the company’s transmission and power procurement practices. As a result, there aren’t any merchant left to compete, and non-affiliated suppliers know of Entergy’s predisposition toward self-dealing, so no one should expect very robust participation in the upcoming RFPs. That increases the chances that Entergy’s self-build proposals will “win” upcoming RFPs.

May also presented Entergy’s “Power to Grow: A Blueprint for a Brighter Future,” saying Entergy hopes to limit rate increases despite the massive new investments because load growth and new customers hopefully will allow the costs to be spread across a broader customer base.

May elaborated on Entergy’s supply plans, noting the company’s needs also would be impacted by expiring PPAs and possible generation retirements, so it needs flexibility. He said Entergy might roll over some expiring PPAs, and low natural gas prices might make it economical to refurbish some older, less efficient generation units. May noted Entergy Louisiana recently filed its integrated resource plan (IRP) with the Louisiana PSC, and the IRP details the company’s projections. The company will need to add combined cycle generation under all foreseeable scenarios, but also might need some combustion turbine units in load-constrained areas.

May said the company needs to be able to act quickly in response to the dynamic changes in its service territory. He noted it took three years to construct the recently completed Ninemile Unit 6 combined cycle project, but the overall process took six years when you include the time for the RFP and permitting. Entergy is evaluating ways to accelerate that process.

GCPA Executive Director Tom Foreman asked about prospects for self-generation and cogeneration. Tulane’s Eric Smith said petrochemical plants and refineries that operate cogens are more concerned about generating steam so they only generate surplus power for the market on an intermittent basis, which makes them look a lot like intermittent renewable resources. He said that means cogens generally aren’t dispatchable resources.

Texas Commissioner Anderson quickly countered that many cogens are very active participants in ERCOT, and make themselves available to be dispatched. Anderson contended the problem in Louisiana is due to the lack of flexibility provided by the incumbent utilities, noting “that isn’t a problem in a ‘real’ market” like ERCOT.

May observed that industrials often have very different load profiles and needs, so some like Sasol would self-generate. It will make sense for others to buy their power from the grid, while others will fall somewhere in between. He noted Entergy Gulf States Louisiana would be serving Sempra’s Cameron LNG liquefaction project, but Sempra initially planned to self-generate. May said reliability needs and economics convinced Sempra to take service from Entergy. May noted it is much simpler to permit and construct an industrial facility when it doesn’t have a power generation component.

May said it might make sense for Entergy to partner with some industrials to help the industrial lower its power and steam costs, which also could help Entergy’s customers. May said Entergy would work with its industrial customers whether they self-generate or are somewhere in between that and full retail service. Katherine King (Kean Miller law firm) noted qualifying facilities (QFs) are concerned about the potential loss of their “PURPA-put” rights, and are worried about the costs and risks of participating in MISO’s markets.

Anderson followed up on May’s comment about how long it takes Entergy to develop generation, reiterating the benefits of competitive markets because developers can build combined cycle projects in ERCOT in less than four years. He said Entergy Texas has been talking for six and a half years about adding new generation in East Texas, but the company has built “zero megawatts” and “precious little” new transmission. He said ERCOT has a much more robust environment because of competition. He conceded the Texas PUC is not known for “being overly generous” with granting returns on investment, but that is because it think the risks associated with regulated utility investments are low. Anderson declared he’d take the competitive market “any day.”

MISO’s policies targeted – Skrmetta turned his attention to MISO’s transmission cost allocation policies, noting Louisiana is expected to export a significant amount of power to MISO North/Central because environmental regulations are expected to make the North and Central regions 2.6 GW short of generation, while Louisiana is expected to be long by 2.6 GW. Skrmetta wants to make sure those who benefit from those imports to pay their share of the estimated $1.25 billion of transmission investment needed.

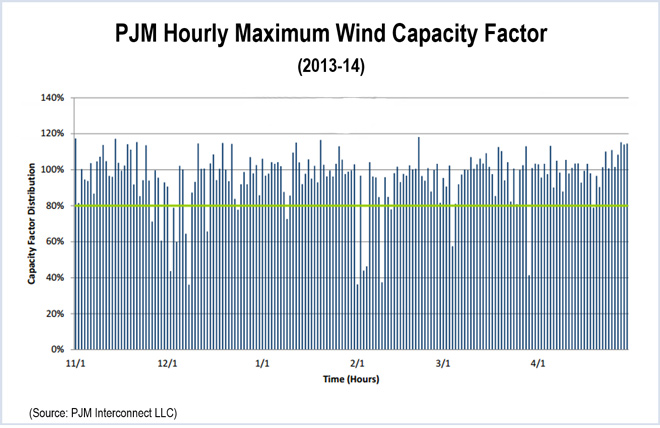

MISO CEO John Bear countered in a subsequent talk that low-cost wind generation from MISO North/Central is lowering energy costs in states without renewable mandates like those in MISO South. Bear contended that consumers in those states shouldn’t object to paying their share of transmission associated with those beneficial wind imports.

Skrmetta acknowledged the MISO relationship has been beneficial to Louisiana, but said MISO needs to be more cognizant of the Louisiana PSC’s jurisdiction, calling that a “paramount concern.” He called on MISO to have more interaction with the commission and its staff, noting the LPSC is “laser focused on serving consumers” rather than on executing federal programs. Skrmetta cautioned that the long-term success of MISO’s relationship with Louisiana requires “great deference” by MISO to Louisiana’s goals and objectives.

EPA’s Clean Power Plan – The special briefing included a good bit of discussion of the impact of the EPA’s proposed section 111 (d) rules on Louisiana’s industrial renaissance. Representatives from the Louisiana Department of Environmental Quality (LDEQ) and industry representatives expressed concerns about the impact of the EPA’s overreaching policies while expressing hope that errors in the EPA’s calculations, equitable considerations, and defects in the legal basis for the rule would cause the EPA to modify some of the more egregious provisions.

LDEQ Environmental Scientist Bryan Johnston contended the EPA’s proposal ignored the unambiguous language of Clean Air Act section 111 (d) that is limited to the “best system of emission reduction (BSER). He also asserted the EPA knows its “beyond the unit” proposal has a weak legal basis because of the great lengths the EPA went to when justifying building blocks 2 (more gas-fired generation), 3 (more renewables), and 4 (more energy efficiency) which are beyond the control of individual electric generators. Johnston also asserted the proposal would jeopardize reliability and increase costs. He criticized the rule for discriminating against states with less coal-fired generation by requiring higher percentage emission reductions, while also penalizing states that took early action to reduce carbon emissions.

Baker Botts lawyer Pam Giblin lamented the “meteoric shower” of EPA air emission regulations that likely will be extended to the chemicals and oil & gas sectors “if the EPA gets away with it” in the power sector. Giblin also criticized the EPA’s legal underpinnings, but acknowledged the EPA used a “masterful approach” to justify the extension of section 111 (d) to existing power plants that aren’t being modified.

AEP-SWEPCO’s Brian Bond also criticized the EPA’s initiative, especially the unreasonable compliance schedule that doesn’t consider the time for development and approval of state implementation plans (SIPs). ION Consulting’s Brian Walshe predicted an $8 billion surge in energy efficiency investments nationwide, suggesting energy efficiency companies could emerge as big winners. He also observed the political dynamics, asserting the “best political negotiators” would gain the most during the EPA’s review of public comments.

The Environmental Defense Fund’s Nicholas Bianco gamely defended the EPA’s initiative based on the expected public health benefits while asserting the cost of renewable generation has dropped to the point where the cost impacts are manageable. He also contended we must have a sustainable climate if we want sustained economic growth, so we must figure out how to do both like India and China.

John Bear weighs in – MISO President & CEO John Bear was the keynote speaker following lunch, providing MISO’s views on a number of topics including section 111 (d) compliance. Bear conceded that surplus generation margins in MISO meant the RTO didn’t need to move very quickly in the past, but shrinking margins from section 111 (d) and issues that arose during last year’s polar vortex are forcing MISO to reexamine its processes and respond much faster. MISO needs to move faster but not at the expense of transparency, inclusiveness and thoughtfulness according to Bear.

Seams issues – Bear tiptoed around the ongoing seams disputes with MISO’s neighbors, asserting the disputes are driven by fundamental regional differences between organizations that are equally convinced they have the best models. He acknowledged the need to compromise and resolve the disputes, especially in light of the looming challenges, reduced reserve margins, and the need to better optimize inter-regional power flows and transactions.

Bear acknowledged criticism for the unresolved dispute with SPP, but said both RTOs have good people but they have different views and these are hard issues. They are making progress, but not as fast as he’d like. Bear said he expects a settlement to be reached this summer.

MISO South “year in review” – Bear also provided a recap of the first year for MISO South, saying things went well overall, but MISO needs to continue to improve and examine its processes, especially for transmission planning. He said the “value proposition” (net economic benefits) for MISO South during the first year were 50% to 60% more than initially projected. The value from MISO membership was initially estimated to be $524 million per year, but the actual results for the first year were in the range of $747 million to $976 million. Bear noted the details would be presented on Feb. 26, 2015 during “MISO week” meetings in New Orleans. He invited stakeholders to provide feedback on how MISO is calculating its value and scorecard.

Lauren Seliga with Genscape’s MISO Analyst Team provided a very interesting recap of power trading, pricing, flows, and market barriers during the first year of MISO South’s integration. Genscape’s analysis showed that power flowed from MISO North/Central to MISO South more often than South to North contrary to the expectations of many. She said the MISO-SPP seams dispute and associated power flow management schemes were a significant barrier to trading and efficient power flows, but the scheduled March 1, 2015 “market-to-market” integration should help.

Patton slams seams management – MISO independent market monitor Dr. David Patton with Potomac Economics was extremely critical of the way the MISO-SPP seams dispute has been handled, scoffing at the notion that operational transmission congestion was the problems. Patton said it is very clear the issue is a “generation imbalance” situation between MISO North/Central and MISO South rather than physical congestion on the grid. Patton was very critical of the “completely ridiculous” constructs approved by FERC, calling the situation a “nightmare” that likely would get worse. Patton said there is “nothing physical” about the MISO-SPP constraint, asserting it is “totally fictional” to describe it as “congestion.”

Patton also criticized SPP for trying to get MISO to pay for SPP’s embedded transmission costs. He lamented that the current construct is undermining reliability based on a cost dispute. Patton said the “hurdle rate” approach helped, but the $10 hurdle rate isn’t economically efficient and leaves a lot of savings on the table. He said raising the hurdle rate to $40 would totally shut down flows and would demonstrably hurt customers.

Patton continued to express outrage, complaining that the “fictional congestion” between MISO North/Central and MISO South has increased prices in MISO South by $3/MW hour. Patton said he definitely opposes paying SPP for what he described as loop flows because that would be unprecedented. Nonetheless, if SPP is to be compensated, it should be through a flat rather than volumetric rate to minimize the drag on efficient trading. But if SPP is paid, MISO and its market participants should receive FTRs or some sort of right to SPP’s transmission system in return. He said Potomac expects to develop and submit a proposal.

NRG Sr. VP Jennifer Vosburg chimed in with an enthusiastic “amen,” urging MISO to listen to Patton. She said the settlement being developed between MISO and SPP shouldn’t just “check off the box,” but should produce a sound construct that works for the long-run.

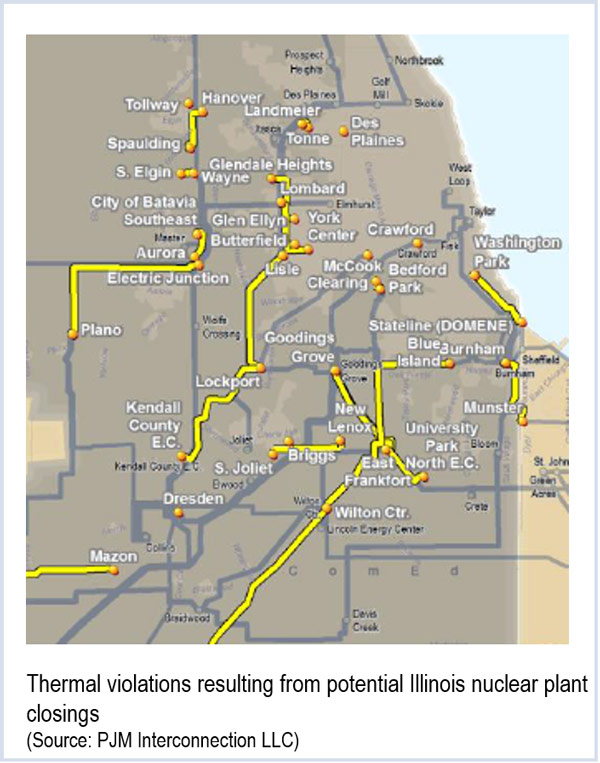

Vosburg agreed the first year in MISO went well overall, but stressed the continued existence of legacy issues from the past like chronic congestion from Entergy’s historic lack of transmission investment. She also agreed that load growth in MISO South likely would limit MISO South’s ability to meet the projected 2,300 MW shortfall in MISO North/Central. She said capacity prices in neighboring markets are puling generation out of MISO. She lamented the demise of merchant generators in MISO South while stressing the need to improve transmission planning and market structures, including more utilization of demand response and energy efficiency. She hoped Louisiana would remove some of its barriers to cogeneration to make it look more like Texas.

Mark Watson with Platts asked panelists to comment on Bear’s and MISO’s assessment of the benefits to MISO South from the first year. Patton said the savings from central generation commitment and dispatch clearly were substantial, but the drag from the SPP-MISO seams dispute subtracted from but didn’t totally eliminate the benefits. Vosburg said the decision to join MISO was the right decision, not just for Entergy. She said MISO has more robust stakeholder processes and is more transparent. She said the visibility of LMP prices is a great improvement, but much more work needs to be done. She said MISO needs to improve its understanding of the market participants and legacy system in MISO South, noting some of MISO’s traditional tariffs don’t work well for MISO South.

Market monitor slams MISO – Market monitor Patton went on the attack again by sharply criticizing MISO’s lack of progress on transitioning to a better capacity market construct and the lack of progress of products that send price signals for where new generation and transmission upgrades are needed. Patton acknowledged the opposition to capacity markets in MISO, but also blamed FERC for not clearly addressing and providing guidance on capacity market issues.

Patton contended competition should shift the risk of capital investments from ratepayers to market participants, but that hasn’t happened in MISO despite the tools and knowledge to accomplish that objective being readily available. The looming generation shortages increase the importance of addressing those issues now according to Patton. Patton said the question of regulated or unregulated generation isn’t an “either or” question because both can be part of a competitive market, but it is essential to have products and market structures that send proper price signals for when and where to build generation and that isn’t being done now in MISO.

Load pockets generate discussion – Bear said MISO is performing economic studies to address the WOTAB and Amite South load pockets located in Southwest and Southeast Louisiana respectively. He said high “Voltage & Local Reliability” (VLR, known elsewhere as “reliability must-run” generation) payments prompted MISO to study whether transmission upgrades to address those areas would be economical. He said MISO sees $70 million in uneconomic generation dispatch costs, but the transmission upgrades don’t appear to be economic based on the current analysis. MISO expects to finalize its recommendations later in 2015, but the Locational Marginal Price (LMP) differentials don’t appear to be significant enough to justify the required transmission investment.

Market monitor David Patton also weighed in on the load pocket issues, generally agreeing that annual make-whole VLR payments of $69 million probably don’t justify significant transmission investments to eliminate. He agreed the load pockets face reliability risks because of the lack of transmission import capacity so they need to rely on old, inefficient generation. Patton said the situation “cries out for a market solution” rather than MISO’s transmission planning approach. MISO needs to develop a 30-minute planning reserve product that would send a price signal so developers would build new gas-fired combustion turbines in the load pockets. He said adding new generation should be a cheaper solution to the load pocket issues than building transmission. Patton stressed the need to develop better market structures rather than continue to depend on regulated generation built at ratepayer risk and expense.

Vosburg countered that the WOTAB and Amite South load pocket issues aren’t new, but – “setting aside the lack of historical transmission investment by Entergy” – transmission may need to be built for the long-term. She agreed with Patton’s concern about the cost and risk to ratepayers if the problems are solved by utility self-build generation.

The view from Texas – Texas Commissioner Ken Anderson provided his frank perspective during a panel discussion of the industrial renaissance, agreeing that Texas also has seen dramatic economic growth – dubbed the “Texas miracle.” Anderson observed that job growth in the United Sates would be negative if jobs created in Texas were deducted from the national numbers. He said pro-growth tax and business policies contribute to the positive environment in Texas.

Plug for competitive markets – Anderson drew sharp contrasts between the results of the competitive electricity market in ERCOT versus East Texas where Entergy and AEP-SWEPCO operate under traditional cost-based rate regulation. Anderson – a strong supporter of competitive markets, and long-time skeptic of Entergy’s ways & means – said the responses of utilities and electric suppliers in ERCOT are very different than by utilities in the “frontier.” He said the competitive market in ERCOT causes suppliers and “wires” companies to be very responsive to customers’ needs. Utilities in East Texas traditionally have been slow to respond to interconnection requests, but he conceded that recent reports indicate utilities like Entergy are treating companies like “customers” rather than like “captive hostages.”

As to MISO, Anderson said MISO needs better pricing transparency and “more steel in the ground” in the form of transmission because of the impact of congestion on locational prices.

Tulane Energy Institute Associate Director Eric Smith listed the numerous large-scale industrial projects being developed in Louisiana, saying the “elephant in the room” is whether the labor pool will be adequate to support all of the projects. He questioned whether there will be enough pipefitters and welders to build all of the projects, predicting fierce competition for skilled workers and escalating wages.

HV-DC projects on the horizon – High-Voltage Direct Current transmission projects entered the conversation during MISO South Region Vice President Todd Hillman’s presentation when an audience member asked about the impact if proposed HV-DC projects like Pattern Energy’s proposed Southern Cross project are built. Hillman said the short answer is that MISO doesn’t know, but is studying that project and others. MISO sees some advantages from such projects, but needs to be careful. He said the concept makes sense because it would move wind power from ERCOT to the Southeast, but MISO must evaluate the projects holistically and needs to coordinate its assessment with ERCOT and the transmission owners in the Southeast.

Market monitor Patton said HV-DC transmission lines present contingency concerns, but nothing different than what transmission operators already face. He said HV-DC lines amount to moving a generator from one place to another, although you would also need to factor in the probability of the transmission line going down. Peter Nance with ICF noted the Southern Cross line out of ERCOT would be supported by a diverse generation fleet and system, so there wouldn’t be much generator risk so the real reliability risk would be if the transmission line was knocked out.

(Editor’s Note – Southern Cross is a proposed HV-DC transmission project that would connect ERCOT with the Southeast US, enabling wind power from Texas to be moved to the Southeast and allow surplus power from the Southeast to flow into ERCOT when economically justified. Author David Cruthirds provides general regulatory support to Pattern for the Southern Cross project.)