The Federal Energy Regulatory Commission last week approved a revised reliability standard, PRC-005-3 (Protection System and Automatic Reclosing Maintenance). The standard proposed by the North American Electric Reliability Corp. requires testing and maintenance of auto-reclosing relays and includes one new definition and six revised definitions (RM14-8). FERC required NERC to modify the standard to include maintenance and testing of supervisory relays.

FERC Orders Market-Based Reliability Program Next Winter in ISO-NE

By William Opalka

ISO-NE must find a market-based solution for ensuring adequate generation by next winter, the Federal Energy Regulatory Commission said last week in a clarification of a previous order.

FERC’s Jan. 20 order (ER14-2407) sided with the region’s generators, who contended ISO-NE was not acting with the urgency the commission intended in a Sept. 9 ruling, in which it approved the second year of the RTO’s Winter Reliability Program.

The program provides dual-fuel capable generators with out-of-market incentives to ensure they can switch to oil when cold weather stresses natural gas supplies. The RTO had previously won FERC approval of a long-term, market-based reliability plan, the Pay-for-Performance program, which will result in a two-settlement process for capacity resources starting in 2018 (ER14-1050).

“We’ll continue with the stakeholder process, which we began a couple of months ago. We’re still assessing the impact of this order, in light of the work that’s been done so far,” ISO-NE spokeswoman Marcia Blomberg. “A jump-ball filing [reflecting a lack of consensus among stakeholders] is theoretically a possible outcome of a stakeholder process on any proposal but, as I said, it’s premature to speculate on the possible outcomes of this stakeholder process.”

The Sept. 9 order directed ISO-NE to start a stakeholder process by Jan. 1, 2015, to develop a market-based solution before Pay-for-Performance takes effect.

Generators: No More ‘Band-Aids’

The RTO began the process last fall, filing a schedule of New England Power Pool stakeholder meetings on Oct. 8, but it made no promises that it would result in an interim market-based solution.

The New England Power Generators Association responded Oct. 9 with a filing complaining that the RTO was misinterpreting FERC’s directive.

“ISO-NE is interpreting the commission’s order to allow ISO-NE to continue proposing out-of-market fixes for the three consecutive winters after winter 2014/2015,” the group wrote. “… The commission’s order should not be read to condone three additional years … of seasonal, out-of-market Band-Aids in lieu of market rule changes based on the competitive market principles necessary to efficiently price system reliability.”

It asked the commission to clarify that the September order required ISO-NE to implement a market-based solution for 2015/16, saying it wanted “to avoid potentially wasting valuable NEPOOL stakeholder meeting time on out-of-market solutions, if any, proposed by ISO-NE.”

ISO-NE: No Consensus

In a Dec. 8 progress report to FERC, ISO-NE said that in response to “concerns that the winter reliability programs to date have not been resource-neutral and market-based, ISO-NE has committed to have a dialogue with stakeholders on current and alternative objectives for winter reliability programs, and the feasibility of designing and implementing a market-based solution for future winters.”

But the RTO said that at a November meeting of the NEPOOL Market Committee, stakeholders were split over what alternatives they should pursue for future winters, with some calling for the development of “price formation projects,” others supporting continuation of the existing winter program, and others for a market-based solution.

“In short, no consensus emerged,” the RTO said, adding that it would discuss the issue again at future Markets Committee meetings.

In its Jan. 20 order, FERC agreed with the generators.

“The commission intended that ISO-NE would determine whether a winter reliability solution is necessary for the 2015-2016 winter and future winters and, if so, develop an appropriate market-based solution through the stakeholder process that can be implemented beginning with the 2015-2016 winter,” FERC wrote. “While the two-settlement capacity market design could help address winter reliability concerns in the future, that design will not be fully implemented until the 2018-2019 Capacity Commitment Period.”

FERC OKs MISO, TO Rules on Formula Rate Challenges

By Rich Heidorn Jr.

The Federal Energy Regulatory Commission last week approved new rules governing how transmission customers can challenge formula rate filings by MISO transmission owners.

The commission conditionally accepted the proposals by MISO and transmission owners Northern Indiana Public Service Co. (ER13-2376-002) and Southern Indiana Gas & Electric Co. (ER13-2375-002) revising the rules regarding how transmission customers can review and appeal the TOs’ cost claims. These formula rate “protocols” are specified in Attachment O of the MISO Tariff.

In a third order, the commission required MISO’s transmission owners to add language stating that a party that has submitted an informal challenge to the TO on any issue has standing to later file a formal challenge with the commission (ER13-2379-002, ER14-2379-003). “We find that the proposed modification will lend clarity to interested parties that the subject of formal challenges does not need to be the same as an interested party’s previous informal challenge,” the commission said, responding to concerns raised by the Organization of MISO States (OMS).

In the same order, the commission conditionally accepted revised protocols by the Central Minnesota Municipal Power Agency, which FERC said had adopted the MISO TOs’ protocols “virtually verbatim.”

Previous Rules Not Just and Reasonable

MISO’s TOs were forced to change their rules in response to the commission’s May 2013 order finding the prior protocols were “insufficient to ensure just and reasonable rates.”

The commission opened a Federal Power Act section 206 investigation in 2012, expressing concern about “the (1) scope of participation (i.e., who can participate in the information exchange); (2) the transparency of the information exchange (i.e., what information is exchanged); and (3) the ability of customers to challenge transmission owners’ implementation of the formula rate as a result of the information exchange (i.e., how the parties may resolve their potential disputes).”

OMS Rehearing Request Denied

In a fourth order last week (ER13-2379-001, et al), the commission denied OMS’ rehearing request of its March 2014 orders on the issue.

OMS contended the commission erred when it allowed the revised formula rate protocols to become effective on Jan. 1, 2014, rather than the refund effective date of May 23, 2012, set by the commission when it began the section 206 inquiry.

OMS said FERC could not conclude that the charges assessed between May 2012 and the end of 2013 were just and reasonable. Establishing the effective date in May 2012 “would provide the first opportunity for meaningful review of those charges by state commissions and other interested parties,” OMS said.

The commission said it was not able to determine the justness and reasonableness of the charges assessed under formula rates between May 2012 and December 2013.

“We find it neither necessary nor practical to require application of the revised protocols as of May 23, 2012, because, as OMS recognizes, it is impossible to re-run the full protocols process for past periods. Instead, the protocols establish a new open and transparent process for conducting the MISO transmission owners’ formula rate updates prospectively, beginning Jan. 1, 2014,” the commission said.

FERC added, however, that OMS and other parties had the right to challenge the prior years’ annual updates under section 206 “if there becomes reason to believe that those prior years’ annual updates were in violation of the filed rate, or that unjust and unreasonable (i.e., imprudently incurred) costs were passed through the formula in the charges assessed pursuant to those updates. The commission has authority to order refunds of charges assessed pursuant to those prior years’ annual updates to the extent those are found to have occurred.”

OMS also sought clarification that the revised protocols accepted by the commission in the March 2014 order apply to the revenue requirement established when a transmission owner joins MISO or an existing MISO member switches from a historical to forward-looking formula rate.

The commission responded that while “neither the formula rate protocols nor our prior orders in these proceedings specifically address how the protocols will be applied to initial rates … we expect that all formula rate updates, including initial rates calculated by a transmission owner under Attachment O of the Tariff after Jan. 1, 2014, will be subject to review and challenge procedures consistent with our determinations in these proceedings.”

OMS Executive Director Bill Smith said Friday that it was too soon to say how the organization might respond to the rulings.

NIPSCO, Southern Indiana Compliance Filings

The commission ordered NIPSCO and Southern Indiana to make compliance filings within 30 days revising their Tariffs to specify that they will file their annual informational filing in a separate docket each year.

The commission told NIPSCO to change the deadline for customers to submit formal challenges to the commission to April 1 — one month following NIPSCO’s informational filings. The commission required Southern Indiana to extend the deadline for submitting a formal challenge to April 15.

FERC Accepts Order 1000 Filings from PJM, MISO

The Federal Energy Regulatory Commission last week approved the latest set of Order 1000 compliance filings from PJM and MISO.

The commission conditionally accepted MISO’s third-round regional compliance filings (ER13-187-006). It denied requests for rehearing of the commission’s second compliance order issued in May 2014.

FERC also found that PJM and its transmission owners have partially complied with their second compliance order and denied in part and granted in part requests for rehearing and clarification of the order (ER13-198-003).

Both RTOs were directed to make additional compliance filings within 30 days.

FERC also conditionally accepted interregional compliance filings by PJM (ER13-1927-000), MISO (ER13-1923-000) and transmission providers in the Southeastern Regional Transmission Planning region, the Florida Reliability Coordinating Council and the South Carolina Regional Transmission Planning region (ER13-1922).

The orders accepted the proposal to allocate costs of interregional transmission facilities to each region based on its share of the total avoided cost of regional transmission facilities displaced by the interregional project.

Bay Statement on ROFR

Commissioner Norman Bay filed concurring statements in the MISO and PJM regional compliance orders, warning states not to attempt to protect their incumbent utilities from competition in transmission development.

Bay noted that while Order 1000’s prohibition on federal rights of first refusal (ROFR) for incumbent transmission developers does not preempt state law regarding construction of transmission facilities, states are also barred by the Constitution from interfering with interstate commerce.

“State laws that discriminate against interstate commerce — that protect or favor in-state enterprise at the expense of out-of-state competition — may run afoul of the dormant commerce clause,” Bay, a former Constitutional law professor, wrote. “The commission’s order today does not determine the constitutionality of any particular state right-of-first-refusal law. That determination, if it is made, lies with a different forum, whether state or federal court.”

FERC Looks Again at Export Pricing for MISO MVPs

By Chris O’Malley

The Federal Energy Regulatory Commission last week ordered a paper hearing to revisit its decision to prohibit MISO from assessing export charges to PJM for multi-value projects that benefit PJM customers.

FERC’s Jan. 22 order (ER10-1791) is in response to a 2013 remand by the U.S. Seventh Circuit Court of Appeals ordering the commission to determine whether its limitations on export pricing to PJM are still justified.

The commission will accept comments for 45 days, with reply comments due 30 days afterward. The commission urged parties to provide studies or other evidence in support of their positions.

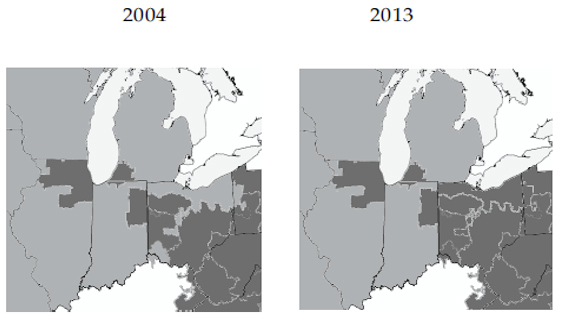

The issue stems from the commission’s July 2002 order allowing American Electric Power, Commonwealth Edison and Dayton Power and Light to join PJM. That left small islands of PJM within MISO territory near Chicago and in southwestern Michigan, dividing highly interconnected transmission systems.

In subsequent rulings, FERC ordered MISO to eliminate rate “pancaking” that it said would otherwise result from the irregular seam, including a prohibition on charging PJM load for multi-value projects.

Less Disjointed Seam

In June 2013, the Seventh Circuit ordered FERC to reconsider whether its prohibitions on charging PJM for multi-value projects was still reasonable in light of membership changes that straightened out the border.

The court also cited the nature of multi-value projects, noting that they are not local in scope and will benefit other regions.

“Since they will benefit electricity users in PJM, those users should contribute to the costs,” the court said.

It added that FERC was being “arbitrary” in continuing to forbid MISO from charging anything for exports of energy to PJM enabled by multi-value projects “while permitting it to charge for exports of energy to all the other RTOs.”

“The commission must determine in light of current conditions what, if any, limitation on export pricing to PJM by MISO is justified.”

PJM TOs Seek Clarity

Impatient at FERC’s inaction since the court’s remand, PJM transmission owners petitioned the commission last May to set the issue for a paper hearing.

Whatever FERC ultimately decides regarding allocation costs of MISO multi-value projects, the TOs said, “there is no disputing the importance of a timely resolution in this matter. At issue are the costs of billions of dollars of projects, some of which are already underway, with others expected to follow.”

“Until this matter is resolved, interested parties will be left with great uncertainty regarding their burdens with respect to the MVP costs.”

Federal Briefs

The Federal Energy Regulatory Commission has requested more information on the market impact of the proposed $2.8 billion sale of Duke Energy’s Midwest power plants to Dynegy. FERC’s request caused a postponement of the deal’s closing date.

FERC wants more information to ensure that competition in wholesale power markets will not be impaired. Dynegy is engaged in two large acquisitions — the Duke transaction and a separate $3.45 billion deal with New Jersey-based Energy Capital Partners — to acquire a total of 21 power plants. Both deals were supposed to close during the first quarter.

In their application for approval of the purchase, the companies contend Dynegy’s 6.5% share of the PJM market after completing the two deals would have a minimal impact on competition. FERC said the companies failed to demonstrate that Dynegy’s post-acquisition market share qualified as minimal.

More: Triad Business Journal; Houston Business Journal

NRC Issues Two Yellow Findings Against Entergy’s Arkansas One

The problems “created the potential for water to enter the auxiliary building in the unlikely event of extreme flooding, potentially compromising safety-related equipment,” according to NRC Region IV Administrator Marc Dapas.

The problems were discovered at the Russellville, Ark., power station during inspections in 2013 and 2014. The NRC said Entergy has fixed the problems, and the agency is reassessing “the appropriate level of oversight for the plant.”

More: NRC

‘No Chilled Work Environment’ at Palisades Plant, NRC Determines

The NRC reviewed plant operations, conducted focus groups and interviewed 30% of security department workers before issuing its findings that the work climate at the plant had improved. “The NRC will continue to monitor for safety-conscious work environment issues to assess the sustainability of improvements seen to date,” an NRC official wrote.

Palisades spokeswoman Lindsay Rose said the company promised to maintain the improved climate. “This is not an issue that we’re going to drop and wash our hands of,” she said.

More: MLive

FERC Extends Comment Deadline for PennEast Pipeline Project

FERC has already scheduled five public “scoping” meetings, starting this week, which will give the public information on the proposed line. Pipeline opponents argued that the public comment period did not allow enough time for property owners affected by proposed route changes to respond.

The $1 billion pipeline would transport natural gas from the Marcellus Shale region in northeastern Pennsylvania to a connection near Trenton, N.J. It is financed by UGI and four New Jersey gas utilities.

More: NJ.com

Interior Department Moves Forward on North Carolina Offshore Wind Lease Plan

The Department of the Interior released an environmental assessment last week supporting a plan to lease up to 300,000 acres off the North Carolina coast to developers of wind farms. “In close coordination with our partners in North Carolina, we are moving forward to determine what places make sense to harness the enormous wind energy potential off the Atlantic seaboard,” Secretary of the Interior Sally Jewell said.

The study delineates three areas off the coast that could be leased to developers: about 122,000 acres 24 miles off Kitty Hawk; a 51,000-acre tract 10 miles off Wilmington; and a third area of about 133,000 acres 15 miles offshore of Bald Head Island.

A North Carolina Sierra Club organizer, Zak Keith, called the announcement “a huge opportunity to create jobs and investment in the clean energy sector without the risk of oil spills.” The study is open for public comment through Feb. 23.

More: News & Observer

ISO-NE CEO: Despite Mild Winter, Region Still Needs Infrastructure

By William Opalka

The mild winter that has moderated energy prices in New England shouldn’t lull policy makers into complacence about the region’s infrastructure needs, ISO-NE CEO Gordon van Welie said last week.

In a Jan. 21 presentation to the media on the state of the energy market, van Welie acknowledged that this winter has been warmer than the previous two, resulting in less demand for power and natural gas and a reduction in pipeline constraints.

“But this is New England,” van Welie said. “Winter’s not over yet, and a mild winter or two doesn’t guarantee we won’t have extremely cold winters again.”

The increasing reliance on natural gas-fired generation and retirements of oil- and coal-fired power plants have created “an urgent need for more energy infrastructure,” he said.

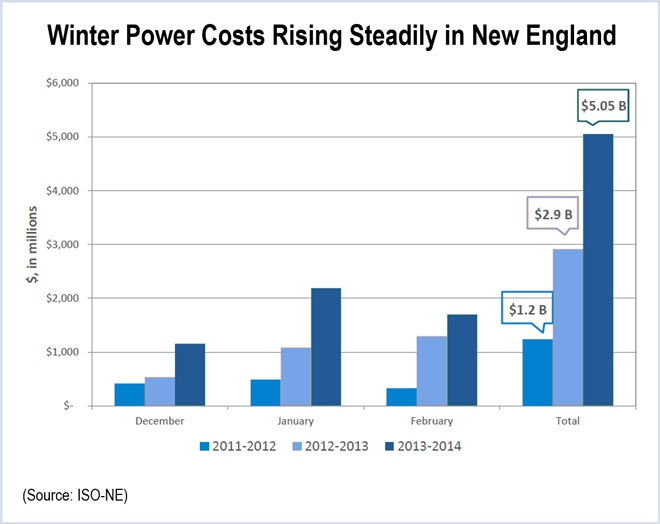

ISO-NE began a winter reliability program for 2013-2014 that was essentially repeated for the current season. That supplemental program provided financial incentives for oil-fired generators to store more oil than they otherwise would have. It has encouraged dual-fuel capable generation that can switch from gas to oil.

Although the RTO has added $7 billion in transmission since 2003 and has generation projects totaling about 9,500 MW in its transmission queue, plant retirements are causing localized stresses.

“We’re already seeing worrisome conditions in greater Boston, with the recent retirement of the Salem Harbor station and delays in development of the proposed Footprint natural gas power plant. That area will be short of needed resources as soon as 2016,” van Welie said.

Southeastern Massachusetts and Rhode Island also are areas of concern, with Brayton Point’s planned retirement in 2017.

In addition, the RTO hasn’t been able to add natural gas pipeline capacity fast enough to react to increased power and heating demand.

For each of the last three winters, natural gas prices have risen steeply, showing the effects of increasing pipeline constraints. On Jan. 1, 2014, the spot price for natural gas in New England was nearly $20 higher than the price paid in most of the country.

“They were not only the highest forward prices in the U.S.; at the time, they were the highest on the planet,” van Welie said.

He said ensuring the reliability of the power system will likely require more gas pipelines, more liquefied natural gas storage and more transmission lines.

“The region faces a conundrum: who will be the customer to ensure new gas infrastructure is built? Will it be end-use electricity consumers or electricity producers — that is, generators?” he asked. “Thus far, electric generators have not signed up for additional gas infrastructure and as a result, the New England states have been considering making an investment in additional gas infrastructure on behalf of consumers.

“Until more infrastructure is added, consumers can expect volatile pricing for both natural gas and wholesale power, with price spikes when either the pipeline or power system is operating under stressed conditions,” he said.

DOE-Funded Report Suggests ‘ISO’ for Gas-Electric Communications

By William Opalka

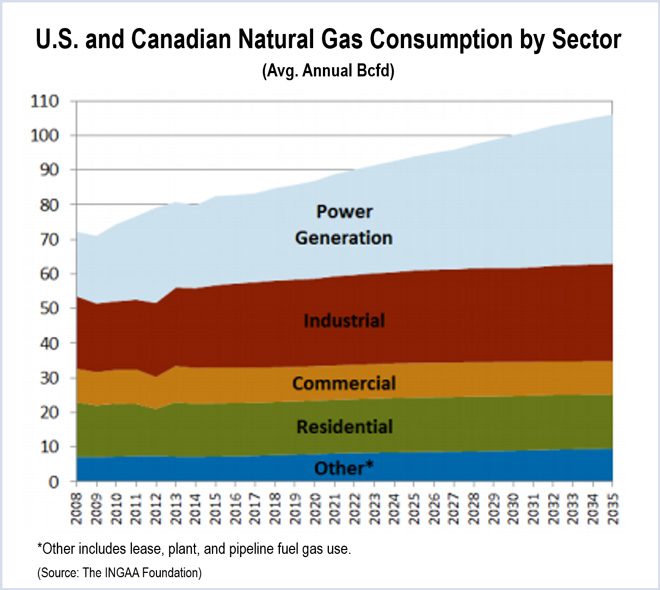

(Click to zoom.)

A U.S. Department of Energy-funded study on gas-electric coordination suggests natural gas pipeline operators create an independent system operator (ISO) to coordinate communications with electric grid operators.

The proposal is one of nine recommendations in a white paper on long-term electric and natural gas infrastructure requirements, conducted by the Illinois Institute of Technology for the Eastern Interconnection States’ Planning Council (EISPC) and the National Association of Utility Regulatory Commissioners. Although dated November 2014, the report was released by NARUC only last week.

Most of the report’s other recommendations — such as aligning daily gas and electric market schedules, building more pipelines to serve growing electric load and improving training — have been under discussion or development by industry participants for more than a year.

For example, in November 2013, the Federal Energy Regulatory Commission approved a rule allowing pipeline operators to exchange non-public operational information with RTOs. (See FERC OKs Gas-Electric Talk.)

But the report notes that while public domain information “is generally shared between pipeline operators and ISOs,” concerns about proprietary information remain.

“[E]stablishing a coordinator in the natural gas industry that could directly communicate with ISOs through appropriate protocols could be an option to solve the confidentiality problem and enhance the information sharing in natural gas-electric system planning,” the report says.

The recommendation doesn’t go as far as those from some other commentators, who have suggested a “Regional Pipeline Organization” or a centralized gas trading platform. (See Gas Trading Platform Finds Few Takers at Moeller Meeting.)

The report also calls for integrating natural gas availability into the North American Electric Reliability Corp.’s long-term and seasonal reliability assessments and for improvements to NERC’s Generator Availability Data System to better track generator outages resulting from a lack of gas supply.

The EISPC, which is funded by the Department of Energy, is a consortium of state-level agencies responsible for siting electric transmission across the 39 states in the Eastern Interconnection.

EISPC President David Boyd, a member of the Minnesota Public Utilities Commission, said the report will help regulators overcome challenges of the electric industry’s increased dependence on pipelines.

“As this report spells out, there are a number of differences between the two industries that, if not reconciled, could have unintended consequences for consumers,” he said in a statement.

FERC Denies IMEA Request for Extended Waiver on Capacity Obligation

By Suzanne Herel

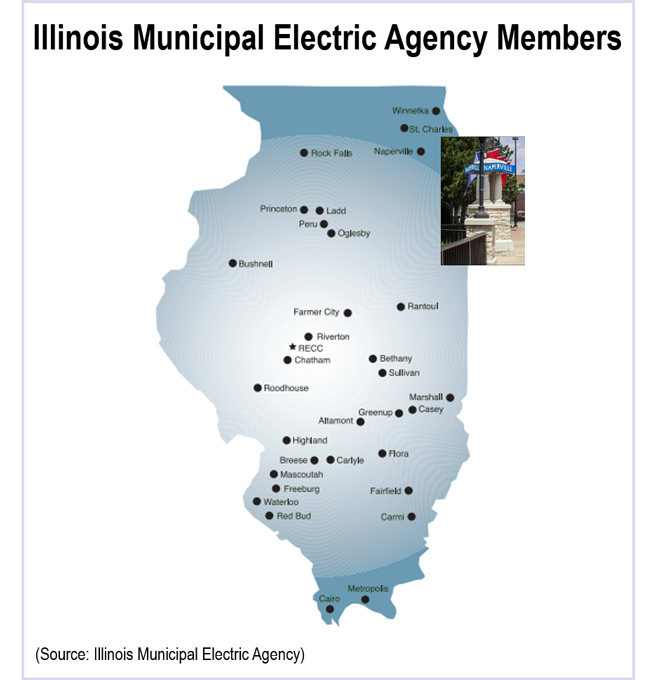

The Federal Energy Regulatory Commission on Thursday rejected the Illinois Municipal Electric Agency’s request for an extended waiver that would allow it to use capacity resources outside of the Commonwealth Edison Locational Deliverability Area to meet its internal resource requirement in serving its Naperville, Ill., load. (ER14-1681-001).

Last May, FERC granted IMEA a waiver for the 2017/18 delivery year after the ComEd LDA last year was modeled for the first time with a separate variable resource requirement curve (ER14-1681).

In June, IMEA asked FERC to clarify that the waiver extended beyond the one delivery year to the “term of the life of IMEA’s resource investments and commitments or at a minimum for the five-year minimum term of the [Fixed Resource Requirement] Alternative.”

Without a waiver, IMEA said it will be subject to unnecessary financial risks in any delivery year for which PJM uses a separate VRR curve, estimating the annual penalty charges at $100 million.

In its Jan. 22 order, FERC said it approved the one-year waiver because the short notice of PJM’s announcement to establish the separate VRR curve left IMEA little time to prepare to meet the internal resource requirement. “For subsequent delivery years, IMEA has sufficient time to prepare for the requirements of the FRR Alternative,” the commission said.

While IMEA contended that a longer waiver would have no adverse effects, FERC said it could expose customers in the ComEd LDA to higher prices because the aggregate internal resource requirement would need to be increased in future delivery years.

If IMEA decides not to continue under the FRR Alternative, FERC said, it could seek early termination from that status for the Naperville load and instead participate in PJM’s capacity auctions.

FERC’s ruling does not bode well for the waiver request IMEA filed earlier this month for this May’s Base Residual Auction (ER15-834).

But it may get some relief from PJM.

In December, stakeholders agreed to a problem statement proposed by Vice President of Market Operations Stu Bresler to review modeling practices that he said may be shortchanging loads with transmission agreements that pre-date the RTO’s capacity market. (See PJM MIC OKs Capacity Transfer Rights Query.)

Members approved a related issue charge earlier this month, agreeing to consider adding a mechanism in the capacity market similar to one used to allocate auction revenue rights to historical transmission paths in the energy market.

States, LSEs Skeptical, Utilities Split Over Capacity Performance

By Suzanne Herel, Michael Brooks and Rich Heidorn Jr.

More than 60 parties filed comments or protests in response to PJM’s Capacity Performance proposal before last week’s deadline, with states and load-serving entities expressing skepticism over the need for a major overhaul and generators split over elements they like and others they insist must be changed.

The Electric Power Supply Association, which represents generators, was singularly conflicted, saying it “generally supports” the proposal, but joined with other generators in complaining that the proposed changes to force majeure provisions were unduly punitive.

EPSA also joined states and LSEs in criticizing the limited stakeholder input before PJM’s Board of Managers made its unilateral filing with the Federal Energy Regulatory Commission on Dec. 12. But the association said implementation of the new structure should not be delayed by needed changes.

In a 51-page filing, PJM’s Independent Market Monitor said it “strongly supports” the proposal but listed numerous changes it said were needed to prevent market manipulation and clarify the oversight roles of PJM and the Monitor.

Most other commenters fell clearly into camps of supporters or opponents.

PJM’s proposal would increase the reliability expectations of capacity resources with a “no excuses” policy. It is expected to result in both larger capacity payments and higher penalties for non-performance. (See What You Need to Know about PJM’s Capacity Performance Proposal.)

The details are outlined in nearly 1,300 pages filed in two dockets:

- EL15-29 contains proposed changes to PJM’s Operating Agreement and Tariff “to correct present deficiencies in those agreements on matters of resource performance and excuses for resource performance.”

- ER15-623 proposes changes to the Reliability Pricing Model rules in the Tariff and Reliability Assurance Agreement.

Below is a summary of the main arguments presented in the comments.

Supporters

Those supporting the proposal included the Natural Gas Supply Association, America’s Natural Gas Alliance and the Energy Storage Association.

“The Capacity Resource Performance provision would begin to address PJM’s current difficulties by incenting investments by generators that would help them perform more reliably and economically even during periods of peak demand,” said the Natural Gas Supply Association, which represents gas producers and marketers.

The Energy Storage Association lauded the proposal as an opportunity for energy storage resources to participate in PJM’s capacity market.

Exelon said it “strongly agrees with PJM on the urgent need” for the changes to address “an imminent reliability crisis due to a capacity market design that fails to ensure that generators who have made capacity commitments actually perform when they are needed.”

Exelon, the nation’s largest nuclear operator, stands to benefit perhaps more than any other market participant from the proposal’s incentives to ensure generators have secure fuel supplies.

Penalties, Force Majeure

Unlike most other generators, Exelon complained that PJM’s proposed non-performance penalties were too lax. It said the RTO’s method for determining the hourly penalty rate is flawed and will result in much lower penalties than intended. It also called on the commission to clarify that a forced outage due to fuel unavailability during emergencies, or “performance assessment hours,” will result in automatic referral to the commission for violation of the Tariff.

Other generators complained that the penalties are already too harsh.

“Redefining force majeure to apply only when catastrophic conditions occur over the entire PJM region is unnecessarily broad and, as applied, too punitive to generators,” the PJM Power Providers (P3 Group) said. “Notwithstanding the most prudent investments, it is nonetheless impossible for every generator to foresee every eventuality. Equally as important, it is illogical to apply a penalty for nonperformance of a generator based on the requirement that the entire PJM operational system would need to be negatively impacted.”

Not Enough

American Electric Power, Dayton Power and Light, FirstEnergy, Buckeye Power and East Kentucky Power Cooperative also called for a reduction in proposed non-performance penalties in a 186-page filing.

The group, filing as the PJM Utilities Coalition, said the proposal is insufficient to correct a revenue inadequacy problem that they said is threatening reliability. They said that the proposal fails to eliminate incentives for bidding as a price-taker and that clearing multiple products simultaneously with different performance obligations will result in price suppression.

Too Much, Too Expensive

Load-serving entities, however, complained that PJM’s redesign is overkill and will result in unnecessary price increases.

“Capacity Performance is too much, too quickly, for no clearly stated reason,” the Old Dominion and Southern Maryland electric cooperatives said in a joint filing with American Municipal Power.

The Transition Coalition — whose members include the PJM Industrial Customer Coalition, cooperatives and other load-serving entities — said its members estimate the proposal would cost as much as $2.8 billion in the 2016/17 delivery year and $3.6 billion in the 2017/18 delivery year. “What will we get in return for billions of dollars in new payments?” it asked.

Similarly, Pepco Holdings Inc. said PJM should be required to provide a more thorough analysis of its proposal’s impacts, including costs and benefits.

Some commenters took aim at the transition provisions that would apply to resources that clear in the base capacity auctions this May and in 2016.

“Acceptance would constitute retroactive ratemaking,” the Retail Energy Supply Association said, while Direct Energy maintained the transition mechanism contained “billions of dollars in unforeseen costs on the region.”

Impact on Renewables

Public interest organizations said that renewable, energy efficiency and demand response resources would be disadvantaged by the new market structure, concerns echoed by the American Wind Energy and Solar Energy Industries associations.

The Environmental Defense Fund, the Natural Resources Defense Council, the Sierra Club, the Sustainable FERC Project and the Union of Concerned Scientists filed a joint protest, calling on FERC to either reject the proposal, set it for evidentiary hearing or exempt non-fossil fuel resources from the proposed penalties.

“Unlike fuel-based generation, renewable generation and non-fuel-based demand-side resources cannot become available all year round through upgrades, and cannot avail themselves to the benefits of being able to firm up fuel supply and pass associated costs to consumers accorded to fuel-based generation under this rule,” the group said.

States: Evidentiary Hearing Needed

The concerns of the states within PJM’s territory differed, with some warning of higher rates and others complaining the proposal violates state resource planning authority. Almost all states, even those who generally support PJM’s overhaul efforts, said the proposal needed changes as a result of it being rushed without adequate stakeholder input. Many also called for FERC to hold an evidentiary hearing.

The Organization of PJM States Inc. (OPSI) said it could not determine the need for the proposal or whether it would result in just rates because PJM had not provided sufficient analysis.

“To better quantify the impact of the proposal on customers’ rates, and on system operations and grid reliability … requires the development, presentation and evaluation of data that have not yet been provided by PJM.”

Capacity Performance is “Overreaction”

Some stakeholders also said the proposal changes more than is necessary.

The Delaware Public Service Commission called the proposal “an overreaction” to the poor generator response in January 2014. “All stakeholders should have an opportunity to fully evaluate the [proposal] before it is implemented with undeterminable and questionable costs and unquantified benefits,” it said.

In a joint protest, consumer advocates in Maryland, New Jersey, D.C., Delaware, Ohio and Illinois, along with the PJM Industrial Customer Coalition, said the proposal is “unnecessarily costly and disproportionate to the level of changes that are required. The sole focus should be on revamping the structure of penalties that applies to cleared capacity resources, to align actual performance with the level of revenue that cleared capacity resources currently receive.”

The Illinois Commerce Commission agreed. “Addressing deficiencies revealed by 2014’s winter conditions is a critical need, but the [proposal] goes far beyond addressing the specific issues that likely contributed to poor generator performance during this period,” the ICC said. “Rather, the [proposal] represents an extensive revision and, in some of its elements, is an unnecessary reworking of the RPM model.”

The Pennsylvania Public Utility Commission said it supports PJM’s changes to generators’ performance requirement. But it said FERC should “reject or modify the other changes to PJM’s Tariff filing wherein PJM seeks to unilaterally and, without stakeholder support, alter the provisions of RPM that have developed through much deliberation by FERC, PJM and stakeholders and that contribute to the functioning of healthy wholesale markets.”

For example, the PUC said it was concerned that how PJM defines what qualifies as a Capacity Performance resource would affect DR resources. “The characteristics of DR providers are not compatible with PJM’s proposed trading restrictions and should be eliminated for these types of resources given the fundamental nature of the underlying characteristics of residential, business and industrial customers,” the commission said.