VALLEY FORGE, Pa. — PJM planners again pushed back a decision on the stability fix for New Jersey’s Artificial Island and said they could offer no timeframe for a recommendation to the RTO’s board.

PJM has hired a consultant to review studies of four finalists’ proposals. (See Further Study Delays PJM’s Artificial Island Decision.)

During a presentation at Thursday’s meeting of the Transmission Expansion Advisory Committee, Steve Herling, vice president of planning, said there was no telling how long it would take for PJM to decide on a recommendation after receiving the consultant’s report.

“Obviously, we want this done as quickly as possible, but each step has taken longer than expected,” he said. “At this point we’re probably out of the business of prognostication.”

Herling said planners may end up taking pieces from the proposals and putting them together. (See Artificial Island Finalists Face Off in Tense Meeting.)

“It’s entirely possible we could take part of one proposer’s project, the line that they proposed, and elements of another proposer’s project and put them together and say this is the solution, and then go back and see whose proposal that looks most like. We think we are in our powers to assemble that solution from the parts and pieces given to us.”

Herling also said PJM will be responding to a complaint that Public Service Electric and Gas filed with the Federal Energy Regulatory Commission (EL15-40) over the solicitation process. (See PSE&G: PJM Broke the Rules in Artificial Island Solicitation.) It has until Wednesday to do so.

“The complaint is not impacting PJM’s timeline on a decision,” Herling said.

All of the potential solutions involve new transmission lines connecting Artificial Island to Delaware. LS Power and Transource have proposed a southern crossing of the Delaware River. Dominion and PSE&G offered a northern route with an overhead crossing.

The project involving the island, home to the Salem-Hope Creek nuclear complex, was PJM’s first solicitation under FERC’s Order 1000, which opens up transmission line projects to non-incumbent companies.

Study: Capacity Imports not Affecting NC Pricing, Reliability

PJM said that was the finding of a joint study by PJM, MISO and the North Carolina Transmission Planning Collaborative (NCTPC).

The study was requested by the North Carolina Utilities Commission following the 2013 Base Residual Auction, which PJM said had cleared an unprecedented amount of imports, most of them located in MISO.

The commission was concerned that the MISO imports could exacerbate loop flows within its state and might cause Duke Energy Carolinas (DEC) and Duke Energy Progress (DEP) to alter their joint generation dispatch, raising prices for consumers.

The analysis examined 7,663 MW of external generation that cleared, 2,774 MW of which had not procured firm transmission service. Of the imports without firm transmission service, about 463 MW will flow through the DEC and DEP transmission systems, most of it on 500-kV and 230-kV lines, the study found.

“The study results indicate that the BRA resources cannot be considered a significant adverse impact on North Carolina reliability,” PJM said. “Also, the results of the economic analysis show the impacts of the modeled BRA resources to be insignificant.”

Duke complained that PJM confidentiality provisions prevent the RTO from sharing the individual resource locations with MISO, Duke or other members of the NCTPC.

“Not having access to this information and the modeling data makes it virtually impossible for Duke Energy’s transmission planners to fully understand any identified issues or to determine appropriate corrective actions,” Duke said. “Duke Energy believes that its transmission planners have a right and necessity, due to their responsibilities under FERC and [North American Electric Reliability Corp.] rules, to obtain detailed information on all activities that may affect the reliability of Duke Energy’s bulk electric system.”

Duke also complained that using low distribution factors as a threshold for considering transmission impacts is inappropriate for the analyses conducted. The company said they limit “the likelihood that calling transmission loading reliefs (TLRs) on BRA-related generators will be a viable means of relieving congestion in real time.” It said the analysis should use higher thresholds and be run after each annual auction.

Nevertheless, Duke said it “believes that PJM performed the analysis accurately and conscientiously.”

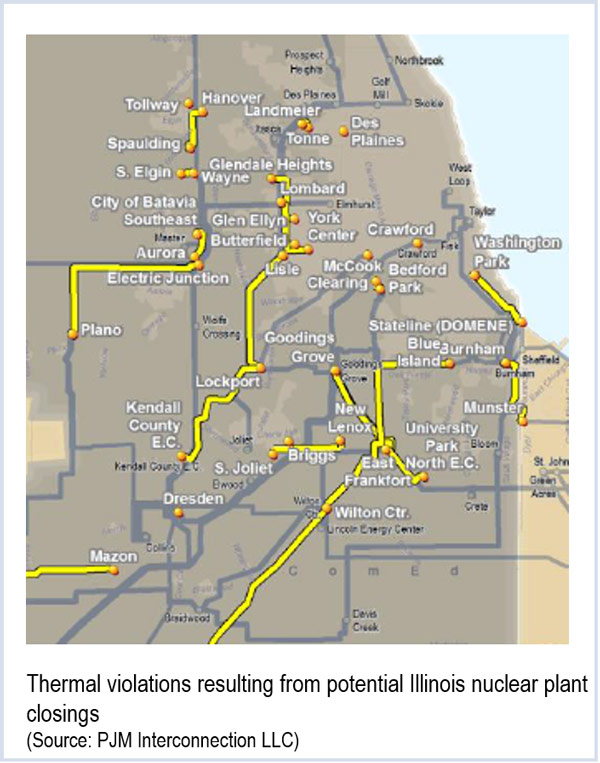

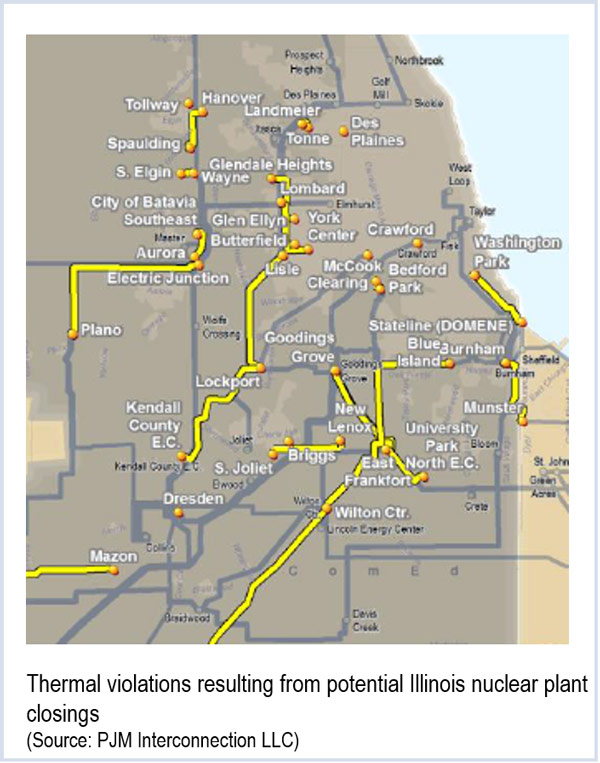

Ill. Nuke Retirements Could Prompt Major Tx Projects in PJM, MISO

Planners said their study, done at the request of the Illinois Commerce Commission, indicated the retirement of the plants would cause numerous thermal and voltage violations requiring almost $305 million in transmission improvements in AMIL and an estimated $68 million in NIPSCO. The largest potential project was the reconductoring of 34 miles of a 138-kV line in AMIL, estimated at $51.3 million.

The study also identified numerous violations within PJM, although the costs of corrective measures were not included in planners’ presentation.

“It’s not surprising that taking out 5,000 MW of generation in Illinois that we would see some reliability issues,” said Paul McGlynn, general manager of system planning.

Exelon last year said that the three nuclear plants are unprofitable under current market rules and that it might shut them down without changes. (See Illinois Considering Carbon Tax, Cap-and-Trade to Save Exelon Nukes.)

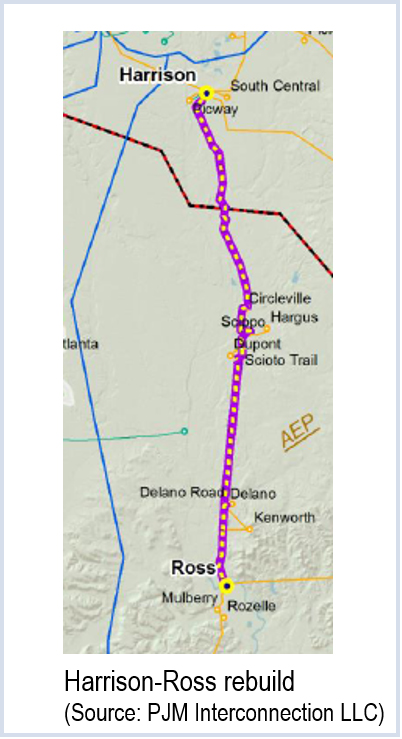

AEP Upgrade Project Triples in Cost to $130M

Engineers discovered that outages of the line would jeopardize a large load pocket and that a de-energized rebuild would take much longer than the required in-service date of June 1, 2017.

Instead, AEP will rebuild the line while it is energized, increasing the cost, PJM said.

Dominion, FirstEnergy Recommended for Pratts Solution

PJM planners are recommending the RTO’s board select a proposal from Dominion Resources and FirstEnergy to solve reliability problems near Pratts, Va.

Dominion and FirstEnergy estimated the cost of the project at $149 million, but PJM says the cost could range between $129 million and $164 million.

PJM solicited solutions in its second Order 1000 proposal window last year. Four developers suggested 16 proposals, including two transmission owner upgrades and 14 greenfield projects. Only six of the proposals were judged to have solved the violations.

LS Power’s Northeast Transmission Development agreed to cap the costs on its proposals but PJM said its own estimates suggested the upgrades would exceed the developer’s caps, making them more expensive than the Dominion-FirstEnergy greenfield proposal, which also had less risk because the companies own the substations involved and most of the rights-of-way required.

Planners said the winning project (2014_2-13A) should be submitted to the Virginia State Corporation Commission for approval by the end of the first quarter. It includes a new 230-kV line, uprates of existing 115-kV lines and substation upgrades.

Suzanne Herel and Rich Heidorn Jr.