By Rich Heidorn Jr. and Suzanne Herel

Some coal-fired power plants at risk of retirement under the Environmental Protection Agency’s proposed carbon emission rule could survive thanks to unlikely saviors: energy efficiency and renewable energy.

That is a surprising conclusion of a PJM economic and reliability analysis of the EPA’s Clean Power Plan, which PJM officials outlined last week for the Transmission Expansion Advisory Committee.

PJM had presented preliminary results on the study, which was requested by the Organization of PJM States Inc. (OPSI), in November. (See PJM: Regional Approach the Cheapest Way to Comply with EPA Carbon Rule.)

The analysis included eight compliance scenarios requested by OPSI and seven proposed by PJM. Among the issues it examined was the impact of the carbon rule on generation retirements.

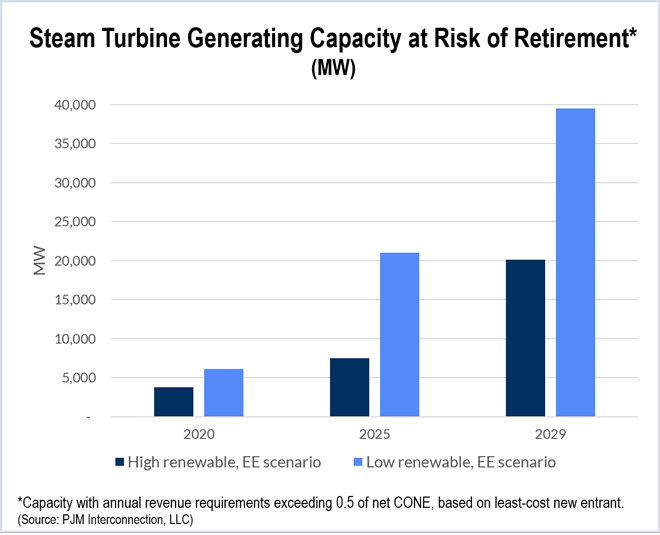

The study forecast 20,000 MW of steam generation retirement by 2029 under the four high renewable/energy efficiency scenarios, doubling to about 40,000 for the four low renewable/energy efficiency scenarios.

Counter-Intuitive Result

“Although this seems counter-intuitive, under the proposed Clean Power Plan, more energy efficiency and renewable energy means lower CO2 prices, which implies that the financial stress on higher emitting resources is reduced,” PJM said. “In the extreme … it is possible to add enough energy efficiency and renewable energy so that re-dispatch is not needed since there will be sufficient zero-emitting resources to avoid re-dispatch.”

The EPA said last week that it will finalize the carbon rule for existing generators, along with companion rules for new and modified power plants, by mid-summer. (See related story, EPA Delays Power Plant Carbon Rules.)

The EPA’s proposal for existing generators would set interim carbon emission goals beginning in 2020, with emissions rate targets declining over the following decade. During the 2020 and 2029 “glide path” to full compliance, states would be permitted to average emissions, allowing them to “bank” earlier emissions reductions to be used in later years or “borrow” reductions that must be repaid in later years.

Retirements of less efficient, high-emitting generators early in the transition would provide an immediate cut in CO2 emissions, reducing the need for re-dispatch of more efficient, lower emitting sources. More efficient sources will face increasing pressure to retire as the emission limits decline and CO2 prices increase.

Identifying At-Risk Units

PJM’s study set a benchmark for retirement based on the net cost of new entry (net CONE) for a combustion turbine or natural gas combined-cycle plant, depending on which was cheaper under the scenario. (Due to the stricter emissions targets under the proposed EPA rule, PJM said combined-cycle plants are the cheapest supply source for meeting reliability targets in many of the simulations.)

Generators were considered at-risk for retirement if their annual revenue requirements exceeded the net-CONE benchmark (either 0.5 or 0.6 of net CONE).

The study found that although increased use of energy efficiency, renewables and nuclear power reduce energy market prices, they also reduce CO2 prices, which means less need for re-dispatching from coal to natural gas generators.

Increased Operations Trumps Lower Prices

“Being able to operate economically for more hours is more beneficial to coal unit revenues than the reduction in energy market prices,” PJM said.

Retirements of steam turbines — gas-, oil- and coal-fired resources whose prime mover is a steam turbine — would rise from less than 4,000 MW in 2020 to more than 20,000 in 2029 under the high renewable/energy efficiency scenarios.

Under the low renewable/energy efficiency scenario, retirements would rise from about 6,100 MW in 2020 to almost 40,000 in 2029.

The high renewable/energy efficiency scenarios assume achievement of at least 50% of the EPA’s 23.3-GWh energy efficiency goal. The low renewable/energy efficiency scenarios project wind and solar power and energy efficiency based on historic growth rates, with energy efficiency of 9.2 GWh.

PJM transmission planners will conduct reliability analyses on generators identified as “at-risk” in at least 50% of the scenarios evaluated to determine whether their closure would necessitate transmission upgrades or other actions. About 8,000 MW fell into that category in 2020, increasing to almost 40,000 in 2029.

“Through the course of January and early February we’ll be trying to get a handle on what kinds of upgrades might be required,” Paul McGlynn, general manager of system planning, told the TEAC.

Regional vs. State Compliance

PJM cautioned that the quantitative results of the study reflect many scenario assumptions, including fuel prices, electricity demand, retention of nuclear resources and whether compliance is done regionally or state by state.

“Given the uncertainty about future market conditions, the form of the final rule, and the form of state compliance plans, it is best to focus on the qualitative results, which show the direction of wholesale power prices, units ‘at risk’ for retirement, CO2 prices and similar metrics,” PJM said.

In 2020, for example, PJM projects state-by-state compliance would result in twice as many retirements as regional compliance under the high renewable/energy efficiency scenario and 3.5 times as many under the low renewable/energy efficiency scenario.

The study also found that state-by-state compliance would be almost 30% more expensive than a regional approach. A regional compliance plan would allow states to trade reductions among each other, giving PJM access to lower cost units for re-dispatch.

“Not only is it more cost effective to do regional compliance, but there’s now fewer units at risk for retirement,” PJM Chief Economist Paul Sotkiewicz explained. “There’s a reliability message here.”