PJM and NYISO last week successfully launched Coordinated Transaction Scheduling (CTS), an effort to reduce uneconomic interchange flows. “So far it’s going well,” PJM’s Stan Williams told the Market Implementation Committee last week.

The new product allows traders to submit bids that clear only when the price difference between New York and PJM exceeds a threshold set by the bidder.

CTS began Nov. 4, a day after PJM began implementing credit checks for all exports. Williams said 57 CTS transactions were consummated Nov. 4 and the volume has grown since. PJM said as much as one-third of exports from PJM to New York occur when PJM prices are higher. (See NYISO Scheduling Product Wins FERC OK.)

PJM will continue discussions on a similar product with MISO at today’s Joint Stakeholder meeting at MISO headquarters.

PJM, Members to Discuss Earlier Notice on Pricing Interfaces

Stakeholders agreed Thursday to consider whether PJM should be required to provide more notice to the market before introducing “closed loop” interfaces to capture operator actions in pricing.

The MIC approved a problem statement by DC Energy’s Bruce Bleiweis to consider if such pricing interfaces should be barred from taking effect until they are announced before the monthly Financial Transmission Rights or Balance of Planning Period FTR auction.

In the last year, PJM has created closed loop interfaces in at least four locations so that operator actions — such as sub-zonal dispatch of demand response — are captured in LMPs rather than uplift. PJM said it must use the interfaces to set prices because its modeling software can only set prices for thermal constraints, not voltage problems.

Bleiweis’ initiative follows objections he raised at the August MIC, in which he said PJM’s efforts to reduce uplift were exacerbating FTR underfunding. (See PJM: Can’t Delay Interface Postings for FTR Auctions.)

On Thursday, PJM’s Joe Ciabattoni said that PJM will attempt to provide one-day notice for subzonal DR but that such notice may not be available for pricing interfaces needed for other reasons. “The potential exists for [pricing interfaces] at all of the 6,000 active constraints,” he said.

Bleiweis said that he wants PJM to formalize its notification procedures in its manuals.

Path Set for Query on Synch Reserve Payments

The MIC agreed to host the initial education session on the Independent Market Monitor’s effort to change compensation for Tier 1 synchronized reserves. The MIC endorsed an issue charge that scheduled the first session as part of the regular MIC meeting and defers a decision on whether to create a subgroup to complete the inquiry.

The MIC approved Market Monitor Joe Bowring’s problem statement last month.

Tier 1 synchronized reserves — all on‐line resources following economic dispatch and able to ramp up at PJM’s request — are paid the Tier 2 synchronized reserve market clearing price whenever the non-synchronized reserve price is more than zero. Bowring said it’s wasteful to pay Tier 1 the same price as Tier 2, because only Tier 2 are subject to penalties for non-performance.

PJM officials said they will likely oppose Bowring’s proposed change, which they said could upset the balance of the RTO’s scarcity pricing scheme. (See Monitor: Cut Pay for Tier 1 Synchronized Reserves.)

Initiative on Replacement Capacity Transactions Set for January

Members approved an issue charge deferring until January the first meeting to discuss Citigroup Energy’s request to change rules regarding the timing for recording replacement capacity transactions. Citigroup’s Barry Trayers said the current procedures, which don’t allow recording of the transactions until after the third incremental auction, create administrative headaches.

The MIC approved Trayers’ problem statement last month. (See MIC Briefs.)

Members Endorse Change on DR Dual Role

PJM will relieve DR resources of their regulation and synchronized reserve responsibilities during Load Management Events under a change to Manual 11 endorsed by the MIC. The change addresses the inability of DR resources to provide ancillary services and load management simultaneously.

Monthly Seller Credit Eliminated

Members endorsed PJM’s plan to eliminate the “seller credit” provision from its credit policy, which RTO officials said was unnecessary. The provision was begun under monthly billing to allow participants with consistent net sell positions some unsecured credit. Due to changes in credit policy and the 2009 switch to weekly billing, PJM said the need for seller credit is now addressed by the Reliability Pricing Model seller credit, a larger and less volatile credit.

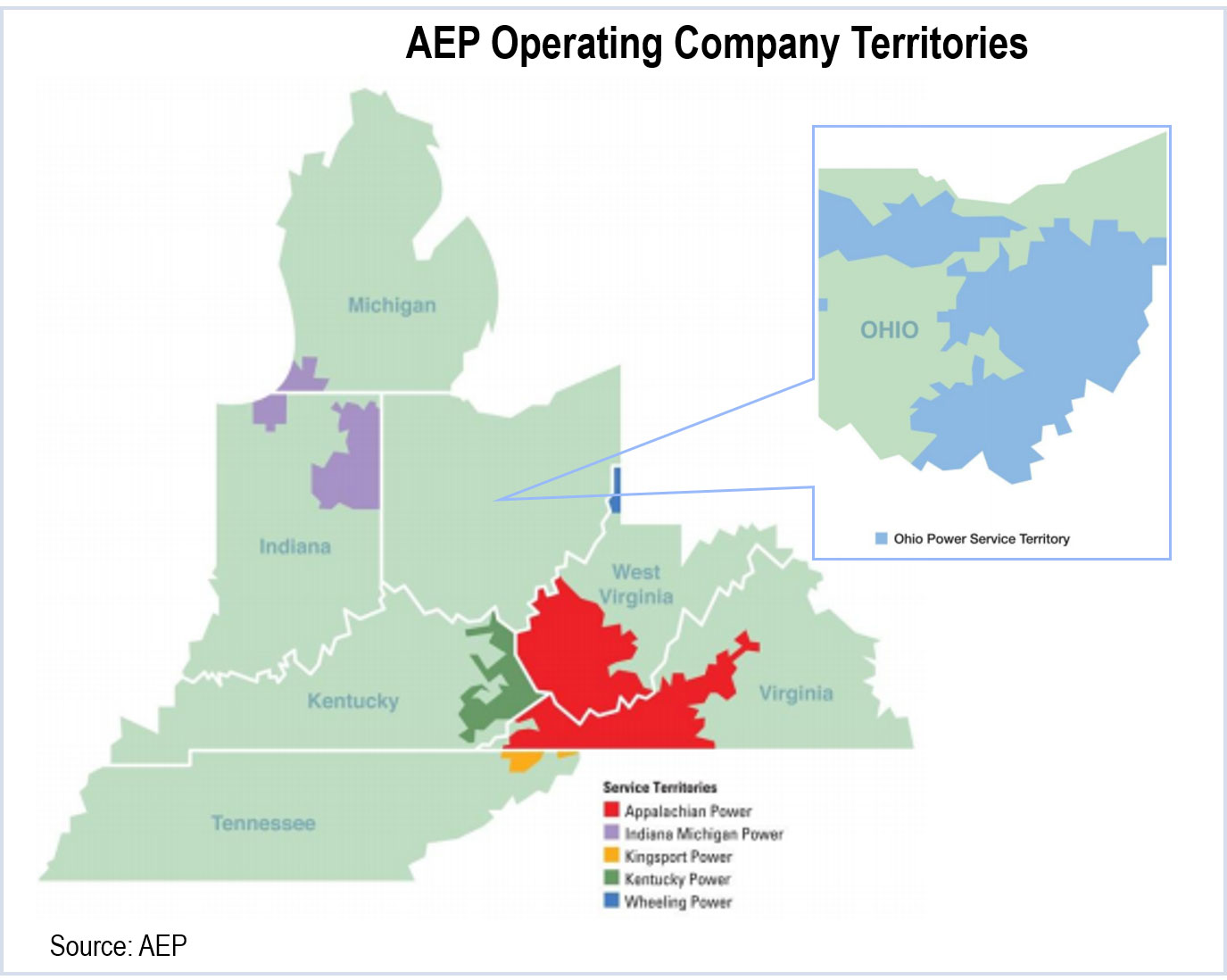

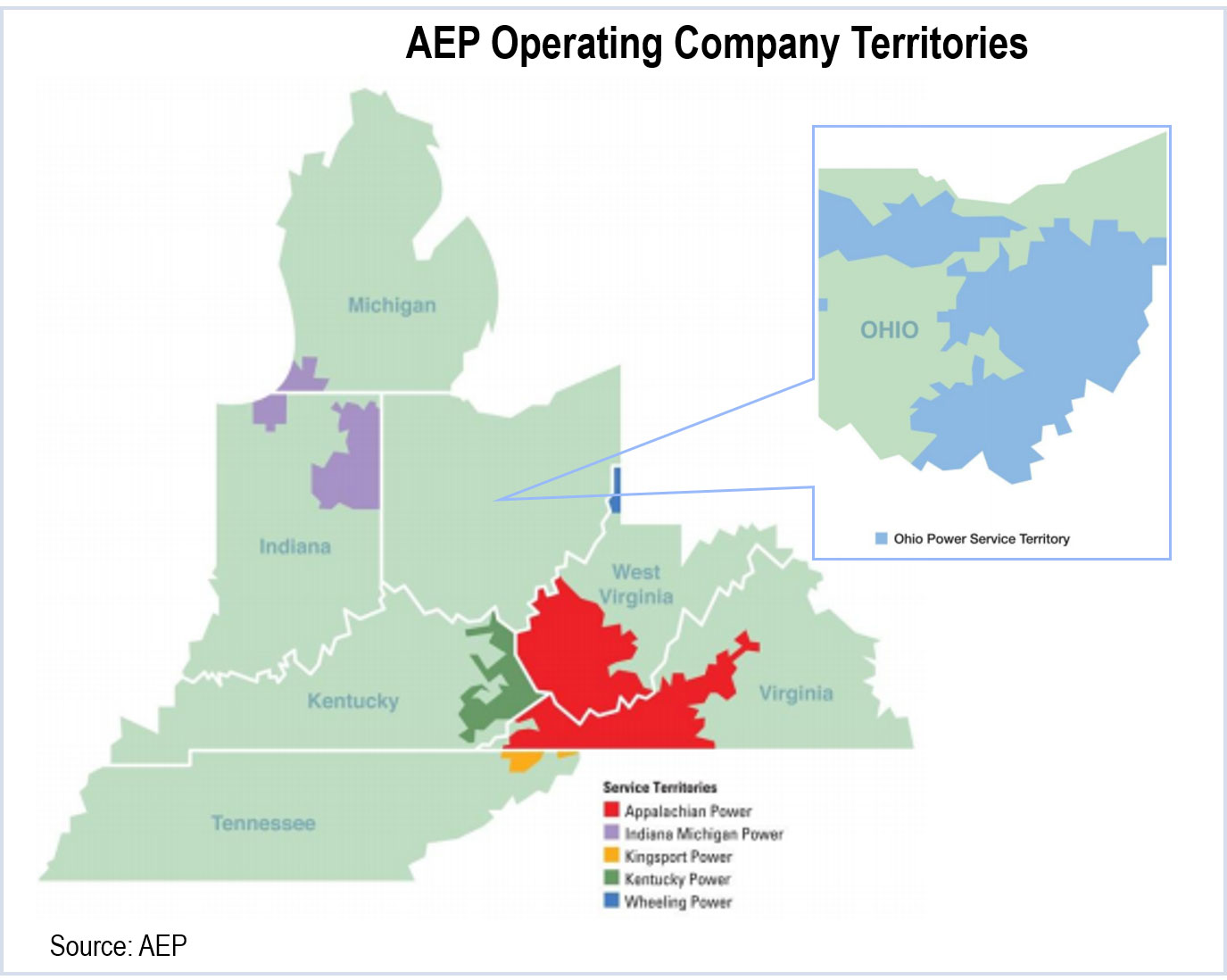

AEP Asks to Split Zone into 4 Settlement Areas

American Electric Power asked PJM to split its zone into four energy settlement areas, a change that will affect demand response pricing, real-time load, InSchedule load contracts and auction revenue rights (ARRs).

New aggregates representing the four operating company energy settlement areas will be created.

Hub and interface definitions will not be impacted and the AEP physical transmission zone pricing point will still exist. Capacity and network transmission service will continue to settle at the AEP zone.

AEP has not provided a list of buses defining each of the proposed settlement areas but is required to do so by Dec. 1.

PJM said the following changes will result:

- InSchedule load contracts will need to be created identifying the new settlement area.

- Any real-time load currently priced at the AEP physical transmission zone will shift to being priced at the applicable operating company load aggregate.

- Effective with the 2015/2016 ARR Allocation, load serving entities (LSEs) in the AEP zone will be assigned into one of the four new operating companies based on the location of their load unless the LSE sinks at a nodal location. Each LSE will be assigned a pro-rata amount of capability from each historical generation resource based on its proportion of peak load in the AEP zone. ARR allocations for LSEs not sinking at a nodal location will be assigned as follows: Load in the Indiana Michigan Power, Kentucky Power and Appalachian Power areas will sink at their respective aggregates. Load in the Ohio Power area will sink at the Ohio Power aggregate for Stage 2 only. In Stage 1, load at Ohio Power area will sink at the Ohio Power without MON POWER and the MON POWER Aggregates. The Stage 1 configuration is needed to maintain ARR requests from historical generation for the AEP zone corresponding to the AEP integration reference year (2004).