By Chris O’Malley

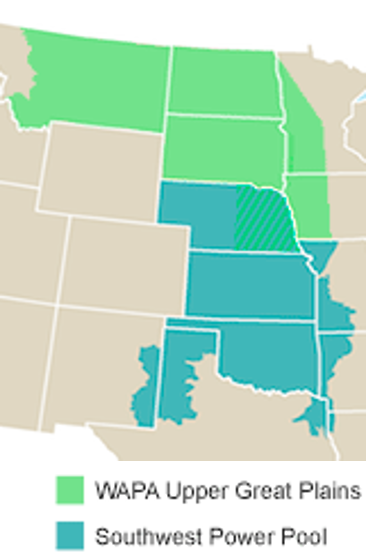

SPP won federal approval Nov. 10 to add three new members in the Upper Great Plains, a seven-state expansion that restores the RTO’s scope after its loss of Entergy to MISO.

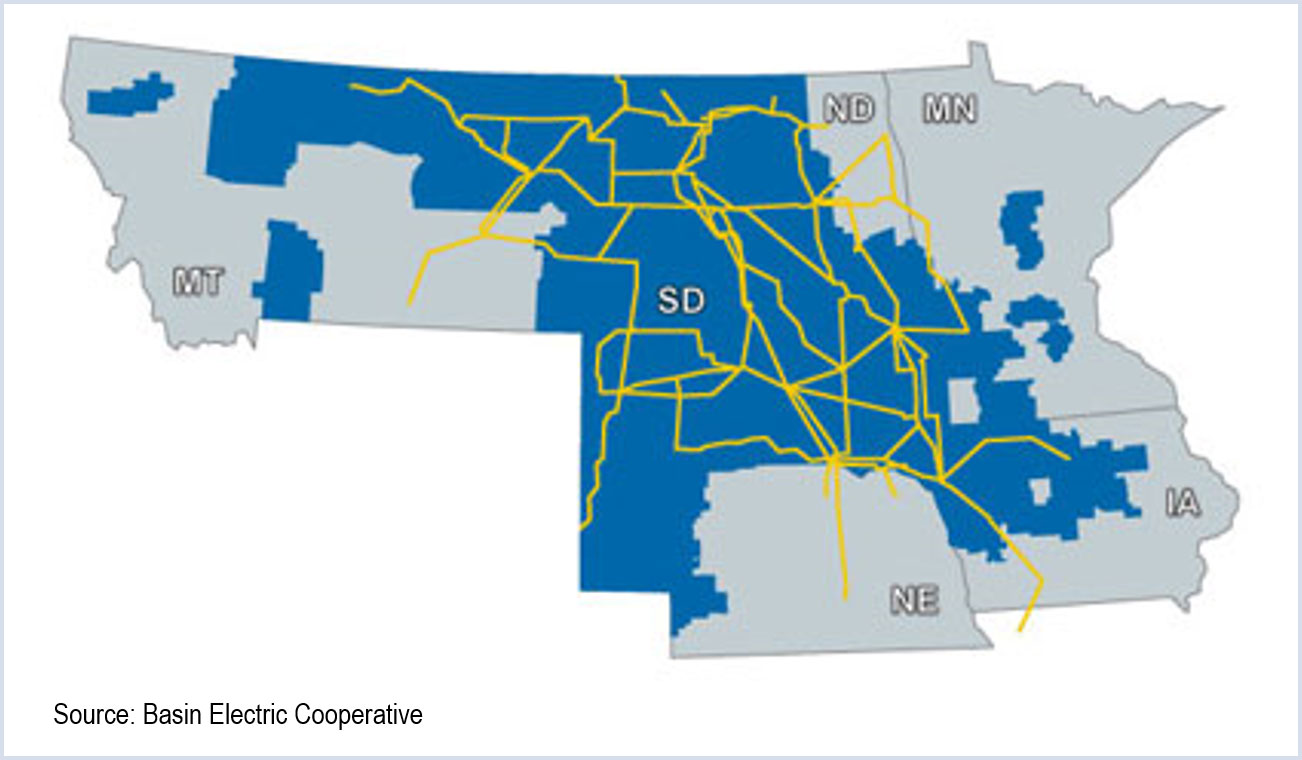

SPP’s footprint shrunk in Arkansas, Louisiana, Mississippi and Texas after Entergy’s defection to MISO. Its territory now shifts north with the Federal Energy Regulatory Commission’s approval (ER14-2850) to add Heartland Consumers Power District, Basin Electric Power Cooperative and the Western Area Power Administration’s Upper Great Plains Region (Western-UGP).

The three new SPP members represent the backbone of the bulk electric system in seven states and consist of about 9,500 miles of transmission lines with more than 3 million customers, increasing SPP by about one-fifth.

Basin Electric has 2.8 million customers and 2,100 miles of transmission lines. Heartland serves 28 municipalities, including Sioux Falls, S.D. Western-UGP covers 378,000 square miles of prairie and farmland.

“FERC’s substantive approval clears the way for us to continue to work toward [integration]. We expect to take on reliability coordination of the … transmission system in June 2015, with full membership in October 2015,” SPP Chief Operating Officer Carl Monroe said in a statement after FERC’s approval.

Little Rock-based SPP said the expansion will bring stakeholders more than $334 million in net benefits. SPP cites increased ability to commit and dispatch generation that affects flows through and out of Nebraska. It also pointed to the availability of lower-priced generation, including Western-UGP’s excess hydro power.

Concerns Raised

FERC and stakeholders took issue with parts of SPP’s integration plan, however.

The commission rejected SPP’s proposal to revise Schedule 12 of its Tariff, which covers the collection of FERC assessments. FERC noted that the cost of regulating Western-UGP and other federal power marketing agencies is administered in a different manner and that it was concerned about the possibility of a double assessment of FERC charges.

Kansas utility regulators told FERC that the three new members of SPP should be responsible for a “proportionate share” of costs for certain base plan upgrades in service before and after Oct. 1, 2015, because they would benefit from SPP membership and services. Otherwise, Kansas ratepayers would face an unreasonable financial burden when utilities in the state recover those costs from their customers, the Kansas commission argued.

FERC said the Kansas commission “neglects to consider the benefits the rest of the SPP membership will receive” from the three new members’ legacy systems, such as increased grid reliability and congestion management.

A number of consumer groups, transmission operators and state regulators also raised concerns about seams issues, including the potential that some utilities that serve Montana retail customers could be required to pay for transmission service from both SPP and MISO.

FERC said concerns about such pancaked rates were beyond the scope of the proceeding and should be taken up in hearings and settlement judge procedures later.

MISO-SPP Dispute

MISO raised a handful of concerns, including whether FERC’s rulings on the expansion could put it at a disadvantage in its dispute with SPP over their joint operating agreement.

SPP alleges that the JOA was breached after Entergy joined MISO late last year and began transferring electricity over SPP’s lines. MISO said that SPP has billed it for more than $35 million for flows exceeding the limited 1,000-MW physical contract path between MISO Midwest and MISO South. The latter consists mainly of Entergy’s footprint.

MISO sought a confirmation that FERC’s approval of SPP’s proposed cost allocations for Basin Electric’s projects would not prejudice the issue of whether MISO should be held responsible for any charges that could stem from the JOA dispute.

FERC sought to alleviate MISO’s concerns, saying “we confirm that our acceptance of [SPP’s expansion] does not prejudge the outcome of the ongoing hearing and settlement judge procedures.”

Since last April, FERC has convened five settlement conferences between SPP and MISO.

Talks Sour

The tone of the talks soured recently. On Nov. 17, SPP filed a scathing rebuttal opposing a request by MISO for expedited consideration of the JOA dispute, calling it “procedurally improper, unsupported and an impediment to further progress in ongoing settlement negotiations.”

To date, MISO “has not paid a dime for any of the flows it has imposed on SPP’s system,” SPP said.

SPP argues that some of the charges are the result of MISO failing to reserve service under an accepted agreement. “If MISO simply reserved service on an hourly basis it would not be subject to these daily charges,” SPP said.

Hands Full

SPP plans to take on reliability coordination of its three new members starting in June.

SPP said in its most recent annual report that the most significant transmission challenges facing much of its footprint stem from an increase in oil and gas drilling.

“New oil and gas drilling facilities are built faster than they can be captured in SPP’s planning processes and models,” the RTO said. “Additionally, pipeline expansions are proposed for the region that will increase the need for electric transmission facilities to serve the pumping stations.”