Clark, Bay Would Throw Out Results

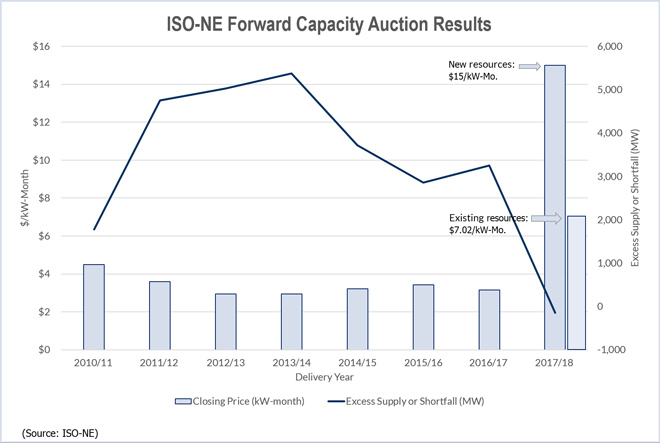

The Federal Energy Regulatory Commission yesterday called for changes in ISO-NE’s capacity market rules, but split over whether it should reject the results from the ISO’s February auction due to unchecked market power.

Republican Tony Clark and Democrat Norman Bay called for FERC to reject the auction results, but Chairman Cheryl LaFleur and Republican Philip Moeller said the commission should seek only prospective changes in the auction rules. Because of the 2-2 deadlock, the 2017-18 auction results “became effective by operation of law” (ER14-1409).

In a separate docket (EL14-99), the commissioners unanimously ordered the ISO to defend its current auction rules or submit Tariff revisions creating a process for reviewing importers’ capacity offers and mitigating any market power. The commission set a 30-day deadline for the ISO’s response.

$3 Billion

The ISO’s eighth Forward Capacity Auction (FCA) resulted in a sharp price increase after nearly 3,000 MW of capacity submitted retirement requests. Fearing they would have less capacity offered than required, ISO-NE officials applied administrative price rules to the auction.

The ISO said total capacity costs for 2017/18 would be $3.05 billion, almost double the previous high ($1.77 billion in 2009).

Unlike other RTOs, ISO-NE’s capacity auction results are subject to commission review under the just and reasonable standard — the result of a 2006 settlement to address stakeholder concerns over the market design.

Clark and Bay issued a joint statement saying the auction results should be rejected and the matter set for a fast-track hearing and settlement procedures.

“Here, there is evidence suggesting the exercise of market power, and it is uncontroverted that the market power, if it existed, was not mitigated,” Clark and Bay said. “Moreover, it is possible that ISO-NE may have violated its Tariff in the way it conducted the auction. On this record, we do not believe that ISO-NE has carried its burden of establishing that the auction results are just and reasonable.”

LaFleur and Moeller said they would have approved the auction results because the ISO followed the rules previously judged just and reasonable.

“My objecting colleagues raise a valid point, that is, can an auction process that has previously been found to be just and reasonable produce results that are not just and reasonable? While such circumstances are not common, the answer is most certainly yes,” Moeller said in a statement. “However, in this case, while the prices resulting from FCA 8 were much higher than in prior auctions, the existence of very tight supply and demand fundamentals are primarily responsible for the FCA 8 results.”

After-the-Fact Ratemaking

In her statement, LaFleur said Clark and Bay’s position — that the commission not only determine whether the auction rules were followed but also assess whether the resulting rates were just and reasonable — would violate commission precedent and subject auction participants to “regulatory uncertainty or after-the-fact ratemaking.”

“I believe that respecting the established expectations of market participants as to the operation of the auction will be critical to the future ability of the FCM [Forward Capacity Market] to attract resources needed for reliability,” LaFleur said. “If market outcomes are accepted during times of excess capacity when the auction clears at the price floor, but the commission-approved auction rules are subject to retroactive revision when capacity is tight and market capacity prices are high, the long-term viability of the market is undermined.”

Even if the commission had authority to retroactively change the auction rules, LaFleur said, “The alternative approach begs the question of how to set the auction rates. Upon rejecting the existing, commission-approved auction rules, the alternative approach offers no guidance for establishing a just and reasonable replacement rate. This would be true whether the new rate were to be established by ISO-NE, the commission or a judge, because the only way to obtain a different rate is to change the underlying auction rules.”

Clark and Bay said LaFleur’s position “renders illusory the commission’s prior assurance [in approving the 2006 settlement] it would undertake a ‘thorough review of the final auction clearing prices.’”

“This alternative theory, to which we cannot subscribe, requires the commission to ignore the clear terms of the FCM settlement which the commission itself approved, and also requires the commission to accept as a fait accompli whatever price outputs are generated from the auction,” they wrote. “Under such a theory, not even allegations of unmitigated exercises of market power, nor referrals by a market monitor, could be taken into consideration by this commission, no matter the harm imposed on consumers.”

Unlike the first seven auctions, New England faced a capacity shortage entering FCA 8 after 3,135 MW of capacity, including the 1,535-MW Brayton Point generator, sought to retire before delivery year 2017-18. The retirement announcements came after the qualification deadline for new resources seeking to participate in the auction.

Instead of an expected surplus of more than 2,000 MW, the ISO went into the auction more than 1,000 MW short of its net Installed Capacity Requirement.

The ISO acknowledged that in “situations with limited excess supply, participants with a large amount of that supply are likely to recognize that they can be pivotal and set the auction price. Indeed, participants [in FCA 8] may have already been aware of the situation due to the publicly available information provided prior to the auction.”

Order to Show Cause

The commission’s Order to Show Cause is focused on rules specifying the Independent Market Monitor’s authority for reviewing offers from capacity imports.

The ISO’s Tariff requires its IMM to review import offers and reject any that the Monitor determines “may be an attempt to manipulate” the auction.

The commission said the Tariff limits the review to the qualification process, “and it only involves ensuring that the behavior of import resources was consistent with their actions in previous FCAs, rather than evaluating the bids of import resources for consistency with their net risk-adjusted going-forward costs, as is done for the offers of other resources.”

“Given the changing balance of supply and demand in New England,” the commission said, that provision “may be insufficient to ensure just and reasonable rates.”