By William Opalka

ISO-NE will be expanding the winter reliability program it began last winter with additional incentives for fuel purchases and new pricing flexibility for generators.

Nevertheless, the ISO “will be in a precarious operating position for the next several winters due to the natural gas pipeline constraints that have limited the delivery of fuel to natural gas-fired power generators at times, combined with recent and pending generator retirements,” ISO-NE spokeswoman Marcia Blomberg said.

Although new pipeline capacity has been added since last winter, the region is still vulnerable to constraints, the Federal Energy Regulatory Commission staff told the commission last week. “With no [additional] pipeline capacity planned until 2016, the region will need to rely on fuel diversity to meet the region’s energy needs,” staff said.

Increased Marcellus Shale production and a mild summer created some unusual dynamics, with prices at the Algonquin citygate near Boston below Henry Hub since April.

But fears of another polar vortex and low natural gas storage have caused an 82% jump in natural gas futures for January and February 2015 versus a year ago, with prices averaging $21/MMBtu, FERC’s Division of Energy Market Oversight (DEMO) said. “Futures are raised because they are taking into account what happened last winter — so they’ve added kind of an insurance premium,” said Christopher Ellsworth, a DEMO branch chief.

Those expectations have rippled into the electricity markets, with winter power futures up 84% to $184/MWh.

FERC Chairman Cheryl LaFleur said the increase in futures prices is “quite sobering.”

New England Model ‘Unsustainable’

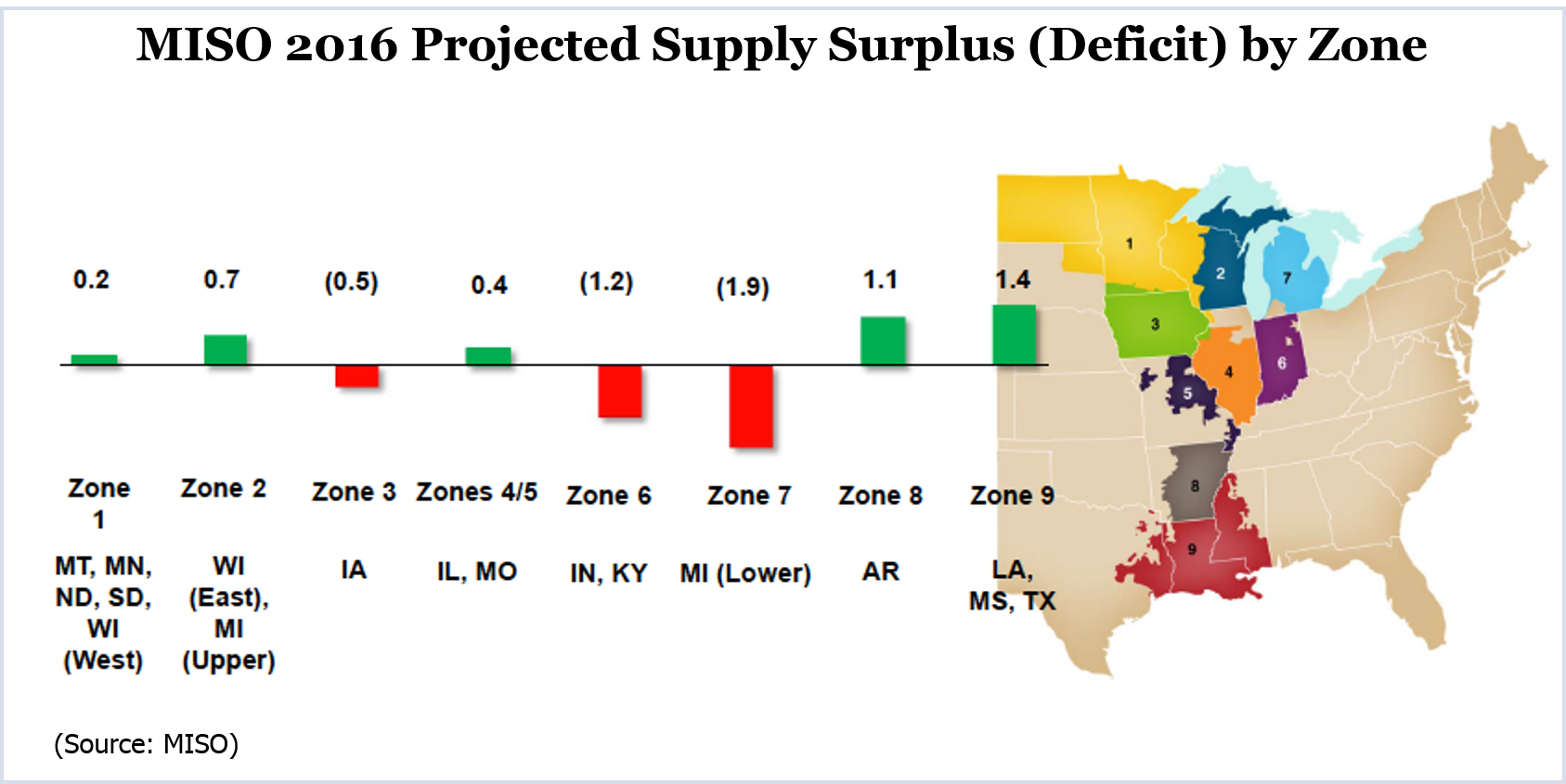

Commissioner Tony Clark said the Northeast is the area of “greatest concern” in the nation. “Already we’re hearing about potential all-in retail rates in parts of New England of 25 cents a kWh,” he said. “It’s really not a supply problem. We have a rather severe infrastructure problem.”

Clark said New England’s regulatory model — a mix of retail choice and state central planning — may be “unworkable and unsustainable.”

In an Oct. 15 response to a letter to the commission from New Hampshire Sen. Jeanne Shaheen, Clark said he believes both the traditional vertically integrated model and fully restructured markets can be effective.

“The one regulatory model that does not appear to be working well is one in which a market is created to procure resources for unbundled utilities, but then the pricing signals in the market are undermined by policies designed to select energy resource mixes through legislative or regulatory planning,” he wrote.

Last Winter’s Experience

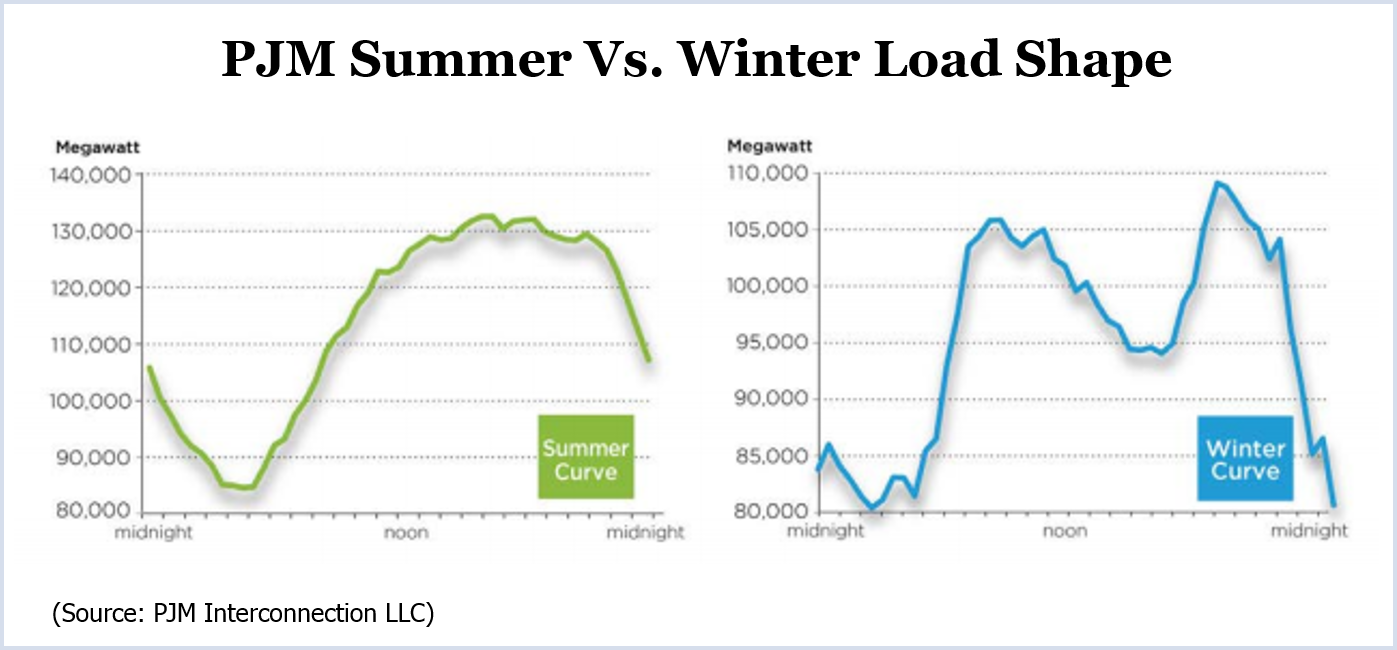

While New England did not set a new winter demand record last winter, the ISO had its share of white-knuckle moments as gas-starved combined-cycle plants dropped offline and reserve margins briefly fell below prescribed levels. Natural gas supply constraints last year were worse than expected and some generators experienced difficulties replenishing oil supplies.

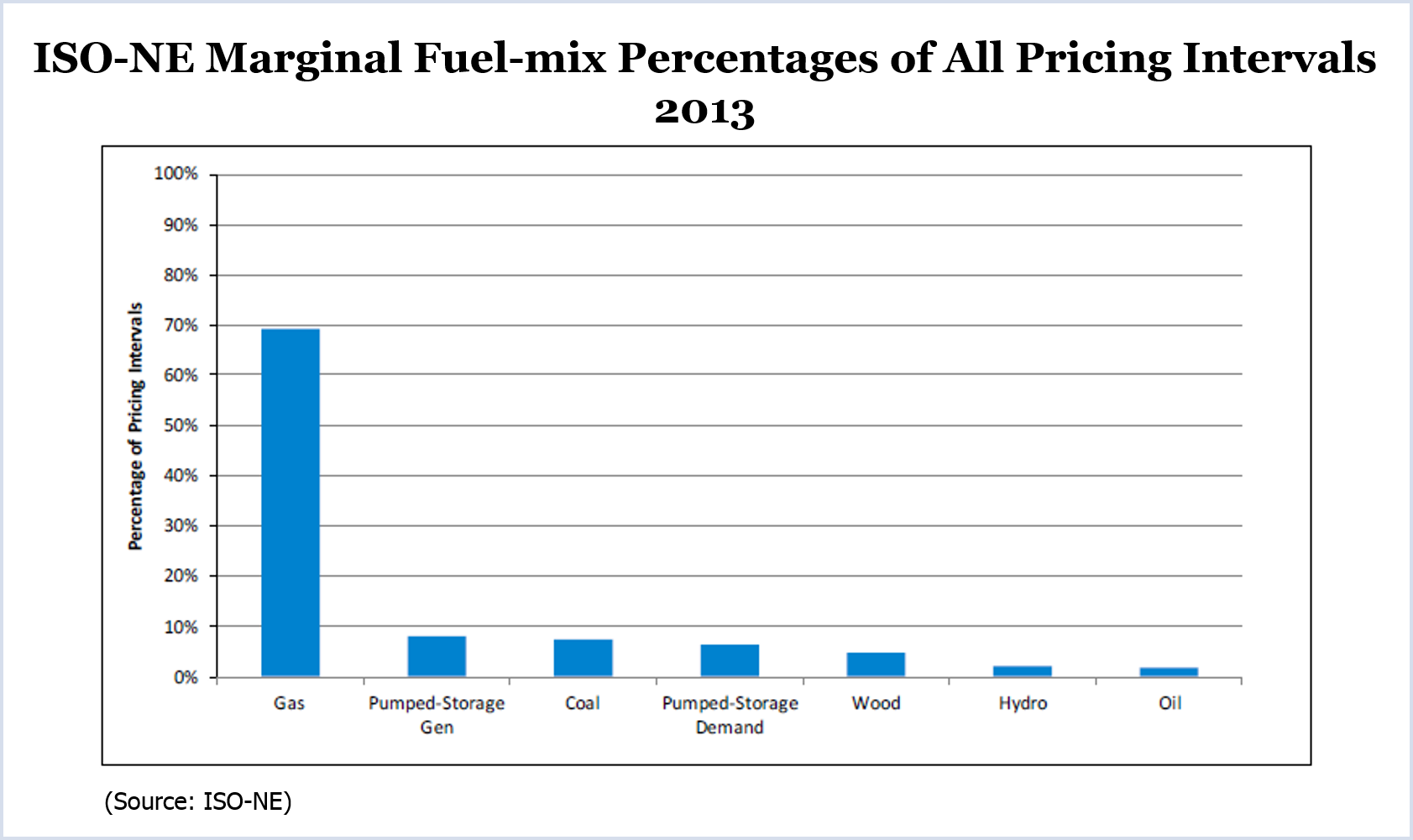

The region’s heavy reliance on natural gas generation, coupled with a high heating demand for that fuel, meant that gas prices exceeded that of oil on 57% of winter days. During cold periods, oil units provided nearly one-fourth of the region’s power instead of the typical 1% average.

Winter reliability was also enhanced, according to FERC, by its August 2013 order that clarified the ISO-NE tariff to impose a strict performance obligation on capacity resources. FERC ruled that capacity resources may not take outages based on economic decisions not to procure fuel or fuel transportation.

Winter Outlook

In September, the Federal Energy Regulatory Commission approved New England’s plan for the coming winter (ER14-2407). It creates incentives for dual-fuel resources, offsets the carrying costs of unused fuel oil purchased by generators and provides compensation for demand response services.

“Based on preliminary review of submissions to participate in the program, the ISO is satisfied that the response will help improve fuel adequacy for the 2014/15 winter,” Blomberg said.

Blomberg said that 69 oil and dual-fuel units have indicated a willingness to stockpile oil for the winter and several other gas-fired generators told the ISO they will add dual-fuel capability by Dec. 1. Another eight units plan to contract for at least 1.5 Bcf of liquefied natural gas.

The ISO also hopes to have 14 MW of DR, Blomberg said.

New England added about 200 MW of gas, biomass and solar since 2013. It expects almost 700 MW of new generation next year and another 300 in 2016, including more than 500 MW of natural gas.

At the same time, however, this year’s retirements of the Salem Harbor coal-fired generator and the Vermont Yankee nuclear plant will eliminate 1,300 MW of non-gas generation — more than the amount of capacity procured through last winter’s reliability program — and it will lose the 1,510-MW Brayton Point coal plant in 2017.

Retirements over the past year mean that gas-fired generation in New England has grown from approximately 44% of capacity in 2013 to 47% in 2014, according to FERC staff, who predicted increased prices and volatility.

Meanwhile, the use of backup oil generators has increased both emissions and costs. National Grid said last month that rates for its Massachusetts customers will increase by 37% over last winter’s as wholesale power prices have risen to the highest level in decades. NSTAR also expects to raise rates in the state, but the utility hasn’t said how much.

Plan for This Winter

The plan approved by FERC has six components:

- Compensation for Unused Fuel:

- Oil: Participants will be paid $18/barrel for carrying costs, price risk, availability cost and liquidity risk. The ISO plans to procure 3.5 million barrels of oil. Last year generators purchased 3 million barrels, 88% of which were burned.

- LNG: Generators that contract for LNG will receive an end-of-season payment to offset the risk of unused LNG.

- Dual-Fuel Incentives:

- Natural gas-fired generators that commission or recommission dual-fuel capability will receive compensation to offset some of their costs. Eligibility is limited to generators that haven’t operated on oil since at least December 2011.

- To allow more operational flexibility, dual-fuel resources won’t be required to demonstrate to the ISO’s Independent Market Monitor that it burned the fuel associated with its offer that cleared in the day-ahead market when fuel markets are volatile. However, the ISO will expand the scope of its audits of dual-fuel units.

- DR: As in 2013/14, DR assets not otherwise participating in the wholesale markets or that have capacity in excess of obligations will receive both monthly payments for participating in the program and demand reduction payments based on the greater of either $250/MWh or the LMP of their zone. New this year:

- The payment structure is modified to avoid double payments.

- DR will be dispatchable up to 30 times this winter (six hours per dispatch), up from a maximum 10 dispatches last year (no more than two dispatches per day, with a minimum of four hours between each dispatch).

- Participants will receive $1.80/kW-month rather than their “as bid” price.

- A DR asset will lose its entire monthly payment if it fails to achieve at least 75% of its commitment for a month. (Last year’s underperformance penalty could have resulted in charges that exceeded assets’ program revenues.)

- The DR program will be limited to 100 assets and 100 MW, down from last year’s cap of 200 assets. The ISO said the change will reduce administrative burdens and allow better estimation of maximum program costs.

Long-Term Plans

In approving New England’s plan for the coming winter, FERC ordered it to continue efforts to develop a long-term, market-based solution. ISO-NE on Wednesday filed a status report with FERC, stating the process will begin in November before the New England Power Pool Markets Committee.

ISO-NE expects to need some type of out-of-market program until 2018 when its Pay-for-Performance program to address the capacity market goes into effect. In that plan, the forward capacity market will have a two-settlement design, based on its actual performance during scarcity. Resources that perform poorly will cover their obligations through purchases from suppliers that perform well. The result will be payments from under-performing to over-performing resources.

A proposal by the six New England governors for a $3 billion taxpayer-supported pipeline transporting shale gas from Pennsylvania stalled in August due to cost concerns in Massachusetts. Gov. Deval Patrick temporarily suspended the state’s support of the pipeline after the state legislature failed to act on another major infrastructure project: additional transmission lines to import Canadian hydropower. The project would be funded through a tariff on ratepayer bills and supported by long-term power-purchase contracts.

Without clear support from Massachusetts, neither infrastructure project would be viable.