WASHINGTON — Summoned to Capitol Hill, members of the Federal Energy Regulatory Commission last week revealed differences over the impact of the Environmental Protection Agency’s proposed carbon emission rule but declined to endorse climate change skeptics’ do-nothing strategy.

Speaking before the House Energy and Commerce Committee’s energy and power subcommittee, Commissioner Philip Moeller renewed his call for a reliability analysis on the impact of expected coal-plant shutdowns while Acting Chair Cheryl LaFleur and other members said such a study was premature.

Moeller and fellow Republican Tony Clark expressed more concern over the rule than the commission’s Democrats. But they refused to join subcommittee Chair Ed Whitefield (R-Ky.) and other Republicans in saying the EPA was wrong to act on climate change.

Whitfield dismissed warnings of increasing droughts, saying they were belied by this year’s bumper corn crop. He also rejected claims that the EPA acted because Congress had failed to do so. “Congress did act by deciding not to act” to approve a cap-and-trade bill in 2010, Whitfield said.

No Takers

California Democrat Henry Waxman, co-sponsor of the bill, got his chance to respond a few minutes later, asking the commission members to raise their hands if they believed “there is no need to deal with climate change.” None did.

“We can reduce carbon emissions and keep the lights on,” Commissioner John Norris said. “I feel Congress is missing the point. [The EPA’s proposed rule] is a very gradual transition and a very necessary transition.”

LaFleur pushed back when Texas Republican Joe Barton said the EPA rule appears to conflict with FERC’s mandate to ensure power “at reasonable cost.” (LaFleur was named chairman effective July 30. See related story, Bay to Take FERC Gavel April 15.)

“I do not see the rule as inconsistent with FERC’s responsibilities,” she said.

The proposed rule seeks to reduce carbon dioxide emissions from electric generation by 30% from 2005 levels. The EPA set reduction targets for individual states based on four “building blocks”: unit-level efficiency improvements for coal-fired units; fuel switching from coal to natural gas; renewable energy and nuclear power; and demand-side energy efficiency.

In written responses to the subcommittee’s questions, the members revealed that none but LaFleur had any discussions with the EPA prior to the release of the proposed rule June 2. LaFleur said she or FERC staff met with EPA or Office of Management and Budget officials on seven occasions between February and July and that FERC had told officials of the need to respect reliability concerns in drafting the rule.

Norman Bay Speaks

The session included FERC enforcement Director Norman Bay, who was confirmed as the commission’s fifth member last month and is awaiting his swearing in. Bay demonstrated that his transition from behind-the-scenes prosecutor to a commissioner is a work in progress, forgetting twice to press his microphone before speaking. Bay professed confidence that “the challenges [of implementing the rule] are manageable.”

Bay also was pressed by Texas Democrat Rep. Gene Green on his running of FERC’s Office of Enforcement. Green said FERC should create an office of compliance to provide “more transparency” to energy traders seeking to avoid running afoul of commission rules. Bay said FERC already maintains a help line and issues “no-action” letters in response to questions about market rules.

Call for Reliability Analysis

The session provided Moeller an opportunity to renew his call for a FERC-led reliability analysis. Moeller noted that the EPA has identified 180 GW of coal-fired generation that it expects to be shuttered as a result of the carbon rule and the Mercury and Air Toxics (MATS) rule, which takes effect next year.

Moeller acknowledged that disagreements on the reliability implications are likely but said “a reliability study shouldn’t be that difficult.”

“Getting the electricity reliability experts together in a public and transparent forum to address these questions and develop answers is the responsible approach. Engineers can debate and disagree on details, but presently there is no public forum for this discussion to occur,” Moeller said in written testimony. “Although the EPA’s proposal mentions the concept of reliability more than a hundred times, it’s the details of calculating proper reserve margins and specific load pockets that matter from a reliability perspective.”

But others on the commission agreed with LaFleur, who said that a study “could be more speculative than informative” due to uncertainty over the requirements of the final rule and how it will be implemented by the states.

“You’re not going to prove it is or isn’t going to work because it’s still in development,” Norris told the subcommittee.

Questioning EPA Assumptions

Moeller also raised questions about several of EPA’s assumptions, including its expectation that natural gas generators will reach dispatch factors of 70% and that there will be enough pipeline capacity built to support a change from coal to natural gas.

Moeller said 70% gas dispatch “has been very rarely done in this country.”

Moeller said officials haven’t figured out a way to obtain financing for pipeline expansions to serve generators and that the EPA “doesn’t fully understand the challenges.” Generators are reluctant to sign long-term gas supply contracts — which traditionally have enabled financing of pipelines — because of uncertainty over how much they will be dispatched.

Norris said the increase in natural gas-fired generation capacity assumed by the EPA will be “challenging but not impossible.”

Moeller also suggested the rule could inhibit economic growth by “essentially capping” electricity consumption in 2030 and differed from LaFleur on whether the EPA had adequately accounted for interstate power flows.

Clark said he feared a “jurisdictional train wreck” between the EPA and FERC and said states may be forced into a “‘mother-may-I?’ relationship” with the agency, which will pass judgment on individual State Implementation Plans (SIPs). Once approved, SIPs could limit states’ ability to change building codes and renewable portfolio or energy-efficiency standards, Clark said.

Impact on RTOs

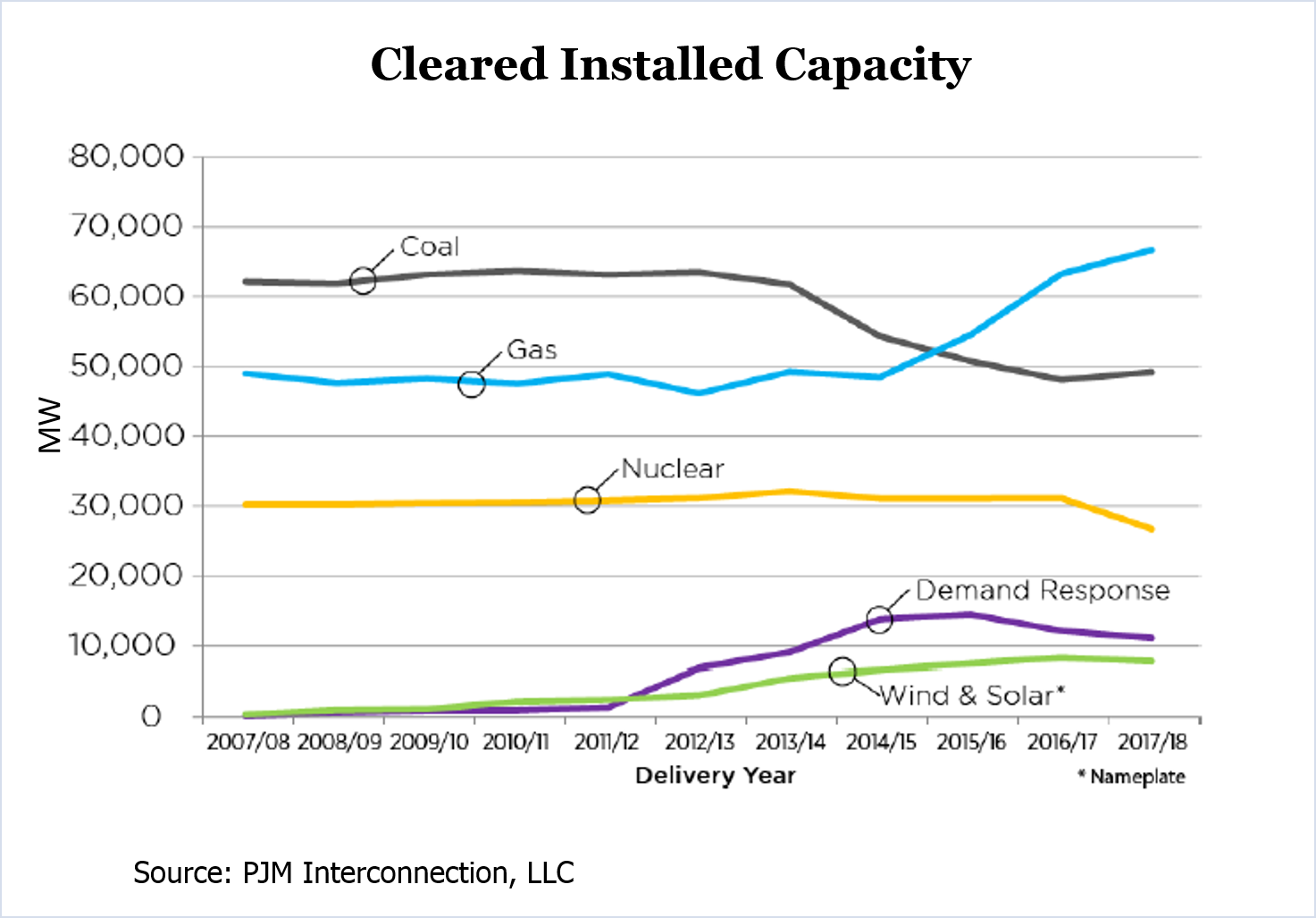

Much of the discussion concerned the rule’s likely impact on PJM and other RTO markets. Moeller said the rule would result in a shift from economic dispatch to “environmental dispatch.”

“It’s a fundamental change … with how the system operates. It needs to be examined very carefully,” Moeller said.

LaFleur said it was “too soon to speculate” on the impact on RTOs. She and Norris expressed confidence in RTOs’ ability to respond, noting that PJM and others have incorporated regional cap-and-trade programs and state renewable portfolio standards into their market operations.

“We’ll have a much better idea of the challenges once the SIPs are done,” LaFleur said.